More than 1.5 million DBS/POSB customers use bank’s self-managed security features to protect themselves from scams

Bank has enhanced its digiVault feature, with customers now able to instantly lock their funds via the digibank app and unlock these funds at over 1,200 ATMs islandwide

New Digital Card Fraud Dispute tool enables customers to file card fraud disputes more swiftly and conveniently via the digibank app

Singapore, 14 Oct 2024 - Over 1.5 million DBS/POSB customers – representing a three-fold increase from a year ago – are using self-managed security features in the digibank app to protect themselves from scams. The features include Payment Controls, which enable customers to manage key payment settings; Security Checkup, which guides them through a curated checklist of essential security actions; and digiVault, which allows them to lock their funds and prevent digital transfers out. The bank expects the number of users to increase to two million over the next six months as it continues to enhance its security features and intensify anti-scam education.

To cater to customers’ growing demand for greater control over the security of their funds, DBS/POSB is making it even easier for them to lock their savings or file a card fraud dispute – with just a few taps in their digibank app.

These new features and enhancements, alongside existing options such as Payment Controls and Security Checkup, are part of the bank’s ongoing efforts to equip customers with the tools and knowledge needed to combat the evolving threat of scams and fraud.

Jeremy Soo, Head of Consumer Banking, DBS Singapore, said: “Empowering customers with the right tools and knowledge is vital in the fight against scams and fraud. Earlier this year, we announced our goal to double the number of customers using our security features over a 12-month period. In just half a year, we have seen very encouraging results. We are heartened that in tandem with our rollout of enhanced security features and continued public education efforts, more customers are actively taking charge of their own funds security. This is important as a strong, multi-layered defence against scams has to be rooted in collective vigilance.”

Rising adoption of DBS/POSB security controls

DBS/POSB observed a 55% year-on-year increase in the number of customers using Payment Controls to manage their payment settings. The most significant growth was among customers aged 45 to 60, with nearly twice as many using the controls to enable or disable overseas spending and cash advances compared to last year. Gen Z customers, aged 21 to 29, also tend to use Payment Controls to manage their spending limits. During peak travel months – July, August, November and December – more customers have also been using the “overseas transactions” feature to manage their card security and spending while travelling.

In addition, on average, 10,000 customers each month lower their transaction notification thresholds, allowing them to receive alerts for smaller transactions. This enables them to quickly detect and respond to any suspicious activity on their cards and accounts, enhancing protection against potential fraud.

Ongoing public education initiatives equip more with the know-how to stay safe

In addition to DBS/POSB’s suite of self-managed security controls, the bank also continues to ramp up its public education efforts to equip customers with the knowledge needed to stay safe. To date, the bank has organised nine POSB Your Neighbourhood Getai anti-scam and digital literacy events across various neighbourhoods to educate seniors and the wider community on safe online banking. This series combines Getai entertainment with essential digital literacy and anti-scam education, benefitting over 3,000 senior participants to date. In line with its commitment to anti-scam education, the bank also launched its new Bank Safely Hub earlier this year, featuring essential scam alerts, educational materials and resources to help the public stay informed about scams.

Appendix

(1) Enhanced digiVault allows customers to instantly lock existing accounts via the digibank app

Customers can choose from three locking options: lock funds in existing accounts while continuing to earn the same interest rate, lock their fixed deposits, or set up a separate account to lock their funds in; providing them with greater flexibility in securing their funds while enjoying an added layer of security.

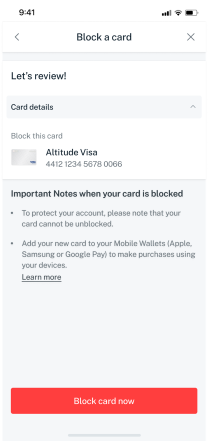

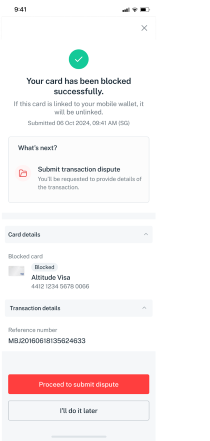

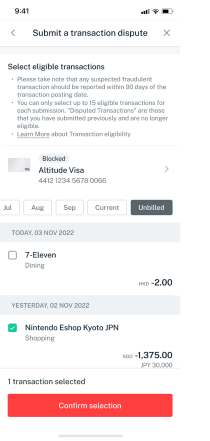

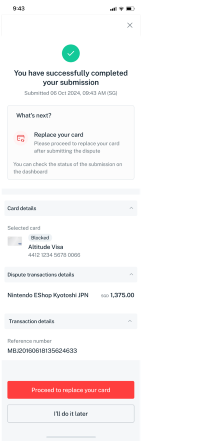

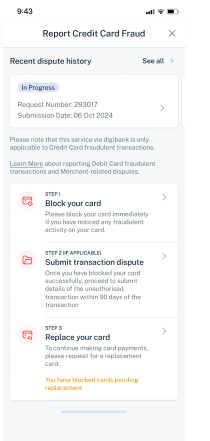

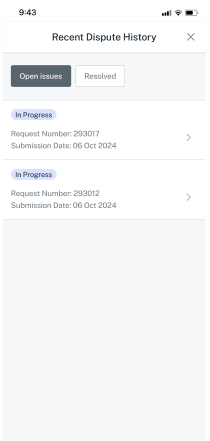

(2) New Digital Card Fraud Dispute tool simplifies card fraud reporting

Customers can easily submit a report through digibank and track the status of disputed transactions via an in-app dashboard.

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 15 consecutive years from 2009 to 2023.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com..

To cater to customers’ growing demand for greater control over the security of their funds, DBS/POSB is making it even easier for them to lock their savings or file a card fraud dispute – with just a few taps in their digibank app.

- Added convenience to lock and unlock funds in digiVault: From today (14 Oct), customers can instantly lock funds in their existing accounts via the DBS/POSB digibank app. This is in addition to the existing way of locking up funds via DBS/POSB digibot. The funds can be unlocked at over 1,200 ATMs islandwide in addition to branches. Customers will continue to earn the same interest on their locked savings and fixed deposits. Since its rollout nearly a year ago, the number of customers locking their funds has been steadily increasing by 15% each month.

- New Digital Card Fraud Dispute Tool: Launched last week, customers can now submit a dispute report for any unauthorised credit card transaction via the DBS/POSB digibank app. In addition, they will also be able to track the real-time status of disputed transactions via an in-app dashboard.

These new features and enhancements, alongside existing options such as Payment Controls and Security Checkup, are part of the bank’s ongoing efforts to equip customers with the tools and knowledge needed to combat the evolving threat of scams and fraud.

Jeremy Soo, Head of Consumer Banking, DBS Singapore, said: “Empowering customers with the right tools and knowledge is vital in the fight against scams and fraud. Earlier this year, we announced our goal to double the number of customers using our security features over a 12-month period. In just half a year, we have seen very encouraging results. We are heartened that in tandem with our rollout of enhanced security features and continued public education efforts, more customers are actively taking charge of their own funds security. This is important as a strong, multi-layered defence against scams has to be rooted in collective vigilance.”

Rising adoption of DBS/POSB security controls

DBS/POSB observed a 55% year-on-year increase in the number of customers using Payment Controls to manage their payment settings. The most significant growth was among customers aged 45 to 60, with nearly twice as many using the controls to enable or disable overseas spending and cash advances compared to last year. Gen Z customers, aged 21 to 29, also tend to use Payment Controls to manage their spending limits. During peak travel months – July, August, November and December – more customers have also been using the “overseas transactions” feature to manage their card security and spending while travelling.

In addition, on average, 10,000 customers each month lower their transaction notification thresholds, allowing them to receive alerts for smaller transactions. This enables them to quickly detect and respond to any suspicious activity on their cards and accounts, enhancing protection against potential fraud.

Ongoing public education initiatives equip more with the know-how to stay safe

In addition to DBS/POSB’s suite of self-managed security controls, the bank also continues to ramp up its public education efforts to equip customers with the knowledge needed to stay safe. To date, the bank has organised nine POSB Your Neighbourhood Getai anti-scam and digital literacy events across various neighbourhoods to educate seniors and the wider community on safe online banking. This series combines Getai entertainment with essential digital literacy and anti-scam education, benefitting over 3,000 senior participants to date. In line with its commitment to anti-scam education, the bank also launched its new Bank Safely Hub earlier this year, featuring essential scam alerts, educational materials and resources to help the public stay informed about scams.

Appendix

(1) Enhanced digiVault allows customers to instantly lock existing accounts via the digibank app

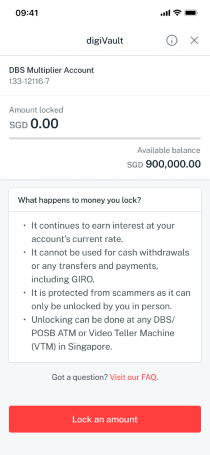

Customers can choose from three locking options: lock funds in existing accounts while continuing to earn the same interest rate, lock their fixed deposits, or set up a separate account to lock their funds in; providing them with greater flexibility in securing their funds while enjoying an added layer of security.

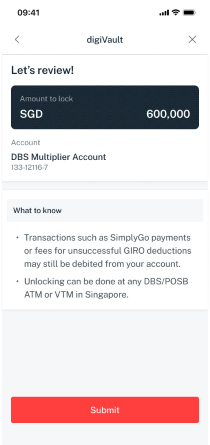

| Lock funds in an existing account | |

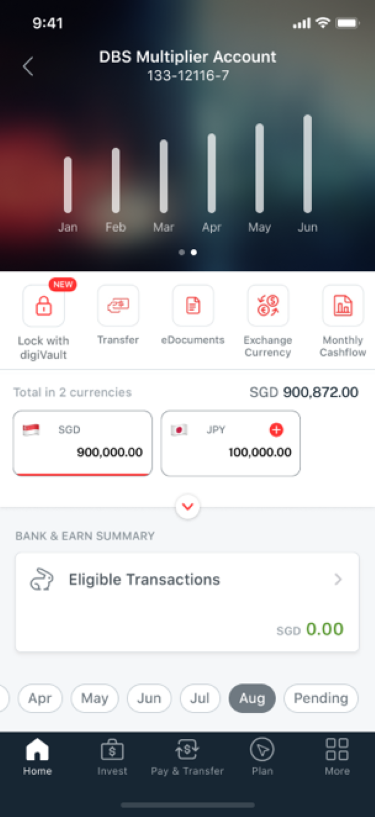

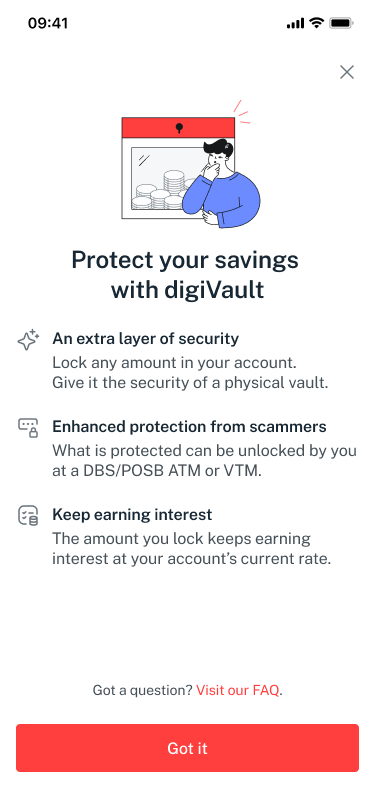

| Step 1 Select the account you wish to lock up funds in. Click the ‘Lock with digiVault’ button on the top left-hand corner. Read about the benefits of digiVault and click ‘Got it’ to proceed. |   |

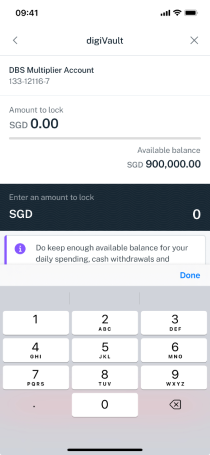

| Step 2 Input the amount you wish to lock. |   |

| Step 3 Review and click submit. Receive a confirmation email and in-app push notification once funds are successfully locked, usually within seconds. |   |

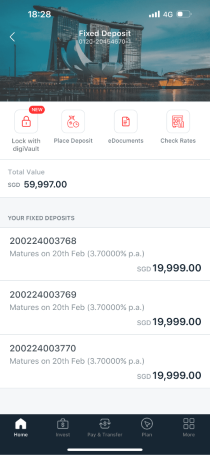

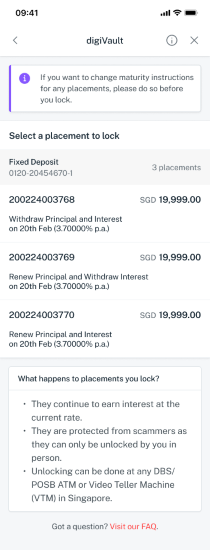

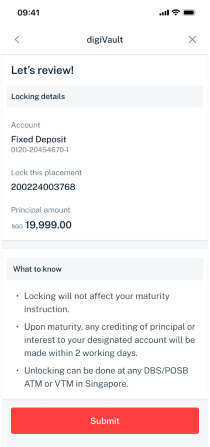

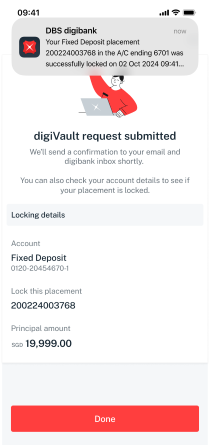

| Lock a fixed deposit | |

| Step 1 Click the ‘Lock with digiVault’ button on the top left-hand corner on your fixed deposit page. Read about the benefits of digiVault, and click ‘Got it’ to proceed. |   |

| Step 2 Select the fixed deposit placement to lock. * After locking current placements, any new placements will not be auto locked. You must submit a request to lock your new placements. * Locking will not affect your maturity instruction. |  |

| Step 3 Review and click submit. Receive a confirmation email and in-app push notification once the fixed deposit placement is successfully locked, usually within seconds. |   |

(2) New Digital Card Fraud Dispute tool simplifies card fraud reporting

Customers can easily submit a report through digibank and track the status of disputed transactions via an in-app dashboard.

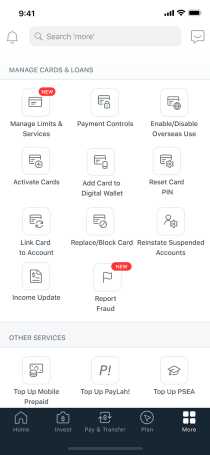

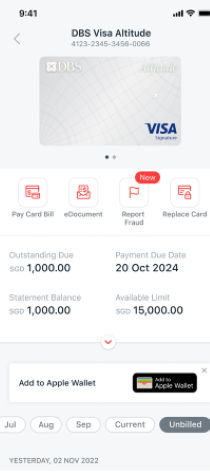

| Step 1 Option 1: Via the ‘More’ tab on digibank homepage. Under ‘Manage card and loans’, click ‘Report Fraud’ button. Option 2: Via the credit card tab. Click ‘Report Fraud’ button. |   |

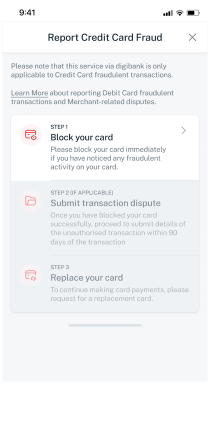

| Step 2 You will be prompted to block your card. |   |

| Step 3 Once your card has been successfully blocked, proceed to submit details of the unauthorised transaction. After submitting the dispute report, you will be prompted to request a card replacement. |    |

| Step 4 Track the status of your submitted dispute via the in-app dashboard. The amount will usually be refunded within 3 – 5 working days. |   |

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 15 consecutive years from 2009 to 2023.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com..