4Q24 key investment takeaways: in a sweet spot | Bahasa

- Macro Policy

- Economic Outlook

- Equities

- Credit

- Rates

- Currencies

- Alternatives

- Commodities

- Thematic focus: ASEAN equities

Over the past two quarters, we have expounded our case that risk assets were in play. Going into 4Q, risk assets should remain in a sweet spot as the Federal Reserve’s surprise 50 bps rate cut will increase the odds of a soft landing. The combination of easing rates and economic resilience, accompanied by technological advancements driving productivity gains, will be constructive for risk assets.

The bull market in equities is poised to continue, with a broadening to laggard sectors. US Big Tech continues to shine in the growth end of our portfolio – unlike the dot-com boom during the 1990s, the AI revolution today is led by large, profitable businesses funded by free cash flow instead of debt. We maintain that the AI revolution is in its infancy, and continues to hold immense growth potential.

While a soft landing scenario remains our base case, we are cognisant that growth is slowing. To navigate an environment of lower bond yields and weaker top-line demand from waning economic momentum, one should gain exposure to risk assets that capture (i) resilient consumer demand despite overall macro moderation, and/or (ii) benefits from falling bond yields and dollar weakness. They include:

- Defensive sectors: Our analysis of previous rate cutting cycles suggests that Utilities, Consumer Staples, and Healthcare tend to outperform (on a three-month basis) after the initial rate cut. In addition to these sectors’ inelastic consumer demand, the likes of Utilities provide above-average dividend yield of c.3.0% (vs c.1.4% for the S&P 500), which are attractive for income-seeking investors.

- ASEAN equities: Against global headwinds, ASEAN continues to sustain strong growth. Resilient domestic demand backed by tight labour markets and stable prices, robust tourism and a recovery in exports buoyed by China+1 have been key growth drivers. Lower rates and a weaker dollar, alongside China’s new stimulus measures, will bring further tailwinds for ASEAN equities.

- Asia REITs: Asia REITs are prime beneficiaries of rate cuts given their high gearing and sensitivity to funding costs. Lower financing costs as the Fed continues policy easing will enhance the profitability of REITs, and their dividend distributions to investors.

- Gold: Gold has a broadly inverse correlation with the dollar, which is expected to weaken as the Fed continues lowering rates. Escalation of geopolitical tension and continued buying by global central banks will be tailwinds for the haven asset.

From a cross-asset perspective, we continue to maintain a preference for bonds over equities. Longer-duration, investment-grade bonds will provide consistent cashflow on the income end of the barbell portfolio, with potential for capital gains as the Fed embarks on a series of rate cuts. As we transition from a pause to a cutting cycle, bond investors should continue to switch from cash into fixed income.

Key highlights of our tactical calls for the coming quarter are:

- Cross Assets – Maintain preference for bonds over income equities

While the gap between US earnings yield and 10-year treasury yields has improved slightly, bonds remain more attractive than dividend equities on a relative basis. While equity fund flows saw marginally stronger momentum in 3Q24, year-to-date fund flow data show bond flows continue to lead, suggesting broad-based preference for bonds on a cross asset basis

- Equities – Time for ASEAN equities to shine

The performance of equity markets in 3Q reflects major shifts in portfolio positioning as investors adjust their exposures to ride the wave of Fed monetary easing. With further Fed rate cuts and dollar weakness on the horizon, ASEAN equities are poised to outperform.

- Bonds – Prevailing tight credit spreads not a concern in higher rate environment; maintain “barbell” approach in 1-3Y segment and 7-10Y segments

As the Fed cuts rates, investors may question if current spreads are sufficiently wide to compensate for a potential spike in credit risks as macro momentum moderates. Our analysis shows that in a higher interest rate regime, HY spread tends to be tighter as the central banks have a bigger buffer to cut rates should economic momentum deteriorate, suggesting that spreads valuation may not be as expensive as it seems.

In terms of positioning, the sweet spot remains in A/BBB credit, with duration barbell between 1-3Y credit to mitigate reinvestment risk and 7-10Y credit to capture risk premium and yield spread compression. US MBS and European credit poised to offer strong value plays.

- Alternatives – Hedge funds and private assets provide source of additional alpha, gold set for further highs

Trudging into an era of uncertainty, investors may do well to consider the use of private assets to improve portfolio diversification and resilience. Recent valuation adjustments in private equity offer attractive entry opportunities for investors, while private credit’s ability to generate stable income through lower default rates makes it an attractive investment instrument.

In the medium to long term, we remain bullish on gold. Themes of fiscal sustainability, monetary debasement, and de-dollarisation are all supportive of structural central bank buying and general investment demand for gold.

4Q24 Global Tactical Asset Allocation (TAA)

| Per triwulan | Per tahun |

Equities | Underweight | Neutral |

US Equities | Overweight | Overweight |

Europe Equities | Underweight | Underweight |

Japan Equities | Neutral | Neutral |

Asia ex-Japan Equities | Overweight | Overweight |

Fixed Income | Overweight | Underweight |

Developed Markets (DM) Government Bonds | Overweight | Underweight |

Developed Markets (DM) Corporate Bonds | Overweight | Neutral |

Emerging Markets (EM) Bonds | Underweight | Neutral |

Alternatives | Overweight | Overweight |

Gold | Overweight | Overweight |

Private Assets & Hedge Funds | Overweight | Overweight |

Cash | Underweight | Neutral |

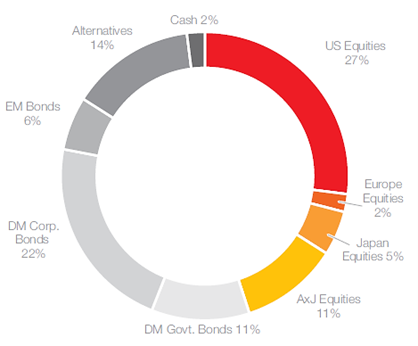

TAA breakdown by asset class (Medium risk profile)

Source: DBS

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia“ award by Global Finance for 15 consecutive years from 2009 to 2023. DBS Indonesia is ranked second in the top as World’s Best Bank in Indonesia for three consecutive years from 2020 to 2022.

Established in 1989 as part of the Singapore-based DBS Group, PT Bank DBS Indonesia (Bank DBS Indonesia) is one of the banks with the longest history in Asia. Currently operating 1 Head Office, 13 Branch Offices, 16 Assistant Offices and 4 Functional Offices and 3,011 active employees in 15 Major Cities in Indonesia, Bank DBS Indonesia provides comprehensive banking services in the corporate, SME and consumer banking segments that focuses on the customer experience to 'Live more, Bank less'. We also see a purpose beyond banking and are committed to supporting our customers, employees and the community towards a sustainable future.

PT Bank DBS Indonesia is licensed and supervised by The Indonesian Financial Services Authority (OJK), and an insured member of Indonesia Deposit Insurance Corporation (LPS).

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

Investment