DBS introduces first-of-its-kind digital sustainability platform LiveBetter to spur customers towards eco-friendly living

DBS’ Consumer Sustainability survey findings indicate 86% of Singaporeans believe their carbon footprint will impact the world but 73% are willing to change their lifestyles

Integrated with DBS’ digibank app, LiveBetter is a one-stop digital platform that aims to simplify and aid the transition towards greener living

Bank also sees growing adoption of green retail financial solutions across home renovation, car loans and investments

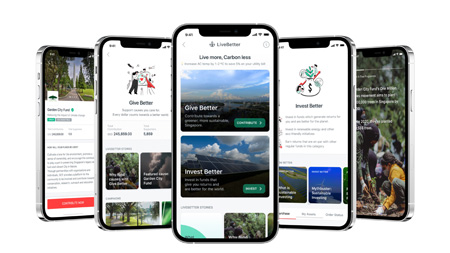

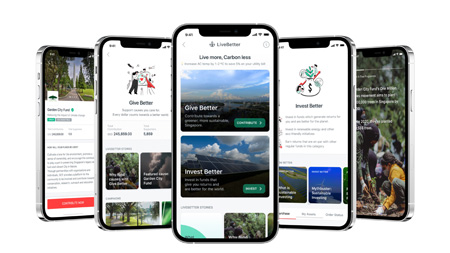

Singapore, 31 Oct 2021 - As part of its drive to encourage eco-conscious living, DBS Bank has launched LiveBetter – a one-stop digital platform where users can easily access eco-friendly tips, donate to local green causes, as well as invest in sustainability-themed funds. The platform, which is the first of its kind in the industry, is now available to all DBS/POSB customers in Singapore via the bank’s digibank app. By January 2022, LiveBetter will also have the industry’s first autonomous carbon calculator – one that automatically generates carbon footprint profiles and insights based on customers’ spending patterns. The bank is also developing a function that will enable customers to purchase carbon credits to offset their carbon footprint.

LiveBetter - First of its kind one-stop digital sustainability platform

Said Jeremy Soo, Head of Consumer Banking Group (Singapore) at DBS Bank, “Climate change impacts all of us, and we believe everyone has a role to play in building a better world. To encourage customers to adopt sustainable living habits, we take care to provide accessible green offerings that are highly competitive and easy to adopt. This approach has been borne out in the findings from our recent DBS Consumer Sustainability Survey[1], where 73% of respondents indicated a willingness to change their lifestyle to live more sustainably only if it was convenient for them. By embedding LiveBetter into DBS digibank, our customers can now easily access ways to live green with a few simple taps.”

Findings from the DBS Consumer Sustainability Survey, which was conducted in July 2021 with over 1,000 Singapore residents aged 18 and above, showed respondents had high awareness regarding the environmental impact of their activities with 93% being aware that their activities contribute to carbon emissions and 86% being aware that their carbon footprint will impact the world. However, many are unlikely to take action towards sustainable living: 73% are willing to change their lifestyle to live more sustainably, but only if it’s convenient for them, while 31% are undecided as to whether they will reduce their carbon footprint. 33% also cited having difficulties finding the right channels to learn about sustainability.

How LiveBetter works

LiveBetter on DBS digibank aims to address these challenges by reducing barriers and consumer inertia towards sustainable living. An industry first, the one-stop digital platform makes it simple and easy to access an array of sustainability-centric educational resources, services, and offerings with the following features:

Carbon calculator coming in Jan 2022

Please refer to the appendix for more details on LiveBetter or visit https://www.dbs.com.sg/personal/livebetter.

DBS has also seen encouraging reception towards “DBS Green Solutions”, a suite of green retail offerings introduced this year, a sign of rising adoption in sustainability-centric financial solutions:

For more information on the “DBS Green Solutions” package, please visit https://www.dbs.com.sg/personal/live-green-effortlessly.

DBS has been advancing its sustainability agenda over the years. The bank has set targets for its operational carbon footprint to ensure net zero operational carbon by 2022. In 2017, DBS became the first Asian bank and first Singapore company to join global renewable energy initiative RE100 by committing to using 100% renewable energy for its Singapore operations by 2030. Recently, DBS also supported the World Business Council for Sustainable Development (WBCSD)’s Vision 2050 agenda that lays out nine transformation pathways that aims to help improve lives, livelihoods, and protect the planet in three decades. Finally, DBS recently became the first Singapore bank to become a signatory on the UN-convened, industry-led Net-Zero Banking Alliance (NZBA).

[1]DBS Consumer Sustainability Survey, conducted in July 2021, with 1,000 Singapore residents aged 18 and above

[2] Ninety One Global Environment Fund 1-year performance as of 21 October 2021: 33.21% (USD); BNP Paribas Global Environment Fund 1-year performance as of 21 October 2021: 29.5% (SGD Hedged)

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 13 consecutive years from 2009 to 2021.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

LiveBetter - First of its kind one-stop digital sustainability platform

Said Jeremy Soo, Head of Consumer Banking Group (Singapore) at DBS Bank, “Climate change impacts all of us, and we believe everyone has a role to play in building a better world. To encourage customers to adopt sustainable living habits, we take care to provide accessible green offerings that are highly competitive and easy to adopt. This approach has been borne out in the findings from our recent DBS Consumer Sustainability Survey[1], where 73% of respondents indicated a willingness to change their lifestyle to live more sustainably only if it was convenient for them. By embedding LiveBetter into DBS digibank, our customers can now easily access ways to live green with a few simple taps.”

Findings from the DBS Consumer Sustainability Survey, which was conducted in July 2021 with over 1,000 Singapore residents aged 18 and above, showed respondents had high awareness regarding the environmental impact of their activities with 93% being aware that their activities contribute to carbon emissions and 86% being aware that their carbon footprint will impact the world. However, many are unlikely to take action towards sustainable living: 73% are willing to change their lifestyle to live more sustainably, but only if it’s convenient for them, while 31% are undecided as to whether they will reduce their carbon footprint. 33% also cited having difficulties finding the right channels to learn about sustainability.

How LiveBetter works

LiveBetter on DBS digibank aims to address these challenges by reducing barriers and consumer inertia towards sustainable living. An industry first, the one-stop digital platform makes it simple and easy to access an array of sustainability-centric educational resources, services, and offerings with the following features:

- Give Better: Featuring local environment and sustainability organisations, customers can easily view sustainability-related causes that require funding and donate to them. The donation process takes less than five seconds, from fund transfer to filing for tax deduction, and 100% of funds raised go towards the organisations, such as The Food Bank Singapore, World Wide Fund for Nature (WWF) and Mandai Nature Fund, among others.

- Invest Better: Customers can learn about sustainable investing and instantly invest in a selection of sustainability-themed funds.

- Know Better: From learning more about climate change to getting eco-friendly tips, the platform serves bite-sized content to customers, and shows them the relevant actions to take.

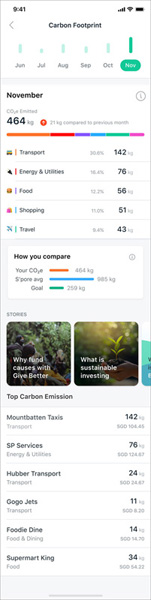

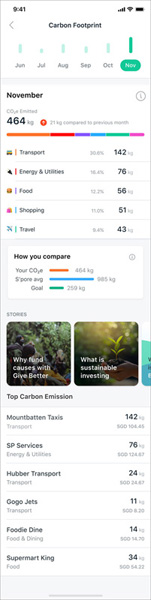

- Carbon calculator (coming in January 2022): The industry’s first autonomous carbon calculator – one that automatically generates carbon footprint profiles and insights based on customers’ spending patterns. The bank is also developing a complementary function that will enable customers to purchase carbon credits to offset their carbon footprint.

Carbon calculator coming in Jan 2022

Please refer to the appendix for more details on LiveBetter or visit https://www.dbs.com.sg/personal/livebetter.

DBS has also seen encouraging reception towards “DBS Green Solutions”, a suite of green retail offerings introduced this year, a sign of rising adoption in sustainability-centric financial solutions:

- Sustainability-themed funds: Since January 2021, retail purchases of sustainability-themed funds (Ninety One Global Environment Fund and BNP Paribas Global Environment Fund) have been steadily increasing. As of 30 September 2021, fund purchases are close to three times higher compared to January 2021. The one-year performance of these funds has also been healthy at around 30%[2].

- DBS Green Car Loan: Singapore’s first green car loan when introduced in February 2021, the loan provides an attractive rate of 1.68% (EIR 3.22%) p.a. car loan to all customers purchasing new and used electric and hybrid vehicles. As of 30 September 2021, green car loan volumes made up 10% of car loan volumes, and total green car loan volumes are at their its highest since the green loan’s launch. With more electric vehicle models coming into the market, green car loan volumes are expected to continue to rise.

- DBS Green Renovation Loan: The loan has seen exceptionally high take-up rates since its launch in late April. As of 30 September 2021, green loans comprise some 85% of DBS’ new renovation loan bookings – with approved renovation loans at their highest since January 2019. The bank expects green renovation loans to continue to dominate its renovation loan portfolio. At 2.68% p.a., it’s likely one of the lowest rates in the market today, compared to the average market renovation loan rate of around 4% p.a. To be eligible for the green renovation loan, customers simply need to fulfil three items on DBS’ green renovation checklist, jointly developed in partnership with the Singapore Green Building Council. This includes having energy-efficient lighting and systems, and using renewable energy power sources and certified environmentally friendly paints, among others. Approximately two-thirds of DBS customers taking up green renovation loans are HDB dwellers.

For more information on the “DBS Green Solutions” package, please visit https://www.dbs.com.sg/personal/live-green-effortlessly.

DBS has been advancing its sustainability agenda over the years. The bank has set targets for its operational carbon footprint to ensure net zero operational carbon by 2022. In 2017, DBS became the first Asian bank and first Singapore company to join global renewable energy initiative RE100 by committing to using 100% renewable energy for its Singapore operations by 2030. Recently, DBS also supported the World Business Council for Sustainable Development (WBCSD)’s Vision 2050 agenda that lays out nine transformation pathways that aims to help improve lives, livelihoods, and protect the planet in three decades. Finally, DBS recently became the first Singapore bank to become a signatory on the UN-convened, industry-led Net-Zero Banking Alliance (NZBA).

[1]DBS Consumer Sustainability Survey, conducted in July 2021, with 1,000 Singapore residents aged 18 and above

[2] Ninety One Global Environment Fund 1-year performance as of 21 October 2021: 33.21% (USD); BNP Paribas Global Environment Fund 1-year performance as of 21 October 2021: 29.5% (SGD Hedged)

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 13 consecutive years from 2009 to 2021.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.