DBS Research: Capital optimization, AI, & ESG to be top businesses priorities in Indonesia over the next five years | Bahasa

Findings from the ‘New Realities, New Possibilities’ report by DBS Bank highlight a strategic shift amidst an evolving business landscape

As a starting point, the research noted three macroeconomic trends that are perceived as challenges to stability and growth: geopolitical tensions (58 percent), volatility due to inflation and interest rate instability (57 percent), and supply chain disruptions (55 percent). In contrast, the emergence of new technologies, such as generative AI and Blockchain (83 percent), as well as an increased focus on sustainability (76 percent), are considered trends that have the potential for positive impact, capable of driving innovation and improving operational efficiency.

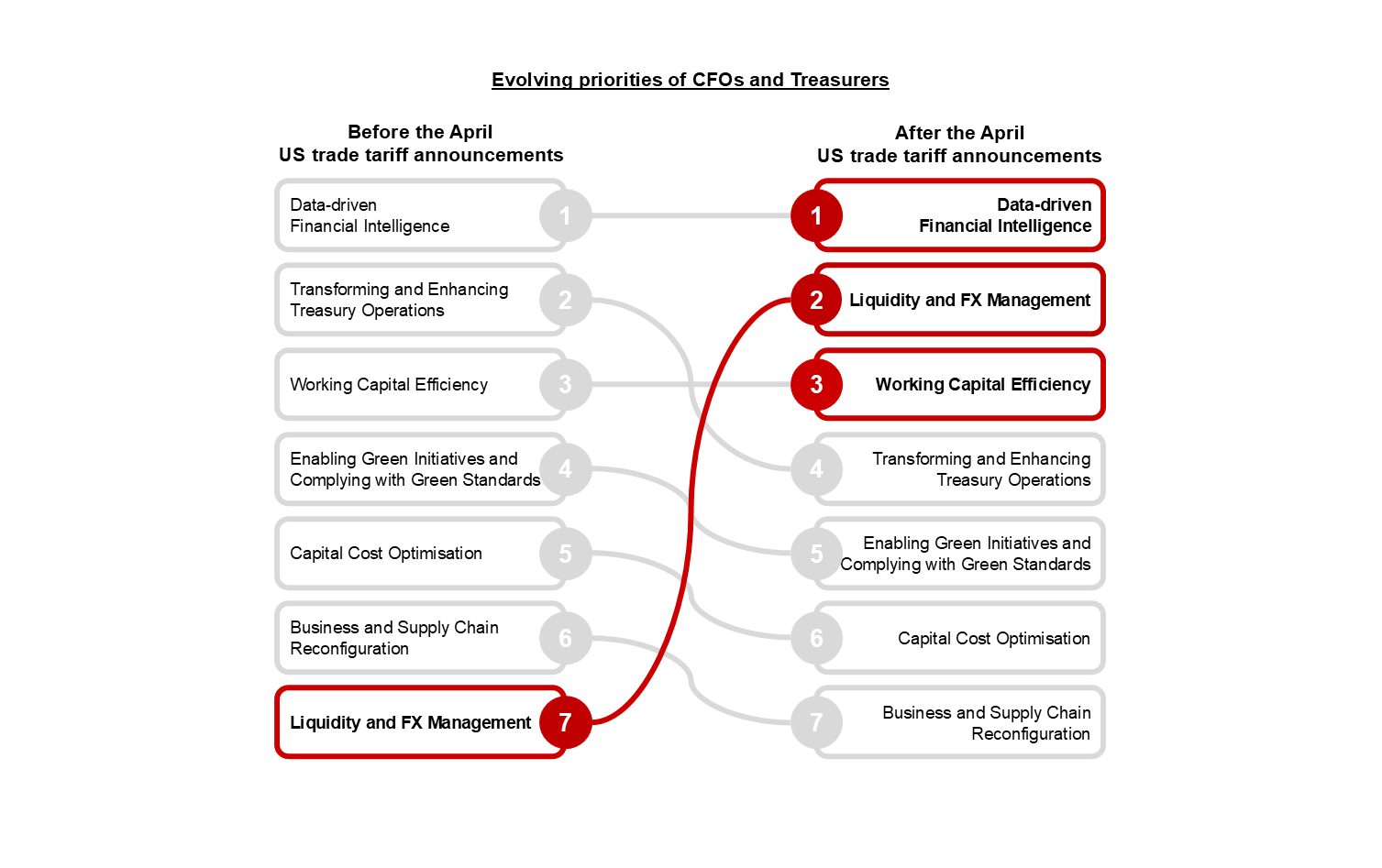

To better understand how macroeconomic trends influence the roles and priorities of financial leaders, DBS Bank conducted this survey in two waves, before and after the US trade tariff announcements in April this year. Based on the seven priorities studied, the use of data-driven financial intelligence remains the top priority for companies in strengthening their financial resilience. Survey results from both periods consistently show that the use of AI for data analysis and visualization is important for improving corporate treasury functions.

A significant jump was seen in liquidity and foreign exchange (FX) management. Based on the results of the second survey after Liberation Day, this aspect rose five positions from seventh to second. Liquidity and foreign exchange management are seen as increasingly crucial as companies start planning to strengthen financial stability amidst higher upfront costs and potential inventory stockpiling associated with increased market volatility.

Capital Optimization is a Priority for Indonesian Leaders, with AI and Automation as the Solution

In Indonesia, this study reveals a shift in priorities in response to the ever-evolving global business landscape. Financial leaders in Indonesia recognize that global economic volatility is putting new pressure on domestic industries. Nevertheless, this situation also presents strategic opportunities for Indonesia to emerge as a competitive manufacturing hub, supported by the increasingly aggressive expansion of Special Economic Zones (SEZs). These changes are expected to significantly reshape the landscape of trade, investment, and the national industrial sector in the coming years.

“Bank DBS Indonesia recognises CFOs now face broader challenges—beyond tech and data—to include liquidity and FX amidst global volatility. Our ‘New Realities, New Possibilities’ research offers timely insights, reflecting our commitment to being a trusted partner in navigating market shifts and seizing growth opportunities,” said Head of Institutional Banking Group at PT Bank DBS Indonesia Anthonius Sehonamin.

While global executives prioritize data-driven financial intelligence, liquidity management, and foreign exchange (FX), 80 percent of Indonesian financial leaders place capital cost optimization as their top priority. This reflects their response to trade pressures, the weakening rupiah, and ongoing inflation.

At the same time, 78 percent of companies in Indonesia identify ESG (Environmental, Social, Governance) performance as a key strategic agenda, in line with the implementation of reporting requirements and increasing investor expectations, including ensuring access to funding. Next, 76 percent of respondents rated transforming and enhancing treasury operations as a critical priority for companies to identify opportunities to refine processes, drive efficiency, and strengthen strategic impact.

In addition, this survey added a new indicator, the Strategic Effectiveness Indicator (SEI), to evaluate the effectiveness of an organization's strategy. Of the three main focuses of Indonesian CFOs and treasurers mentioned above, ESG performance received the highest average SEI score (82 percent), followed by capital cost optimization (78 percent) and increased treasury activities (76 percent).

What are the solutions that CFOs and treasurers in Indonesia can implement? This research highlights three strategies:

Following in the footsteps of global executives in exploring Gen AI and intelligent automation tools as enablers of financial resilience.

Turning to ESG consulting services to integrate sustainability aspects into financial planning and support access to green financing.

Rebalancing debt and equity ratios, exploring long-term financing, and diversifying financing sources to optimize capital costs.

"Amidst global uncertainty and tech disruption, business leaders must manage risks while staying adaptable. Digital innovation and performance evaluation are key to growth, scaling, and market expansion—making a trusted business partner more essential than ever in navigating this critical moment," said Head of Global Transaction Services at PT Bank DBS Indonesia Dandy Indra Wardhana Pandi.

‘New Realities, New Possibilities’ is the third edition of a thought leadership series by DBS Bank, aimed at professionals in the treasury and finance sectors. Each edition aims to help companies understand current dynamics and identify strategic opportunities amid an ever-changing business landscape.

The report, ‘New Realities, New Possibilities’, is available here

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

Established in 1989 as part of the Singapore-based DBS Group, PT Bank DBS Indonesia (Bank DBS Indonesia) is one of the banks with the longest history in Asia. Currently operating 1 Head Office, 13 Branch Offices, 16 Assistant Offices and 1 Functional Office and 3,011 active employees in 15 Major Cities in Indonesia, Bank DBS Indonesia provides comprehensive banking services that focus on the customer experience to 'Live more, Bank less'. We also see a purpose beyond banking and are committed to supporting our customers, employees, and the community towards a sustainable future.

PT Bank DBS Indonesia is licensed and supervised by The Indonesian Financial Services Authority (OJK), and an insured member of Indonesia Deposit Insurance Corporation (LPS).

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by uplifting lives and livelihoods of those in need. It provides essential needs to the underprivileged, and fosters inclusion by equipping the underserved with financial and digital literacy skills. It also nurtures innovative social enterprises that create positive impact.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.