Space: The Next Frontier

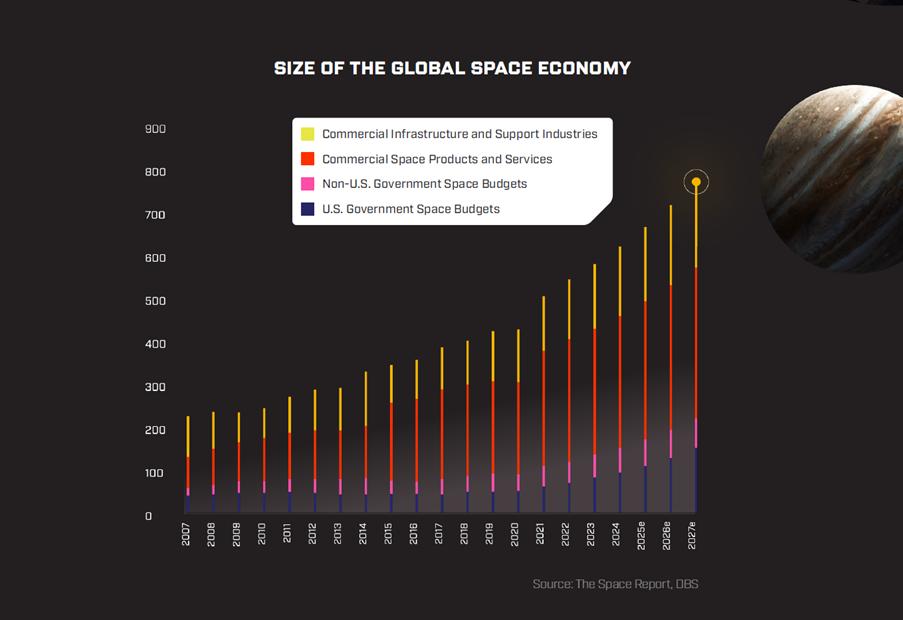

In the past 40 years, the cost of launching spaceships fell around 98%. The space economy, in tandem, has grown explosively, and is expected to reach USD772bn by 2027. We examine this theme and explain why it goes beyond space tourism to harken the future of investing – and humanity itself.

24 Jun 2024

In the past 40 years, the cost of launching spaceships fell around 98%. The space economy, in tandem, has grown explosively, and is expected to reach USD772bn by 2027. We examine this theme and explain why it goes beyond space tourism to harken the future of investing – and humanity itself.

A not-too-long time ago, in a galaxy rather near, mankind took its first step on the Moon. Neil Armstrong, the first person to walk on the Moon, remarked on that fateful day in 1969, “that’s one small step for man, one giant leap for mankind.”

His words were the fruition of the United States’s Apollo programme, which was a response to the launch of artificial satellite Sputnik 1 by the Soviet Union in 1957 during the Cold War’s space race. That promised leap, however, was stalled for decades. Mankind’s space exploration efforts slowed to a crawl in the 1980s after the space shuttle Challenger tragically exploded 73 seconds after liftoff, and as the Cold War gave way to a new era of peace. In recent years, however, mankind’s quest for cosmic dominance has resurfaced, evolving from geopolitical and technological competition to one of multifaceted collaboration involving governments and private entities worldwide.

In the last few decades, space exploration has witnessed exponential growth thanks to a new era of international cooperation, exemplified by the establishment of the International Space Station (ISS) – a symbol of global partnership in space research and exploration. The entry of private companies (including SpaceX, Blue Origin, and Virgin Galactic) has also added dynamism into the space industry, propelling technological advancements and reducing costs through innovation and competition.

US at the forefront of space race: Triumph of its flourishing commercial sector: The US remains the undisputed leader in space exploration, launching more rockets than any other nation. In 2023, the US conducted 116 launches, representing 52% of the world’s total, with China, Russia, and India trailing at 30%, 8.5%, and 3.1% respectively. Unlike most nations where government and military initiatives still dominate the space sector, the US benefits from a highly developed commercial space industry where commercial launches constitute a remarkable 81% of the US’s total launches. This shift towards a predominantly privatised model in space exploration has not only spurred innovation and expanded accessibility, but also established a model for others.

Propelling the Space Economy through cost reduction: The rise of reusable rockets and smaller satellites

Historically, the prohibitively high costs associated with space exploration have limited the industry primarily to government agencies. Space exploration, however, has undergone a dramatic transformation over the past few decades largely due to commercialisation efforts that have significantly lowered the financial barriers to entry. Here are some of the pivotal innovations that has made space exploration more economically viable:

- Operationalisation of reusable rockets

- Proliferation of small satellites (SmallSats)

I. Operationalisation of reusable rockets:

The lion’s share of launch expenses stems from the construction of rockets which are designed for just one flight. Although government entities like NASA have dedicated substantial resources to exploring reusable rocket concepts, it was the pioneering endeavours of private enterprises like SpaceX that propelled this technology to new heights. On December 2015, SpaceX’s Falcon 9, a two-stage rocket meticulously engineered for reusability, marked a pivotal milestone in its journey by developing a first stage capable of enduring re-entry and executing a successful return to Earth. This groundbreaking achievement empowers SpaceX to re-fly the costliest components of a rocket, effectively reducing the expense of space exploration.

According to a study by the Centre for Strategic and International Studies (CSIS), the cost of launching heavy payloads into low Earth orbit (LEO) dropped from around USD65.4k/kg in 1981 to USD1.5k/kg in 2020 (FY 2021-Dollar terms), a decrease of approximately 98%. As reusability technology advances and becomes more prevalent, we foresee an increase in the reuse threshold, leading to even greater reductions in launch costs.

II. Proliferation of small satellites (SmallSats):

While our skies are increasingly crowded with satellites, their sizes are getting smaller. According to the Space Foundation Database, the average satellite mass per payload has undergone a staggering reduction of c.80% since 2012, plummeting from 2,1548 kg in 2012 to a mere 431 kg in 2022. This shift is propelled by the relentless technological progress that has improved the capabilities of SmallSats. Small Satellites (SmallSats) are defined by NASA as satellites with a mass less than 180 kg and having a size no larger than that of a “large kitchen fridge”. Unlike their larger counterparts, which are often expensive to construct, SmallSats can be mass produced using commercially available parts, which makes them cheaper and hence more accessible to a wider range of organisations.

As a result, the number of SmallSats launched globally have been on an uptrend, registering CAGR of 44.9%, from 39 SmallSats launched in 2011 to 2304 in 2022, according to Statista.

The Monetisation Angle: Investment themes for the space economy

With the space economy attracting rising interest from investors, ultra-high-net-worth (UHNW) individuals and companies alike, our current edition of CIO Vantage Point offers a detailed exploration of key investment themes primed to thrive in this rapidly expanding industry, namely:

- “Picks and Shovels” of the space economy

- Position Navigation and Timing (PNT)

- Earth observation

- Space tourism

I. “Pick and Shovels” of the space economy

The flourishing space economy presents a compelling opportunity for investors to capitalise on tools and services that are indispensable for space endeavours. Companies embarking on space missions will rely on spacecraft— including satellites and launch vehicles — to execute their tasks in space. Furthermore, the successful deployment of these spacecraft hinges on efficient and reliable launch services. Not surprisingly, we see opportunities in: Launch services and Space-related manufacturing

Launch services: Launch services are critical for the entire space economy. According to estimates by Allied Market Research, the launch service space was valued at USD13.9bn in 2022 and expected to grow at a CAGR of 13.4% to reach USD47.3bn by 2032. Once dominated by government-led programs, private companies are reshaping the space through technological breakthroughs and innovative business models.

Launch services underpin a wide range of spacebased applications that are driving economic growth. The deployment of communication, Earth observation, and navigation satellites, for instance, depends on the availability of launch capabilities. These space-based services, in turn, enable a host of downstream industries, from global connectivity and precision agriculture to weather forecasting and environmental monitoring – serving as a critical enabler for the space economy.

Private space companies have outpaced government-led missions in terms of launch attempts and payloads in recent years. This shift is highlighted by the significant role companies like SpaceX, United Launch Alliance (Joint venture between Boeing & Lockheed Martin), and Rocket Lab play in the modern space economy.

Space-related manufacturing: Space-related manufacturing encompasses the production of launch vehicles, satellites, and spacecraft components essential for activities ranging from telecommunications to earth observation. Space-related manufacturing is inherently positioned at the leading edge of multiple disciplines including materials science, and engineering.

According to estimates by Mordor Intelligence, just the satellite manufacturing market size alone is valued at USD244.9bn in 2024 and it is expected to reach USD389.69bn by 2029, growing at a CAGR of 9.73% during this period.

II. Position, Navigation, and Timing (PNT)

The backbone of the space economy. Satellites play a crucial role in global communications, enabling the transmission of information across the world. Estimates from the World Economic Forum suggest that “backbone” applications, such as satellites for communication and navigation (GPS) and launch vehicles, make up roughly 50% (~USD330bn in 2023) of the total space economy. Meanwhile, Market.us forecasts the satellite communication markets to grow from USD76.1bn in 2022 to USD182.7bn by 2032, representing a CAGR of 9.4%.

Satellite communication networks underpin everything from phone calls and internet access in remote areas to live broadcasts and secure military communications. These communication networks are intrinsically linked to Positioning, Navigation, and Timing (PNT) applications, as they often rely on the precise timing and positioning capabilities provided by satellite-based systems to determine location, synchronise time, and navigate routes.

Image source: Unsplash

Image source: Unsplash

Global Navigation Satellite System (GNSS). GNSS are satellite constellations that provide accurate positioning, navigation, and timing information to users globally. While many are familiar with a variant of this called the Global Positioning System (GPS), this is only one of several GNSSs around. For example, Russia operates the Global’naya Navigatsionnaya Sputnikovaya Sistema (GLONASS), China has the BeiDou Navigation Satellite System (北斗卫星导 航系统), and the European Union has the Galileo system. These systems work independently yet collaboratively, as GNSS receivers can tap into signals from multiple constellations for enhanced accuracy and reliability.

The importance of a strong PNT system. A study conducted by the US Department of Commerce has revealed that GPS has contributed an estimated USD1.4tn to the U.S. economy since its inception in the 1980s. A single day without GPS could result in losses exceeding USD1bn, with this figure potentially escalating to USD45bn during crucial periods such as the planting season for farmers. These statistics demonstrate the indispensable role of GPS in supporting essential economic activities across a diverse range of sectors. As the space economy continues to grow, advancements in satellite technology, miniaturisation, and constellations of smaller satellites are enabling a dramatic reduction in the cost of deploying and operating satellite systems, while an increase in reliability and frequency of launches would facilitate a plethora of new applications.

III. Earth observation

Earth observation, once primarily reserved for weather forecasting, disaster monitoring, and biodiversity assessment, has undergone a remarkable evolution, expanding its reach and impact across multiple industries and emerging as a powerful tool with diverse applications, penetrating even into areas like finance and insurance. Within Earth observation, the European Union Agency for the Space Programme (EUSPA) has identified 12 distinct segments with quantifiable revenue streams.

According to Verified Market Reports, the satellitebased Earth observation services market is expected to register robust CAGR of 6.52% from USD3.8bn in 2023 to USD11.3bn in 2030. The tremendous growth in the Earth Observation market can be attributed to two key factors:

- Advancements in sensing technologies

- Ever-increasing demand for Earth observation data

Advancements in sensing technologies: This has catalysed a revolution in the quality, resolution, and coverage of satellite imagery and geospatial data. Notably, innovations such as the Airbus Pléiades Neo constellation and Maxar’s Legion constellation have increased spatial resolution, achieving a ground sampling distance (GSD) as precise as 30 centimetres. Ever-increasing demand for Earth observation data: According to McKinsey, high-resolution Earth imagery collected is expected to grow at a CAGR of c.14% from c.175 million images per square km to more than 500 million images in 2030. This increase in demand for data is due to the increasing use case across a wide range of industries.

Moreover, the escalating regulatory demands concerning environmental stewardship, alongside the growing imperative to incorporate Environmental, Social, and Governance (ESG) initiatives, have propelled companies to leverage Earth observation data to achieve these objectives.

IV. Space tourism

In 2001, Dennis Tito, an American Businessman, became the first tourist in space, having travelled to the International Space Station (ISS) aboard the Russian Soyuz spacecraft after paying a whopping USD20mn for the experience. Tito’s experience as a “tourist” in space demonstrated that private individuals can travel to space so long as they have the financial means. Since then, this has inspired generations of space tourists.

As advancement in technology reduces the cost of space tourism, sub-orbital trips – once priced in the millions – are now available for USD250,000 to USD450,000. This accessibility has sparked growing interest among the wealthy. Polaris Market Research forecasts significant growth in the space tourism industry, projecting a CAGR of 47.4% from USD1.2bn in 2024 to USD27.9bn by 2032.

According to the World Economic Forum, until 2035, space tourism revenue will likely be limited to UHNW customers looking for space travel experiences. However, as costs continue to decrease, space travel will become more affordable, opening the experience to a broader demographic. This will not only democratise access to space, but expand the market for space tourism, potentially transforming it into a mainstream industry.

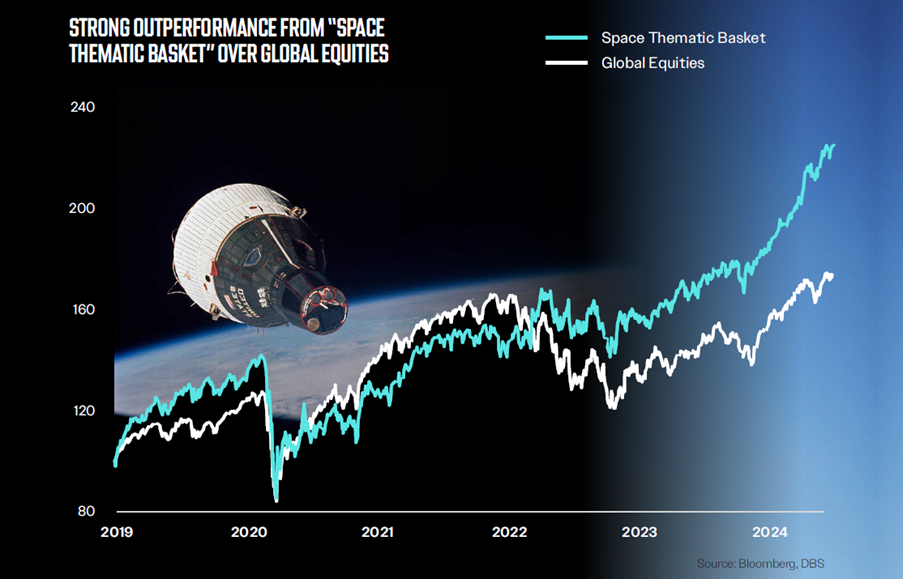

Robust outperformance for Space theme underpinned by strong fundamentals

We constructed a “Space Thematic Basket” that consists of companies with meaningful exposure to the space industry. Since 2019, this basket has outperformed global equities by 51 %pts and this is testament to the industry’s robust growth trajectory. As the sub-investment themes relating to the space economy gains traction, we anticipate this momentum to drive exponential growth for the industry. Apart from strong equity performance, companies with exposure to space also possess higher blended ROE as compared to the broader market (23.5% vs 14.4%). This trend underscores the attractiveness of space-related investments as well as highlights the industry’s potential in delivering compelling returns.

DisclaimersJoin DBS Private Bank

With our size, safety and expertise, you can fully immerse yourself in life's best moments while we handle the rest.

It’s time to take the next step, the logical step.