| |

Approach to Risk Management

DBS embraces risk management as a core discipline to uphold

the integrity of

our business practices and ensure the safety and

soundness of our operating environment. We consider having

world-class skills in monitoring, interpreting and forecasting our

risk profile a critical internal capability. Our approach to risk

management has several components: comprehensive risk

management processes, early identification systems, accurate

risk measures, investments in people and technology to interpret

and manage risk on a daily basis, stress tests and

comprehensive process reviews in conjunction with internal

auditors, external auditors and regulatory officials.

DBS embraces risk management as a core discipline

to uphold the integrity of our business practices and ensure

the safety and soundness of our operating environment.

Risk Governance

Although business units have primary responsibility for

managing specific risk exposures, Group Risk Management is

the central resource for quantifying and managing the portfolio

of risks taken by the Group as a whole. Group Risk

Management performs the following roles:

| • |

Develops, implements, maintains, improves and communicates a consistent risk management framework |

| • |

Recommends risk limits and concentration limits |

| • |

Develops and implements an infrastructure that will qualify

DBS for risk-based regulatory capital requirements |

| • |

Provides senior management and Board with independent and

timely assessment of the aggregate risk profile concerning

significant risk concentrations, portfolio composition and quality |

| • |

Develops framework for economic capital |

| • |

Identifies opportunities to optimise risk-based return on capital |

DBS Group has implemented policies and procedures to

identify, measure, analyse and control risk across the firm.

These policies and procedures rely on constant communication,

judgment, knowledge of products and markets, and controls by

business and support units.

To assist the Board of Directors in fulfilling its duties, the Board

Risk Management Committee oversees matters relating to the

management of risk. Management is accountable to the Board

for maintaining an effective control environment that reflects

established risk appetite and business objectives. Five senior

management risk committees provide forums for discussion on

specific risk areas: the Market Risk Committee, the Credit Risk

Committee, the Group Asset and Liability Committee, the Group

Operational Risk Committee and the Commitments, Compliance

and Conflicts Committee.

Credit Risk

Credit risk is the potential earnings volatility caused by

obligors’ inability and/or unwillingness to fulfill their contractual

debt obligations. Exposure to credit risks arises primarily from

lending activities and also from sales and trading activities,

derivatives activities and from participation in payment

transactions and securities settlements. Credit exposure includes

current as well as potential credit exposure. Current credit

exposure is represented by the notional value or principal

amount of on-balance sheet financial instruments and offbalance

sheet direct credit substitutes, and by the positive

market value of derivative instruments. DBS Group also

estimates the potential credit exposure over the remaining term

of transactions. At DBS Group, a disciplined credit risk

management process integrates risk management into the

business management processes, while preserving the

independence and integrity of risk assessment.

An enterprise-wide Core Credit Risk Policy sets forth the

principles by which the Bank and its subsidiaries conduct their

credit risk management activities. It ensures credit risk

underwriting consistency across the Group, and provides

guidance to various credit management units in the formulation

of supplementary credit policies specific to their businesses.

Individual corporate credit risks are analysed and approved by

experienced credit officers who consider a number of factors in

the identification and assessment of credit risk. Each borrower is

assigned a rating under the Counterparty Risk Rating process. For

large corporate borrowers, the rating is based on the assessment

of all relevant factors including the borrower’s financial condition

and outlook, industry and economic conditions, market position,

access to capital, and management strength. The Counterparty

Risk Rating assigned to smaller business borrowers is primarily

based on the borrower’s financial position and strength, which

are assessed via the use of a validated quantitative tool. All

ratings are reviewed at least annually and more frequently when

conditions warrant. The Counterparty Risk Rating process is

further enhanced by the Facility Risk Rating System which takes

into consideration facility specific considerations such as credit

structuring, collateral, third party guarantees and transfer risks.

These credit risk-rating tools are used to assess the credit quality

of the portfolio, so that deteriorating exposures are quickly

identified and appropriate remedial action can be taken.

Consumer credit risk is managed on a portfolio basis. Business-specific

credit risk policies and procedures including

underwriting criteria, scoring models, approving authorities,

regular asset quality review and business strategy review as

well as systems, processes and techniques to monitor portfolio

performance against benchmarks are in place.

The credit control functions ensure that credit risks are being

taken and maintained in compliance with group-wide credit

policies and guidelines. These functions ensure proper

activation of approved limits, appropriate endorsement of

excesses and policy exceptions, and also monitor compliance

with guidelines established by management and regulators.

An independent Risk Review team conducts regular reviews of

credit exposures and processes. These reviews provide senior

Management with objective and timely assessments of the

effectiveness of credit risk practices and ensure group-wide

policies and guidelines are being adopted consistently across

different business units including relevant subsidiaries.

In the past few years, various “shocks” in the financial market

had adversely impacted the creditworthiness of borrowers. As a

result, stress testing of credit risk has assumed increasing

importance in the discipline of credit risk management. DBS uses

a combination of “top-down” and “bottom-up” credit risk stress

testing approaches to assess the vulnerability of the portfolio to

“exceptional but plausible” adverse credit risk events.

DBS has developed an Economic Capital-at-Risk Framework for

the measurement and management of credit concentration risk

to individual borrowers, borrower groups and industry sectors.

The Economic Capital-at-Risk Framework also provides the basis

for economic capital attribution.

Information on credit exposures by geographical area, business

line and industrial classification, and the breakdown of

investment and dealing securities are disclosed in Notes 23,

24, 25, 27 and 40.1 to the Financial Statements and the

Management Discussion and Analysis chapter.

Country Risk

The management of cross-border risk is embedded in a Country

Risk Management Framework, which was approved at the Board

level. The Framework includes an internal country risk rating

system which taps into the expertise of the Bank within the

markets it operates, and where the country assessments are made

independent of business decisions. Benchmark country limits are

set to delineate when exposures approach levels that may imply

concentration risk. Day-to-day operational country limits, called

working limits, are also imposed to manage the shape and

growth of the cross-border exposures as they build up. A rigorous

environment scanning process is in place, with proactive action

as warranted to expand or roll back country exposures.

Trading Market Risk

Trading market risk arises from changes in market rates such as

interest rates, foreign exchange rates, equity prices and credit

spreads, as well as in their correlation and implied volatilities.

DBS Group takes trading market risk in the course of market

making, structuring and packaging products for investors and

issuers, as well as to benefit from market opportunities.

The trading market risk framework comprises the following

elements:

| • |

Limits to ensure that risk-takers do not exceed aggregate risk

and concentration parameters set by senior management and

the Board |

| • |

Independent validation of valuation and risk models and

methodologies |

| • |

Independent mark-to-market valuation, reconciliation of

positions and tracking of stop-loss for trading positions on a

timely basis |

| • |

New product/service process whereby risk issues are

identified before new products and services are launched |

DBS adopts a Daily-Earnings-at-Risk (DEaR) methodology to

estimate the Group’s trading market risk with a 99% level of

confidence. DEaR is computed using a combination of parametric

(variance-covariance) and historical simulation approaches. It

takes into account all pertinent risk factors and covers all financial

instruments which expose the Group to market risk across all

geographies. On a daily basis, DBS computes DEaR for each

trading business unit and for each risk type such as foreign

exchange, interest rate or equity which are then rolled up to the

Group level. The DEaR figures are backtested against profit and

loss of the trading book to validate its robustness.

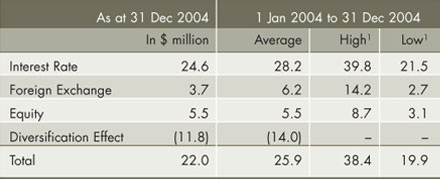

Daily Earnings at Risk

The table below provides the year-end, average, high and low

DEaR for the trading risk exposure of DBS Group during the year:

1) The high (& low) DEaR figures reported for each risk class did not necessarily occur on the same

day as the high (& low) reported for total. A corresponding diversification effect cannot be

calculated and is therefore omitted from the table.

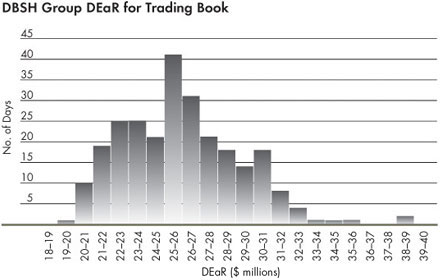

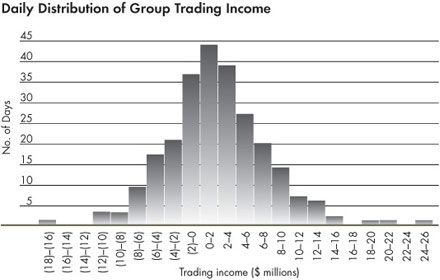

The charts below provide the range of DEaR and the daily

distribution of trading income in the trading portfolio for the

year ended December 31 2004:

Although DEaR provides valuable insights, no single measure

can capture all aspects of trading market risk. To complement

the DEaR framework, daily stress testing is carried out to

monitor the Group’s vulnerability to unlikely but plausible shocks

to individual market factors. Stress limits are also established

accordingly. On a monthly basis, a set of scenarios (historical

or hypothetical) are developed and applied on the trading

books to further assess the potential impact from simultaneous

shocks on all market rates, prices and their implied volatilities.

The Group’s Market Risk Committee meets fortnightly to review

and give direction on the level of market risk taken within DBS

Group; its breakdown by desk and geography risk type;

trading profit and loss; stress testing results; risk model

backtesting performance; and requests for limit changes. The

Greater China Market Risk Committee focuses on the same

market risk metrics and issues within the Greater China area.

Information on the Group’s financial assets and liabilities in

relation to exposures to interest rate and foreign exchange risks

can be found in Notes 37.2.2 and 37.2.3 to the Financial

Statements.

Structural Market Risk

The Group Asset and Liability Committee (“Group ALCO” or

“GALCO”) oversees the structural interest rate risk, structural

foreign exchange risk and funding liquidity risk in the Group.

It allocates core limits to regional/local ALCOs in the different

countries and ensures that the consolidated exposures of the

Group are within prudent levels. Regional/local ALCOs are

responsible to manage the risks in their areas including the

setting of operational limits and guidelines to fine tune risk

management, consistent with the Group’s Asset and Liability

Management (“ALM”) Policy.

Structural interest rate risk arises from mismatches in the interest

rate profile of customer loans and deposits. This interest rate

risk has several aspects: basis risk arising from different interest

rate benchmarks, interest rate repricing risk, yield curve

movements and embedded optionality.

In managing structural interest rate risk, the Bank tries to

achieve a desired profile given the strategic considerations and

market conditions of the various business segments. To monitor

the structural interest rate risk, various tools are used including

repricing gap reports, sensitivity analysis and income

simulations under various scenarios. These measures take into

account both economic value and earnings perspectives.

In structural foreign exchange exposures, the Group’s policy is

to manage the effect of exchange rate movements on its

earnings and capital accounts. Foreign currency loans and investments in fundable currencies are generally funded with the

same foreign currencies. Non-fundable or illiquid currencies

may be hedged with instruments such as non-deliverable

forwards. For currencies with high hedging costs or lack of

liquidity, alternative strategies may be used.

An Investment Framework governs the Group’s investment of

funds arising from the banking business. These investments are

separately subject to Board and senior management limits on the

portfolio size, credit quality, product and sector concentrations

and market risk sensitivities under the Framework. Investment

market risk is monitored by risk type using sensitivities and by

valuation action triggers. Valuation as well as validation of

models used in valuation and risk management are carried out

by independent support units.

Liquidity Risk

Liquidity risk is the potential earnings volatility arising from being

unable to fund portfolio assets at reasonable rates over required

maturities. Liquidity obligations arise from withdrawals of deposits,

repayments of purchased funds at maturity, extensions of credit

and working capital needs. DBS seeks to manage its liquidity risk

across all classes of assets and liabilities to ensure that even under

adverse conditions, DBS has access to funds at a reasonable cost.

The primary tool for monitoring liquidity is the maturity

mismatch analysis, which is monitored over successive time

bands and across functional currencies. This analysis includes

behavioural assumptions on, inter-alia, customer loans, customer

deposits and reserve assets. This is tested under normal and

adverse market scenario conditions. Limits are established by

the Board and senior management for the maximum cumulative

cash outflows over successive time bands. Various liquidity

ratios, concentration and stress limits are additional tools

employed by the Bank to manage funding liquidity risk.

We consider having world-class skills in monitoring,

interpreting and forecasting our risk profile a critical

internal capability.

As part of its liquidity risk management, DBS Group focuses on

a number of components, including tapping available sources

of liquidity, preserving necessary funding capacity and

contingency planning.

Information on the Group’s financial assets and liabilities in

relation to exposures to interest rate risk, currency risk and

liquidity risks can be found in Notes 37.2.2, 37.2.3 and

37.2.6 to the Financial Statements.

Operational Risk

Operational risk is the risk of loss resulting from inadequate or

failed internal processes, people or systems, or from external

events. An Operational Risk Management Framework has been

developed to ensure that operational risks within the DBS Group

are properly identified, monitored, managed and reported in a

structured, systematic and consistent manner. Key elements of the

Framework include control self-assessment, risk event

management and key risk indicator monitoring. To reinforce

accountability and ownership of risk and control by the business

units and support units, Unit Operational Risk Managers are

appointed to assist the unit heads in driving the overall risk and

control agenda and programmes at the units.

The day-to-day management of operational risk exposures is

through the maintenance of a comprehensive system of internal

controls, supported by an infrastructure of robust systems and

procedures to monitor transaction positions and documentation.

A set of Core Operational Risk Standards have been established

to provide guidance to business units and support units on the

baseline internal controls to be put in place to ensure the safety

and soundness of their operating environment. Other major

operational risk mitigation programmes include Business

Continuity Management and the Global Insurance Programme

that apply to all DBS entities and units in all locations.

Each new product or service introduced is subject to a rigorous

risk review and signoff process where all relevant risks are

identified and assessed by departments independent of the

risk-taking unit proposing the product. Variations of existing

products, as well as outsourcing and process centralisation

initiatives, are also subject to a similar process. |