DBS and J.P. Morgan Asset Management avail Asia’s first retirement investment portfolio that right-sizes risk based on an investor’s life stage

Through automated risk calibration, DBS Retirement digiPortfolio optimises one’s retirement runway for growth, and provides stability near retirement

The solution will enable many young investors to maximise the benefit of having a longer time horizon to achieve greater capital gains through compounding returns

Pilot launch received strong response; younger customers make up half of total investors, of which 70% also committed to making recurring top-ups

Launched as part of the bank’s holistic retirement proposition aimed at helping all Singaporeans plan and retire well, DBS Retirement digiPortfolio is premised on the concept that investors should only take on risk appropriate to their life stage (defined as Early Career, Mid-life, and Retirement). It plugs a long-standing gap in the market by enabling investors to take more risk earlier and moderate their risk when they approach retirement. Customers can better map out and plan for their long-term needs while staying disciplined to invest and accumulate wealth when they are younger. This gives them greater peace of mind during their golden years.

A pilot programme, progressively rolled out to select customers since late last year, has drawn strong interest. DBS Retirement digiPortfolio proved to be highly effective in motivating them to start planning for their retirement, with nearly half of the investors made up of younger customers aged 40 and below. 70% of them also opted to make recurring top-ups to their portfolios, which signalled that young investors are willing to make smaller but regular investments that will contribute meaningfully to their retirement nest egg when compounded over the years.

Contrary to popular belief, retirement planning should not stop at the point of one’s retirement. Even as investors start to make withdrawals from their DBS Retirement digiPortfolio, it will continue to be professionally managed by the DBS and JPMAM investment teams. Investors will be able to automate these withdrawals and be presented with a view of the longevity of these payouts, as part of its market-first proposition, later this year. More importantly, they will be able to see how these payouts contribute towards their broader retirement plan, which will comprise various other sources of passive income, such as CPF Life, traditional annuities, and endowment plans.

How it works

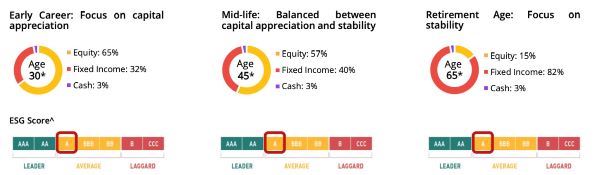

For a customer aged 30, the portfolio would focus on leveraging the benefit of a longer investment horizon to achieve greater capital appreciation by allocating greater exposure to equities (65%) versus fixed income (32%) and cash (3%). With the passing of time, the portfolio will gradually de-risk from this skew, to hold more in fixed income instead. When the customer finally nears his or her pre-determined retirement age of 65 (as an example, since age is customisable), the portfolio would have reduced equity exposure (15%) and a heavier weight towards fixed income (82%), which provides more stability and cushions the investment against market volatility.

Prior to DBS Retirement digiPortfolio, investors looking to invest in such a manner would incur frequent transaction or switching costs, as they transition from one portfolio mix to the next in preparation for retirement. DBS Retirement digiPortfolio investors pay only a flat 0.75% annual management fee, which allows them to benefit from a fully automated experience with the glidepath strategy and enjoy other features, such as making recurring top ups and withdrawals at any time. A portfolio can be created with a minimum one-time SGD 1,000 lump sum investment, and customers can subsequently choose to top-up their portfolio monthly with as little as SGD 100. They are also not subject to a sales charge, lock-in period, or withdrawal penalties.

The portfolio, which is professionally managed by the DBS Chief Investment Office and JPMAM, is an extension of the bank’s years-long effort to lower barriers of entry to investing and democratise retail investors’ access to wealth management services.

“DBS Retirement digiPortfolio is designed with careful risk calibration over decades in mind. This effectively breaks down big hurdles for customers who want to plan for retirement, yet find it too daunting. It also serves to remove some of the inertia we hear around retirement planning, by making it not only more accessible to all but also more affordable to start with,” said Ling Seng Chuan, Head of Financial Planning, Insurance and Investment, DBS Bank. “When markets become volatile as retirement nears, it can put a damper on years of otherwise diligent retirement planning. We can help mitigate this through our holistic retirement planning proposition, where DBS Retirement digiPortfolio complements other passive income such as CPF Life and insurance annuities, so that our customers can ultimately feel more secure with well-diversified and optimised retirement plans.”

Jacklyn Goh, Head of Singapore Intermediaries, J.P. Morgan Asset Management, said: “Achieving financial independence and retiring meaningfully will be on the mind of investors as countries like Singapore, confront an ageing demographicshift. Acknowledging the personalised needs for each individual’s retirement is critical in helping investors find the right balance of having a stable and growing portfolio to help achieve their retirement goals. We are excited to partner with DBS to introduce an industry-first personalised retirement proposition for Singapore investors planning for their retirement needs. The personalised feature is what sets this retirement solution apart and brings retirees’ experience to the next level – we are proud to enable the customisation leveraging our investment insights, technology resources and model-advisory portfolio capabilities.”

Ng Bing Hua, a pilot investor aged 34, said: “Most of my existing investments require monitoring and research, and this takes up a good portion of my free time. I chose DBS Retirement digiPortfolio because I enjoy the ease of access via digibank, and unlike other investment products, it had no lock-in or withdrawal penalty should I need to access these funds for an emergency. The portfolio is comprehensive as it had provided me with an idea of how much I need to set aside to attain my ideal retirement payout to complement government schemes like CPF Life. I also trust the expertise of the DBS and JPM investment teams in terms of portfolio composition, and to rebalance and de-risk the portfolio based on market outlook as I age. This is a service that I believe is typically only available to UHNW clients, and so it’s great that I get to enjoy it as well.”

“We are very heartened by our customers’ positive response to the pilot, and especially by the fact that 70% of them have committed to making recurring top-ups to their portfolios. It affirms our belief that we are on the right track in getting our customers interested in planning for the longer term. We look forward to helping more of our younger salaried customers take advantage of their longer retirement runway by not only starting to invest now, but also adopting a consistent, disciplined approach to investing that prioritises time in the market, rather than timing the market,” added Ling.

Customers can sign up for the DBS Retirement digiPortfolio conveniently via DBS/POSB digibank. For more information on DBS Retirement digiPortfolio, please visit here or here.

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 15 consecutive years from 2009 to 2023.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

About J.P. Morgan Asset Management

J.P. Morgan Asset Management, with assets under management of US$3.1 trillion (as of December 31, 2023), is a global leader in investment management. J.P. Morgan Asset Management's clients include institutions, retail investors and high net worth individuals in every major market throughout the world. J.P. Morgan Asset Management offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity. For more information: www.jpmorganassetmanagement.com. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co., and its affiliates worldwide.

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had US$3.9 trillion in assets and US$328 billion in stockholders’ equity as of December 31, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.