"DBS hit a new milestone with full-year profit exceeding SGD 4 billion in 2014. This is testament to the strength and resilience of

the franchise. We believe that the multiple business engines we’ve built are sustainable and scalable."

– Piyush Gupta, CEO, DBS

Grow Income

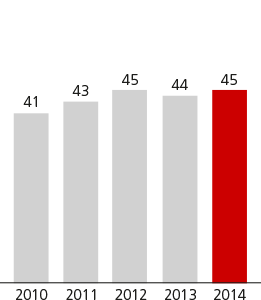

Income (SGD m)

Target: Deliver consistent income growth

Target: Deliver consistent income growth

Outcome: 8% income growth to record SGD 9.62 billion

Manage Expenses

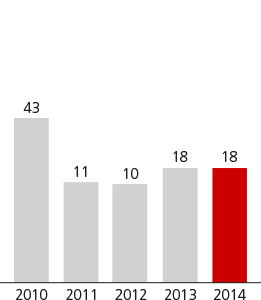

Cost/Income (%)

Target: Be cost efficient while investing for growth; cost-income ratio target of 45% or better

Target: Be cost efficient while investing for growth; cost-income ratio target of 45% or better

Outcome: Cost-income ratio in line with target of 45%. Continue to drive efficiency through strategic cost management efforts. Savings of SGD 500 million over three years reinvested in headcount and new capabilities including digital

Manage Portfolio Risk

Specific Allowances/Average Loans (bp)

Target: Grow exposures prudently, aligned to risk appetite. Expect specific allowances to average 25 basis points (bp) of loans through the economic cycle

Target: Grow exposures prudently, aligned to risk appetite. Expect specific allowances to average 25 basis points (bp) of loans through the economic cycle

Outcome: Specific allowances as a percentage of loans maintained at 18 bp

Improve Returns

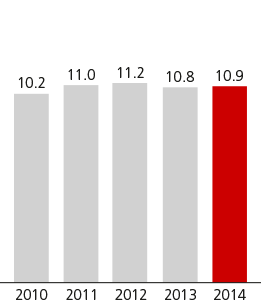

Return on Equity (%)

Target: Return on equity of 12% or better in a normalised interest rate environment

Target: Return on equity of 12% or better in a normalised interest rate environment

Outcome: Double-digit return on equity in a low interest rate environment

| Financial Performance Highlights | |||

|---|---|---|---|

| Selected Income statement items (SGD m) | 2014 | 2013 | % chg |

| Total income | 9,618 | 8,927 | 8 |

| Expenses | 4,330 | 3,918 | 11 |

| Profit before allowances | 5,288 | 5,009 | 6 |

| Allowances for credit and other losses | 667 | 770 | (13) |

| Net profit | 3,848 | 3,501 | 10 |

| One-time items | 198 | 171 | 16 |

| Net profit including one-time items | 4,046 | 3,672 | 10 |

| Selected balance sheet items (SGD m) | |||

| Customer loans | 275,588 | 248,654 | 11 |

| Customer deposits | 317,173 | 292,365 | 8 |

| Shareholders’ funds | 37,708 | 34,233 | 10 |

| Shareholders’ funds | 37,708 | 34,233 | 10 |

| Key financial ratios (%) | |||

| Return on equity 1 | 10.9 | 10.8 | – |

| NPL ratio | 0.9 | 1.1 | – |

| Allowance coverage | 163 | 135 | – |

| Common Equity Tier 1 Capital Adequacy Ratio | 13.1 | 13.7 | – |

- (1)Excluding one-time items and calculated based on net profit attributable to shareholders net of dividends on preference shares and other equity instruments. Non-controlling interests, preference shares and other equity instruments are not included as equity in the computation of return on equity