Key Financial Highlights

Grow Income

Income (SGD m)

Target: Deliver consistent income growth

Target: Deliver consistent income growth

Outcome: 8% income growth to record SGD 9.62 billion

Manage Expenses

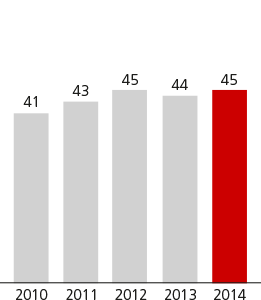

Cost/Income (%)

Target: Be cost efficient while investing for growth; cost-income ratio target of 45% or better

Target: Be cost efficient while investing for growth; cost-income ratio target of 45% or better

Outcome: Cost-income ratio in line with target of 45%. Continue to drive efficiency through strategic cost management efforts. Savings of SGD 500 million over three years reinvested in headcount and new capabilities including digital

Manage Portfolio Risk

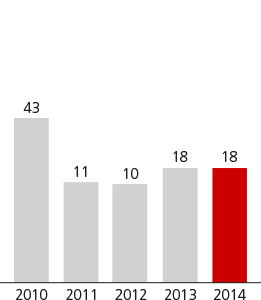

Specific Allowances/Average Loans (bp)

Target: Grow exposures prudently, aligned to risk appetite. Expect specific allowances to average 25 basis points (bp) of loans through the economic cycle

Target: Grow exposures prudently, aligned to risk appetite. Expect specific allowances to average 25 basis points (bp) of loans through the economic cycle

Outcome: Specific allowances as a percentage of loans maintained at 18 bp

Improve Returns

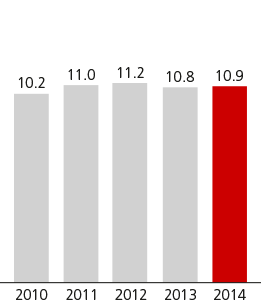

Return on Equity (%)

Target: Return on equity of 12% or better in a normalised interest rate environment

Target: Return on equity of 12% or better in a normalised interest rate environment

Outcome: Double-digit return on equity in a low interest rate environment