Behind Closed Doors: The Secret World of Private Assets

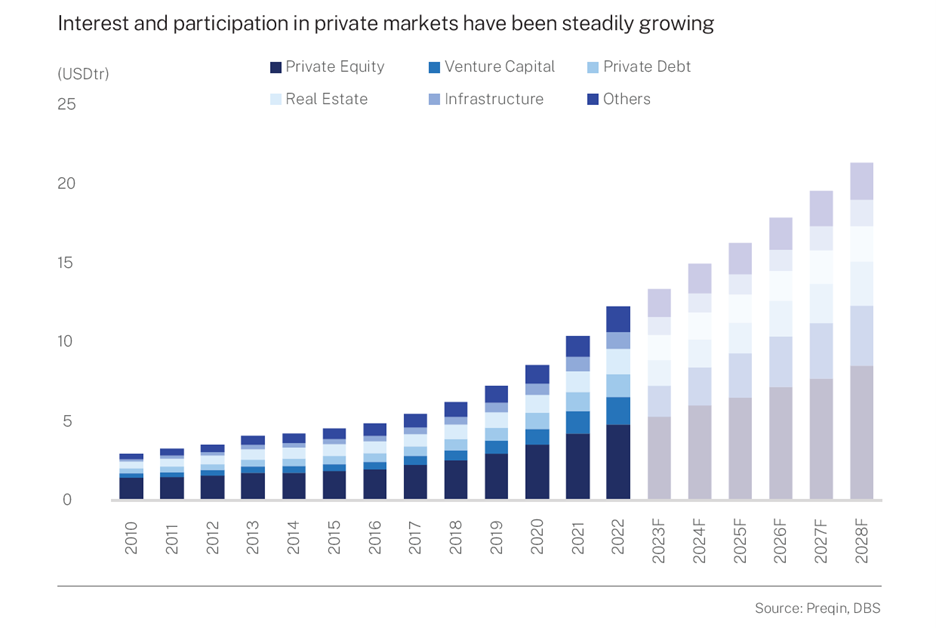

Private markets have rapidly risen in prominence over the past two decades. Businesses and investors alike are increasingly appreciating the benefits of remaining outside the public eye, and this has supported private market growth.

1 Dec 2024

Private markets have rapidly risen in prominence over the past two decades. Businesses and investors alike are increasingly appreciating the benefits of remaining outside the public eye, and this has supported private market growth, both in terms of the increasing value of private companies, and causing a rise in investor participation in the private markets. Today, many of the largest and most influential companies are privately owned. With private markets presenting a significant investable opportunity set—boasting the position as the epicentre of corporate growth and value creation, and offering outsized returns—it is no wonder that investor interest and participation in the private markets have been steadily growing. As investor awareness and interest in the private markets build, this article provides an introduction for investors looking explore this space for an allocation within their core portfolio.

Benefits of investing in private markets

A wider investment universe available on private markets

Many expressions of emerging innovations remain underrepresented in public markets, such as in the fields of artificial intelligence, space exploration, and biomedical science. However, investors willing and able to sacrifice some degree of liquidity may gain access to such opportunities, widening their universe by venturing into private markets. Furthermore, a rising concentration of performance on public markets — where growth is increasingly heavily attributed to just a few large-cap companies — underscores the need to look to private markets as an important source of diversification.

Value creation through active management

Due to substantial stakes and generally illiquid positions, private market firms tend to emphasise a long-term investment horizon. This, combined with their level of involvement in actively managing investments, aligns their interest closely with those of limited partners (LPs), fostering a shared commitment to sustainable growth and success of portfolio companies, rather than focusing on immediate stock price fluctuations.

Harnessing behavioural benefits of illiquidity

Although illiquid private asset holdings could make it challenging for investors to react to unforeseen changes or opportunities, this illiquidity also protects against impulsive selling tendencies that may arise during volatile market conditions, shielding the portfolio from inherent behavioural biases. Consequently, investors in private markets must be prepared for a long investment horizon, and private markets exposure in a portfolio context must come as a complement to exposure to a core portfolio of liquid assets.

What is private market investing?

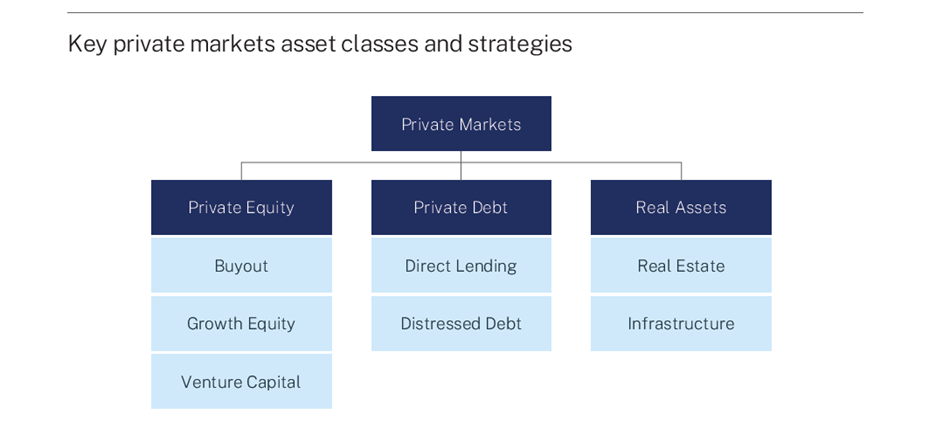

Private markets include the following broad asset classes: private equity, private debt, and real assets. Each involves a different investment approach, time horizon, and risk-adjusted returns.

Private Equity refers to investments in equity capital of companies that are not listed in any stock exchange. This can range across different parts of a company’s life cycle. Key private equity strategies include:

- Venture Capital: Investing into fledging companies, often with unproven business models but high growth potential.

- Growth Capital: Providing capital (often as a minority stake) to facilitate a company’s growth through expansion, new markets, or M&A activity.

- Buyout: Acquiring a controlling stake to turnaround a mature company with proven cash flows. Such strategies often employ a significant amount of leverage, with the acquired company’s assets staked as collateral for the loans (i.e. leveraged buyout).

A key difference between private and public equity investing is that the former involves controlling or owning significant stakes in a company. Such control allows private equity firms to create value in portfolio companies through working with management to implement strategic or operational changes, as opposed to passive strategies of buying shares in listed companies. This, in addition to the lower transparency in private markets, makes private equity investing relatively resource-intensive and complex, rewarding higher returns to those with the necessary skillset, operational execution capabilities, and appetite for illiquidity.

Private Debt (also known as private credit) refers to non-traded debt instruments, typically held to generate income. Examples of private debt strategies include:

- Direct Lending: Financing directly negotiated between a lender (often an asset manager or private credit fund) and a borrower, without the involvement of any intermediary (such as an investment bank).

- Distressed Debt: Investing in undervalued debt instruments of companies that are already in default or have a high likelihood of default.

Real Assets include investments in unlisted real estate and infrastructure, particularly where active management can create significant value. Such assets also offer the potential for inflation protection and low correlations to traditional assets. Strategies like real estate and infrastructure generally provide investors with an additional source of income while also potentially mitigating against inflation in cases where revenues are inflation-adjusted. Depending on the strategy, investments may generate a mix of income and capital gains. The strategies involving real assets may be categorised as follows:

- Core: Targeting established, quality assets, with minimal capex requirements and predictable contracted revenues.

- Value-add: Investing in underlying assets with some development or refurbishment risk.

- Opportunistic: Investing in assets requiring significant capital expenditure for repositioning.

Features of private market investing

While the prospect of improved risk-adjusted returns and an expanded opportunity set on private markets may be enticing, practical issues in introducing private market exposure to a portfolio often prove a barrier to entry for even sophisticated investors. Complexities include:

- How much, and when, should we commit to reach allocation targets?

- What should we do with committed, uncalled capital?

- How do we maintain our allocations, as funds return capital to us?

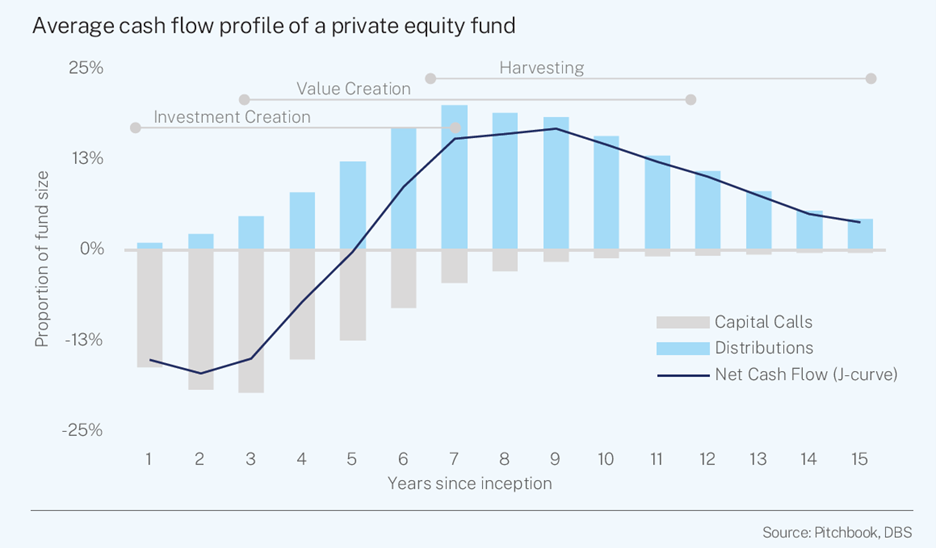

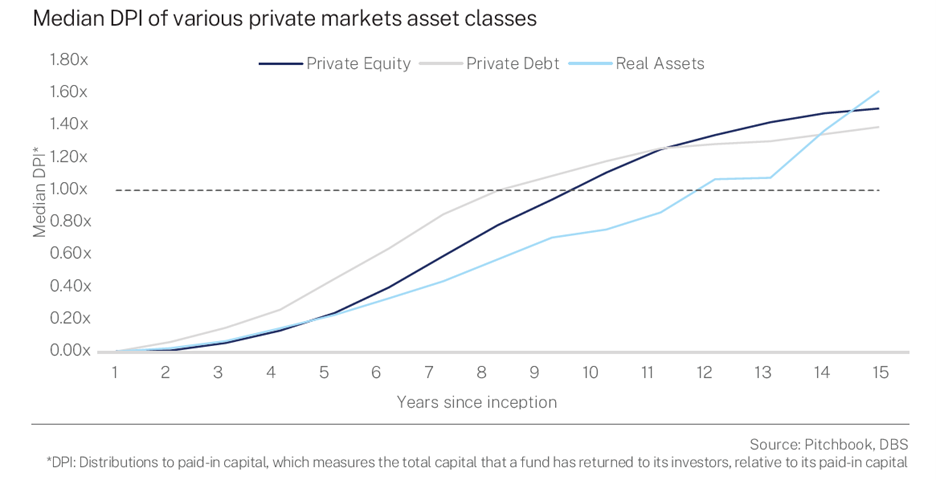

A traditional private equity fund structure is fairly simple. An investor commits as an LP to a general partner’s (GP) new primary fund. A primary fund is a close-ended vehicle, with a limited lifetime, that invests directly into private companies or assets. The fund does not typically call committed capital all at once. Instead, this is done gradually over a predetermined period as the fund makes investments in portfolio companies. The GP would generally work with the portfolio investments’ management teams to enhance their value, until the investments are ripe for harvesting. In the later years of the fund’s lifetime, the fund sells its investments, and this generates cash that is distributed back to its LPs. This overall cash flow pattern is referred to as the “J-curve,” represented below:

Reaching target allocations in private assets takes time. This J-curve cash flow pattern typical of private market funds implies that, unlike public market investing, investors new to private markets would not be able to achieve their target exposure to any private market asset class with a single fund at one go. Instead, building and maintaining a private market programme is a multi-year process that entails cash flow planning, and pacing commitments to new funds in various asset classes.

Cash flow planning

Capital calls and distributions are uncertain and beyond an LP’s control. Hence, investors must carefully plan for capital calls and distributions as they budget for cash flow needs at each stage of private markets investing.

- Capital calls. A commitment to a close-ended fund may take several years to be called, and LPs must ensure sufficient liquidity to meet these obligations. To avoid a cash drag on returns, investors may maintain capital earmarked for private market capital calls invested in liquid public instruments until it is needed – to capture beta of the market along the way, or held in cash or cash-equivalents for liquidity.

- Distributions and performance. As a fund’s portfolio of investments matures, underlying investment performance, and distributions during the investment period (which are uncertain at time of initial commitment) work against an investor’s allocation target. Consequently, maintaining a stable allocation to private assets entails consistently pacing allocations to fresh investments.

Ultimately, by constructing a rolling programme of investing into private market funds, an investor’s portfolio will effectively become self-funding, as distributions from funds of earlier vintages would generally offset contributions to new funds, reducing additional cash outlay required from investors.

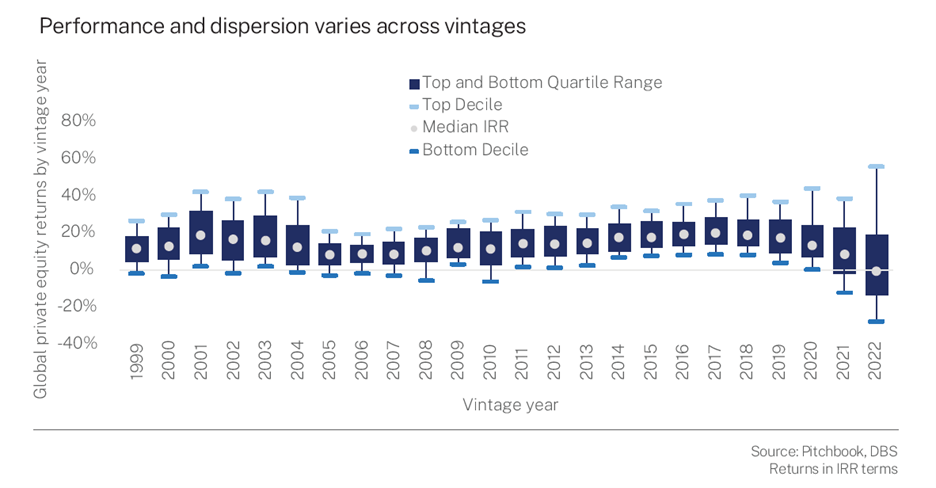

Investors allocating to private markets must further note that private market strategies are not homogenous; across strategies, vintages, and managers, performance diverges. For example, based on Pitchbook’s analysis, private debt funds on average call and distribute capital more quickly than private equity or real asset, while venture capital’s boom-and-bust cycle presents more volatile returns. Each different vintage year (starting year of a fund) has historically also seen differences in the dispersion of fund performance and median performance.

Varied cash flow and return profiles within private markets underscore the importance of diversification within private market allocations. Spreading commitments across geographies, managers, strategies, and vintage years, has been found to have a positive effect on the risk exposure of a private asset portfolio because it reduces reliance on any economic environment or manager. To illustrate, a study by Diller and Jackel found that risks of losing capital in a portfolio of randomly selected funds declines significantly as more funds are added. While an investor randomly selecting one fund had a risk of losing capital (TVPI* below 1) in 28% of cases, the risk reduced to 10% for a randomly selected portfolio of five funds, and just 1.4% for a randomly selected portfolio with 20 funds. Where 50 funds were drawn randomly within three vintage years, the risk of capital loss was virtually zero (0.26%). This reiterates that committing regularly to multiple new funds is necessary, not only to maintain a stable allocation over time, but also construct a diversified and resilient portfolio.

General guidelines for developing a private markets investment programme:

- Investors new to private assets may build their target exposure to each asset class over a number of years, working backwards from the length of time they expect to be fully allocated to private markets.

- By pacing allocations across different vintages, the private market programme eventually becomes “self-funding” as funds of earlier vintages eventually begin distributing capital, and this cash may be re-deployed to new funds

In general, there is no one-size-fits-all allocation to private markets. The portion to allocate to illiquid assets varies depending on personal preferences and/or constraints, including the need to retain flexibility, anticipated time horizon, and short-to-medium term cash flow needs relative to overall wealth. Investors must weigh the trade-off between diversification benefits and higher expected returns, against any liquidity constraints.

Nonetheless, our analysis suggests that an allocation of around 35% in a multi-asset portfolio would enable most investors to harvest benefits from higher expected returns without excessively compromising flexibility. Investors with more moderate liquidity needs may also be accommodate a higher allocation to private assets in their portfolios.

When sizing how much of a portfolio to allocate to private markets, investors should consider:

- Illiquidity Tolerance: With fund terms that could last upwards of 10 years, investors must be comfortable with having a portion of their portfolio inaccessible during the fund term.

- Personal Circumstances and Risk Tolerance: Investors must consider personal goals, expected expenses, and potential changes in personal circumstances, alongside the expected duration of private market holdings.

- Planning for Capital Calls: Private market investors must also ensure sufficient liquidity to meet capital calls, considering the possibility of periods of severe market drawdowns which could weigh on their public market holdings.

How do I invest in the private markets?

Given the relative complexity of investing in private market funds, exposure through primary funds is best pursued by investors with the resources to identify and conduct due diligence on multiple managers and monitor their various fund holdings. Alternatively, individuals may choose to delegate these responsibilities to a discretionary program. Under such a programme, an investment advisor would not only provide the services needed to manage a funds programme, but also facilitate access to highly sought after, best-in-class fund managers.

It is also worth noting that, in addition to primary funds, there are a range of different options available to investors seeking private markets exposure. The suitability of each approach depends on factors including an investor’s allocation size, level of expertise, and preferred degree of involvement.

Direct or Co-investments

Investments can be made directly into private companies or assets. However, this involves a high level of resources and expertise to source, evaluate, and manage investments. It also requires scale, which makes it unsuitable for some investors seeking diversified exposure to private markets. Investors may also co-invest alongside a GP (usually a private asset firm) which will undertake management responsibility, for a chance to invest alongside specific private asset fund managers.

Secondary Funds

Secondary funds purchase existing primary fund stakes from LPs. By purchasing interests in primary funds further down their performance cycle, secondary funds mitigate J-curve effects and reduce the duration of illiquidity for investors. Other than a shorter or shallower J-curve, exposure to secondary funds may also be useful at inception of a primary market programme as they may provide immediate exposure and diversification across strategies, geographies, and vintage years.

Fund of Funds

A fund of funds pools investors’ capital to create a diversified portfolio of private market funds. Investors give up control over their investment, in exchange for a convenient means for first-time private markets investors to gain diversified exposure to hard-to-access top tier managers. Fund of funds is often selected by investors seeking diversified private market exposure, but who are unwilling or unable to build and implement a custom primary funds programme.

Semi-liquid Funds

Semi-liquid funds are open-ended structures that offer investors the option to subscribe and redeem shares on a regular basis, in a portfolio of private assets that is already cashflow-generating. Liquidity in semi-liquid structures is often engineered through part of the portfolio being invested in liquid assets, which may dilute the exposure to private markets. Unlike closed-end funds, there is no J-curve, although lock-up periods and fund-level gating may still apply. Hence, while investors may fall back on liquidity mechanisms if individual circumstances require them to withdraw capital, it should not be relied on in market drawdowns or duress.

There is a myriad of ways to get exposure to private assets. Investors must consider the following in establishing how they choose to access the private markets: administration, portfolio diversification, cost, and the long-term commitment required to participate in a private market program.

For example, smaller scale individual investors may consider fund of funds or semi-liquid private assets as a portfolio construction tool, given the illiquid nature of private market investments and their limited amount of capital to deploy. Ultimately, to construct a successful private market program, investors should explore and understand the various facets to building a programme that allows them to enjoy the benefits of investing in the private markets for years to come.

DisclaimersJoin DBS Private Bank

With our size, safety and expertise, you can fully immerse yourself in life's best moments while we handle the rest.

It’s time to take the next step, the logical step.