DBS introduces new “Mobile wallets” security feature to further protect customers from phishing frauds

New feature prevents scammers from adding phished card details to mobile wallets

Singapore, 07 May 2025 - In an effort to combat the rise of mobile wallet phishing, DBS Bank will launch a new “Mobile wallets” feature within DBS/POSB digibank app’s Payment Controls, preventing scammers from adding phished card details to their mobile wallets.

Payment Controls – located within the DBS/POSB digibank app – allows customers to self-manage their card transaction limits in real-time. Customers can use these controls to protect themselves from unauthorised transactions when their card is misplaced, stolen or misused. This includes disabling e-commerce or cash advance transactions, locking the card, among others.

From mid-May 2025, customers will not be able to add DBS/POSB cards to their mobile wallets until they turn on the new “Mobile wallets” toggle in Payment Controls. The “Mobile wallets” feature is turned off by default and customers will need to first turn on the “Mobile wallets” toggle before adding their cards. Using the “Mobile wallets” in-app control introduces a deliberate pause in the transaction process, allowing users to verify their intention to add their card to a mobile wallet.

The new “Mobile wallets” feature is the latest addition to the bank’s suite of self-managed security control features in the DBS/POSB digibank app. DBS was the first bank in Singapore to introduce the most comprehensive set of payment controls and has continued to maintain that leading position since 2021. To date, over 1.5 million users have adopted DBS’ self-managed security tools that also include DBS’ money lock feature (digiVault) and security checkup.

Calvin Ong, DBS Head of Consumer Banking Singapore said, “Along with the Singapore Police Force (SPF), the Cyber Security Agency of Singapore (CSA) and the Monetary Authority of Singapore (MAS), DBS has also observed a rise in mobile wallet phishing incidents, where scammers target customers’ cards to add to their mobile wallet for subsequent unauthorised transactions. As part of the industry’s initiative to address this issue, DBS has introduced a new ‘Mobile wallets’ feature to verify our customers’ intention to add their card to a mobile wallet. By introducing the deliberate pause, we enable customers to be alert when performing transactions.”

Customers should add only their own cards to their mobile wallets. If they are unfamiliar with mobile wallets, they should consult their family or call the ScamShield Helpline (1799) for assistance.

“Joint vigilance with our customers is essential to combating scams and we will continue to expand our suite of self-managed security features, as well as anti-scam educational resources and community events, to empower our customers to take control of their security,” added Ong.

SPF, CSA and MAS have been working with banks, mobile wallet providers, and card service providers to combat this trend. According to the Singapore Police Force, there were over 650 reports of phished card credentials being added to mobile wallets in the last three months of 2024, resulting in at least SGD 1.2 million in losses from transactions made on scammers’ mobile wallets.

How DBS/POSB’s Mobile wallets security feature works

The “Mobile wallets” feature in Payment Controls is turned off by default to ensure customers’ cards cannot be added to mobile wallets. Customers who wish to add their DBS/POSB card must first turn on the “Mobile wallets” toggle in Payment Controls within the DBS/POSB digibank app. To further protect users, this “Mobile wallets” feature will be automatically turned off if the card is not added to any mobile wallet within 10 minutes.

To add their card to a mobile wallet, DBS/POSB cardholders can follow these steps:

DBS enhances the anti-scam security features of its digibank app

Creating a robust anti-scam ecosystem with partners and customers

DBS works closely with key partners including the SPF, Infocomm Media Development Authority (IMDA) and the CSA to co-create educational anti-scam content (e.g an anti-scam quiz) and extend its reach to a wider audience through digital literacy roadshows and street performances (‘getais’) in the heartlands. In 2024, DBS conducted over 300 anti-scam and digital literacy workshops, reaching 90,000 Singaporeans and residents. The bank also launched its new Bank Safely Hub last year to help the public stay informed about scams by featuring essential scam alerts, educational materials and resources.

Since January 2025, DBS has held POSB neighbourhood getai events and POSB SG60 neighbourhood carnivals in Bedok, Eunos, Tiong Bahru and Punggol, where residents were trained to use DBS security tools including Payment Controls, digiVault and security checkup. DBS has plans to continue to roll out these activities this year.

-450.jpg)

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

Payment Controls – located within the DBS/POSB digibank app – allows customers to self-manage their card transaction limits in real-time. Customers can use these controls to protect themselves from unauthorised transactions when their card is misplaced, stolen or misused. This includes disabling e-commerce or cash advance transactions, locking the card, among others.

From mid-May 2025, customers will not be able to add DBS/POSB cards to their mobile wallets until they turn on the new “Mobile wallets” toggle in Payment Controls. The “Mobile wallets” feature is turned off by default and customers will need to first turn on the “Mobile wallets” toggle before adding their cards. Using the “Mobile wallets” in-app control introduces a deliberate pause in the transaction process, allowing users to verify their intention to add their card to a mobile wallet.

The new “Mobile wallets” feature is the latest addition to the bank’s suite of self-managed security control features in the DBS/POSB digibank app. DBS was the first bank in Singapore to introduce the most comprehensive set of payment controls and has continued to maintain that leading position since 2021. To date, over 1.5 million users have adopted DBS’ self-managed security tools that also include DBS’ money lock feature (digiVault) and security checkup.

Calvin Ong, DBS Head of Consumer Banking Singapore said, “Along with the Singapore Police Force (SPF), the Cyber Security Agency of Singapore (CSA) and the Monetary Authority of Singapore (MAS), DBS has also observed a rise in mobile wallet phishing incidents, where scammers target customers’ cards to add to their mobile wallet for subsequent unauthorised transactions. As part of the industry’s initiative to address this issue, DBS has introduced a new ‘Mobile wallets’ feature to verify our customers’ intention to add their card to a mobile wallet. By introducing the deliberate pause, we enable customers to be alert when performing transactions.”

Customers should add only their own cards to their mobile wallets. If they are unfamiliar with mobile wallets, they should consult their family or call the ScamShield Helpline (1799) for assistance.

“Joint vigilance with our customers is essential to combating scams and we will continue to expand our suite of self-managed security features, as well as anti-scam educational resources and community events, to empower our customers to take control of their security,” added Ong.

SPF, CSA and MAS have been working with banks, mobile wallet providers, and card service providers to combat this trend. According to the Singapore Police Force, there were over 650 reports of phished card credentials being added to mobile wallets in the last three months of 2024, resulting in at least SGD 1.2 million in losses from transactions made on scammers’ mobile wallets.

How DBS/POSB’s Mobile wallets security feature works

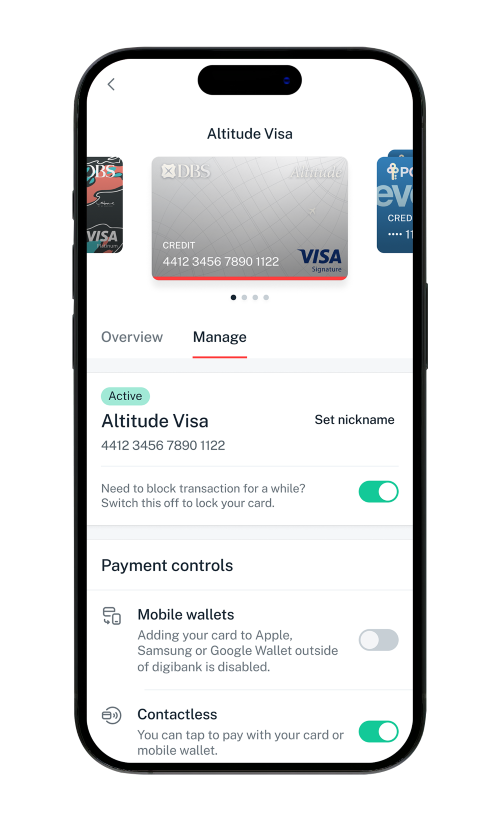

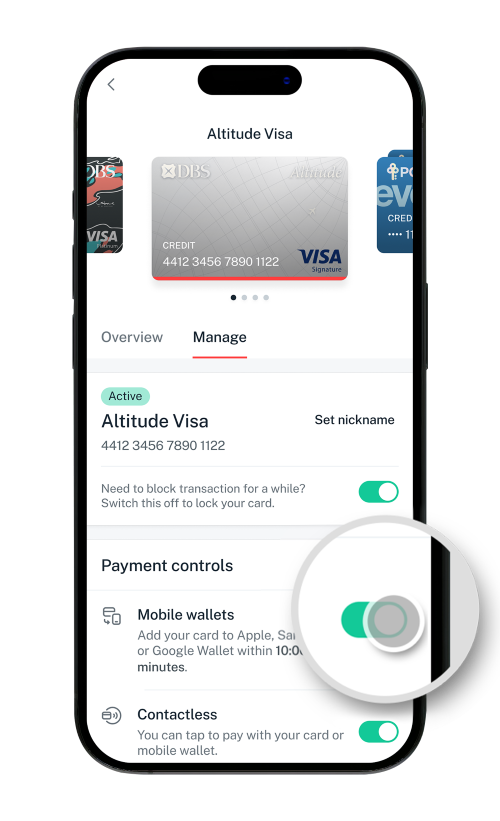

The “Mobile wallets” feature in Payment Controls is turned off by default to ensure customers’ cards cannot be added to mobile wallets. Customers who wish to add their DBS/POSB card must first turn on the “Mobile wallets” toggle in Payment Controls within the DBS/POSB digibank app. To further protect users, this “Mobile wallets” feature will be automatically turned off if the card is not added to any mobile wallet within 10 minutes.

To add their card to a mobile wallet, DBS/POSB cardholders can follow these steps:

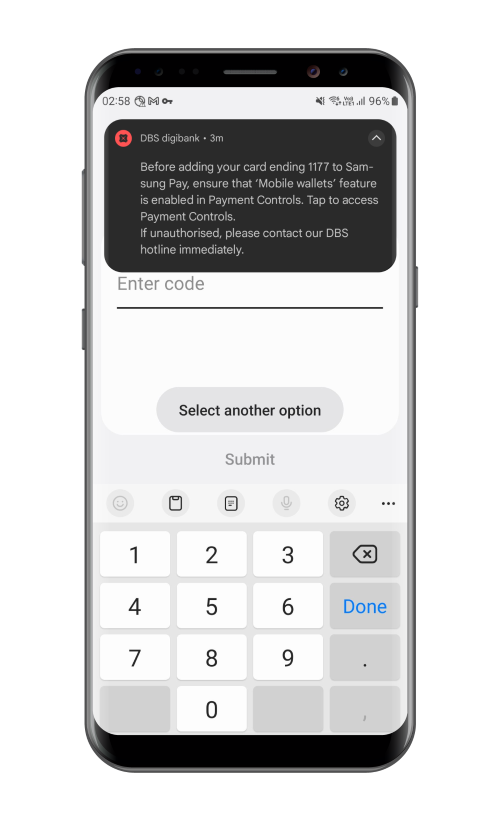

| 1. After card details are submitted while adding card to a mobile wallet, tap the digibank push notification to ensure the ‘Mobile wallets’ feature is enabled in Payment Controls. |  |

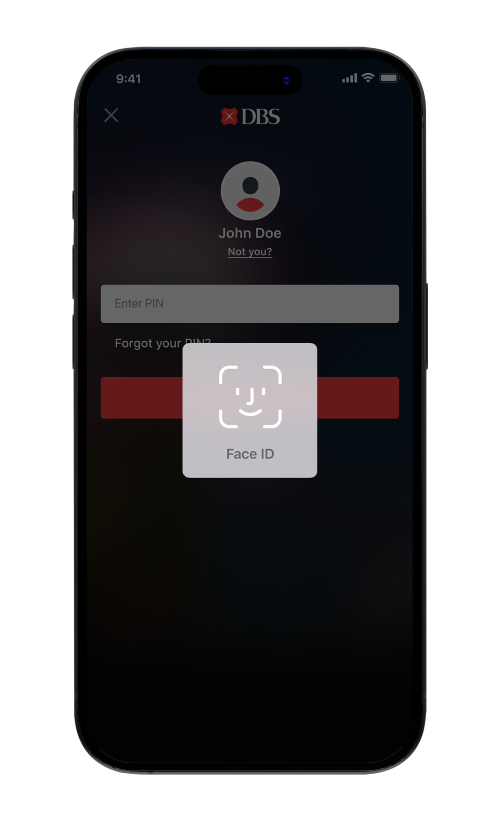

| 2. Log in to the DBS/POSB digibank app. |  |

| 3. Access the Payment Controls section of the app. The “Mobile wallets” toggle is turned off by default for all cards. |  |

| 4. Choose the card to be added to your mobile wallet and turn on the “Mobile wallets” toggle. |  |

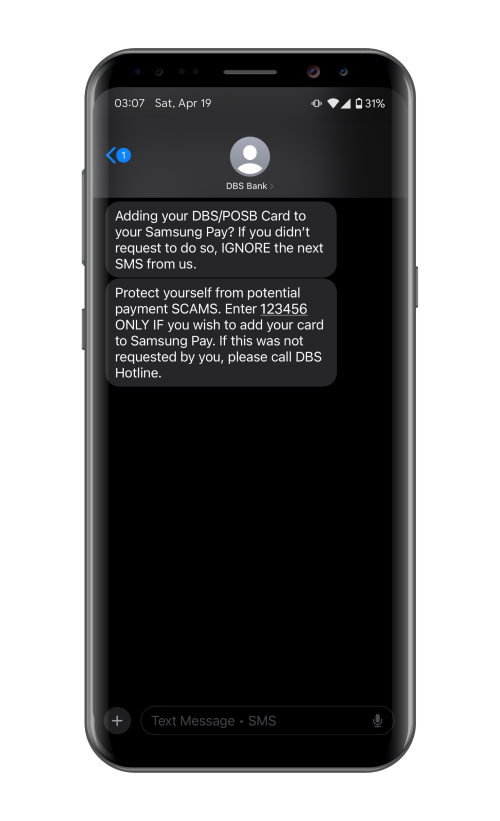

| 5. To complete the process, enter a one-time password (OTP) sent via SMS. The message is deliberately split into two separate SMSes to introduce a thoughtful pause, giving users time to reconsider their action before entering the OTP. |  |

DBS enhances the anti-scam security features of its digibank app

- Greater convenience for DBS digiVault: Since October last year, customers can instantly lock funds and prevent digital transfers from their accounts via the DBS/POSB digibank app, or digibot on the DBS/POSB website. The funds can then be unlocked at over 1,200 ATMs island-wide in addition to the bank’s branches. Customers will continue to earn the same interest on their locked savings and fixed deposits.

- More capabilities for DBS anti-malware tool for Android devices: The digibank app’s anti-malware tool for Android devices will alert users when the app is being remotely controlled by another device or when the Android device’s USB/wireless debugging setting is enabled. When the USB/wireless debugging setting in the Developer Options is turned on, scammers can remotely control a user’s Android device without their knowledge, steal sensitive information such as passwords and access the user’s digibank app. Users will also be cautioned by the anti-malware tool when screen-sharing or mirroring is enabled on their Android device.

| DBS/POSB digibank app’s anti-malware tool alerts users when their digibank app is being remotely controlled by another device |  500.png) |

| DBS/POSB digibank app’s anti-malware tool alerts users when their Android device’s USB/wireless debugging setting is turned on. | .png) |

Creating a robust anti-scam ecosystem with partners and customers

DBS works closely with key partners including the SPF, Infocomm Media Development Authority (IMDA) and the CSA to co-create educational anti-scam content (e.g an anti-scam quiz) and extend its reach to a wider audience through digital literacy roadshows and street performances (‘getais’) in the heartlands. In 2024, DBS conducted over 300 anti-scam and digital literacy workshops, reaching 90,000 Singaporeans and residents. The bank also launched its new Bank Safely Hub last year to help the public stay informed about scams by featuring essential scam alerts, educational materials and resources.

Since January 2025, DBS has held POSB neighbourhood getai events and POSB SG60 neighbourhood carnivals in Bedok, Eunos, Tiong Bahru and Punggol, where residents were trained to use DBS security tools including Payment Controls, digiVault and security checkup. DBS has plans to continue to roll out these activities this year.

-450.jpg)

Seniors learning anti-scam tips during a POSB neighbourhood getai event.

-450.jpg) Sharing an anti-scam quiz DBS co-developed with CSA at a recent POSB Neighbourhood Carnival.

Sharing an anti-scam quiz DBS co-developed with CSA at a recent POSB Neighbourhood Carnival.

-450.jpg) Sharing an anti-scam quiz DBS co-developed with CSA at a recent POSB Neighbourhood Carnival.

Sharing an anti-scam quiz DBS co-developed with CSA at a recent POSB Neighbourhood Carnival.DBS has a multi-layered defence against scams which combines real-time fraud surveillance, advanced security infrastructure and customer education. Furthermore, DBS continues to deploy dedicated personnel who are embedded within the SPF's Anti-Scam Centre, performing real-time transaction monitoring and immediate intervention against suspicious activities.

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.