| |

This report describes DBS’ remuneration practices and policies

with reference to the following principles set out in the Code of

Corporate Governance.

Procedures for Developing Remuneration Policies

Principle 7: There should be a formal and transparent

procedure for fixing the remuneration packages of

individual directors. No Director should be involved

in deciding his own remuneration.

Level and Mix of Remuneration

Principle 8: The level of remuneration should be

appropriate to attract, retain and motivate the directors

needed to run the company successfully, but companies

should avoid paying more for this purpose. A proportion

of the remuneration, especially that of executive directors,

should be linked to performance.

Disclosure on Remuneration

Principle 9: Each company should provide clear disclosure of its remuneration policy, level and mix of remuneration,

and the procedure for setting remuneration, in the

company’s annual report.

The Group’s remuneration philosophy and policies are an

integral part of its corporate strategy. We pay special attention

to developing employees as the Group’s most important resource

and as an important stakeholder, and recognise that a

transparent reward system is an important key driver of

performance (although not the only one).We focus on driving

desired employee behaviour and performance, supported by our

transparent remuneration policy and incentive system as well as

an open performance appraisal system.

Policy on Employee Remuneration

DBS’ remuneration policy seeks to:

| (a) |

Attract and retain talented and skilled employees who are

critical to the long-term success of DBS; |

| (b) |

motivate employees to perform at the highest levels to

achieve individual, business and group objectives; |

| (c) |

support a strong performance-oriented culture at all

employee levels by linking pay and reward directly to

individual, unit and group performance; and |

| (d) |

foster an ownership culture which aligns the interests of

employees with the interests of shareholders. |

The total compensation of each employee, which is

benchmarked to market total compensation for similar job

functions, consists of the following components:

| (a) |

base pay; |

| (b) |

cash bonuses; and |

| (c) |

long-term share incentives comprising DBSH performance

shares and share option awards. |

In determining the total compensation, individual, unit and DBS

Group performance as well as market remuneration

competitiveness are taken into consideration. Market

competitiveness data are obtained from external benchmarks,

including market surveys.

Long-term Share Incentives – Performance Share Plan,

Share Option Plan, Employee Share Plan and Share

Ownership Scheme

DBSH Group has in place share-based remuneration programmes

that allow its employees to share in the growth and success of

DBSH Group. These plans include a DBSH Performance Share Plan

(“PSP”), a DBSH Share Option Plan (“SOP”), an Employee Share

Plan (“ESP”) and a DBSH Share Ownership Scheme (“SOS”).

Managing Directors, Senior Vice Presidents and Vice Presidents

are eligible to participate in the PSP and SOP. Select high-performing

Assistant Vice Presidents are eligible to participate in

the SOP. The awards made under the PSP and SOP are part of

the annual incentive remuneration, which comprises cash

bonuses and share-based awards. The share portion (i.e., PSP

and SOP) of an employee’s annual incentive remuneration

increases correspondingly with the amount of the employee’s

total annual incentive remuneration, such that employees with

higher annual incentive remuneration receive a larger portion of

their compensation in share-based awards.

For the PSP and SOP, vesting periods are imposed. The number of

shares eventually awarded upon vesting under the PSP is based

on DBS Group’s performance for a three-year performance

period as measured by the Group’s return on equity (ROE). The

aggregate total number of new DBSH ordinary shares that may

be issued under the SOP and the PSP at any time may not exceed

7.5% of the issued ordinary shares of DBSH.

Employees of DBSH Group who are not eligible for the SOP or

PSP are eligible to participate in the ESP and SOS. Under the ESP,

employees are awarded DBSH ordinary shares when DBS Group

meets certain performance targets. These awards vest after a

period of three years. The SOS is a market purchase plan

administered by DBS Trustee Ltd, a wholly-owned subsidiary

company of DBS Bank. Under the SOS, all confirmed employees

with at least one year of service can subscribe up to 10% of their

monthly base pay to buy units of DBSH ordinary shares, with DBS

contributing an additional 50% of what the employee contributes.

Within certain business units or countries, it is not possible to

operate all or part of the above share-based remuneration

programmes, typically because of securities laws and regulatory

issues or market driven practices.

Policy on Directors’ Fees

DBS Group’s policy on Directors’ fees is that it should be

competitive with regional competitors and should align directors’

interests with the interests of the shareholders. Directors receive

basic directors’ fees, and fees for being the Chairmen or

members of the Executive Committee, Audit Committee and

Board Risk Management Committee.

Directors are encouraged, but are not obliged, to invest half of their

fees in DBSH shares and to hold not less than 50% of these shares

for the duration of their respective terms. Directors’ fees are approved

by shareholders at the annual general meeting (AGM) of DBSH.

Remuneration of Executive Directors

In determining the remuneration for executive directors, the

Compensation Committee takes into account the following

principles:

| (a) |

the remuneration should motivate the executive directors to

achieve DBS Group’s performance targets, both annual and

long-term; |

| (b) |

the performance-related elements of remuneration should

form a significant part of their total remuneration package; |

| (c) |

the interest of the executive directors should be aligned with

shareholders; and |

| (d) |

the remuneration is directly linked to the performance of DBS

Group and individual performance. |

The Compensation Committee recommends specific remuneration packages for each executive director for

endorsement by the full Board.

Executive directors are recruited by DBS under employment

contracts covering their services as employees.

These employment contracts have general clauses for termination

of service as employees, rather than a specific provision for early

termination. The contracts do not deal with directorship matters,

which are approved separately by the Board. An executive

director’s term on the Board is determined by the Board.

Remuneration of Non-Executive Directors

Following a review of industry benchmarks, with effect from

January 1, 2004, the basic annual fee paid to each director of

DBSH is proposed to be increased from $40,000 to $50,000,

while the annual fee paid to the Board Chairman is raised from

$50,000 to $85,000. Fees paid to Audit, Board Risk

Management and Executive Committee members are increased

from $6,000 to $20,000 each per annum. Fees for the

Chairmen of the Audit and Board Risk Management Committees

are raised from $15,000 to $35,000 each per annum, while the

annual fee for the Chairman of the Executive Committee is

increased from $10,000 to $35,000 per annum.

The revised fee structure will be presented to shareholders for

approval at the AGM on April 29, 2005.

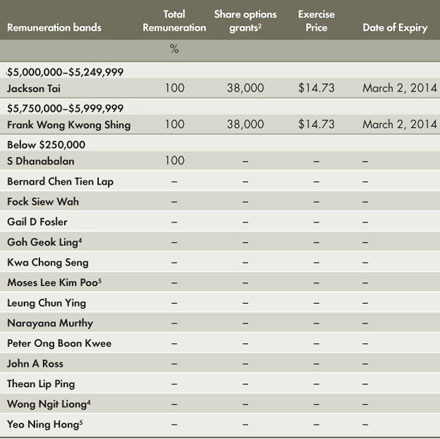

Breakdown of Directors’ Remuneration

The following table shows the breakdown (in percentage terms) of the remuneration of directors, including those appointed and

resigned/retired during the year. They are grouped by bands of $250,000 for the year ended December 31, 2004.

1) Valuation based on Black Scholes model

2) Refers to the number of unissued DBSH ordinary shares of par value S$1 under the

DBSH

Share Option Plan

3) Fees are not retained by directors

4) Appointed on May 3, 2004

5) Resigned on April 30, 2004

Key Executives’ Remuneration

The Code requires the remuneration of at least the top five key

executives who are not also directors to be disclosed within

bands of $250,000. DBS believes that disclosure of the

remuneration of individual executives is disadvantageous to its

business interests, given the highly competitive industry

conditions, where poaching of executives has become

commonplace in a liberalised environment.

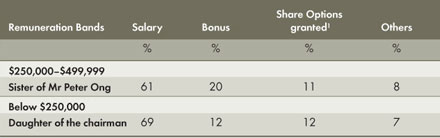

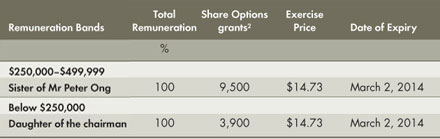

Immediate Family Member of Director

The following table shows the breakdown (in percentage terms) of the annual remuneration of employees who are immediate

family members of directors.

1) Valuation based on Black Scholes model

2) Refers to the number of unissued DBSH ordinary shares of par value S$1 under the

DBSH Share Option Plan

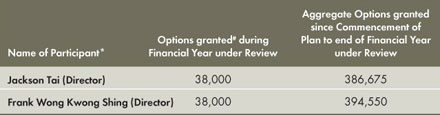

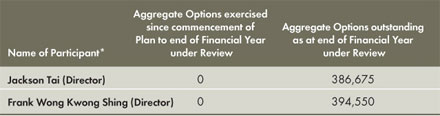

Share Plans

Details of the DBSH Performance Share Plan and the DBSH Share Option Plan (the “Plan”) appear in pages 150 to 152 of the

Directors’ Report. In compliance with Rule 852 of the SGX Listing Manual, the following participants in the Plan received the

following number of options:

* DBSH has no controlling shareholders and no disclosure is made in this respect

# The options granted were in accordance with the terms of the Plan

During the financial year:

| (a) |

no options were issued to any participant totalling 5% or

more of the total number of options available under the Plan; |

| (b) |

no options were issued to any director or employee of

DBSH or its subsidiaries totalling 5% or more of the total

number of options available to all directors and employees

of DBSH and its subsidiaries under the Plan; and |

| (c) |

no options were granted at a discount. |

The aggregate number of options granted to the directors and

employees of the DBS Group for the financial year under

review is 7,494,000.

The aggregate number of options granted to the directors and

employees of the DBS Group since the commencement of the Plan

to the end of the financial year under review is 46,749,383.

Approval by shareholders

Shareholders’ approval was previously obtained for the

implementation of the DBSH Share Option Plan and the DBSH

Performance Share Plan. Directors’ fees are also approved by

shareholders at the AGM. The remuneration framework for

executive directors and executives has also been approved by

the Compensation Committee and endorsed by the Board. The

Board considers that the remuneration framework does not

need to be approved by shareholders. |