Indonesians are not easily rattled. Afterall, they live in a land where earthquakes, tsunamis, and volcanic eruptions occur every once in a while, and are able to take the hardest knocks that come their way. So, when Covid-19 first surfaced in China late last year and then spread to Southeast Asia in January and February, they remained calm.

After all, during the deadly SARS epidemic in 2003, the country was left relatively unscathed, with the disease infecting only two people who eventually survived. This was in stark contrast to what their closest neighbours suffered. The epidemic claimed 36 lives out of a total 230 who were infected with the disease in Singapore, Malaysia and the Philippines.

As Covid-19 swept the region this time round, infecting 130 people in the three countries by the end of February, Indonesia was not alarmed. They had no cases. Recalling her thoughts at the time, Ms Vega Henrietta, Head Operation and Settlement at fund manager PT Trimegah Asset Management, says, “We didn’t think the virus would affect us because SARS did not. In fact, we know of no other deadly viruses from other countries that have ever had a huge impact in Indonesia.”

While neighboring countries imposed social distancing and work-from-home rules, it was business as usual in Indonesia. All that changed on March 2 when President Joko Widodo confirmed the country’s first two cases of COVID-19 but did not restrict public lifeCovid-19.

When the numbers rose and spiked to 117 cases in mid-March, killing five in the country, companies such as PT Trimegah took action and sent their staff to work digitally from home. This was a new way of working to many and threw up niggling issues. Among some key concerns was whether their IT systems would give them seamless connection to their work.

With PT Trimegah handling about 15 trillion rupiah of assets under their its management, Ms Henrietta’s Vega’s pressing issue was to get contractually-sound transactions done online. The convention had been to have clients faxed through signed copies of deals that have been struck but this posed a challenge when they staff had to suddenly work from home .. But there was no turning back because by March 15, Indonesia had reported five deaths in the country with signs the toll would continue to rise unabated.

“We were caught off guard but assured our clients that our operations would continue to run smoothly because we had very good IT and vendor support and were coordinating closely with our custodian bank (DBS), brokers and KSEI (Indonesia Stock Exchange),” she adds.

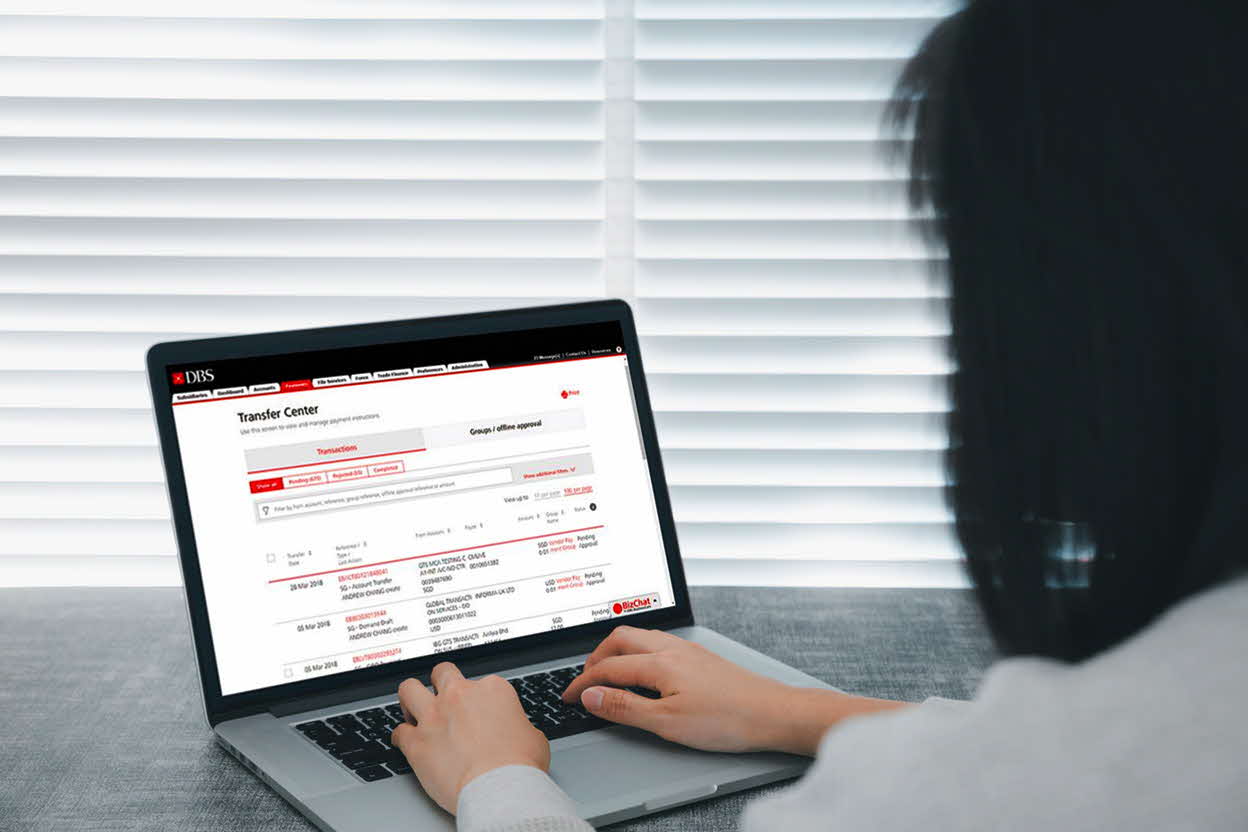

The crucial player in this new matrix was DBS Bank. Fortunately, DBS bank already had in place several systems to help their institutional investor base to fully digitalise their financial operations. DBS IDEAL, the bank’s corporate online banking platform, IDEAL was the perfect solution fit for Vega Ms Henrietta and her clients.

“Most of our customers already had the platform, but were using it only for basic stuff like checking their account balances and not utilising its entire suite,” says Michael Sidarta, a relationship manager at, DBS Indonesia Bank Relationship Manager.

“When we started working from home early in March, we anticipated that our customers would need help in using some of IDEAL’s more advanced features and started contacting every one of them, including Vega.”

Normally it would take two months to train those who are digitally savvy to fully operate IDEAL and up to eight months for others. But As these customers needed to hit the ground running, the DBS team zeroed in on their specific needs, especially in authenticating their digital transactions.

“Everything was done for them through our digital network and we had support teams in place to help each of them to confidently operate IDEAL according to their needs within just two weeks,” he adds.

“Everything was done for them through our digital network and we had support teams in place to help each of them to confidently operate IDEAL according to their needs within just two weeks,” he adds.

With the platform, there is now no need for Ms HenriettaVega and her clients to authenticate their transactions through signed documents.. Still, she says, working within an office environment is the best option for her company.

“We found that working from home can now be a solution if in the future we face situations that prevent us from going to the office,” she explains. “But IDEAL can now also help us to keep monitoring our transactions and conduct our daily reconciliation.”