- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Uncertainty with regards to Chinese banks’ asset quality has increased amid a real estate downturn

- The ballooning number of home buyers refusing mortgage service amid delivery concerns is a key risk

- CNY1.1-1.8trn of mortgages are at risk, which could lower banks’ Tier 1 capital ratio by 40-80bps

- Large banks have ample capital to withstand headwinds, and government support may provide cushions

- China bank credit spreads have not widened much despite headwinds

Related Insights

Outlook of Chinese banking sector

Between slower economic growth arising from intermittent Covid lockdowns, continued stresses in the real estate sector, and narrowing interest margins, the outlook for Chinese banks has dimmed slightly. Given a dismal Q2 GDP outturn, our economists have lowered China’s 2022 growth forecast to 4.2%, well below the official target of 5.5%. Even as activity is expected to pick up in 2H on infrastructure stimulus, Chinese banks’ net income growth is slowing compared to 2021’s pace.

Besides slowing income growth, banks’ asset quality is also becoming an issue of concern. Real estate risks are turning more prominent, resulting in accentuated credit risks from three major developments:

(I) More and more home buyers facing project delivery risks are refusing to service their mortgages.

(II) Secondary exposure to distressed developers for banks via Wealth Management Product (WMP) trust loans

(III) Easing home prices pose a negative impact on recovery values in the event of foreclosure.

We examine each in turn to assess their probable impact on Chinese banks’ NPLs and capital ratios. Overall, we expect risks to be contained for large banks given their strong capital buffers, while property price declines should remain moderate enough to avert systemic risks.

Rise in mortgage payment suspensions

There is now a fast-rising number of mortgage payment suspensions by home buyers who had committed to presales but not taken delivery of their property. According to China Real Estate Information Corporation, home buyers across almost 100 projects in more than 50 cities have told their banks that they would no longer make mortgage repayments. The catalyst for these unusual defaults is due to long construction halts by distressed developers, on top of concerns that properties are not delivered according to specification, becoming what are colloquially known as lanweilou. Banks have legal recourse to reclaim debts, but can face litigation risks from home buyers given the unusual situation over project delivery.

Some buyers’ remorse may also be at work given the decline in residential property prices since early 2021, and construction halts could be an avenue to exit purchase commitments. On the flip side, presales prior to 2020 should be less problematic, as home buyers should be more reluctant to risk foreclosure given that they are sitting on price gains, while housing should also be very close to completion.

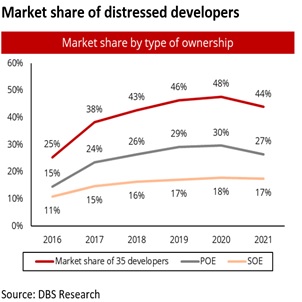

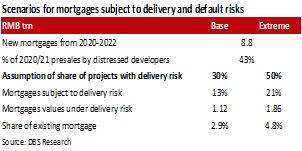

As such, the current wave of mortgage suspensions is likely to be concentrated within mortgages from the 2020-2022 vintages, which amount to CNY8.8trn in total. We estimate that 43% of these mortgages is likely to be ascribed to projects of distressed developers, which we define as developers which have entered into bond extension, exchange, or default.

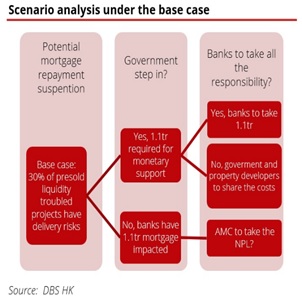

As a base case, we assume that 30% of such distressed project mortgages is now subject to delivery risk, and in the extreme case could even rise to 50% of mortgages. This implies CNY 1.1trn of mortgages at risk in our base case, and up to CNY 1.8trn of mortgages at risk in our extreme scenario.

In response, the CBIRC has urged banks to increase financing support to developers for project completion, while emphasizing on market-based solutions. Given the social implications, further direct support by the government should not be ruled out. China’s planned Financial Stability Guaranteed Fund may play an intermediary role in future. Meanwhile, the authorities are also weighing a mortgage grace period for stalled home projects, which provides temporary relief for home buyers, allows banks to defer recognition of delinquent mortgages, and gives time to find a solution for dealing with distressed developers.

The worst outcome is a full write down of the mortgages that are subject to delivery risk, and this could trigger a 40-80bps decline in system-wide Tier 1 capital ratio without provisioning buffers. Still, the more probable scenario is one where there is government assistance to ensure home delivery due to the scale of the problem, which involves >RMB3trn of residential sales value and c.4m families. This will be in line with previous guidance by the Ministry of Housing and Urban-Rural Development, which has vowed to tackle risks stemming from overdue delivery of residential properties. Our property analysts estimate that the government monetary support required is around RMB 1.1trn, which is well within fiscal means. Assuming that support via government credit guarantees or other measures comes through, the scale of mortgage defaults could be smaller than the RMB1.1trn at risk.

Minimal secondary risk exposure via WMP

Another risk is the prevalence of trust loans given to distressed developers, which could be linked to banks’ wealth management products (WMP). This could see banks taking on secondary credit exposure to developers via these WMPs. Our company queries found that developers’ WMP liabilities appear quite small at under RMB 1bn.

Nevertheless, there could be a sizeable amount of undeclared WMP liabilities to be wary of. Looking at total outstanding pecuniary trust loans of RMB 14.7trn in Q1 2022, around 11% or RMB 1.57trn is invested in the real estate sector. This amount is manageable. Even if all real estate trust loans enter default and also spill over to banks, the total impact on system-wide Tier 1 capital ratio is modest at 70bps. The most likely scenario is that secondary WMP losses are very circumscribed.

Easing property prices mitigated by measures

The historical experience across countries is that NPLs should increase during periods of falling home prices. Nevertheless, the impact from easing Chinese property prices on banks’ asset quality can be mitigated by various factors. The locale of lending and the standard of credit underwriting varies across banks, and large SOE banks are better equipped to manage credit risks. Conservative lending practices due to regulation also provide additional buffers against a deterioration in property values.

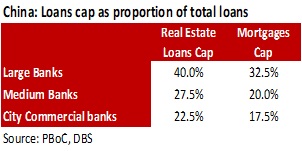

Indeed, China had imposed various macro-prudential measures to limit real estate credit risks. Demand-side measures, such as LTV and debt-service-to-income (DSTL) limits have been utilized for a long time. Starting from last year, the PBoC and CBIRC also implemented supply-side control measures, namely loan caps for banks that limit the proportion of credit they can extend to real estate developers and mortgages.

We expect mortgages to be relatively resilient to a fall in prices, since LTV ratios for first-time home buyers is usually no higher than 70%, and are often set lower by local authorities to limit speculation. It was only in February this year that the minimum down-payment ratio was eased to 20%, and such high LTV mortgages should be small.

Given low LTV ratios for Chinese mortgages that average from 30%-40%, only a stark fall in property prices could result in valuations that fall through the mortgage liability, even if one assumes a 40% discount to value from foreclosure. Assuming conservatively that banks’ recovery from defaulted mortgages is only limited to the foreclosure value, it would require a dramatic 40% decline in home prices for system wide CET1 ratio to fall below 7.5%, which is the BIS regulatory minimum.

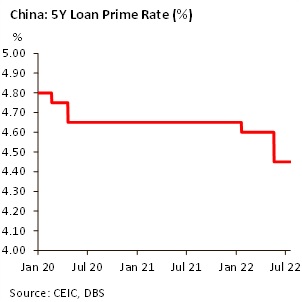

There is no precedent where prices have fallen by such a magnitude since the start of housing reforms. The largest national YTD price decline was 10.4% in 2011. It is challenging to imagine price declines of a scale that could induce mortgage losses for finished properties. Furthermore, the government has already taken steps to support the property sector since September 2021. This includes urging banks to accelerate mortgage approvals and cash disbursement, and the lowering of mortgage interest rates, which was encouraged by a 20bps cut in the 5Y Loan Prime Rate since January 2022.

Implications for Chinese bank credit

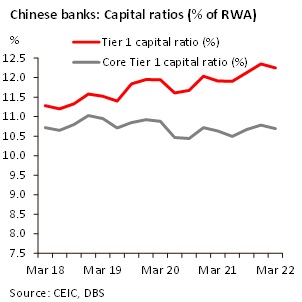

The good news for credit investors is that Chinese banks are entering this new period of real-estate driven uncertainty from a position of strength. Banks’ Tier 1 capital ratios are close to a record high, standing at 12.2% in Q1 2022. Thus, there are adequate buffers to withstand a modest rise in mortgage defaults, particularly for the larger state banks and listed banks.

With all risks considered, the issue of mortgage payment defaults stemming from project delivery risks strikes as most consequential compared to the other risks. Potential losses to banks will depend first on whether government support is available, and to what extent.

Ideally, we envision that the government steps in to cover RMB 1.1trn of funding required to resume construction across stalled projects. In the event that the government defers to a market-based resolution, uncertainty increases. First, the wave of mortgage defaults could lead to extensive litigation between banks and mortgagors, and whether safeguards over presales money have been adequate. Given the different regulations surrounding presales across local administrations, litigation risk is difficult to ascertain and may be considerable for banks.

Even if we assume that Chinese banks are to prevail fully in litigation, the collateral value of unfinished buildings for these mortgages is likely to be low, and recovery could be minimal. A rise in household bankruptcies is also not inconceivable given that life savings are mostly invested in property, and this also means reduced scope for loan restructuring.

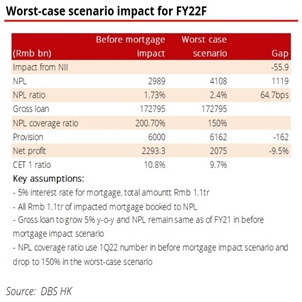

In the event of no government support, unfavourable legal outcomes, and a full-scale default of the mortgage amount at risk, we see a scenario where banks’ NPLs rise by RMB1.1trn, resulting in a 65bps rise in the NPL ratio to 2.4%. This outturn will result in the highest NPL ratio for Chinese banks since 2008. Meanwhile, banks’ aggregate CET1 ratio will decline by 110bps towards 9.7%, which is near 2013 levels. Importantly, it will remain higher than China’s regulatory minimum of 7.5%. Solvency risks will rise somewhat for smaller city and rural banks, but are still contained for the major listed banks.

Implications for credit

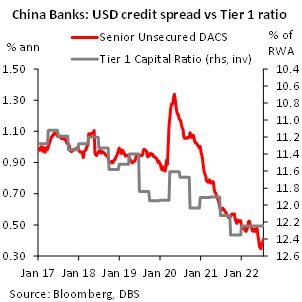

Have credit markets price in the mortgage default risks? The aggregate Z-spread (or DACS index) for China bank credit has widened by only 6bps since the start of July. Spreads are still hovering near record lows of around 40bps, which sets up an asymmetric risk profile in our view. Further compression looks difficult, while an escalation of mortgage default risks could lead to a widening of the aggregate Z-spread towards pre-pandemic norms.

On the whole, we expect solvency risks for major Chinese banks to remain contained. Nevertheless, credit pricing is not too attractive at this juncture, given historically tight credit spreads and a possible peak in asset quality and capital ratios.

On the whole, we expect solvency risks for major Chinese banks to remain contained. Nevertheless, credit pricing is not too attractive at this juncture, given historically tight credit spreads and a possible peak in asset quality and capital ratios.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

Explore more

E & S FocusThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.