More time saved and less hassle when you submit your loan servicing transactions online, track the real time status and get notified upon completion of the transaction requests.

DBS IDEAL Loan Services is a one-stop solution for DBS Corporate customers to fulfil their major loan-related transaction requests without the need to send any physical instruction or visit the branch.

You can now have a comprehensive overview of your loan on DBS IDEAL

Get access to a variety of loan services including inquiry of all outstanding loan facilities, submission of loan transaction requests and notifications via email & SMS, all on a single platform.

Loan Services supports the following loan transactions & services:

- Enquiry of loan amount outstanding, interest rate, next payment due date & amount, past transaction and repayment history of principal and interest amount paid etc

- Loan rollovers

- Scheduled payments

- Partial or full loan settlements

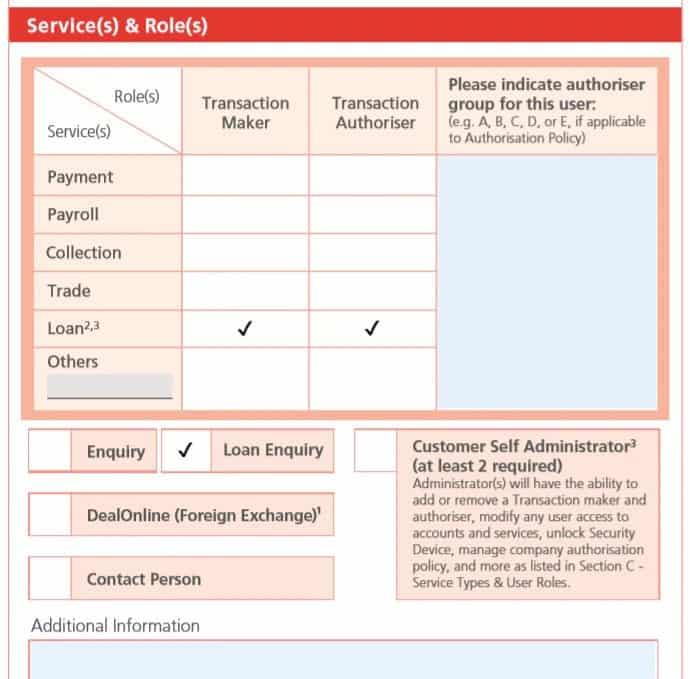

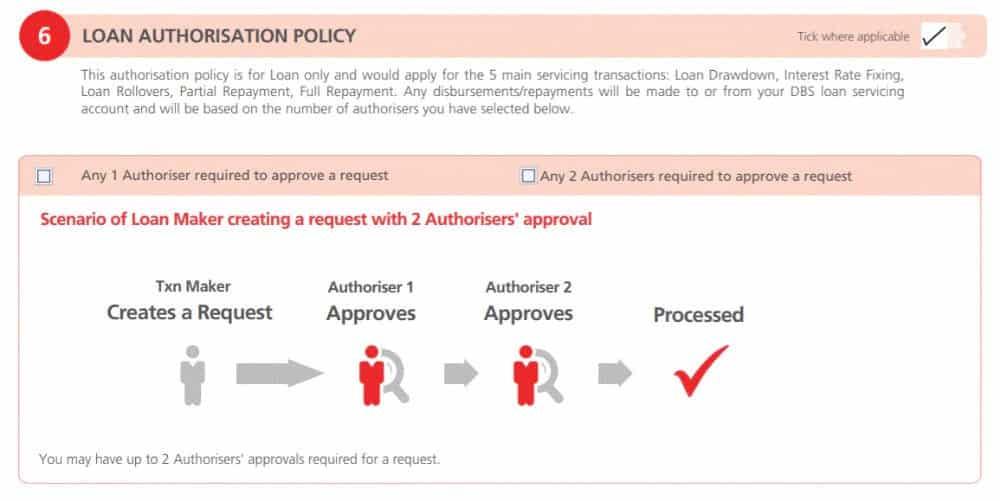

- Manage and control DBS IDEAL user accesses to company’s loan accounts and online banking functions through the Customer Self Administration module

*Syndicated Loans, Property loans and Equipment Financing are excluded.

For existing IDEAL customers, you can apply for Loan Enquiry & Transaction Services through IDEAL Maintenance form

For new to DBS customers, apply online for a business account in just 5 minutes, and enjoy the convenience of DBS IDEAL online banking.

Call BusinessCare

In India: 1800 419 9500 / 1800 103 6500

Overseas: +91 44 6632 8000

Operating hours: 10:00am to 7:00PM, Monday to Friday & RBI working Saturdays (excluding public holidays in India)

For more information, visit dbs.com/sustainability.