| |

At the start of 2004, Asian economies surged ahead

toward recovery and favourable market conditions prevailed.

|

Jackson Tai

Vice Chairman & Chief Executive Officer |

As the year progressed, capital-raising activities and investment

sales languished in a market rattled by an uncertain outlook for

US interest rates, concerns over China’s overheated economy,

rising oil prices and a demand slowdown for technology-related

products. Trading volumes suffered and conditions became

particularly difficult when bond yields fell sharply against

widespread expectations.

Against this uneven 2004 operating environment, DBS chalked

up record earnings and delivered the strongest bottom-line

numbers in its 36-year history. Our net profit rose 97% to

$2.02 billion, including $497 million in one-time gains from

sales of stakes in affiliate banks. Excluding these gains, net

profit of $1.52 billion was up 48% from the year before and

surpassed the record of $1.39 billion set in 2000.

|

| |

DBS in Singapore

Singapore, as well as Hong Kong,

is DBS’ springboard from which our

successful business models,

expertise and processes will be

exported across the region. |

Net interest income grew 8% last year to $2.57 billion with net

interest margin arresting previous year’s decline to stabilise at

1.79%. Non interest income increased 30% to $2.36 billion but

excluding one-time gains, the increase was 2% to $1.87 billion.

The stronger performance can be traced to our dogged determination

over the past three years to growing annuity income

from our core customer businesses across segments and

geography.

| • |

For the year, our loan book grew 13% to $69.7 billion, excluding our deconsolidated Thailand operations. |

| |

|

| • |

But the larger trend is more revealing: our loan book grew over eight consecutive quarters. During this period, loan assets increased 20% or $11.6 billion. |

Eight Consecutive Quarters of Loan Growth |

|

| • |

Our success in diversifying our income streams by growing recurring income across all customer segments significantly reduced our past reliance on market-related income. |

Six Consecutive Years of Fee Income Growth |

|

Although loan margins have contracted in Asia’s ocean of excess

liquidity, our lending operations generate not only recurring

interest income, but also the opportunity for us to garner

franchise-building fee business. Thus, our loan book’s net interest

income must be juxtaposed against our fee income which has

climbed to 22.9% of total income (excluding one-time gains). Importantly, fee income has grown at a compound annual growth

rate of 24% over six consecutive years, from $274 million in

1998 to $1.013 billion in 2004.

Our higher earnings boosted our capital resources to a 15.8%

group total capital adequacy ratio under the MAS capital

framework. Our strong profitability placed us on a new level of

operating strength and toughened our resolve to become a

leader among Asian financial institutions.

Fundamentally, we owe our improved performance to a

customer-centric approach that puts customers at the core of our

business strategy.

In this regard, we failed in one spectacular instance last year

when operational lapses during the renovation of our Mei Foo

branch in Hong Kong led to the accidental destruction of

83 customers’ safe deposit boxes. While others might have deftly

side-stepped the blame to contractors, we chose to promptly

acknowledge our responsibility for the incident, and took steps to

fairly compensate our customers without delay.

To date we have settled in full with all but seven customers. The

incident had no material financial impact on our Hong Kong

operations, but nonetheless set back our efforts to establish our

brand in our second biggest market in Asia. We deeply regret this

incident, have since taken remedial action to ensure that such

lapses do not recur, and pledge to regain the trust of our customers.

The unfortunate incident was a reminder of the continuous need

to improve the quality of our business as we expand in scale and

scope. Business achievements are of no consequence if we let our

customers down. Arising from the incident, all DBS employees

were reminded that producing strong financial results alone does

not make DBS a well-managed bank. Since then, we have taken

steps to reinforce a company culture that places customers first

and upholds the highest business standards and practices.

2004 Highlights

We completed in 2004 a range of notable achievements,

a reflection of DBS’ growing diversity and depth of talent.

| • |

We won standout investment banking mandates, including lead

manager for the biggest IPO in Singapore, the $830.3 million

Suntec REIT; the first global bond in Asia after the 1997 Asian

financial crisis, a US$270 million bond financing for Indonesia’s

PT MGTI; and a HK$609 million IPO for Li-Ning Co. Ltd, the

consumer goods company founded by the namesake Olympic

gymnast and three-time gold medalist. |

| |

|

| • |

We embarked on a programme of organic growth to underpin

our continued search for appropriate mergers and acquisitions

opportunities. We opened new branches and offices in China,

Indonesia and India, and saw double-digit growth in assets

and revenues in these countries. |

| |

|

| • |

We completed the merger of DBS Thai Danu, Thai Military

Bank and The Industrial Finance Corporation of Thailand in

September. The new entity now operates under the Thai

Military Bank name and is the fifth largest bank in Thailand

with combined assets in excess of Bt 677 billion ($29 billion).

DBS’ 16.1% ownership is second only to the 31.2% stake of

the Thai Ministry of Finance. |

| |

|

| • |

During the year, we took advantage of favourable market

conditions to raise US$750 million of Upper Tier 2 capital for

DBS Bank through a 15-year, 5% subordinated notes issue.

The financing supplements maturing subordinated notes, was

in line with our policy of proactively managing our capital

base, and positions DBS to pursue business and strategic

initiatives as suitable opportunities arise. |

| |

|

| • |

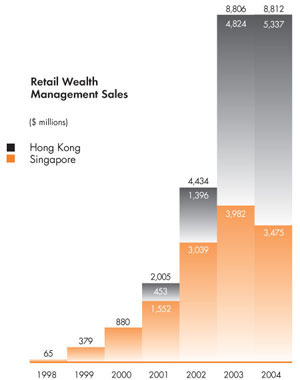

We maintained our wealth management sales despite intense

competition and in the face of sluggish market conditions in

the second half of the year. Total sales of investment products

in Singapore and Hong Kong amounted to $8.812 billion. |

| |

|

| • |

We divested our long-held 10% stake in Hong Kong’s Wing

Lung Bank Ltd in April to Wing Lung Bank’s controlling Wu

family. We also took initial steps in November to divest our

12.7% stake in Banco D’Oro to the controlling Sy family of the

Philippines, which was completed in January this year. Although

neither stake fits into our program for highly integrated banking

operations in the region, we value the relationship and trust with

the lead shareholders of these institutions and look forward to

continued business collaboration. |

| |

|

To achieve scale, we embrace a multi-pronged approach of pursuing organic growth, acquisitions, and hybrid strategies of

joint-ventures and alliances.

DBS Revenues by Business Segments in 2004 |

|

Embracing our Roots as we Build Diversity and Depth

DBS is an Asian bank of the 21st century. We live, breathe and

work in the most exciting and fastest-growing region of the

world. Our prospects are inextricably tied to the fortunes of

Asia; for us, there is no running away when storm clouds

gather over the horizon and returning when blue skies

reappear. We are firmly rooted here to serve our Asian clients,

in good times and bad.

Our Asian origin and orientation have endowed us with the

advantage of local knowledge and insight while our

commitment to international best practices have helped us build

profitable operating models and leadership in product and

service quality. We embrace good governance, transparency,

as well as timely and full disclosure.

Our strategy has been the same regardless of market cycles.

We strive to build scale, diversity and depth as we expand

further into the region to serve our customers.

| • |

We must grow the scale of our operations to harness lower

per unit cost for our customers, and to remain relevant to our

customers and shareholders. |

| |

|

| • |

We seek diversity in business mix and product offerings to

address our customers’ growth across Asia, as well as to

achieve better balance in shareholder returns. |

| |

|

| • |

We are increasing our business depth to anchor our market

penetration and dominance, and to capture higher returns

from our more developed products and services. |

We adopt this strategy on top of an unwavering commitment to

sound risk and credit management, as well as a culture of

strong internal controls, compliance and transparency.

To achieve scale, we embrace a multi-pronged approach of

pursuing organic growth, acquisitions, and hybrid strategies of

joint-ventures and alliances. What form we adopt, and how

fast, depends very much on business opportunities at hand as

well as changing local regulatory policies and forbearance.

Outside of our twin hubs of Singapore and Hong Kong,

organic growth has driven top-line numbers in countries like

China, Indonesia, India and Malaysia. In the coming years, we

will be channelling more resources to significantly reinforce our

presence in these countries. Asset growth in these countries

swelled more than 14% last year.

We will pursue acquisitions only when the right opportunities

arise, and only if they extend our regional reach and add

significant value to our existing businesses.

Thus far, our regionalisation efforts have helped us achieve a

more balanced geographical distribution of our income and

assets in 2004. In 1998, only 17% of our assets were sourced

outside Singapore. Last year, that share was 32%. Operations

outside of Singapore contributed 37% in revenues last year,

compared to 15% six years ago when we started to map out

our pan-Asian ambitions.

Operating Income |

|

| |

Total Assets |

|

a) Excludes $497 million one-time gains

b) Includes goodwill assets; distribution of assets by geography excludes goodwill assets |

Replicating Singapore Strengths in the Region

As we expand our operations, we seek to replicate the

capabilities we have built up over three decades in Singapore,

and more recently in Hong Kong, in the rest of Asia.

Notwithstanding regulatory constraints that sometimes slow our

agenda, we made headway last year in markets beyond

Singapore and Hong Kong.

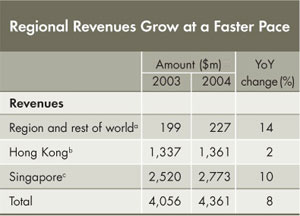

Momentum is building in our operations in China, Indonesia,

India, Malaysia, and South Korea. Growth in revenues from the

region and the rest of the world outside Singapore and Hong

Kong outpaced that of the twin hubs last year, increasing 14%

against 10% and 2% for Singapore and Hong Kong respectively.

As we grow in these countries, we will be using Singapore and

Hong Kong as springboards, exporting from these two markets

successful business models, expertise and processes, and

extending a common technology and operations infrastructure

across the region.

Most of the business growth outside our two key markets has thus

far been in wholesale banking since local regulations continue to

impose varying degrees of restrictions on foreign banks’ presence

in the retail market. We have, for example, been a new and

aggressive challenger in the syndicated loans markets in India,

Malaysia and South Korea. In Malaysia, where we have an

offshore branch in Labuan and a marketing office in Kuala

Lumpur, we were lead arranger of numerous high profile

syndicated loans. They included a US$250 million term loan for

YTL Power International Bhd, a US$300 million term loan for

Astro, a US$700 million floating rate facility for Titan Capital (L)

Ltd, and a US$400 million revolving credit facility for Star Cruises.

In India, we emerged as the number two bookrunner for

syndicated lending as ranked by the Thomson Financial League

Tables 2004, capturing 9.7% share from 13 issues totalling

US$444.4 million.

Looking forward, we are focused on opportunities to

accelerate client coverage across geographies, and to offer

the same full suite of services we already have in our twin

hubs of Singapore and Hong Kong. These include capital

markets and advisory, treasury and markets, structured

finance, private banking, stockbroking, asset management and

transaction services. There is no reason, for example, for us

not to replicate abroad our asset securitisation capabilities

which have seen us pioneer and dominate the Real Estate

Investment Trusts (REIT) business in Singapore.

We also look for an enhanced presence in the regional

derivatives market, particularly in China where we were

awarded a licence to conduct derivatives business last year.

This approval will help us expand the modest scale of wealth

management business we have already developed through our

“white labelling” collaboration with Chinese banks.

In most of the markets in greater China and South and

Southeast Asia, we aim to capitalise on our track record in

corporate and SME banking to target mid-cap customers. We

will take full advantage of our on-site presence, local insight,

and Asian commitment to build an enduring mid-cap franchise,

one that weathers cycles and is not affected by competing

demands from other parts of the world. We must do so before

global bank competitors finally demonstrate a long-term

willingness to invest in Asian mid-cap customers. We must also differentiate ourselves from some global banks who still find it

more compelling at their remote headquarters to book trophy

transactions with large high-profile customers in their episodic

view of Asia.

We will take full advantage of our on-site presence, local insight,

and Asian commitment to build an enduring mid-cap franchise,

one that weathers cycles and is not affected by competing demands

from other parts of the world.

a) Excludes DBS Thai Danu in all periods

b) Includes non-DBS Bank (HK) operations

c) Excludes one-time gains of $497 million in 2004 |

An Integrated Approach to Serving our Customers

As we extend our geographical reach and product offerings,

we will make evolutionary organisational adjustments that will

allow us to offer our customers a seamless experience of high

level of service and quality of products across the region. Early

in 2005, we placed all of our client-facing businesses under

Frank Wong, who was appointed Chief Operating Officer in

recognition of his success in forging the agendas and priorities

of different businesses. He will help ensure that we harness

DBS’ resources across functions and geographies to serve our

customers with integrated, innovative and timely solutions.

Another evolutionary organisation change took place two years

ago and is now beginning to take hold. We grouped six

businesses – Investment Banking, Treasury & Markets, DBS

Vickers Securities, Private Banking, Asset Management as well

as some of the functions within Central Treasury Unit – into a

new integrated Wholesale Banking team. By hard-wiring

product manufacturers, relationship managers and distribution

specialists who serve corporates and institutions closer together,

we were able to leverage product capabilities and sector

expertise across the DBS Group, facilitating closer teamwork

and more efficient cross-selling of products and services.

In our SMEs business, we have set up a Regional Enterprise

Banking Management Team comprising senior managers from

Singapore and Hong Kong, to consolidate and drive regional

plans and ensure alignment of policies and practices in credit,

processes and systems.

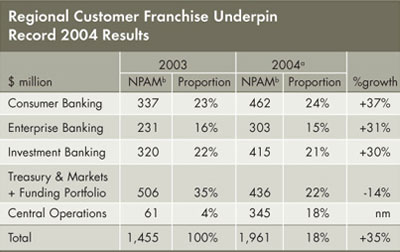

Expanding Distribution to Serve Retail Customers

Our consumer banking franchise in Singapore and Hong Kong

registered a 37% increase in earnings in 2004 to become the

largest net profit contributor within the Group. But beyond the

bookkeeping of profit, our regional consumer banking franchise

is addressing the challenge that banking is increasingly about

access to customers and distribution.

DBS retained its dominant position as the largest distributor of

investment and insurance products to the mass market, with the

bulk of the treasury products engineered in-house and insurance

products sourced from Aviva, our strategic bancassurance

partner.

Sharing a common wealth management business model with

Singapore, Hong Kong reported yet another year of robust

sales in investment and bancassurance products, particularly in

unit trusts where it now commands at least a 5% market share.

Fees from sale of bancassurance and unit trust products rose

47% despite uncertainties in the financial markets.

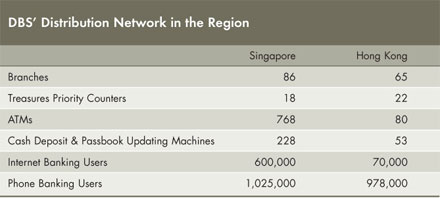

DBS’ retail distribution network is the largest in Singapore, with

86 branches and 768 ATMs located conveniently at consumer

hotspots across the island. We opened a new branch for POSB

in Jurong East in July. In 2004, our ATMs in Singapore processed

an average of 17 million transactions a month from a total of

about 3.7 million ATM cards in circulation.

Excludes bancassurance

|

|

| |

a) Excludes $497 million one-off gains

b) Cash NPAM; excludes goodwill amortisation

nm: not meaningful

|

In addition to being able to access our combined network of

151 branches and 848 ATMs in Singapore and Hong Kong,

DBS customers are also able to use their ATM cards at over

500,000 ATMs in 120 countries that are part of the PLUS/Cirrus

network. From last year, they could also carry out transactions at

the cash machines of four partner banks in the region following

the signing of ATM alliances with the HDFC Bank in India, Bank

Internasional Indonesia and Bank Danamon in Indonesia and

BPI in The Philippines.

The number of credit cards issued by DBS in Hong Kong crossed

the one million mark in July, making the bank the fourth largest

credit card issuer in the Chinese Special Administrative Region.

The success of the Woman’s Card in Singapore, which debuted

in May, led to a similar launch in Hong Kong seven months

later. We are now the second largest issuer of credit cards in

Singapore, with more than 750,000 cards in circulation,

including the successful Black Card and the Woman’s Card.

In Singapore, we defended our traditional strongholds in

housing loans which grew 13% year-on-year, making headway

in the public housing market with an innovative HDB Loyalty

Programme. We started rebuilding our auto loans portfolio

towards the end of 2003 and have been fast gaining market

share with packages designed to provide attractive pricing,

convenience and simplicity to our customers. Compared to

2003, auto loans in Singapore grew even stronger at 90%

to $1.12 billion.

Bottom-line growth in Hong Kong consumer banking was

impressive. Concerted efforts to build relationships with Treasures

Priority Banking customers, and to target the emerging affluent

with a new DBS Wealth Account, were well received, resulting in

higher customer acquisition and retention, and higher profitability.

During the year, six branches with full Treasures Priority Banking

services were renovated and expanded, while a new branch was

opened in the new Tseung Kwan O residential district.

During the year, we also launched a new Internet banking

platform to deliver online products and services faster, to more

users, and across the region in a seamless manner.

Helping SMEs Flourish in Asia

With our origins in development financing of heavy industries,

it is no surprise that DBS was a relative late-comer to serving

SMEs. To make up for lost time, we stepped up investments in

people and infrastructure over the last two years as we set our

sights on building an enduring SME franchise in this higher

risk-adjusted return business.

These investments are beginning to pay off. In 2004, our

Enterprise Banking business in the region registered record

earnings with double digit growth in loans to customers in

Hong Kong, China and Singapore. Overall, Enterprise Banking’s

earnings rose 31% in 2004. Increasingly, DBS’ products and

services, including capital markets, trade finance, and strong

local credit knowledge, make us an attractive financing partner

for growth-bound SMEs.

In 2004, our Enterprise Banking business in the region registered record earnings with double digit growth in loans to customers in Hong Kong, China and Singapore.

In Hong Kong, where our more mature SME business commands

a 12% market share, we continued to outperform the industry in

loan growth, registering a 17% increase compared to the industry average of 1%. Our SME portfolio in Hong Kong

expanded for eight straight quarters, with notable growth in

factoring and equipment finance. We also maintained a number

two position in trade finance in a very competitive environment.

The Hong Kong team extended their coverage in southern China

last year with a flurry of activity, including the award of a

Domestic Enterprise Licence to the Shanghai Branch in April and

the Shenzhen Branch in July, the commencement of business in

Guangzhou Branch in July and the opening of the Dongguan

Representative Office in November.

In Singapore, our Enterprise Banking asset base grew 28% in a market facing marginal growth and narrowing lending spreads.

A structured finance team was set up to provide customers with

a comprehensive suite of products and services ranging from

term loans to risk management and cash management products.

We also upgraded the credit turnaround and selection process,

and introduced more rigorous risk assessment and monitoring.

Our capabilities were recognised in September when DBS was

selected by the Singapore Government to pioneer the nation’s

first loan securitisation programme for SMEs, scheduled for

launch this year. This programme is intended to help SMEs tap

funding through the capital markets.

Providing Financial Solutions to Leading Asian Corporates

DBS aims to be the top financial solutions partner of leading

corporate and institutional clients in Asia. Towards this end, we

are accelerating the expansion of our regional client coverage

and the roll out of product origination capabilities. We will

continue to leverage our unique institutional and retail investor

distribution capabilities as well as our dominant position in

local currency capital market financings. As Asia grows and

becomes the centre of capital formation, DBS is well-positioned

to intermediate regional capital flows

|

|

|

|

DBS Dealing Room

One of DBS’ core strengths is our ability

to manage risk arising from volatility in

financial markets for our clients. |

DBS Indonesia

With the forming of ATM alliances, DBS customers can

now carry out transactions at the cash machines of four

partner banks in the region, namely Bank Internasional

Indonesia and Bank Danamon in Indonesia, HDFC Bank

in India, and BPI in The Philippines. |

Corporate and investment banking contributed $415 million in

net profit, up 30% over 2003. The sterling performance was

due to higher fee income principally from capital market

activities, and strong growth in loan-related fees from higher

volume of loan syndication transactions.

We were involved in many of the year’s major transactions in

Asia, demonstrating our distinctive capabilities across debt and

equity capital markets. We again led in the value of Initial Public

Offerings in Singapore, accounting for 20% of the total $3.4

billion raised in 2004. In November, we assisted Ascendas-

MGM Funds Management Limited offer 37.5 million units of

their Ascendas Real Estate Investment Trust (“A-REIT”). The retail

investor portion of that A-REIT was sold out at our ATMs within

25 minutes of launch. We were also underwriter for Meghmani

Organics, the first Indian company to seek a listing on the

Singapore Exchange.

In another deal that showcased our unique cross-functional

capabilities involving the mergers & acquisitions, debt capital

market, and equity capital market teams, we worked with

CapitaLand Limited on the creation and distribution-in-specie of

CapitaCommercial Trust (CCT), which became the first

commercial REIT to be listed on the Singapore Exchange.

In Hong Kong, DBS Asia Capital kept its focus on the mid-cap

segment and clinched two significant transactions during the year – the IPO for Li-Ning Co. Ltd, which was more than 11 times

subscribed, and for China Force, an edible oil manufacturer which

sold HK$295 million worth of shares to the public.

In syndicated finance, DBS was sole arranger for a US$215 million

syndicated term loan facility for Hebei Pan Asia Long-teng Paper

Co Ltd, as well as a HK$7 billion syndicated credit facility for

Kerry Properties.

In addition, we raised our profile in South Korea’s loan syndication

market by completing the US$230 million syndicated loan facility

for Kookmin Bank, a US$200 million floating rate notes issue for

Hyundai Motor Finance Company and a JPY10 billion floating

rate notes issue for Samsung Corning.

Our debt capital markets team was selected by Pan Asia

Paper Co Ltd as the sole arranger for its US$500 million

multi-currency debt issuance programme and sole lead

manager for its inaugural debt issues. Other deals included

being mandated lead manager for Yellow Pages (Singapore)

Pte Ltd’s $130 million bond issue.

In mergers & acquisitions, we successfully advised Titan

(Holdings) Ltd, a Hong Kong-listed oil group, on its

US$103 million acquisition of Neptune Associated Shipping Pte

Ltd and two other oil tankers in Singapore. We were also

financial adviser to China Merchant Holdings (Pacific) Limited,

a company listed on the Singapore Exchange, on its

HK$2.8 billion acquisition of five toll roads in China.

Supporting our investment banking team, our award-winning

custody and trust services expanded its product offerings and

geographical coverage during the year. In the ADR (American

Depository Receipt) custody business, we were awarded several

mandates for the ADR programmes of major Chinese

companies and appointed administration agent for a major

debt restructuring.

Managing Risks amid Volatility

One of DBS’ core strengths is our ability to manage risks

arising from volatility in financial markets. The compounded

annual growth rate of revenue from our treasury and markets

operations since 1999 has exceeded 30%. This growth reflects

our commitment to building a treasury centre of excellence in

Singapore that will supply a growing pipeline of interest rate,

currency and equity products to the rest of the region. We aim

to extend our dominance in Singapore dollar instruments to

other Asian currencies, and to expand our sales capabilities in

derivatives across multiple asset classes.

A major synthetic collateralised debt obligation transaction during

the year involved the US$1.65 billion securitisation of DBS Bank’s

Asian loan portfolio, one of the largest securitisation deals in Asia

outside Japan.

Treasury & Markets’ growth reflects our commitment to building

a treasury centre of excellence in Singapore that will supply

a growing pipeline of interest rate, currency and equity products

to the rest of the region.

|

| |

DBS Hong Kong

The number of credit cards issued by DBS

in Hong Kong reached one million in July,

making DBS the fourth largest credit card issuer

in the Chinese SAR. |

Making Headway in Managing Wealth

In another intensely competitive segment, DBS Asset Management

retained its lead position as the largest retail fund manager in

Singapore and in Malaysia through Hwang-DBS during 2004. Our flagship Shenton Income Fund was awarded best Global

Bond Fund over three and five years by Standard & Poor’s and

Lipper. Our Malaysian joint venture, Hwang-DBS Securities, saw

strong growth in 2004 with eleven distributors selling our retail

funds there, making us the fastest growing fund management

company in Malaysia in terms of total assets under management.

Full-service brokerage DBS Vickers Securities benefited from a

buoyant stock market in the first half of the year but saw

volumes decline in the second half because of more sluggish

conditions. It reported 11% increase in fees and commission to

$240.6 million, another record contribution to the Group. DBS

Vickers remains one of the top three brokers in Singapore by

market share and among the leading players in Hong Kong

and Thailand.

Our private banking business in Singapore and Hong Kong

continues to work closely with other wholesale banking units

within the Group to offer clients tailored solutions for their

financial needs. Joining forces with DBS Asset Management and

one of the world’s largest fund managers, the private banking

team launched the first Singapore dollar leveraged fund of

hedged funds, the Sentinel II Enhanced Opportunity Fund.

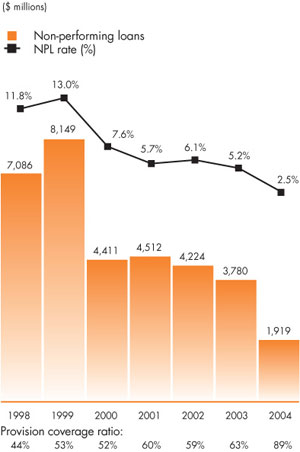

Strong Asset Quality Allows DBS to Grow with our Customers

In the aftermath of the 1997 Asian financial crisis, our

non-performing loans reached an embarrassing 13.1% in 1999,

as a result of our limited credit risk management and a lending

discipline that did not match our regional ambitions at the time.

Our resolve to put right our asset quality never wavered over the

past five years, despite setbacks and disruption from economic

recession, asset deflation, terrorism and the SARS episode. Our

year-end 2.5% non-performing loan rate is now among the best of

Asian banks and reflects our willingness to disclose our mistakes

through early classification of problem loans, the readiness to take

precautionary and sizeable provisions despite the profit and loss

consequences, and the courage to write off or sell non-performing

loans notwithstanding the impact on our regulatory capital.

Non-Performing Loan Rate at 2.5%

Among Best of Asian Banks |

|

Today, our provision coverage of non-performing loans stands

at 89%, up significantly from the 44% in 1998. We now have

sufficient provision cushion to weather economic shocks to our

loan book. More importantly, our asset quality and provision

cushion give us the leeway and confidence to grow with our

customers as they expand their operations throughout Asia.

Integrating Technology and Operations for Productivity

We integrated our technology and operations teams nearly two

years ago and are building on the foundation laid in 2003.

Unit costs declined by 7%, productivity increased by 11%, while

quality, measured in both customer satisfaction and six sigma

terms, continued to improve.

Our IT outsourcing program is now two years into its planned

ten-year cycle and we are reaping the benefits of increased

focus on adding business value, and access to the global

competencies of our partner, IBM. As the relationship progresses,

we are moving away from capital investments in technology

towards a pay-as-you-use model of operation. We are also beginning to deploy other advanced technologies from IBM as

part of our joint technology planning process.

With our strategic partners, we achieved a number of

significant milestones in 2004. We relocated, consolidated and

upgraded our core data centres in Singapore and Hong Kong,

implemented new Internet Banking systems for both our retail

and corporate customers and completed the standardisation of

our unsecured lending platform.

|

| |

Suntec REIT

2004 was a banner year for

DBS’ investment banking team.

Among the marquee deals was

the $830.3 million Suntec REIT,

the biggest IPO in Singapore. |

Recruiting and Retaining Talent as Economy Recovers

Even as we invest millions in hardware and software we never

lose sight of the fact that our people are our most important asset.

The talent of our people – their drive, intelligence and curiosity – differentiate DBS in a crowded market of financial service

providers. In our recruitment and retention policies, we search

for the best and brightest and reward them on a meritocratic

basis that directly links reward with performance.

As economies in Asia recover and competition intensifies in the

banking industry, attracting, retaining and motivating talent

across the region is a clear and present challenge for DBS, as it

is for other Asian banks. To address this challenge, we are

undertaking different initiatives in the area of career development

and progression, talent management, leadership development

and remuneration review.

We continue to embrace family-friendly policies that help

employees strike a better work-life balance. Last year, DBS

became the first major corporation in Singapore to grant all

employees two days paid family childcare leave, exceeding

the statutory requirement which confines the benefit to

employees with children less than seven years of age. We also

extended maternity for any childbirth, again going beyond the

new legislated benefit for the fourth childbirth.

During the year, we won the Family Friendly Employer Award

given by a tripartite body comprising government, union and

employers for our efforts in building harmonious industrial

relations. For our commitment to staff welfare and training and

development, we received the NTUC Plaque of Commendation

in Singapore.

Giving Back to the Communities

Beyond providing financial products and services, creating

wealth, generating jobs and paying taxes, DBS recognises our

larger civic and social responsibilities to the communities in

which we operate. We continue to champion thoughtful

philanthropic and volunteer work.

The Indian Ocean tsunami, unleashed by an earthquake off

Indonesia’s Sumatra island on Boxing Day, devastated coastal

communities in South Asia, causing death and destruction on

an unprecedented scale. Although the economic impact from

the terrible tragedy is expected to be modest, the toll it exacted

on human life was staggering. As a bank firmly rooted in Asia,

DBS shares in the grief of the communities affected by the

disaster. We have contributed to relief efforts through our own

donations and through facilitating donations from our staff and business partners in Singapore and Hong Kong. Importantly,

DBS raised almost $5.6 million through our internet banking

and ATM channels for the Singapore Red Cross Tidal Waves

Asia Fund in slightly under a month, a testament to the power

of our retail distribution channels.

After the lull following the 2003 SARS outbreak, our staff

stepped up their volunteerism work for various causes in

Singapore and Hong Kong. During the year, they escorted

underprivileged children to the theatre, conducted a museum

tour for the physically handicapped, cooked for low income

families, built homes for the poor on Batam island, and

celebrated the mooncake festival with residents of an old folks

home. DBS supports its staff in their community work by giving

every employee two days of paid voluntary leave each year.

DBS was once again conferred the “Distinguished Patron of

the Arts” award by the Ministry of Information, Communications & the Arts in Singapore for its contributions to various arts causes.

We Share Asia’s Future and Confidence

DBS is an Asian bank focused on Asia.

We have emerged from the Asian crisis stronger, tougher,

more agile, and more determined to be a leader among Asian

banks. Our portfolio of businesses is more diversified and

geographically balanced, and will be further calibrated to

improve shareholders’ returns. Our capital and asset quality are

among the strongest of our peers, and we are exceptionally

well-placed to grow with our customers as they expand

throughout Asia. Our commitment to good corporate

governance, transparency and timely disclosure – together with

our investments in people, products and systems – differentiate

us as Asia surges ahead.

|

Share A Hope

DBS champions philanthropic and volunteer works, raising funds for charities, including the Community Chest’s “Give a Hand, Share a Hope” campaign. |

We are proud of our record achievements for 2004 and are

quietly confident of DBS’ future. For this, I offer my personal

and heart-felt thanks to our shareholders, customers, business

partners and employees for their support.

Jackson Tai

Vice Chairman and Chief Executive Officer

DBS Group Holdings

|