DBS rolls out new anti-scam security measures to increase customer protection amid fast-evolving scam and fraud tactics

Enhanced measures include that which will protect customers against malware scams

New Security Checkup dashboard enables users of DBS/ POSB digibank to strengthen their own online security

Singapore, 26 Sept 2023 - DBS/POSB today announced new anti-scam security measures which will enhance customer protection amid fast-evolving scam and fraud tactics. These include:

Han Kwee Juan, DBS Singapore Country Head said: “These new measures enhance customer protection against today’s fast-evolving scam tactics and further bolster our strong multi-layered defence. We recognise that certain measures may add some friction to the customer journey and seek their understanding that they are necessary to ensure that they can perform digital transactions on a secured platform with peace of mind. As we intensify efforts to protect our customers, we are also empowering them to take proactive steps in safeguarding themselves through our self-managed security features, including the new Security Checkup dashboard. We believe heightened vigilance is crucial in our combined efforts to combat scams and fraud.”

DBS/POSB has been continuously sharpening its measures in line with evolving scam and fraud typologies. These new measures add to existing safeguards, including surveillance and monitoring systems, enhanced by the use of artificial intelligence and machine learning.

The bank also has in place a robust anti-scam awareness programme to raise public vigilance on the latest scams and fraud. This includes ongoing partnerships with government bodies such as Singapore Police Force and Infocomm Media Development Authority to create anti-scam educational content. In addition, the bank has organised over 150 digital literacy workshops reaching out to more than 26,000 participants, as part of efforts to bolster digital readiness and vigilance within the community.

With an increasing number of customers becoming more informed and stepping up to strengthen their own online security, the bank has also been rolling out more self-managed security controls to help them do so more conveniently. For instance, the bank’s Payment Controls features launched in 2021 have been used by nearly half a million DBS/POSB customers to manage important payment settings; including enabling/disabling of cash advances and overseas in-store transactions, and setting of monthly cards spending limit, among others.

Among those who used Payment Controls:

Nancy Lim, aged 62, who has been banking with DBS/POSB since she was 18, shared: “Payment Controls is not just useful but critical in view of the fact that scams are so prevalent these days. For instance, when I am travelling, I will set a lower spending limit and also lock my debit card. Then once I am back in Singapore, I will switch disable usage for overseas in-store transactions. The Payment Controls features are simple to use and give me peace of mind that my card is secured.

[1] These measures will take effect progressively from September 2023

APPENDIX

Security Checkup strengthens customers’ account security in just one minute

Security Checkup can be easily accessed on the homepage of the digibank app and completed within a minute. Through this dashboard, customers can easily view and track key security settings within DBS/POSB digibank, and take the recommended actions to protect themselves from being scammed or defrauded.

The current version focuses on getting customers to strengthen their core security accesses for a start. In the coming months, the bank will be expanding Security Checkup to include more security features.

Security Checkup prompts customers to:

Enhanced capabilities to deter customers from falling prey to malware scams

With the launch of the new anti-malware tool, impacted customers may see three types of pop-up messages on their digibank login screen informing them that their digibank access is restricted.

This is a precautionary measure by DBS to safeguard our customers against potential malware threats. Customers will not be able to access DBS/POSB digibank until they have taken the necessary steps to secure their phones.

If customers suspect fraud, they should call our 24-hour fraud hotline immediately at 1800 339 6963 or (65) 6339 6963 from overseas.

The three different messages that a customer may see are:

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 14 consecutive years from 2009 to 2022.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting social enterprises: businesses with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping communities with future-ready skills and building food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

- Enhanced measures to protect customers from falling prey to malware scams: The bank’s new anti-malware tool prevents scammers from fraudulently logging into customers’ digibank accounts by restricting access to the banking app when it detects potential security risks. When a customer logs into DBS/POSB digibank on his or her device, the tool will restrict access to the banking app if it detects a) the presence of malware or malicious applications, b) apps downloaded from unverified app stores (sideloaded apps) with accessibility permission enabled, or c) ongoing screen-sharing / mirroring on the device.[1]

Customers will not be able to access DBS/POSB digibank until they have taken the necessary steps to secure their phones. As with all the bank’s security features, customers can be assured that the new anti-malware capabilities do not monitor phone activity, nor do they collect or store any personal data.

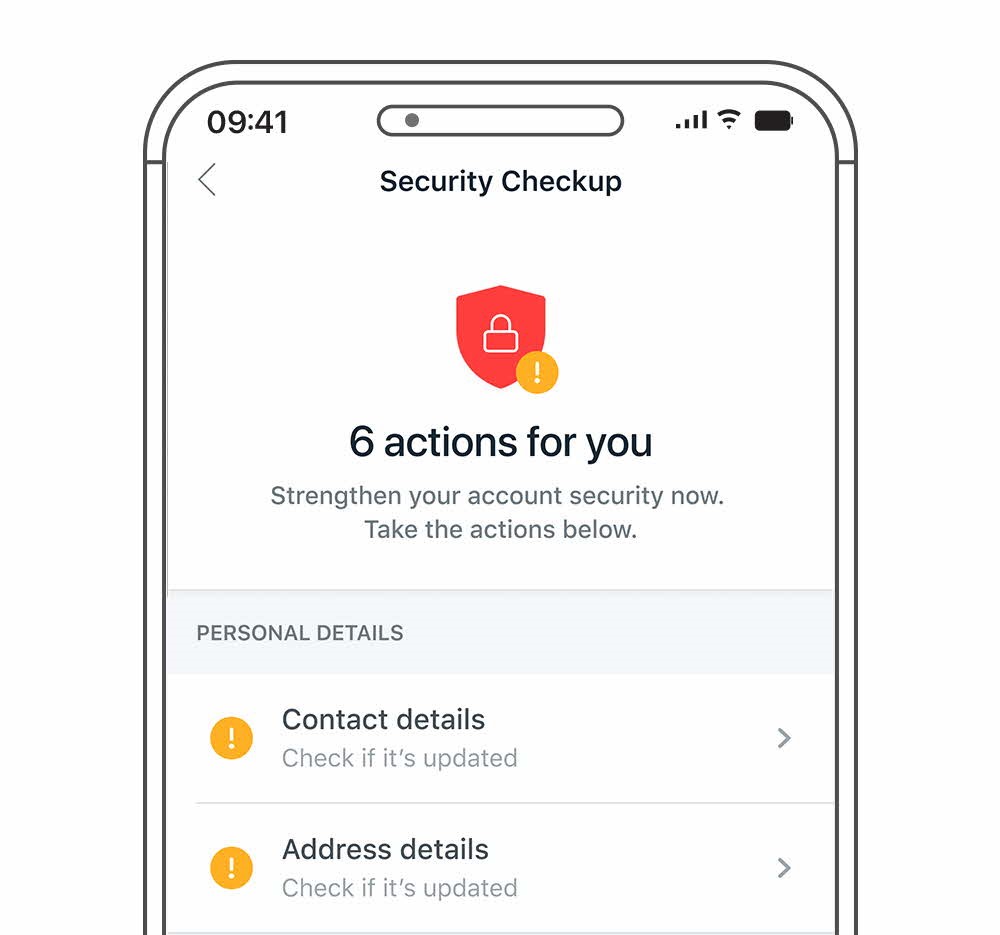

- Launch of Security Checkup dashboard: This is the latest addition to the bank’s arsenal of self-managed security controls, empowering customers to proactively safeguard themselves. Through this dashboard, customers can easily view and track key security settings within DBS/POSB digibank, and take the recommended actions to protect themselves from being scammed or defrauded. The Security Checkup dashboard serves to inculcate in customers the habit of regularly reviewing their security settings.

Han Kwee Juan, DBS Singapore Country Head said: “These new measures enhance customer protection against today’s fast-evolving scam tactics and further bolster our strong multi-layered defence. We recognise that certain measures may add some friction to the customer journey and seek their understanding that they are necessary to ensure that they can perform digital transactions on a secured platform with peace of mind. As we intensify efforts to protect our customers, we are also empowering them to take proactive steps in safeguarding themselves through our self-managed security features, including the new Security Checkup dashboard. We believe heightened vigilance is crucial in our combined efforts to combat scams and fraud.”

DBS/POSB has been continuously sharpening its measures in line with evolving scam and fraud typologies. These new measures add to existing safeguards, including surveillance and monitoring systems, enhanced by the use of artificial intelligence and machine learning.

The bank also has in place a robust anti-scam awareness programme to raise public vigilance on the latest scams and fraud. This includes ongoing partnerships with government bodies such as Singapore Police Force and Infocomm Media Development Authority to create anti-scam educational content. In addition, the bank has organised over 150 digital literacy workshops reaching out to more than 26,000 participants, as part of efforts to bolster digital readiness and vigilance within the community.

With an increasing number of customers becoming more informed and stepping up to strengthen their own online security, the bank has also been rolling out more self-managed security controls to help them do so more conveniently. For instance, the bank’s Payment Controls features launched in 2021 have been used by nearly half a million DBS/POSB customers to manage important payment settings; including enabling/disabling of cash advances and overseas in-store transactions, and setting of monthly cards spending limit, among others.

Among those who used Payment Controls:

- Setting of monthly spending limits was the most popular among customers aged 25 and under, with this feature being used twice as many times compared to the other two features.

- Disabling/enabling of cash advances was the most popular feature with customers aged 26 to 50 years old.

- Disabling/enabling of cash advances and overseas in-store transactions were the two most popular features among customers aged above 50.

Nancy Lim, aged 62, who has been banking with DBS/POSB since she was 18, shared: “Payment Controls is not just useful but critical in view of the fact that scams are so prevalent these days. For instance, when I am travelling, I will set a lower spending limit and also lock my debit card. Then once I am back in Singapore, I will switch disable usage for overseas in-store transactions. The Payment Controls features are simple to use and give me peace of mind that my card is secured.

[1] These measures will take effect progressively from September 2023

APPENDIX

Security Checkup strengthens customers’ account security in just one minute

Security Checkup can be easily accessed on the homepage of the digibank app and completed within a minute. Through this dashboard, customers can easily view and track key security settings within DBS/POSB digibank, and take the recommended actions to protect themselves from being scammed or defrauded.

The current version focuses on getting customers to strengthen their core security accesses for a start. In the coming months, the bank will be expanding Security Checkup to include more security features.

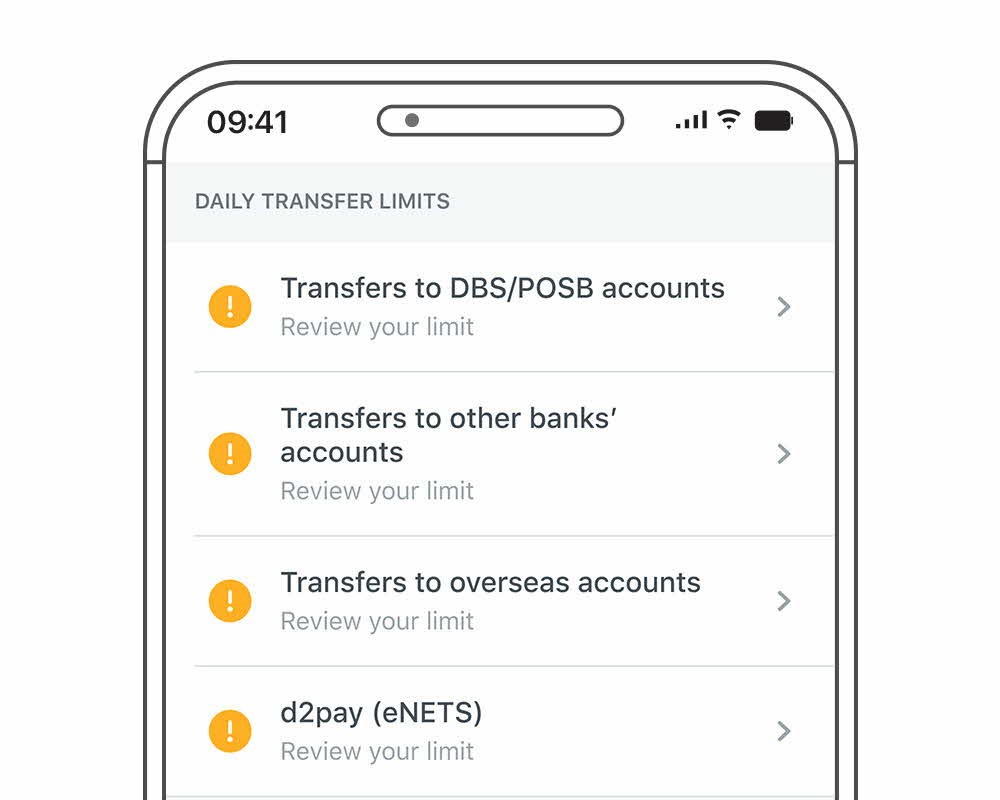

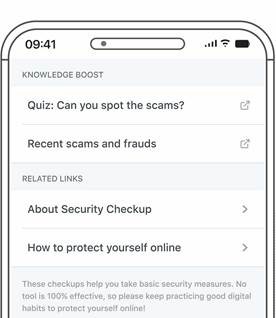

Security Checkup prompts customers to:

| (1) Update their personal details including contact information to ensure they never miss any important alerts from the bank. This offers an additional layer of protection against unauthorised transactions and potential fraud. |  |

| (2) Review their daily transfer limits to other local and overseas banking accounts. |  |

| (3) Take a quick quiz to ensure they are up to date with the latest scams and frauds, and tips on how to protect themselves. |  |

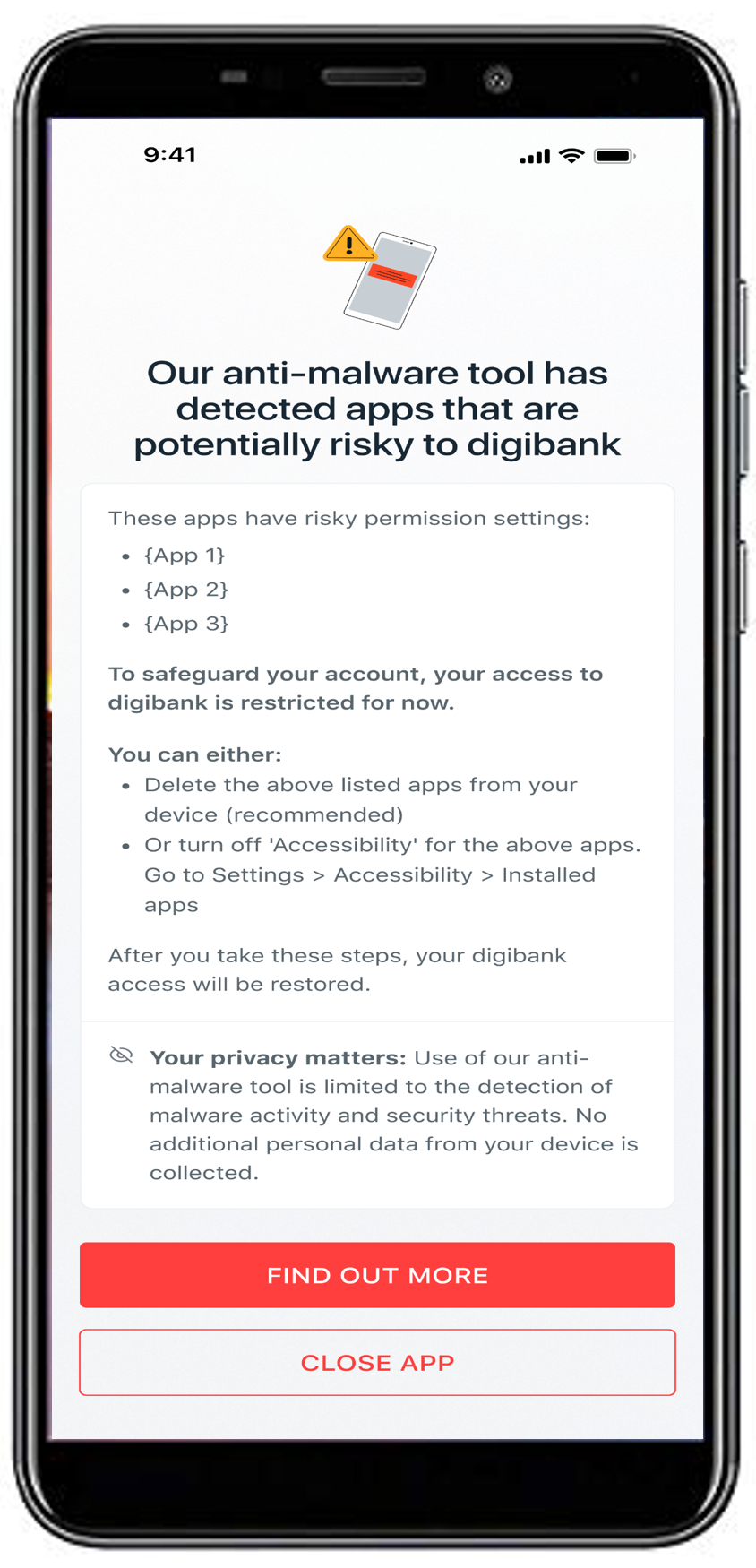

Enhanced capabilities to deter customers from falling prey to malware scams

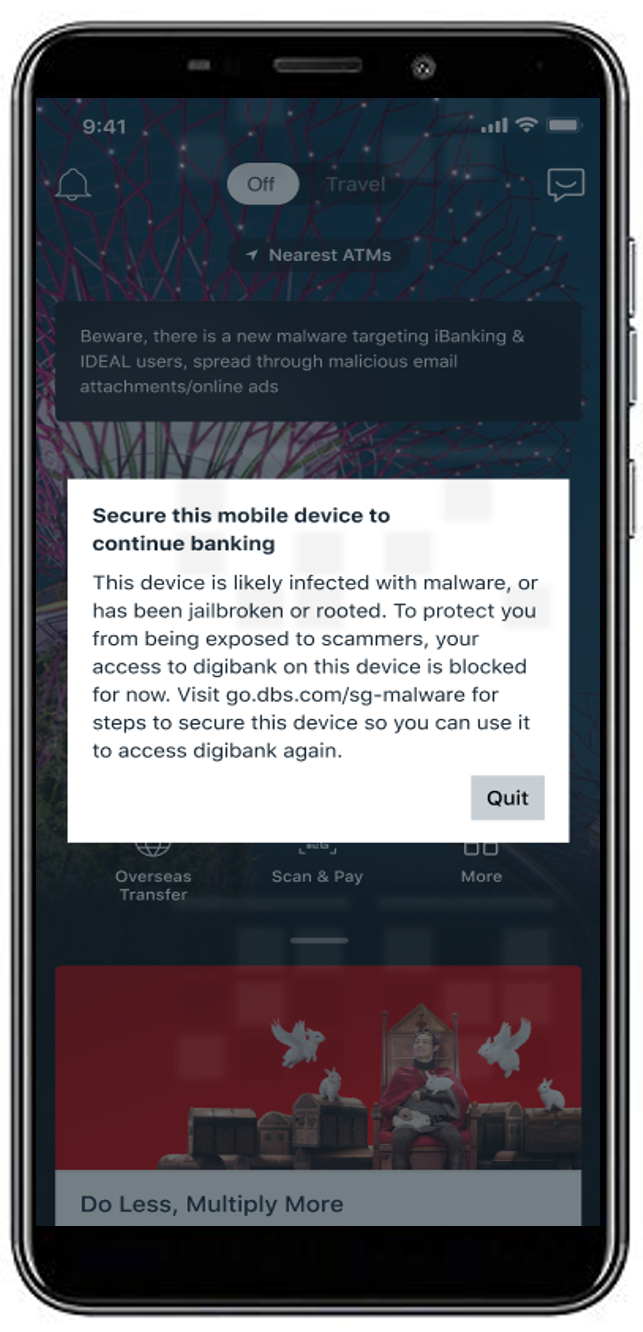

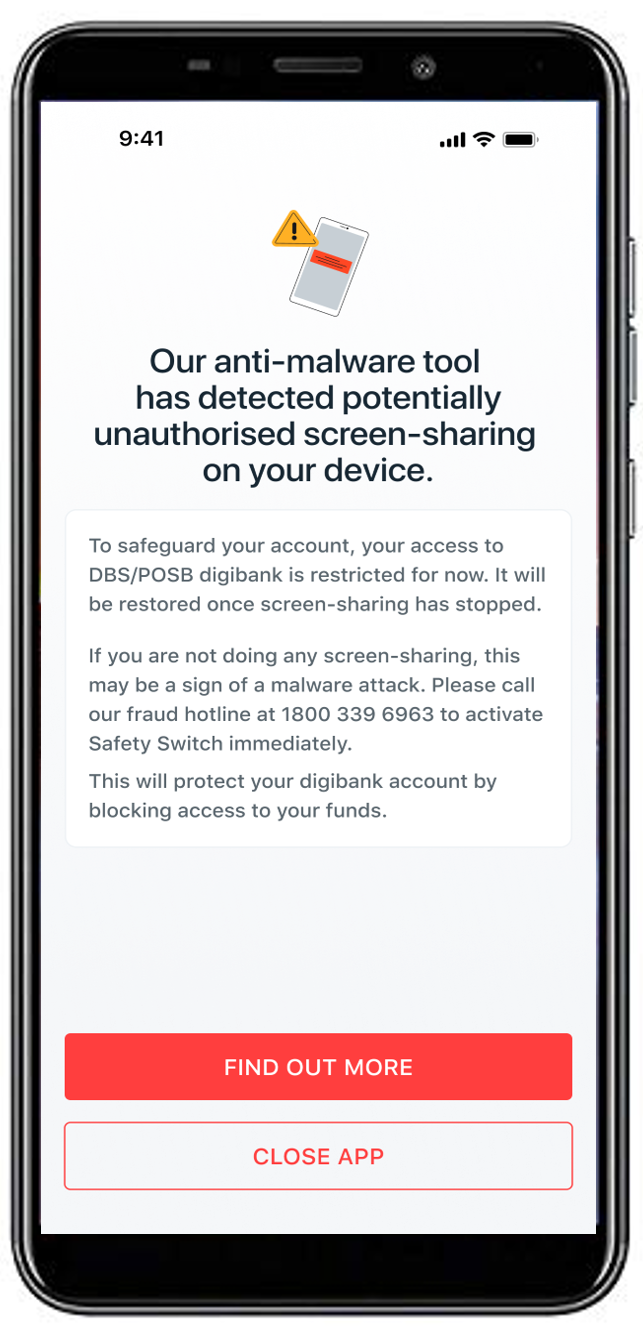

With the launch of the new anti-malware tool, impacted customers may see three types of pop-up messages on their digibank login screen informing them that their digibank access is restricted.

This is a precautionary measure by DBS to safeguard our customers against potential malware threats. Customers will not be able to access DBS/POSB digibank until they have taken the necessary steps to secure their phones.

If customers suspect fraud, they should call our 24-hour fraud hotline immediately at 1800 339 6963 or (65) 6339 6963 from overseas.

The three different messages that a customer may see are:

(1) “Our anti-malware tool has detected apps that are potentially risky to digibank” If customers see this message, it means that their mobile device contains apps that are not downloaded from official app stores (sideloaded) and has accessibility permission enabled. This may give scammers control of their device. To restore access, customers will need to either uninstall the app(s) listed in the pop-message, or disable the accessibility permission of the listed app(s) via the Settings menu on their device if they trust that the app(s) is safe. Once customers have taken the above step, access will be automatically restored. |  |

(2) “Secure this mobile device to continue banking” If customers see this message, it means that their device is likely infected with known malware applications or is jailbroken or rooted. They may have downloaded malicious apps via links in text messages, social media or third-party websites instead of official sources like the Google Play or Apple App Store. To remove malware on the device, customers should take the steps below as advised by the Singapore Police Force and Cyber Security Agency of Singapore: • Disconnect their mobile device from the internet. Turn off WiFi and mobile data, or turn on Airplane Mode or Safe Mode, so scammers cannot access the device through the malicious app. • Go through their list of installed apps. Look for anything suspicious:

• Once customers have taken the above step, access will be automatically restored. If their device is jailbroken / rooted, they should restore the device to its factory setting so they can safely access digibank again. |  |

(3) “Our anti-malware tool has detected potentially unauthorised screen-sharing on your device” If customers see this message, it means that screen-sharing or mirroring is taking place on their device. This can be indicative of a malware attack. To safeguard their banking account, access to digibank will be restricted while screen-sharing or mirroring is going on. • If the customer is doing screen-sharing (example: CarPlay): Access to digibank will be automatically restored once screen-sharing has stopped. • If the customer is not doing any screen-sharing: This may be a sign of an ongoing malware attack. The customer should immediately call our 24-hour fraud hotline at 1800 339 6963 from Singapore or (65) 6339 6963 from Overseas |  |

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 14 consecutive years from 2009 to 2022.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting social enterprises: businesses with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping communities with future-ready skills and building food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.