Governance and risk management

Risk management

- Credit risk and portfolio management

- Regulatory compliance and engagement

- Cyber security and digital banking

- Risk and control construct - Cross border transactions and local practices

- Technology risk - Onshoring of data centre and disaster recovery planning

- Liquidity management

- Outsourcing management - Data

- Large programme initiatives

- Risk appetite and capital management

- Data management

Governance framework

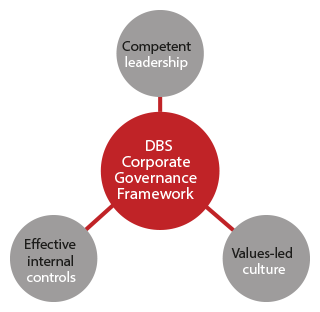

We have a clearly defined governance framework that promotes transparency, fairness and accountability.

The Board believes that corporate governance principles should be embedded in our corporate culture. Our corporate culture is anchored on (a) competent leadership, (b) effective internal controls and (c) a set of common values. Our internal controls cover financial, operational, compliance, technology controls, as well as risk management policies and systems.

We work closely with our regulators to ensure that our internal governance standards meet their increasing expectations. We are committed to the highest standards of corporate governance, and have been recognised for it. We have won SIAS' Corporate Governance Award in the Big Cap category three years in a row (2013 to 2015).