New study examines financial readiness of Singapore residents to tackle cancer costs: preliminary findings point to importance of financial literacy

Singapore.15 Jan 2024

New study will delve deeper into the extent to which cancer, the leading cause of death in Singapore, can lead to perceived financial challenges for local households

Singapore, 15 Jan 2024 - DBS Bank, the National University Cancer Institute, Singapore (NCIS) and Research for Impact Singapore (RFI) have embarked on an ongoing study to examine the level of financial preparedness of Singapore residents to manage cancer, the leading cause of death in Singapore today.

This study aims to assess not only the awareness of potential costs associated with a cancer diagnosis, but also the understanding of its financial implications, emphasising the critical role of financial literacy. By delving into the perspectives of the general population, patients, and healthcare providers, the study seeks to shed light on how financial knowledge can influence an individual’s ability to navigate and cope with the challenges posed by cancer treatment and care.

During the initial phase of the ongoing study, researchers conducted a perception survey of 1,200 respondents, using a sample proportionally representative of the general population. It sought to determine their reported levels of financial literacy and insurance knowledge in relation to their perception of cancer treatment costs and confidence in their ability to cope if diagnosed. The survey, as part of the three-part study, was designed by NCIS and RFI, sponsored by DBS Bank and conducted by Blackbox Research during August and September 2023.

Key finding #1: Respondents perceive difficulty coping with the cost of cancer care

Early survey data suggest that a significant share of Singapore resident households may feel underprepared financially to cope with shocks such as cancer, and more specifically, are unclear of what cancer entails – from the disease incidence to treatment costs, and healthcare financing.

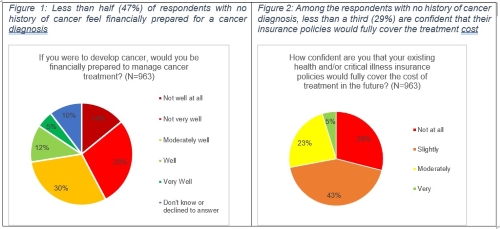

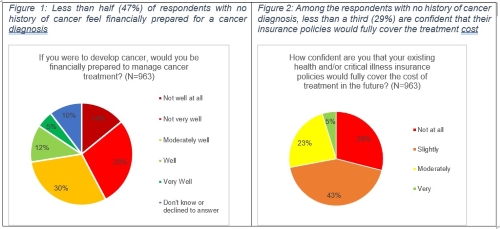

Among respondents who have never had a cancer diagnosis, less than half (47%) think that they are financially well-prepared to manage a cancer diagnosis (Figure 1), and less than a third (29%) are confident that their existing health and/or critical illness insurance policies would fully cover the cost of treatment (Figure 2).

Key finding #2: Cost concerns may significantly impact decisions about treatment

While respondents recognised that adequate insurance coverage is key to being better financially prepared, obstacles – such as familiarity with common terms and conditions, and affordability of premiums – remain.

The early survey data indicate that among the survey respondents with no prior history of cancer diagnosis, almost one in three (32%) expressed concerns over the cost of cancer care. Such concerns are not limited to those in lower income brackets but also extend to middle-income respondents.

This is corroborated by a separate recent study by NCIS and RFI researchers, focused on cancer survivors in Singapore, which revealed that patients of lower socioeconomic status were found to be at higher risk of financial toxicity. Financial toxicity is defined as financial distress arising from the cost of cancer treatment, and that a patient’s quality of life is positively and significantly correlated with the feeling of financial well-being[1].

Other preliminary findings from the study include:

Dr Jen Wei Ying, clinical lead of the study and Consultant, Department of Haematology-Oncology, NCIS said: “The financial impact of cancer is a real but poorly understood and infrequently acknowledged concern in cancer care and survivorship. The data presented here show that cost concerns are prevalent, even in respondents who do not have a cancer diagnosis. Further study is required to understand how such concerns impact care, even with existing safety nets and financial support schemes. Financial preparedness to meet the challenges of critical illness is something that should be addressed as part of a holistic, total approach to preventative health and well-being. Policymakers, financial institutions, the healthcare industry and, critically, all Singapore residents, must share responsibility in mitigating the financial burdens of critical illness. We can accomplish this through education and outreach, while ensuring that coverage is accessible, both in terms of cost and comprehensible, streamlined, policy wording.”

Key finding #3: Improving financial literacy is crucial as part of the solution

Respondents who perceived themselves as ‘highly financial literate’ were less likely to anticipate delaying or foregoing cancer treatment due to cost concerns. Helping more people improve their financial knowledge and awareness of available coverage will thus give them the confidence to prepare for unpredictable ‘catastrophic’ medical expenditure and income loss, allowing them to focus on their treatment should they become unwell.

“Critical illness insurance can not only help alleviate money worries, but also allows patients to focus on what’s most important – that is, seeking professional care and making a full recovery,” said Jeremy Soo, Head of Consumer Banking Group, DBS Singapore. “However, with treatment costs and income replacement sums varying significantly from one to the other, some may find themselves caught unprepared financially even after tapping on national healthcare schemes and existing insurance coverage plans. They may not be able to take a break from work to fully recuperate, as they must provide for their dependents, which greatly hinders recovery.

These findings underscore the importance and urgency for us to help consumers to better plan and protect themselves and their loved ones against critical illnesses, such as cancer, which affects one in four people in Singapore. We believe that financial institutions, alongside policymakers, insurers, and healthcare professionals, have a crucial role to play in mitigating the impact of financial toxicity on cancer patients and their families. We are firmly committed

to continue to provide fit-for-purpose advice, and work with our partners to ensure there are solutions that meet our customers' protection needs at every lifestage, while dialling up efforts to empower everyone on financial literacy.”

DBS/POSB customers can login to their digibank or internet banking to consolidate their insurance coverage data via SGFinDex, before being served personalised insights to close outstanding insurance gaps. They can also browse the DBS Healthcare Marketplace for more details.

Said Dr Joanne Yoong, CEO and Principal Economist & Behavioural Scientist, Research For Impact, and Adjunct Professor, Centre for Behavioural and Implementation Science Interventions at the Yong Loo Lin School of Medicine, National University of Singapore: “Our early findings reinforce that financial literacy can have wider impacts for long-term health and welfare. Empowering consumers to develop their own financial capability and understanding of the policy and insurance environment is a critically important foundation for decision-making in a healthcare system like Singapore, where both public and private stakeholders play a key role in supporting household well-being.”

Ms Alexis Koh, Principal Medical Social Worker, National University Hospital shared: “A cancer diagnosis can be both physically and psychologically challenging. As healthcare providers, we seek to provide support and stability to patients by attending to their needs, including financial concerns. It is important that we proactively communicate with patients about the cost of cancer treatment and engage them on mobilising their financial resources and other avenues of financial support. Patients and families with difficulties can reach out to their doctors and medical social workers for assistance. Ultimately, we hope to ease their journey and reduce as much stressors as possible so that patients can focus on their health and treatment.”

This ongoing study is part of a three-part research series, with the ultimate aim to help individuals, policymakers, and others within the wider healthcare ecosystem in Singapore better understand and meet the financial and welfare challenges that a cancer diagnosis could potentially present. The next phase of the study will use qualitative research methods, such as in-depth interviews, to gather comprehensive insights into the experiences and challenges faced by different stakeholders, including oncologists, medical social workers, the financial counselling team, cancer patients and their caregivers.

[1] Financial toxicity among adult cancer survivors in Singapore: does it exist? https://journals.lww.com/smj/fulltext/9900/financial_toxicity_among_adult_cancer_survivors_in.53.aspx

Chinese Glossary

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 15 consecutive years from 2009 to 2023.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting social enterprises: businesses with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping communities with future-ready skills and building food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

About the National University Cancer Institute, Singapore (NCIS)

The National University Cancer Institute, Singapore (NCIS) is an academic, national specialist centre for cancer under the National University Health System (NUHS), and is the only public cancer centre in Singapore that treats both paediatric and adult cancers in one facility.

As one of two national cancer centres in Singapore, NCIS (pronounced as “n-sis”) offers a broad spectrum of cancer care and management from screening, diagnosis and treatment to rehabilitation and survivorship, as well as palliative and long-term care. NCIS’ strength lies in the multi-disciplinary approach taken by our clinician scientists and clinician-investigators to develop a comprehensive and personalised plan for each cancer patient.

NCIS provides the full suite of specialised oncology and haematology services at the NUH Medical Centre at Kent Ridge, Singapore, including those by the NCIS Chemotherapy Centre, NCIS Radiotherapy Centre and NCIS Cellular Therapy Centre.

NCIS also offers cancer services at other hospitals in Singapore:

• NCIS Cancer & Blood Clinic @ Ng Teng Fong General Hospital

• NCIS Radiotherapy Centre @ Tan Tock Seng Hospital

• NCIS Radiotherapy Clinic @ Khoo Teck Puat Hospital

To bring cancer care even closer to our patients, our NCIS on the Go programme delivers a range of cancer services at clinics within the community for their convenience. For more information, please visit www.ncis.com.sg.

About Research For Impact

Research For Impact (RFI) is a Singapore-based think-tank dedicated to making the behavioural and social sciences accessible, inclusive, and transformative for all. Our multidisciplinary team offers research, monitoring and evaluation, advisory, and capacity-building services to organisations with social purpose goals across diverse sectors, including health, education, social protection, finance, and community development. We combine global experience and technical expertise with a creative, collaborative approach that enables our partners to empower themselves through evidence-driven decision-making for policy-making, practice, and advocacy.

This study aims to assess not only the awareness of potential costs associated with a cancer diagnosis, but also the understanding of its financial implications, emphasising the critical role of financial literacy. By delving into the perspectives of the general population, patients, and healthcare providers, the study seeks to shed light on how financial knowledge can influence an individual’s ability to navigate and cope with the challenges posed by cancer treatment and care.

During the initial phase of the ongoing study, researchers conducted a perception survey of 1,200 respondents, using a sample proportionally representative of the general population. It sought to determine their reported levels of financial literacy and insurance knowledge in relation to their perception of cancer treatment costs and confidence in their ability to cope if diagnosed. The survey, as part of the three-part study, was designed by NCIS and RFI, sponsored by DBS Bank and conducted by Blackbox Research during August and September 2023.

Key finding #1: Respondents perceive difficulty coping with the cost of cancer care

Early survey data suggest that a significant share of Singapore resident households may feel underprepared financially to cope with shocks such as cancer, and more specifically, are unclear of what cancer entails – from the disease incidence to treatment costs, and healthcare financing.

Among respondents who have never had a cancer diagnosis, less than half (47%) think that they are financially well-prepared to manage a cancer diagnosis (Figure 1), and less than a third (29%) are confident that their existing health and/or critical illness insurance policies would fully cover the cost of treatment (Figure 2).

Key finding #2: Cost concerns may significantly impact decisions about treatment

While respondents recognised that adequate insurance coverage is key to being better financially prepared, obstacles – such as familiarity with common terms and conditions, and affordability of premiums – remain.

The early survey data indicate that among the survey respondents with no prior history of cancer diagnosis, almost one in three (32%) expressed concerns over the cost of cancer care. Such concerns are not limited to those in lower income brackets but also extend to middle-income respondents.

This is corroborated by a separate recent study by NCIS and RFI researchers, focused on cancer survivors in Singapore, which revealed that patients of lower socioeconomic status were found to be at higher risk of financial toxicity. Financial toxicity is defined as financial distress arising from the cost of cancer treatment, and that a patient’s quality of life is positively and significantly correlated with the feeling of financial well-being[1].

Other preliminary findings from the study include:

- Respondents without critical illness insurance coverage cited unaffordable premiums as a key reason for not purchasing policies.

- Respondents with insurance coverage may not be knowledgeable about their own insurance plan(s), specifically, policy benefits, exclusions, co-pays and claim amounts.

- More needs to be done to raise awareness and understanding in this space, particularly as healthcare policies change. Only 33% of the 1,200 respondents were aware of the recent changes to the financing of outpatient cancer treatment based on the Cancer Drug List (CDL), which had been announced prior to the survey.

- A correlation likely exists between household income, perceived financial preparedness, as well as one’s understanding of and confidence in insurance.

Dr Jen Wei Ying, clinical lead of the study and Consultant, Department of Haematology-Oncology, NCIS said: “The financial impact of cancer is a real but poorly understood and infrequently acknowledged concern in cancer care and survivorship. The data presented here show that cost concerns are prevalent, even in respondents who do not have a cancer diagnosis. Further study is required to understand how such concerns impact care, even with existing safety nets and financial support schemes. Financial preparedness to meet the challenges of critical illness is something that should be addressed as part of a holistic, total approach to preventative health and well-being. Policymakers, financial institutions, the healthcare industry and, critically, all Singapore residents, must share responsibility in mitigating the financial burdens of critical illness. We can accomplish this through education and outreach, while ensuring that coverage is accessible, both in terms of cost and comprehensible, streamlined, policy wording.”

Key finding #3: Improving financial literacy is crucial as part of the solution

Respondents who perceived themselves as ‘highly financial literate’ were less likely to anticipate delaying or foregoing cancer treatment due to cost concerns. Helping more people improve their financial knowledge and awareness of available coverage will thus give them the confidence to prepare for unpredictable ‘catastrophic’ medical expenditure and income loss, allowing them to focus on their treatment should they become unwell.

“Critical illness insurance can not only help alleviate money worries, but also allows patients to focus on what’s most important – that is, seeking professional care and making a full recovery,” said Jeremy Soo, Head of Consumer Banking Group, DBS Singapore. “However, with treatment costs and income replacement sums varying significantly from one to the other, some may find themselves caught unprepared financially even after tapping on national healthcare schemes and existing insurance coverage plans. They may not be able to take a break from work to fully recuperate, as they must provide for their dependents, which greatly hinders recovery.

These findings underscore the importance and urgency for us to help consumers to better plan and protect themselves and their loved ones against critical illnesses, such as cancer, which affects one in four people in Singapore. We believe that financial institutions, alongside policymakers, insurers, and healthcare professionals, have a crucial role to play in mitigating the impact of financial toxicity on cancer patients and their families. We are firmly committed

to continue to provide fit-for-purpose advice, and work with our partners to ensure there are solutions that meet our customers' protection needs at every lifestage, while dialling up efforts to empower everyone on financial literacy.”

DBS/POSB customers can login to their digibank or internet banking to consolidate their insurance coverage data via SGFinDex, before being served personalised insights to close outstanding insurance gaps. They can also browse the DBS Healthcare Marketplace for more details.

Said Dr Joanne Yoong, CEO and Principal Economist & Behavioural Scientist, Research For Impact, and Adjunct Professor, Centre for Behavioural and Implementation Science Interventions at the Yong Loo Lin School of Medicine, National University of Singapore: “Our early findings reinforce that financial literacy can have wider impacts for long-term health and welfare. Empowering consumers to develop their own financial capability and understanding of the policy and insurance environment is a critically important foundation for decision-making in a healthcare system like Singapore, where both public and private stakeholders play a key role in supporting household well-being.”

Ms Alexis Koh, Principal Medical Social Worker, National University Hospital shared: “A cancer diagnosis can be both physically and psychologically challenging. As healthcare providers, we seek to provide support and stability to patients by attending to their needs, including financial concerns. It is important that we proactively communicate with patients about the cost of cancer treatment and engage them on mobilising their financial resources and other avenues of financial support. Patients and families with difficulties can reach out to their doctors and medical social workers for assistance. Ultimately, we hope to ease their journey and reduce as much stressors as possible so that patients can focus on their health and treatment.”

This ongoing study is part of a three-part research series, with the ultimate aim to help individuals, policymakers, and others within the wider healthcare ecosystem in Singapore better understand and meet the financial and welfare challenges that a cancer diagnosis could potentially present. The next phase of the study will use qualitative research methods, such as in-depth interviews, to gather comprehensive insights into the experiences and challenges faced by different stakeholders, including oncologists, medical social workers, the financial counselling team, cancer patients and their caregivers.

[1] Financial toxicity among adult cancer survivors in Singapore: does it exist? https://journals.lww.com/smj/fulltext/9900/financial_toxicity_among_adult_cancer_survivors_in.53.aspx

Chinese Glossary

| National University Cancer Institute, Singapore (NCIS) | 新加坡国立大学癌症中心 (国大癌症中心) |

| DBS Singapore | 星展银行新加坡 |

| Dr Jen Wei Ying Consultant Department of Haematology-Oncology National University Cancer Institute, Singapore | 任玮瑛 顾问医生 肿瘤血液科 新加坡国立大学癌症中心 |

| Dr Joanne Yoong CEO and Principal Economist & Behavioural Scientist Research For Impact Adjunct Professor Centre for Behavioural and Implementation Science Interventions NUS Yong Loo Lin School of Medicine (NUS Medicine) | 熊淑妍博士 总裁, 首席经济学家与行为科学家 Research For Impact 客座教授 行为与实施科学研究中心 新加坡国立大学杨潞龄医学院 |

| Mr Jeremy Soo Head of Consumer Banking Group DBS Singapore | 苏孝进 消费银行部董事总经理兼主管 星展银行新加坡 |

| Ms Alexis Koh Principal Medical Social Worker National University Hospital | 许玲莉 首席医疗社工 国立大学医院 |

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 15 consecutive years from 2009 to 2023.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting social enterprises: businesses with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping communities with future-ready skills and building food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

About the National University Cancer Institute, Singapore (NCIS)

The National University Cancer Institute, Singapore (NCIS) is an academic, national specialist centre for cancer under the National University Health System (NUHS), and is the only public cancer centre in Singapore that treats both paediatric and adult cancers in one facility.

As one of two national cancer centres in Singapore, NCIS (pronounced as “n-sis”) offers a broad spectrum of cancer care and management from screening, diagnosis and treatment to rehabilitation and survivorship, as well as palliative and long-term care. NCIS’ strength lies in the multi-disciplinary approach taken by our clinician scientists and clinician-investigators to develop a comprehensive and personalised plan for each cancer patient.

NCIS provides the full suite of specialised oncology and haematology services at the NUH Medical Centre at Kent Ridge, Singapore, including those by the NCIS Chemotherapy Centre, NCIS Radiotherapy Centre and NCIS Cellular Therapy Centre.

NCIS also offers cancer services at other hospitals in Singapore:

• NCIS Cancer & Blood Clinic @ Ng Teng Fong General Hospital

• NCIS Radiotherapy Centre @ Tan Tock Seng Hospital

• NCIS Radiotherapy Clinic @ Khoo Teck Puat Hospital

To bring cancer care even closer to our patients, our NCIS on the Go programme delivers a range of cancer services at clinics within the community for their convenience. For more information, please visit www.ncis.com.sg.

About Research For Impact

Research For Impact (RFI) is a Singapore-based think-tank dedicated to making the behavioural and social sciences accessible, inclusive, and transformative for all. Our multidisciplinary team offers research, monitoring and evaluation, advisory, and capacity-building services to organisations with social purpose goals across diverse sectors, including health, education, social protection, finance, and community development. We combine global experience and technical expertise with a creative, collaborative approach that enables our partners to empower themselves through evidence-driven decision-making for policy-making, practice, and advocacy.