Customers

Awards - Delivering superior customer experience

- Excellence in Service Innovation, Asia

- Asia’s Best Branch Banking

- Customer Satisfaction Index of Singapore, 1st for Banks

Placing the customer experience at the heart of our actions, we seek to be respectful, easy to deal with and dependable in every aspect of our customer interaction. Instead of tinkering at the edges, we are re-designing our processes and re-engineering our backroom to bring about changes in the way we deliver our products and services. Most crucially, we have an unwavering commitment to doing right by customers by enshrining fair dealing into our code of conduct.

CUSTOMER KPIs

INCREASE CUSTOMER SATISFACTION

2014 Priority: Increase customer satisfaction

Outcome: Improved customer satisfaction in Institutional Banking and Customer Banking based on customer surveys

| Customer satisfaction scores* | 2013 | 2014 |

| Wealth Management customer engagement score | 4.02 | 4.04 |

| Consumer Bank customer engagement score | 3.86 | 3.93 |

| SME bank customer engagement score | 4.05 | 4.09 |

*Customer engagement scores (1=worst; 5=best) based on surveys to measure customers' satisfaction with DBS across markets.

CUSTOMER KPIs

INCREASE WALLET SHARE

2014 Priority: Deepen wallet share of individual and corporate customers

Outcome: Institutional Banking (IBG) non-loan to total income ratio and Consumer Banking/Wealth Management (CBG) non-interest income ratio were maintained

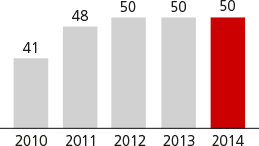

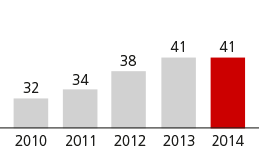

CBG Non-interest Income Ratio (%)

IBG Non-loan Income Ratio (%)

MAKING BANKING JOYFUL FOR CUSTOMERS

We started with a clean slate. We placed ourselves in customers’ shoes and focused on their experience or journey with us. A customer’s journey encompasses his experience from beginning to end rather than at a single point of transaction. We then adopted human-centred design, a discipline of developing solutions based on our customers’ perspective rather than the limitations imposed by our current systems and processes.

Human-centred design seeks to answer three questions regarding a journey:

- Who are our customers and what jobs are they trying to get done?

- Do we know what they are currently experiencing and saying to others?

- Do we know how they will respond to our proposed concepts?

The process of seeking answers enables us to build empathy with our customers, understand the highs and lows of their experience with us, and rectify the underlying causes of a customer problem rather than merely the symptoms. Only then are we able to design journeys that customers expect or desire.

Our approach has been delivering results. Customer satisfaction has improved across all customer segments. To underscore the importance we place on it, customer satisfaction metrics are in our Group’s balanced scorecard.

We have both expanded and further integrated our physical and electronic distribution channels to enable customers to transact seamlessly across multiple touchpoints. We continued to increase the number of physical outlets during the year for customers to perform transactions such as cash withdrawals. We created new mobile apps enabling individuals to carry out cashless transactions with other individuals or with businesses, and extended our corporate internet banking platform to mobile devices so that executives of our corporate and small and medium enterprise (SME) clients can bank on the go. With these enhancements, our customers can now retrieve updated account balances, make immediate payments securely and approve payments at their fingertips wherever they are, whenever they wish.

DOING THE RIGHT THING BY CUSTOMERS

Always doing the right thing by our customers is what will sustain the relationships we have built. Across the organisation - starting with our Chairman, Board and senior management - we are committed to transparency in the way we interact with customers and in delivering fair dealing outcomes.

In applying fair dealing principles, we commit to:

- Only selling products and services that are suitable for our customers

- Ensuring our sales staff are thoroughly trained and equipped with the knowledge and skills to provide quality information to our customers

- Being clear and transparent to our customers

- Being responsive to our customers’ needs and requests, and attending to complaints promptly and effectively

Fair dealing is integral to our culture. We have:

- Strengthened our sales process, expanded the customer fact-finding process, enhanced product risk disclosures and instituted additional customer-product suitability checks

- Rolled out ‘mystery shopping’ and ‘health check’ exercises to ensure that our sales practices are aligned to our fair dealing commitment

- Ensured that staff remuneration is based on a balanced scorecard approach, which takes into account sales and non-sales performance indicators such as the quality of the advisory and sales process, the suitability of product recommendations and customer satisfaction

In addition, all employees complete training modules on fair dealing every year. Sales staff also undergo comprehensive training on the bank’s product suite and compliance guidelines and we test them on their product knowledge and skills regularly.

We are also committed to conducting our business ethically, based on trust and integrity, without the use of corrupt practices, acts of bribery or illicit means. We take a zero-tolerance approach towards bribery and corruption. While no rulebook can anticipate every situation, we have a staff code of conduct that sets out the principles and standards of behaviour that we expect of all our staff. These principles define us and are the standards by which we deal with our customers, business associates, other stakeholders and each other. All our staff are required to read and acknowledge the code of conduct on an annual basis, as well as familiarise themselves with antimoney laundering and combating financing of terrorism policies.

BRINGING "ONE BANK" TO CUSTOMERS

To comprehensively serve customers’ needs, we created a ‘one bank’ model. We built multiple linkages within the bank between customer segments (consumer, wealth, corporate, SME) and our product groups (treasury, transaction banking, capital markets and research). This enables us to offer the most relevant products and services to every customer. By breaking down product and customer segment silos, we are able to manage customer relationships holistically.

We seamlessly serve customers who are both a business owner and an affluent individual with the most suitable range of products for his personal and business needs. For individual customers, we consider their banking requirements at each life stage and offer the most relevant solutions. We also design bespoke solutions for corporates to help them grow and manage their financial risks.

REGIONAL BUSINESS KPIs

1. Build a leading SME BANKING business

2014 Priority: Grow SME franchise by driving client acquisition and deepening existing relationships to offer a differentiated client experience

Outcome: Against the backdrop of an uncertain economic climate, we treaded cautiously in growing our SME business. As such, our SME income growth of 8%* was below target.

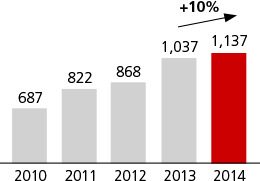

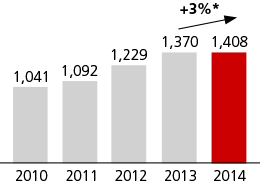

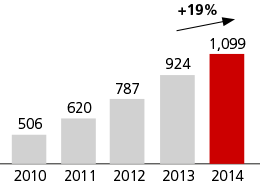

SME Banking Income (SGD m)

* Up 8% on comparable basis that excludes the impact of customer up-tiering

2. Strengthen wealth proposition

2014 Priority: Grow Wealth franchise by driving client acquisition and assets under management market share, and leveraging digital innovation to offer a differentiated client experience

Outcome: Wealth income was at a record. While acquiring new customers proved more challenging than expected, we more than made up for it by deepening customer relationships.

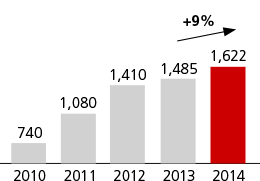

Wealth Income (SGD m)

3. Build out transaction banking and treasury customer business

2014 Priority: Leverage our trade, cash and treasury expertise to offer customers differentiated financial solutions

Outcome: Transaction banking income was at a record. Despite lower China-related trade volumes, our franchise was sufficiently broad-based and we grew in areas such as import financing, guarantees and open account trade. Our cash and custody business across the region also continued to expand.

Transaction Banking Income (SGD m)*

* Includes income from trade, cash management and security and fiduciary services

Treasury Customer Income (SGD m)