DBS helps SMEs tap global markets by locking in foreign exchange rates up to one month in advance with DBS SecureFX

First Singapore bank to offer such a service to SMEs

SMEs can lock in rates for up to USD 1 million of payments in five currency pairs without credit lines

Enables better management of foreign exchange volatility and cash flow

Singapore, 03 Mar 2025 - DBS’ small and medium-sized enterprise (SME) customers can now lock in preferred foreign exchange rates for five currency pairs[1] up to one month in advance when making local and overseas payments. Businesses can do so for up to USD 1 million of payments at any given moment, without credit lines and at no additional cost.

DBS is the first Singapore bank to offer SMEs such a service. It is enabled via DBS SecureFX – a foreign exchange service that empowers customers to lock in rates directly within the bank’s corporate banking application, DBS IDEAL.

This comes at a time when more SME customers are planning to tap global markets. According to DBS’ latest Business Pulse Check Survey conducted early this year, about 70% of SMEs intend to allocate capital towards regionalisation. In addition, more SMEs are making transactions in foreign currencies as they engage foreign suppliers or service providers as part of their overseas expansion. In 2024, more than 80% of SME customers executed a foreign exchange transaction when making cross-border payments.

In January 2025, the average implied volatility for the Euro, Japanese Yen and British Pound soared to its highest in nearly two years, according to analysis by DBS Group Research. With DBS SecureFX, SMEs can expand their global reach with confidence amidst market volatility. By locking in preferred rates for future-dated foreign currency payments, SMEs – including smaller ones with no credit lines – can better manage their cash flow and foreign exchange risk.

Eileen Chia, Regional Head of Corporate Advisory, Global Financial Markets, DBS, said: “SMEs form the bedrock of Singapore’s economy and contribute around half of our country’s GDP. As a purpose-driven bank with our roots as the Development Bank of Singapore, we are committed to supporting our SMEs as they expand into regional markets to capture new opportunities across Asia. By blending DBS’ digital capabilities, financial markets expertise and client-centric ethos, we will continue to support our local businesses as they embark on a journey towards becoming regional champions.”

DBS has been recognised for leveraging technology to provide corporate customers with personalised foreign exchange services tailored to each business’ risk profile, transaction history and needs. The bank was named Most Innovative Bank for Foreign Exchange[2] and Singapore’s best foreign exchange bank[3] in 2025 by Global Finance, a New York-based trade publication, for two consecutive years. In addition, DBS was named Singapore’s best foreign exchange bank by Euromoney[4] in 2024, a London-based business and finance publication.

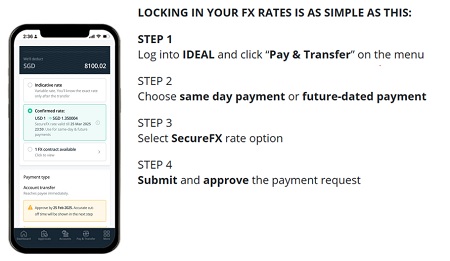

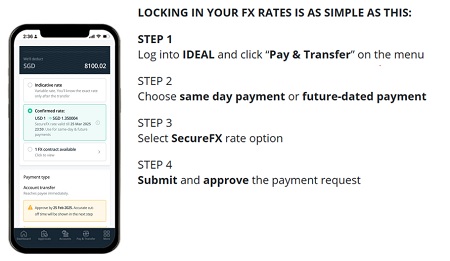

How to access DBS SecureFX

DBS SecureFX is currently available to SME and selected corporate customers in Singapore via DBS IDEAL. The service will eventually be made available to other DBS corporate customers in Singapore.

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

DBS is the first Singapore bank to offer SMEs such a service. It is enabled via DBS SecureFX – a foreign exchange service that empowers customers to lock in rates directly within the bank’s corporate banking application, DBS IDEAL.

This comes at a time when more SME customers are planning to tap global markets. According to DBS’ latest Business Pulse Check Survey conducted early this year, about 70% of SMEs intend to allocate capital towards regionalisation. In addition, more SMEs are making transactions in foreign currencies as they engage foreign suppliers or service providers as part of their overseas expansion. In 2024, more than 80% of SME customers executed a foreign exchange transaction when making cross-border payments.

In January 2025, the average implied volatility for the Euro, Japanese Yen and British Pound soared to its highest in nearly two years, according to analysis by DBS Group Research. With DBS SecureFX, SMEs can expand their global reach with confidence amidst market volatility. By locking in preferred rates for future-dated foreign currency payments, SMEs – including smaller ones with no credit lines – can better manage their cash flow and foreign exchange risk.

Eileen Chia, Regional Head of Corporate Advisory, Global Financial Markets, DBS, said: “SMEs form the bedrock of Singapore’s economy and contribute around half of our country’s GDP. As a purpose-driven bank with our roots as the Development Bank of Singapore, we are committed to supporting our SMEs as they expand into regional markets to capture new opportunities across Asia. By blending DBS’ digital capabilities, financial markets expertise and client-centric ethos, we will continue to support our local businesses as they embark on a journey towards becoming regional champions.”

DBS has been recognised for leveraging technology to provide corporate customers with personalised foreign exchange services tailored to each business’ risk profile, transaction history and needs. The bank was named Most Innovative Bank for Foreign Exchange[2] and Singapore’s best foreign exchange bank[3] in 2025 by Global Finance, a New York-based trade publication, for two consecutive years. In addition, DBS was named Singapore’s best foreign exchange bank by Euromoney[4] in 2024, a London-based business and finance publication.

How to access DBS SecureFX

DBS SecureFX is currently available to SME and selected corporate customers in Singapore via DBS IDEAL. The service will eventually be made available to other DBS corporate customers in Singapore.

[1] USD/SGD, EUR/SGD, EUR/USD, GBP/SGD, JPY/SGD

[2] GW Platt Foreign Exchange Bank Awards 2025: FX Tech Global Winners

[3] Global Finance Names The World’s Best FX Banks 2025 As Part Of The Gordon Platt Foreign Exchange Awards

[4] Euromoney Foreign Exchange Awards 2024

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.