- Day to Day

- Ways to Bank

- DBS IDEAL

- Loan Services

Loan Services

Access to comprehensive loan enquiry and other loan transaction services on DBS IDEAL

- Day to Day

- Ways to Bank

- DBS IDEAL

- Loan Services

Loan Services

Access to comprehensive loan enquiry and other loan transaction services on DBS IDEAL

More time saved and less hassle when you submit your loan servicing transactions online, track the real time status and get notified upon completion of the transaction requests.

DBS IDEAL Loan Services is a one-stop solution for DBS Corporate customers to fulfill their major loan-related transaction requests without the need to send any physical instruction or visit the branch.

You can now have a comprehensive overview of your loan on DBS IDEAL

Get access to a variety of loan services including inquiry of all outstanding loan facilities, submission of loan transaction requests and notifications via email & SMS, all on a single platform.

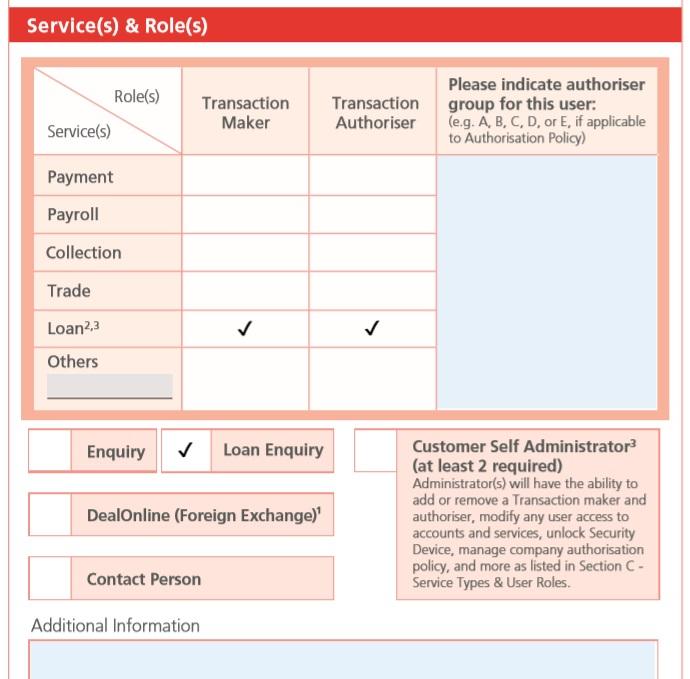

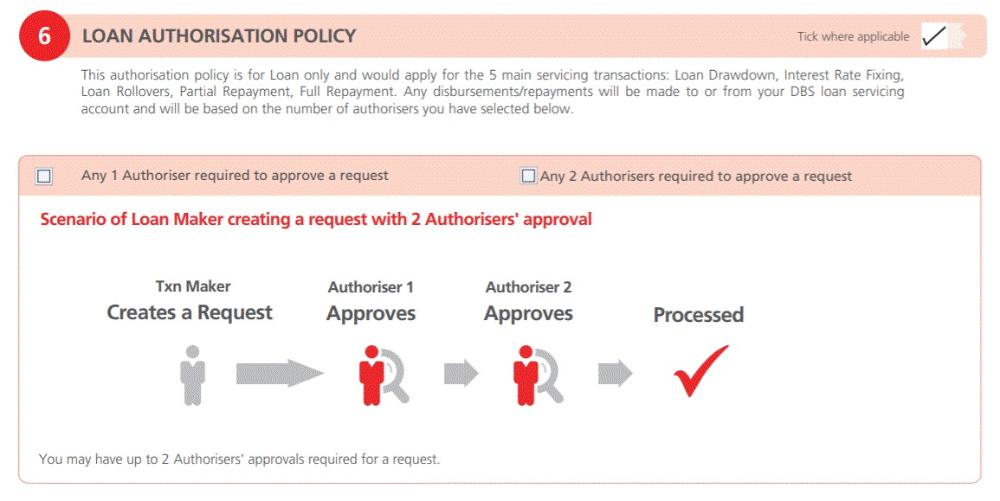

Loan Services supports the following loan transactions & services:

- Enquiry of loan amount outstanding, interest rate, next payment due date & amount, past transaction and repayment history of principal and interest amount paid etc

- Loan rollovers

- Scheduled payments

- Partial or full loan settlements

- Manage and control DBS IDEAL user accesses to company’s loan accounts and online banking functions through the Customer Self Administration module

*Syndicated Loans, Property loans and Equipment Financing are excluded.

For existing IDEAL customers, you can apply for Loan Enquiry & Transaction Services through IDEAL Maintenance form

For new to DBS customers, apply online for a business account in just 5 minutes, and enjoy the convenience of DBS IDEAL online banking.

- Contact your Relationship Manager or

- Schedule a callback via this online form

- Alternatively, you can contact our BusinessCare hotline if you have any further queries. Call us at 1800 419 9500 / 1800 103 6500 or +91 44 6632 8000 if you are calling from overseas (Mon to Fri excl holidays, between 10am to 7pm) or write to us at [email protected]

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?