| |

Introduction

At DBS, we see good corporate governance as the cornerstone

of any effective, well-run organisation. Integrity, honesty and

transparency in dealings are crucial to retaining investor

confidence and in ensuring a firm’s reputation. Not only do we

benchmark ourselves against the Singapore Code of Corporate

Governance, we also adopt, where appropriate, international

best practice corporate governance standards.

This report describes DBS’ corporate governance processes with

specific reference to the guidelines in the Code, and also

includes information required

to be disclosed under the Best

Practices Guide and the Interested Person Transactions Policy in

the SGX Listing Manual.

|

| |

DBS Management Committee

(left to right)

David Lau, Frank Wong, Jeanette Wong,

Jackson Tai, Rajan Raju, Eric Ang

and Steve Ingram |

Board Matters

Board's Conduct of its Affairs

Principle 1: Every company should be headed by an

effective Board to lead and control the company.

Role of the Board

DBS Group Holdings (“DBSH”) Board, which has overall

responsibility for managing the affairs of DBS Group, including

reviewing its financial performance, setting its strategic

direction and performance objectives and reviewing major

corporate initiatives, comprises 14 members, excluding

Ang Kong Hua who joined the Board in March 2005.

Of these, two are executive directors, three are directors

associated with Temasek Holdings Pte Ltd (“THL”), DBSH’s substantial shareholder, and nine are independent directors.

The three directors associated with THL were not appointed at

the request of THL and do not report to THL or take directions

from THL. Six of the 14-member Board are non-Singaporeans.

Certain matters specifically require Board approval, including:

| (a) |

the consolidated financial statements and directors’ report of

the DBS Group; |

| (b) |

any strategic plan for the DBS Group and how actual results

compare with the plan; |

| (c) |

the annual budget for the DBS Group; |

| (d) |

all strategic acquisitions and divestments by the DBS Group; |

| (e) |

all major fund-raising exercises of the DBS Group; and |

| (f) |

all decisions that will have a major impact on the reputation

or standing of the DBS Group. |

Board Meetings

The Board conducts five scheduled Board meetings a year with at

least one meeting held over two days. The agenda includes

review of financial performance and discussions on corporate

strategy, business plans, major corporate initiatives and review of

potential strategic acquisitions or alliances.

In addition to the scheduled meetings, the Board also holds ad

hoc meetings as and when required. Meetings are allowed to

be held via teleconference and video-conference. Board

approval for specific proposals may also be obtained through

written resolutions by circulation due to exigencies.

Attendance at Board and Committee Meetings

@ the number of meetings held during the period the director was a member of the Board and/or

relevant Committee

1) Appointed on May 3, 2004 (Board and Audit Committee)

2) Appointed on January 13, 2004 (Board Risk Management Committee)

3) Resigned on April 30, 2004 (Board and Audit Committee)

4) Appointed on May 3, 2004 (Board and Compensation Committee)

5) Resigned on April 30, 2004 (Board and Compensation Committee)

6) No physical meetings held. Approval of nominations by circulation

Training

New and existing directors undergo comprehensive orientation

and training programmes. New directors are provided with

relevant materials on directors’ roles and responsibilities. They

are also briefed by the company secretary on their fiduciary

responsibilities, and by the CEO and key business and

functional heads on the Group’s businesses and operations.

Board and Board committee members are also updated regularly

on key accounting and regulatory changes. In 2004, the Audit

Committee received comprehensive briefings on fraud risk

management, tax risk management and anti-money laundering,

as well as changes to key accounting standards, such as

Financial Reporting Standards (FRS) 32, 39, 102 and 103.

Directors are given unrestricted access to all DBS staff.

Integrity, honesty and transparency in dealings

are crucial to retaining investor confidence and

in ensuring a firm’s reputation.

Board Committees

A number of Board committees have been established to assist the

Board in discharging its responsibilities and to enhance the

Group’s corporate governance framework. The committees include

the Executive, Board Risk Management, Audit, Compensation and

Nominating Committees. The operations of the Audit Committee

are described in the section “Audit Committee”.

Each of these committees has its own written terms of reference

that describes the responsibilities of the committee.

Executive Committee

The DBSH and DBS Bank Executive Committee (“Exco”)

comprises six members (S Dhanabalan (Chairman), Jackson Tai,

Frank Wong, Bernard Chen, Fock Siew Wah and Kwa Chong

Seng) and is authorised to exercise all the powers of the Board,

except those which the Board may only exercise by law or

which the Board has expressly reserved for itself. The DBSH

and DBS Bank Exco meets twice a month. During those

meetings, the Exco reviews and decides on credit proposals

requiring its approval. The Exco also discusses, and where

required, endorses strategic and other major issues that are

brought up prior to discussion with, and where required,

approval by the full Board. During the year, major initiatives

reviewed by the Exco included:

| (a) |

DBS Thai Danu Bank merger proposal; |

| (b) |

Proposed divestment of Wing Lung Bank stake; and |

| (c) |

Proposed US$750 million Upper Tier 2 subordinated

debt issue. |

The BRMC meets four times a year. In 2004, the BRMC

continued to serve as an active Board forum to review and

exercise oversight on DBS’ risk management activities. The

matters deliberated at the 2004 BRMC meetings included:

(a) periodic updates on the risk profiles of DBS Group, covering

trading market risk, structural market risk, credit risk (including

country risk) as well as operational risk, (b) updates on various

risk management initiatives, such as Basel II Accord preparation,

Market Risk Internal Models preparation and Business Continuity

Management preparedness of the DBS Group, and (c) proposed

revisions to risk management policies and framework.

Compensation Committee

The Compensation Committee (“CC”) comprises five members

(Thean Lip Ping (Chairman), S Dhanabalan, Fock Siew Wah,

Leung Chun Ying and Wong Ngit Liong). The Chairman of the

Committee is an independent director.

The role of the CC is to:

| (a) |

review and approve the remuneration, including the grant of

share options and performance shares, to the executive

directors of DBSH and DBS Bank; |

| (b) |

review and approve the aggregate variable cash bonuses,

share options and performance share grants to the

employees of DBS Group; and |

| (c) |

oversee management development and succession planning

in DBS Group. |

A number of Board committees have been established to assist the

Board in discharging its responsibilities and to enhance the Group’s

corporate governance framework.

Executive directors, who are not members of the CC, may

attend meetings but do not attend discussions pertaining to

themselves, including their own performance and remuneration.

Nominating Committee

As required by regulation and its Articles, DBSH has established

a Nominating Committee (“NC”) comprising five members

(Bernard Chen (Chairman),

S Dhanabalan, Gail Fosler, Leung

Chun Ying and Thean Lip Ping). The Chairman of the Committee

is an independent director.

Regulations issued by the Monetary Authority of Singapore

(“MAS”) require the NCs of Singapore banks to identify

candidates and review all nominations by the Board, any Director

or any member of DBSH for the following positions in DBSH:

| (a) |

Director/Alternate Director (for appointment or re-appointment,

election or re-election). In deciding on the appointment of new

candidates to the Board, the NC will take into account the

proposed appointee’s background, experience and other

board memberships; |

| (b) |

membership of the Executive Committee, the Compensation

Committee, the Audit Committee, the Board Risk

Management Committee and any other Board committees

that may be established from time to time; and |

| (c) |

the Chief Executive Officer, Deputy Chief Executive Officer,

President, Deputy President and Chief Financial Officer,

including any other officer, by whatever name called, who has

responsibilities and functions similar to any of these officers. |

Beyond the regulations, all appointments of key business and

functional heads, and the heads of major subsidiaries in the

Group, must be approved by the NC. In 2004, the NC

reviewed and approved the appointments of the Head of

Group Audit, Group Human Resources and Group Legal and

Compliance.

Board Composition and Balance

Principle 2: There should be a strong and independent

element on the Board, which is able to exercise objective

judgement on corporate affairs independently, in

particular, from Management. No individual or small

group of individuals should be allowed to dominate the

Board’s decision-making.

Five of the directors are considered non-independent. They are

S Dhanabalan (Chairman), Jackson Tai, Frank Wong, Fock

Siew Wah and Kwa Chong Seng.

Mr Dhanabalan is Chairman of THL. Mr Jackson Tai and Mr Frank

Wong are executive directors. Mr Tai is the Vice-Chairman and

CEO of DBSH and DBS Bank, and Mr Wong is the Chief

Operating Officer of DBSH and DBS Bank, Vice-Chairman of

DBS Bank and Chairman, DBS Bank (Hong Kong). Mr Fock and

Mr Kwa are non-executive directors of THL, but are not nominated

nor appointed by THL. They do not report to or take directions

from THL and act in their personal and independent capacity as

directors of DBSH. Under the draft Banking (Corporate

Governance) Regulations 2003 (the “Regulations”) issued by

MAS, directors who are also non-executive directors of a

substantial shareholder are deemed not to be independent.

Although the Regulations are not yet law, we have treated

Mr Fock and Mr Kwa as not independent purely because of the

provision in the draft Regulations.

The NC adopts the definition of independence as stated in the

Code and the Regulations. The independence of each director

is reviewed annually by the NC.

Apart from the five directors mentioned above, the NC has

reviewed and confirmed the independence of the remaining

directors (Bernard Chen, Gail Fosler, Goh Geok Ling, Leung

Chun Ying, Narayana Murthy, Peter Ong, John Ross, Thean Lip

Ping and Wong Ngit Liong).

DBS Building Tower One

The DBS HQ in Singapore is a 50-storey tower

block built in 1973. The four round concrete

caissons in the building’s foundation inspired the

original design of the DBS logo in 1972.

In particular, while Mr Wong is Chairman and Chief Executive

Officer of the Venture Group of companies (“Venture”), and

Venture has made payments to DBS which exceeded $200,000

in the last financial year, he has been assessed as independent

as such payments are not material to DBS’ financials.

Mr Thean is a non-profit sharing consultant at Singapore law

firm KhattarWong (“KW”). While KW rendered services to DBS,

and earned fees which exceeded $200,000 in the last financial

year, Mr Thean does not participate in KW’s deliberations

relating to DBSH. As such, he is viewed as independent.

While there is no limit on the number of directors that may be

appointed under DBSH’s Articles, the Board considers its

current board size to be appropriate, taking into account the

nature and scope of DBS’ operations.

With their deep and broad knowledge, expertise and

experience, Board members provide valuable insight and

advice during Board discussions.

Chairman and Chief Executive Officer

Principle 3: There should be a clear division of

responsibilities at the top of the company – the working

of the Board and the executive responsibility of the

company’s business – which will ensure a balance of

power and authority, such that no one individual

represents a considerable concentration of power.

The Chairman and CEO functions in DBS are assumed by

different individuals. The Chairman, Mr Dhanabalan, is a

non-executive director, while the CEO, Mr Jackson Tai, is an

executive director.

The CEO is the most senior executive in DBS and assumes

executive responsibility for DBS’ business, while the Chairman

assumes responsibility for the management of the Board.

|

|

|

|

DBS Hong Kong

DBS Hong Kong recorded another year

of robust sales

in investment and

bancassurance products, performing

exceptionally well in unit trusts where

it

now has at least 5% market share. |

DBS Treasures Banking

Under Treasures Priority Banking,

DBS offers comprehensive advisory

services tailored to the individual’s

financial needs. |

The Board agenda is set by the CEO and approved by the

Chairman. Board members are provided with comprehensive

materials in advance of Board meetings, and all major issues

and initiatives are discussed and reviewed by the Board.

The Chairman hosts a private session without the presence of

executive directors at every board meeting.

Board Membership

Principle 4: There should be a formal and transparent

process for the appointment of new directors to the

Board. As a principle of good corporate governance,

all directors should be required to submit themselves for

re-nomination and re-election at regular intervals.

New directors are appointed by the Board based on

recommendations by the Nominating Committee (“NC”).

In reviewing the suitability of new candidates, the NC takes into

account certain criteria set out in the relevant regulations and

the Articles of Association. These include the requirement that

the Board must comprise a majority of Singapore citizens or

permanent residents, a majority of directors must be

independent and not more than two directors may be executive

directors. In addition, the NC ensures that the candidate is

qualified for the position.

The NC also takes into consideration whether a candidate has

multiple directorships and whether these other directorships will

constrain the candidate in setting aside sufficient time and

attention to DBS affairs.

All new directors must submit themselves for re-election at the

next annual general meeting of DBSH. One-third of the directors

must also retire by rotation at each annual general meeting.

Directors are appointed for two-year terms, up to a maximum of

three two-year terms. In reviewing the re-appointment of directors, the NC will take into account a range of factors,

including the director’s level of participation at Board and

Board committee meetings and his performance and

contributions during the term. The maximum tenure of three two-year

terms may also be exceeded if the NC considers that the

director’s experience and expertise are valuable to DBS Group

and cannot be easily replaced by a new director.

The NC also reviews the appointments of all Board committee

members. In reviewing such appointments, the NC seeks to

ensure that the appointee has the relevant experience and skills

to make a meaningful contribution to the particular committee,

and that Board committee memberships are equitably

distributed among directors where possible.

Board Performance

Principle 5: There should be a formal assessment of the

effectiveness of the Board as a whole and the contribution

by each director to the effectiveness of the Board.

DBSH has implemented a process to assess the performance

and effectiveness of the Board as a whole as well as to assess

the performance and effectiveness of individual directors.

For collective Board appraisal, each director assesses the

Board’s performance as a whole and provides feedback to the

Chairman of the Board and the Chairman of the NC. Both

Chairmen consolidate the feedback and present the findings to

the Board annually. Board performance is judged on the basis

of accountability as a whole, rather than strict definitive

financial performance criteria, as it would be difficult to apply

specific financial performance criteria to evaluate the Board.

The Board has found the collective Board assessment useful in

evaluating its effectiveness, as directors have provided

constructive feedback and suggestions for improvement.

DBS India

DBS Mumbai branch, established

in 1995, is poised to benefit from

India’s fast growing and rapidly

liberalising market.

In the case of individual assessment, each director is evaluated

on the basis of his or her attendance, knowledge and

contribution to the effectiveness of the Board. Each director

completes a self and peer evaluation form, which is seen only by

the Chairman of the Board. Where the feedback indicates that a

director can benefit from development of certain aspects of his/her

work on the Board, this will be communicated individually.

Access to Information

Principle 6: In order to fulfil their responsibilities, Board

members should be provided with complete, adequate

and timely information prior to Board meetings and on an

on-going basis.

Directors are provided with the agenda and meeting materials

in advance of Board meetings.

Management provides the Board with a monthly update

covering financial results, market and business developments,

business and operations metrics and updates on major issues.

Directors have access to the company secretary and senior

management at all times. Directors requiring external professional

advice will be assisted by the company secretary, with DBS

bearing the cost of such external advice.

The company secretary attends all board meetings and ensures

that board procedures are followed and relevant regulations

are complied with. The company secretary attends all meetings

of the Board and the Audit Committee. The minutes of the Audit

Committee and the BRMC are circulated to the Board.

Remuneration Matters

Principles 7 to 9 of the Code deal with remuneration matters. These

matters will be covered separately in the Remuneration Report.

Accountability and Audit

Accountability

Principle 10: The Board is accountable to the shareholders

while the Management is accountable to the Board.

DBS recognises the importance of keeping the Board regularly

updated on DBS’ performance and prospects. As stated above,

Management provides the Board with a monthly update apart

from the regular Board meetings.

DBS Indonesia

DBS’ expertise in raising funds

for telecommunication companies

helped us land a standout mandate

from PT Mitra Global

Telekomunikasi Indonesia last year.

The heads of all business and support units provide a quarterly

certification to the CEO and the Chief Financial Officer (“CFO”)

stating, inter alia, that the head of such business or support unit

is not aware of any circumstances not otherwise dealt with in

the financial statements that would render any amount stated in

the financial records misleading. The CEO and CFO in turn

provide a Letter of Representation on a quarterly basis to the

Audit Committee and the external auditors, Ernst & Young

(“EY”), confirming that the financial statements have been

properly drawn up.

Disclosure to investors is addressed in the section “Communication with Shareholders” below.

Audit Committee

Principle 11: The Board should establish an Audit

Committee (“AC”) with written terms of reference which

clearly set out its authority and duties.

The AC comprises independent non-executive directors Bernard

Chen (Chairman), Goh Geok Ling and Peter Ong.

The role of the AC is to:

| (a) |

review the financial statements prior to submission to the Board; |

| (b) |

review with the external auditor the audit plan, the

evaluation of the system of internal accounting controls and

the external auditor’s audit report; |

| (c) |

review the scope and results of the internal audit procedures; |

| (d) |

nominate the external auditor; |

| (e) |

review the cost effectiveness, independence and objectivity of

the external auditors and (where the auditors also supply a

substantial volume of non-audit services to DBS) to keep the

nature and extent of such services under review, seeking to

balance the maintenance of objectivity and value for money; |

| (f) |

review interested person’s transactions; and |

| (g) |

perform any other functions which may be agreed by the

AC and the Board. |

The AC also has explicit authority to investigate any matter within

its terms of reference. It has full access to and co-operation of

management and full discretion to invite any director or executive

officer to attend its meetings. The AC has reasonable resources to

enable it to discharge its functions properly.

In its review of the audited financial statements for the financial

year ended 2004, the AC discussed with management and the

external auditors the accounting principles that were applied

and their judgement of items that might affect the financials.

Based on the review and discussions with management and the

external auditors, the AC is of the view that the financial

statements are fairly presented in conformity with generally

accepted accounting principles in all material aspects.

In 2004, the AC met five times. In addition to reviewing the

financial results, the internal and external auditors’ reports, and

discussing the usual business of the AC, the AC also discussed

more wide-ranging issues, including the lessons learnt from high

profile operational lapses in other banks.

The Group Audit Head, the Group Legal and Compliance Head

and the external auditors attend every AC meeting. In addition,

the AC meets with the external auditors separately after each

AC meeting without the presence of management.

The AC has received the requisite information from EY and has

considered the financial, business and professional relationship

between EY and DBS, for the financial year 2004. The AC has

also conducted an annual review of the volume of non-audit

services provided by EY to satisfy itself that the nature and

extent of such services will not prejudice the independence and

objectivity of the auditors before confirming their re-nomination.

The AC is of the view that EY can be considered independent.

Internal Controls

Principle 12: The Board should ensure that the Management

maintains a sound system of internal controls to safeguard

the shareholders’ investments and the company’s assets.

A sound system of internal controls can only operate within a

defined organisational and policy framework. The management

framework at DBS

clearly defines the roles, responsibilities and

reporting lines of business units and support units. Delegation of

authority, control processes and operational procedures are

documented and disseminated to staff. While all employees

have a part to play in upholding the system of internal controls,

certain corporate functions such as Group Audit, Group Risk and

Group Compliance provide independent oversight and control.

A sound system of internal controls can only operate within a defined organisational and policy framework. The management framework at DBS clearly defines the roles, responsibilities and reporting lines of business units and support units.

Internal controls are reviewed on an ongoing basis by Group

Audit, whose work is supplemented by that of the external

auditors. The role of Group Audit and the external auditors is

described in the section on “Internal Audit”.

Risk management is essential to the DBS Group’s business.

Group Risk is responsible for instituting firm-wide risk

management framework and infrastructure. Risk management

processes have been integrated throughout

the DBS Group into

the business planning, execution and monitoring processes,

particularly through the approval process for new products

and/or services. Business units also perform periodic control

self-assessment processes to review and attest to the effectiveness

of their internal control environment. The risk management

process in DBS is also strengthened through the regular

deliberations of the Board Risk Management Committee.

The Group Compliance function has specific accountability for

instilling and maintaining a strong compliance culture and

framework within the DBS Group.

The AC has reviewed the adequacy of DBS’ control

environment and has made its report to the Board.

Based on the information furnished to the Board, nothing has

come to the Board’s attention to cause the Board to believe that

the internal controls and risk management processes are not

satisfactory for the type and volume of business conducted.

Internal Audit

Principle 13: The company should establish an internal

audit function that is independent of the activities it audits.

Group Audit is an independent function that reports directly to the

Audit Committee and the CEO. Its scope of work covers all

business and support functions in the DBS Group, both in

Singapore and overseas. All audit offices

in the Group follow a

consistent set of code of ethics based on principles recommended

by the USA Institute of Internal Auditors.

The annual audit plan is developed under a structured Risk

Assessment Approach that examines all of the Group’s activities

and entities, the inherent risks and internal controls. Audit

assignments are identified based on this approach and audit

resources are focused on the higher risk activities.

The progress of corrective actions on all outstanding audit issues

is monitored monthly through Group Audit’s centralised Global

Audit Tracking System. Information on outstanding issues is

categorised and reported to senior and

line management

through the Monthly Control Reports.

All copies of reports with adverse opinions and a monthly

summary of all audit reports issued in the month are copied to

the Chairman of the Audit Committee, external auditors and

senior executives of the Group including the CEO, CFO, Group

Legal and Compliance Head and Group Risk Head.

Group Audit meets regularly with the external auditors to

strengthen working relationships between both parties, discuss

matters of mutual interest, develop

a common understanding

and co-ordinate the audit efforts.

In the course of 2004, Group Audit carried out its functions

in accordance with the general description provided above.

The department is adequately resourced and has the required

mandate from the AC and the CEO to carry out its functions

effectively.

Group Audit meets regularly with the external auditors to

strengthen working relationships between both parties, discuss

matters of mutual interest, develop a common understanding

and co-ordinate the audit efforts.

The professional competence of the internal auditors is

maintained through Group Audit’s continuing professional

development programme, which focuses on updating auditors’

knowledge of auditing techniques, regulations and banking

products and services.

The Group Audit Head is Edmund J Larkin. Mr Larkin has a

Bachelor of Commerce degree from the University of New South

Wales and is an Associate Member of the Institute of Chartered

Accountants in Australia and Securities Institute of Australia.

As stated above, Group Audit works closely with the external

auditors, EY. The external auditors carry out, in the course of

their annual statutory audit, a review of the effectiveness of DBS’

material internal controls and risk management to the extent of

their audit plan. Material non-compliance and internal control

weaknesses noted during their audit, along with any

recommendations, are reported to the AC.

Communication with Shareholders

Principle 14: Companies should engage in regular,

effective and fair communication with shareholders.

Dissemination of Information

DBS has an active dialogue with shareholders, both institutional

and retail, and takes its responsibilities towards shareholders very

seriously. DBS holds a media and analysts briefing after the

release of its quarterly results. All press releases, audited financial

statements and financial results announcements are published on

SGXNET and DBS’ website. A dedicated investor relations team meets key institutional investors on a regular basis.

During the year, DBS management met more than 160 local

and foreign investors in more than 150 meetings. The meetings

included five investor conferences – two in New York, and one

each in London, Singapore and Hong Kong.

DBS does not practise selective disclosure. Price sensitive

information is first publicly released, either before DBS meets

with any group of investors or analysts or concurrently.

This dissemination process is continuous throughout the year to

ensure the company meets disclosure and reporting obligations.

Shareholders’ Meetings

DBS recognises that the annual general meeting (“AGM”) is an

important opportunity for retail investors to meet with the Board

and management. In addition to the Board, members of the

Management Committee and the external auditors are also

available to answer shareholders’ queries. DBS conducts a

briefing session for shareholders on the financial statements just

before the commencement of the AGM.

DBS has reviewed the Code recommendation that companies

encourage greater shareholder participation at annual general

meetings by allowing shareholders to vote in absentia via such

methods as email, fax etc. Following advice that the present

legal and regulatory environment is not entirely conducive to

absentia voting methods (particularly email voting), DBS has

decided to defer the introduction of absentia voting methods

until an appropriate time.

Code of Conduct

DBS has an internal code of conduct that applies to senior

management and staff. The code of conduct incorporates the

industry’s code of ethics, and covers areas such as client

confidentiality, business conduct, conflicts of interests and insider

trading. All staff are required to acknowledge annually that they

have read and understood the code and have agreed to abide by it.

The following disclosures are required to be made under the

SGX Listing Manual and recommendations of the Working

Group formed by the three Singapore banking groups:

Dealings in Securities/Best Practices Guide

The SGX-ST Best Practices Guide recommends that staff of listed

companies should not trade in the company’s securities:

| (i) |

during the period beginning one month before the release

of the half-year and full-year results; and |

| (ii) |

during the period beginning two weeks before the release

of the first quarter and third quarter results |

and ending on the date of release of the said results.

As the first quarter and third quarter financial results are, in

practice, available to certain staff before the commencement of

the two-week period recommended in the Best Practices Guide,

DBS has extended the two-week “black-out” period to three

weeks for the first quarter and third quarter results.

|

|

|

|

DBS Hong Kong

DBS’ Call Centre in Singapore

consistently scores above 80%

in a customer satisfaction survey

conducted weekly. |

DBS Treasures Banking

DBS operates in 14 markets and multiple time zones

around the world. |

Directors and staff are also reminded periodically in writing that

the general prohibition on trading while in possession of

material non-public information applies at all times.

To further strengthen its corporate governance practices in relation

to staff personal dealings in securities, DBS implemented a

personal investment policy in 2001. The policy requires selected

staff who may have access to price-sensitive information in the

course of their duties to obtain prior approval from Group

Compliance or designated supervisors before trading in securities

listed in countries where DBS has a major presence, such as

Singapore and Hong Kong. Such staff must generally effect trades

in affected securities through the DBS Vickers group of companies.

DBS Vickers is DBS’ 100%-owned stockbroking subsidiary.

Related Party Transactions

The DBS Group’s policy on transactions with related parties is in

compliance with statutory and regulatory requirements, namely:

| (a) |

(in the case of DBS Bank) Section 29 of the Banking Act,

Chapter 19; and |

| (b) |

(in the case of DBSH) MAS Directives to Financial Holding

Companies No. 8 and Chapter 9 of the SGX Listing Manual

on interested person transactions (see the section “Interested

Person Transactions Policy” immediately following this section). |

Under Section 29(1)(d) of the Banking Act, a bank cannot grant

unsecured credit facilities, directly or indirectly, which in the

aggregate and outstanding at any one time exceed the sum of

$5,000 to:

| (a) |

the bank’s directors; |

| (b) |

any firm in which the bank or any of its directors has an

interest as a partner, manager or agent, or to any individual

or firm of whom or of which any of its directors is a guarantor; |

| (c) |

a company in which any of its directors, whether legally or

beneficially, owns more than 50% of the issued capital or in which any of its directors controls the composition of the

board of directors, but excluding public companies, the

securities of which are listed on SGX or other stock

exchange approved by MAS and the subsidiaries of such

public companies; and |

| (d) |

any corporation, other than a bank, that is deemed to be

related to the bank as described in Section 6 of the

Companies Act |

In addition, under Section 29(1)(e) of the Banking Act, a bank

shall not grant to any of its officers (other than a director) or its

employees or other persons, being persons receiving

remuneration from the bank (other than any persons receiving

remuneration from a bank in respect of their professional

services), unsecured credit facilities which in the aggregate and

outstanding at any one time exceed one year’s emoluments of

that officer or employee or person.

To ensure compliance with Section 29(1)(d) and (e), DBS Bank

has taken the following steps:

| (a) |

Compliance with Section 29(1)(d) and (e) is an integral part

of the credit approval process; |

| (b) |

Before directors are appointed, they are notified of the

requirement of Section 29(1)(d) and their existing facilities, if

any, are adjusted to comply; and |

| (c) |

A semi-annual reminder is sent to all directors to update their

particulars and related interests, as defined in Section

29(1)(d). |

Directive 8 restricts lending and guarantees by a financial holding

company such as DBSH. Under Directive 8(1)(a), a financial

holding company may not, inter alia, grant any credit facility to

any person other than a subsidiary or any of its officers (other

than a director) or its employees or other persons, being persons

receiving remuneration from the financial holding company (other

than in respect of professional services rendered). In particular,

under Directive 8(2), a financial holding company shall not grant,

directly or indirectly, unsecured advances or loans under Directive

8(1)(a) to:

| (a) |

Any subsidiary which in the aggregate and outstanding at

any one time exceeds the sum of $5,000 except to any

subsidiary which is a bank licensed under the Banking Act,

a finance company licensed under the Finance Companies

Act or, with MAS’ prior approval, a foreign banking

subsidiary; or |

| (b) |

Any of its officers (other than a director) or its employees or

other persons, being persons receiving remuneration from

the financial holding company (other than in respect of

professional services rendered) which in the aggregate and

outstanding at any one time exceeds one year’s emoluments

of that person. |

Compliance with MAS Directive No. 8 is an integral part of the

credit approval process for all credit facilities granted by DBSH.

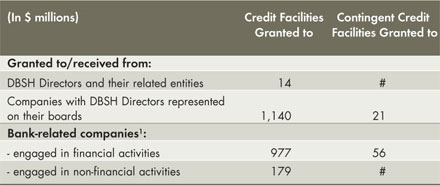

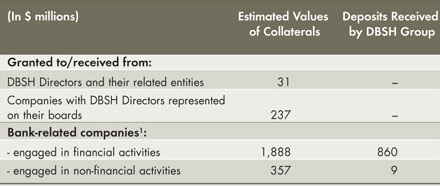

The DBSH Group has granted credit facilities to the following related parties in the ordinary course of business on normal terms and

conditions. The outstanding amounts of these credit facilities and the estimated values of collaterals at December 31, 2004 are as follows:

Notes:

1) Excludes transactions between DBS Bank’s subsidiary companies and their own subsidiary companies

# Amount under $500,000

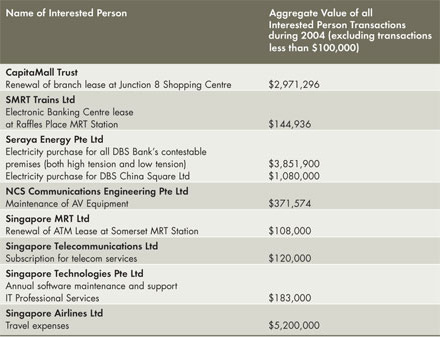

Interested Person Transactions Policy

As a listed company on the Singapore Exchange, DBSH is required to comply with Chapter 9 of the SGX Listing Manual on

interested person transactions. To ensure compliance with Chapter 9, DBSH has taken the following steps:

| (a) |

Compliance with Chapter 9 is an integral part of the credit approval process for the entire DBS Group; and |

| (b) |

A semi-annual update of directors’ personal particulars is obtained. |

The following are details of the interested person transactions entered into by the DBS Group in 2004:

|