- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: DM largely down last week as strong US macroeconomic data quash risk sentiment

- Credit: Short duration IG credit gives investors safety while locking in attractive yields

- FX: GBP/USD in for reality check after reaching a one-year high above 1.26

- Rates: Rates pricing reflective of heightened recession worries; low breakevens across the tenors

- The Week Ahead: Keep a lookout for US Initial Jobless Claims; China Inflation Numbers

Equities: Markets down amid interest rate uncertainty

Global equities fell as US jobs data for April surprise on upside. Markets were down last week (ended 5 May) as resilient US macroeconomic data continues to dampen hopes of an interest rate pivot. The US economy added 253,000 jobs in April, above economists’ expectations of 180,000, hourly wages rose more than expected, and the unemployment rate slid to 3.4%. Global equities were down 0.4% for the week, with Developed Markets (DM) and Emerging Markets (EM) registering returns of -0.5 % and 0.5% respectively.

US equities rebounded on Friday after four consecutive days of losses, led by US regional bank shares and Apple. The S&P 500, and Dow Jones fell -0.8%, and -1.2% respectively, while NASDAQ gained 0.1%. Europe also fell as headline inflation for April rose to 7% and economic growth stagnated for the first quarter; the FTSE 100 and Stoxx 600 lost 1.2% and 0.3% respectively. China equities bucked the trend as China’s Caixin services PMI of 56.4 in April remained well in expansionary territory; the HSI & HSCEI were up 0.8% and 1.4% for the week.

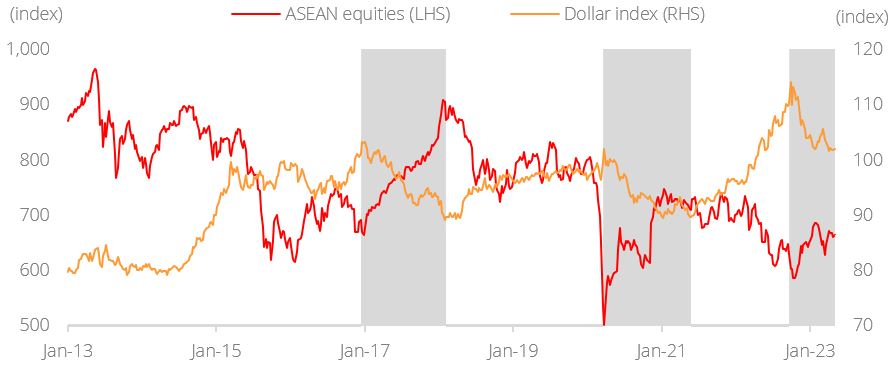

Topic in focus: ASEAN - Structural shift in exports to bolster resilience. Despite ongoing global worries of economic slowdown, ASEAN has stayed resilient thanks to the global diversification away from China, which has created new opportunities and supported its long-term growth prospects. The region is seen as an attractive alternative location for production due to its favourable investment climate and strategic location.

For example, Malaysia’s Penang is fast evolving into a leading electronics hub in ASEAN, with a well-developed ecosystem that includes design, manufacturing, and supply chain capabilities. Indonesia’s commodity sector has also been benefitting from rising FDI and a value-add push in commodities, and has overtaken China as the largest stainless steel exporter in the past two years. As a hub for trade and commerce in the region, Singapore provides access to a market of over 600 million people in ASEAN. The country's world-class port facilities, modern airports, and efficient logistics infrastructure make it a preferred location for multinational companies to set up their regional headquarters and distribution centers. We expect ASEAN’s resilience to persist given the reopening of China, end of US Fed rate hike cycle, and a potential weakening US dollar which should enhance the attractiveness of ASEAN assets.

Figure 1: ASEAN equities move inversely to the dollar

Source: Bloomberg, DBS

Credit: Opportune time to shift cash towards high quality credit with the Liquid+ Strategy

Markets today remain on tenterhooks as investors mull the possibility of a looming recession amid elevated rates and recent banking sector stress. This environment presents an opportune time for investors to shift away from cash to short-duration, high quality credit. Although cash deposit rates may now appear attractive, over the past two decades, cash yields (using 3m T-bills as a proxy) have hardly come close to (Investment Grade) IG credit yields for more than a year. This suggests that investors would do well to take some duration risk in IG credit to lock in yields for a longer timeframe. Especially with the Fed signaling a possible end to its rate hiking cycle after ten consecutive hikes, the days of fleetingly attractive yields on cash deposits are numbered. On the other hand, IG credit investors would experience capital gains should the rate environment subsequently adjust lower, lifting bond prices.

Furthermore, various bank failures in recent months highlight risks concerning the safety of cash that depositors may have previously taken for granted, not least due to concentration on the financial sector. Shifting cash to high quality IG credit provides the additional benefit of diversification away from banking/financial sector risks. With peak rates likely upon us, amid signs of easing inflation and a weakening economy, the window is closing to lock in generous yields. We continue to recommend that investors capitalise on this narrowing window for higher yields by shifting excess cash towards high quality credit in what we termed the Liquid+ Strategy, to capture yields while stocks last.

FX: An important week for the USD

The DXY index is near the floor of this year’s range between 100.8 and 105.9. It could extend its weakness or correct up. EUR/USD did not deviate far from 1.10 after the European Central Bank signalled more hikes. USD/JPY held a 133-138 range after the Bank of Japan kept markets guessing when it would normalise monetary policy. USD/CHF may struggle to push below the 0.88-0.90 range after the Swiss National Bank’s intervention warning.

GBP/USD could be in for a reality check after reaching a one-year high above 1.26 before Thursday’s Bank of England (BOE) meeting. Profit-taking could set in if the BOE delivers the 25 bps hike and signals a pause to assess the impact of the past year’s hikes on the UK economy. The Conservative Party’s major losses at the England council elections, a key test ahead of the next general election due by January 2025, should also remove some of GBP’s shine.

The Fed opened the door for a “hawkish pause.” However, Australia and Malaysia demonstrated that central banks could hike rates again after keeping them unchanged for a meeting or two. The Bank of Canada warned that rates could rise again after keeping them unchanged at 4.50% in March and April. Hence, the Fed’s decision at the FOMC meeting on 14 June will be data-dependent. Last Friday, US nonfarm payrolls were stronger at 253k jobs in April vs. the 185k consensus and the 165k jobs added in March. April’s unemployment rate returned to the lifetime low of 3.4% seen in January. Average hourly earnings increased 0.5% m/m from 0.3%. On 10 May, consensus expects US CPI inflation to firm to 0.4% m/m in April from 0.1% in March, keeping it flat at 5% in y/y terms. Although core inflation is expected to slow to 5.5% y/y from 5.6%, it is still above the 2% target and the 5.25% ceiling of the Fed Funds Rate range. Despite the tighter credit conditions, the Fed sees the US economy averting a recession on a tight labour market.

However, investors cannot dismiss the growth risks from the stress in US regional banks and the US federal debt ceiling brinksmanship on Capitol Hill. Sentiment will falter if the S&P 500 succumbs to weakness in the regional banking index pushing 2020 lows. On Tuesday, US President Joe Biden will host the four Senate and House leaders to start the process of reach a bipartisan decision to lift the federal debt ceiling.

Forty-three Republican Senators signed a letter pledging no support for any debt ceiling increase without substantive spending and budget reforms, depriving the Democrats of the 60 votes needed for a clean debt ceiling bill in the 100-member Senate. Markets expect an eleventh-hour solution by the X-date on 1 June.

Rates: Focus switches to data resilience

Non-farm payrolls coming in above expectations (actual: 253k, consensus: 185k) in April helped to nudge US Treasury yields off depressed levels. The unemployment rate fell back to 3.4% while average hourly earnings beat (actual: 0.5% m/m sa, consensus: 0.3%). However, there was a blot of weakness as the previous two months’ payrolls were revised lower by 149k. The market will probably take comfort that data has not fallen off a cliff and this should assuage imminent recent worries. This week’s CPI print (due 10 May) will provide another hint on how long the Fed should keep rates high.

On our part, we see signs that the banking crisis has stabilised for now but longer-term challenges remain. First, we note that usage of the Fed’s discount window has collapsed. Timing wise, this suggests that First Republic Bank’s failure and subsequent acquisition by JP Morgan appears to have warded off the immediate challenge. Usage of the Bank Term Funding Program has been fairly stable, but we suspect that banks will use the facility for cheap funding and doubt that levels would fall quickly. Meanwhile, credit growth and deposits at small banks have bounced. The last wrinkle would be that bank (large and small) deposits are still being eroded, highlighting the challenges of high risk-free rates. On Friday, bank stocks staged a sharp rebound, reflecting easing fears.

Rates pricing is still reflective of heightened recession worries. Breakevens across the tenors are low by historical standards (1Y breakeven around 2%) and the market is still pricing in three cuts (first cut in September) by the end of the year and 213bps of cuts by end- 2024. These bets on Fed easing still look outsized by historical standards and likely represents a fair amount of risk premium built in as market participants hedge against a worst-case scenario. If banking system worries ease a bit more, we suspect that yields (especially the 2y to 5Y) can take a modest grind higher this week, flattening the curve somewhat. Meanwhile, keep an eye on debt ceiling wrangling that will likely get more intense the coming two weeks.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.