- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Israel-Hamas conflict provides short-term boost for gold

- Inverse relationship between real rates and gold challenged; gold displaying downside resilience

- US debt sustainability issues limit further rate hikes, curtails downside for gold

- Healthy gold demand in China and continued central bank buying in August bolsters tailwinds

- Hold gold as a portfolio risk diversifier and black swan hedge

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Short-term boost from conflict in the Middle East. It is almost a foregone conclusion that gold benefits during tumultuous times given its status as a haven asset. Unsurprisingly, the recent escalation of Israel-Hamas tensions into a full-blown war boosted gold significantly, lifting spot prices almost 5% since 7 October (the inception of the latest flare-up). What remains uncertain at this point is how much more and how much longer gold prices will continue to rally from here. To a large extent, this would depend on how the conflict plays out – if it is contained and resolved within the next one to three months, then it is likely that the bulk of the rally is behind us.

However, if the conflict spreads and becomes a destabilising force regionally, gold may yet have legs to run. Given the efforts by the US and its allies to contain the conflict, which include back-channel talks with Iran to warn against escalation, as well as the maintenance of a safe corridor open between Israel and north Gaza, our base case is that of a ring-fenced conflict rather than a regional crisis. On a more quantitative front, we analysed past risk-off incidents to see their effects on gold price and found that, such episodes resulted in a gold rally that lasted an average of 15 days (trough to peak) and resulted in an average increase in price of c.8.0%.

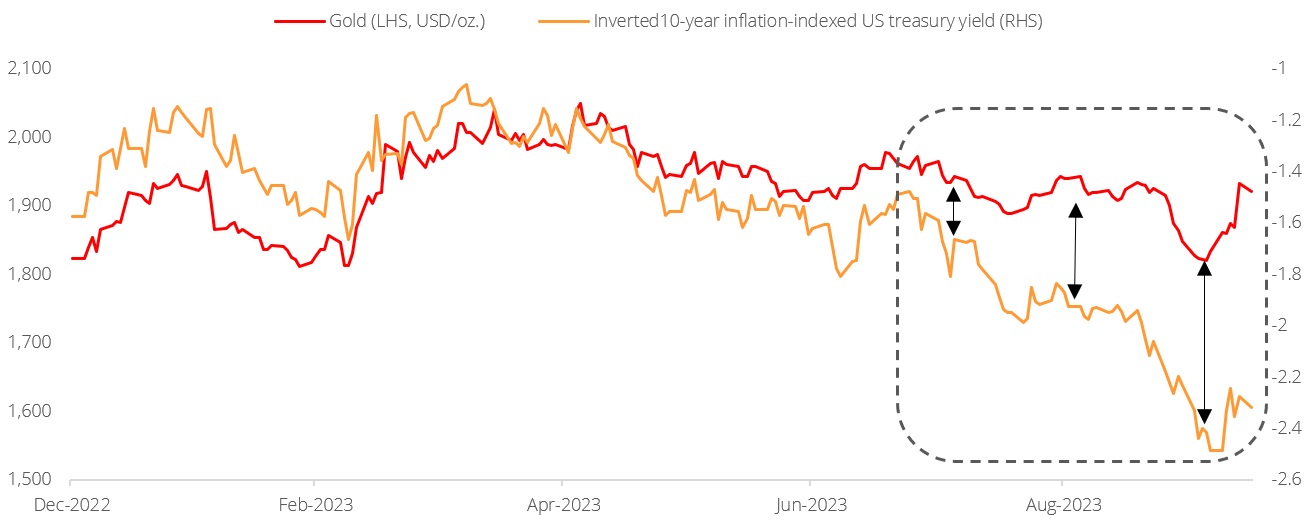

Increasing resilience to real rate rises. Since the start of the Fed’s rate hiking cycle in March last year, interest rates and the dollar have been the primary headwind for gold. This makes sense as treasury yields represent the (risk-free) opportunity cost of holding non-interest-bearing gold. However, this relationship has been somewhat challenged in recent times; the inverse directionality between real rates and gold price remains, but the downside sensitivity of gold price (in response to a rise in rates) has diminished to some extent.

From 1 June to 16 October, the 10Y inflation-indexed US Treasury (GTII10) yield, which is seen as a proxy for real rates, increased 58.8%, while gold receded just 1.5%. Even if we disregard the supportive effect of the Israel-Hamas conflict on gold, the point on reduced downside sensitivity remains valid – between 1 June to 6 October (just before tensions escalated in the Middle East), the GTII10 yield increased 73.6%, while gold fell 7.3%. There are many reasons behind this phenomenon, but a key explanation is that markets are predicting a peak in rates in the near future and positioning themselves for it.

Figure 1: Real rates soared since June but Gold held steady

Source: Department of Treasury, Bureau of Fiscal Service, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024