DBS on the inclusion of investment holdings data in SGFinDex

Singapore.08 Nov 2021

Singapore, 08 Nov 2021 - DBS welcomes the inclusion of Central Depository (CDP) account data in SGFinDex, which marks another step forward for consumers in Singapore to gain a more holistic view of their finances and investments.

CDP data integration on DBS NAV Planner

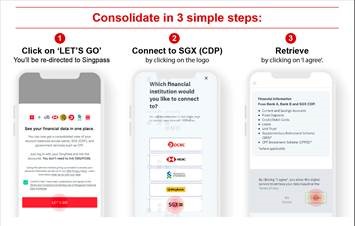

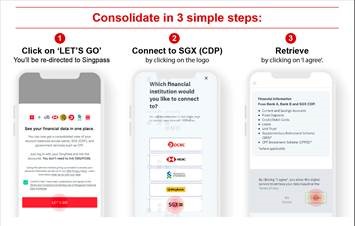

After authorising the CDP data integration[1] on DBS NAV Planner[2], DBS/POSB customers will be able to view their investments automatically by asset class, providing greater clarity into what they have invested in. Users will also gain access to a consolidated view of their holdings of foreign and local shares, with share prices updated daily.

Since December last year, DBS NAV Planner users have been able to pool their data account balances, credit cards, loans and investments across seven participating banks, and retrieve data from the Central Provident Fund, the Housing Board and the Inland Revenue Authority of Singapore, via SGFinDex.

Evy Wee, Head of Financial Planning, Investments and Insurance Solutions at DBS Bank, said: “The pandemic-fuelled market volatility brought new investors into the world of stocks, who have driven the market rally. Here in Singapore, we saw a surge in retail equity trading activity last year, which carried into the first quarter of this year. The boom in retail trading underscores the importance for financial companies to do more to help retail investors invest their money wisely and safely, which starts with the ability to be able to track their investments holistically regardless of where they are held.

CDP has been the main custodian for SGX-listed securities and government issued securities, and availing this data is core to financial and retirement planning. On the back of this integration, we are working with the Monetary Authority of Singapore (MAS) to provide interest payment information of each customer's Singapore Savings Bonds via DBS NAV Planner, so that they can see their investment returns at one glance. This also allows us to sharpen the projections provided by its retirement planning function ‘Map Your Money’.”

The bank’s current collaboration with MAS is part of a multi-year effort to offer retail investors an integrated journey across its banking and brokerage services. Back in 2018, DBS Vickers (the bank’s brokerage arm) was the first trading platform in Singapore to provide its customers a seamless multi-currency settlement option, enabling them to perform non-SGD trades without the need to transfer foreign exchange from a separate FX account to fund these trades. It was also first to offer digital onboarding and CDP account linkage for clients.

In September this year, the bank introduced a new net settlement feature to benefit customers who actively trade in foreign markets, who now enjoy a more efficient and timelier settlement of contracts. To help retail investors maximise their returns, DBS also provides customers with quality research reports by its Group Research analysts and weekly curated investment insights from the DBS Chief Investment Office.

DBS NAV Planner is available to everyone in Singapore – including non-DBS/POSB customers. DBS/POSB customers can log into their internet banking or digibank accounts to access NAV Planner, whereas new-to-bank customers can sign up for a digibank account in four steps with MyInfo. Some 2.6 million customers have used DBS NAV Planner to date, with the majority between the ages of 21 and 50. Customer authorisation via Singpass is required for the consolidation of data through SGFindex, which must be renewed every 12 months.

[1] – Please note that only month-end account data will be shared by CDP.

[2] – DBS’ proprietary AI-powered digital financial and retirement planning tool which provides personalised recommendations and insights to help users better manage their money.

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 13 consecutive years from 2009 to 2021.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

CDP data integration on DBS NAV Planner

After authorising the CDP data integration[1] on DBS NAV Planner[2], DBS/POSB customers will be able to view their investments automatically by asset class, providing greater clarity into what they have invested in. Users will also gain access to a consolidated view of their holdings of foreign and local shares, with share prices updated daily.

Since December last year, DBS NAV Planner users have been able to pool their data account balances, credit cards, loans and investments across seven participating banks, and retrieve data from the Central Provident Fund, the Housing Board and the Inland Revenue Authority of Singapore, via SGFinDex.

Evy Wee, Head of Financial Planning, Investments and Insurance Solutions at DBS Bank, said: “The pandemic-fuelled market volatility brought new investors into the world of stocks, who have driven the market rally. Here in Singapore, we saw a surge in retail equity trading activity last year, which carried into the first quarter of this year. The boom in retail trading underscores the importance for financial companies to do more to help retail investors invest their money wisely and safely, which starts with the ability to be able to track their investments holistically regardless of where they are held.

CDP has been the main custodian for SGX-listed securities and government issued securities, and availing this data is core to financial and retirement planning. On the back of this integration, we are working with the Monetary Authority of Singapore (MAS) to provide interest payment information of each customer's Singapore Savings Bonds via DBS NAV Planner, so that they can see their investment returns at one glance. This also allows us to sharpen the projections provided by its retirement planning function ‘Map Your Money’.”

The bank’s current collaboration with MAS is part of a multi-year effort to offer retail investors an integrated journey across its banking and brokerage services. Back in 2018, DBS Vickers (the bank’s brokerage arm) was the first trading platform in Singapore to provide its customers a seamless multi-currency settlement option, enabling them to perform non-SGD trades without the need to transfer foreign exchange from a separate FX account to fund these trades. It was also first to offer digital onboarding and CDP account linkage for clients.

In September this year, the bank introduced a new net settlement feature to benefit customers who actively trade in foreign markets, who now enjoy a more efficient and timelier settlement of contracts. To help retail investors maximise their returns, DBS also provides customers with quality research reports by its Group Research analysts and weekly curated investment insights from the DBS Chief Investment Office.

DBS NAV Planner is available to everyone in Singapore – including non-DBS/POSB customers. DBS/POSB customers can log into their internet banking or digibank accounts to access NAV Planner, whereas new-to-bank customers can sign up for a digibank account in four steps with MyInfo. Some 2.6 million customers have used DBS NAV Planner to date, with the majority between the ages of 21 and 50. Customer authorisation via Singpass is required for the consolidation of data through SGFindex, which must be renewed every 12 months.

[1] – Please note that only month-end account data will be shared by CDP.

[2] – DBS’ proprietary AI-powered digital financial and retirement planning tool which provides personalised recommendations and insights to help users better manage their money.

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 13 consecutive years from 2009 to 2021.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.