DBS fortifies NAV Planner with new AI-powered digital investment advisory feature to help retail customers make better investment decisions

Bank’s new digital investment advisory feature can determine individualised investment risk profiles and make specific recommendations

Singapore, 08 Apr 2021 - All DBS/POSB retail customers can now access a new feature on DBS’ AI-powered financial and retirement planning tool NAV Planner, which will provide specific investment recommendations that are tailored to their investment profile. As customers increasingly take a self-directed approach to investing digitally, the bank has adopted a multi-dimensional approach to help investors determine their investment profiles to ensure they meet regulatory requirements before investing amid market volatility. This provides them additional peace of mind so that they can make more informed investment decisions to boost their personal finances.

To make the investing journey seamless, DBS has also streamlined several processes such as amalgamating the Customer Knowledge Assessment (CKA) and Customer Account Review (CAR) assessments a customer must take and pass, before being permitted to invest in more sophisticated products. This rigorous approach, dubbed “Make Your Money Work Harder”, is available via NAV Planner on DBS digibank online and mobile banking app. It mirrors the offline consultation a customer would have today with the bank’s Wealth Planning Managers (WPMs), which safeguards the interests of investors as they grow their retirement nest egg.

Said Evy Wee, Head of Financial Planning and Personal Investing, DBS Bank: “Our ongoing efforts to democratise access to wealth management services not only enable more people to participate in the markets, but also help mitigate their risks. We found that only one in 10 customers could successfully complete their investment journey, because they actually prefer a lot more hand holding. So with today’s launch, we are augmenting the advice our customers receive with the expertise of our funds selection team, where we prioritise funds which are positively-rated by the team. The additional expert guidance will help our customers overcome investment inertia, and for some who are already savvy investors, to make more informed investment decisions.”

A need to help our customers get their investment fundamentals right

Even as more people begun investing in the first half of 2020, a majority of DBS customers are still underinvested, and for some, remain uninvested. In fact, only two in 10 retail customers took action to invest over the past 12 months. Data has also revealed that the bank’s customers are prioritising retirement planning, even as Covid-19 related uncertainties force a shorter-term review of financial obligations, as almost half of its retail customers who are currently invested have invested via their retirement schemes (e.g. in CPFIS and/or SRS).

The bank has also observed a positive response to the personalised nudges and recommendations provided by its NAV Planner tool. Retail customers invest on average a sum of SGD3,000 a year, and DBS found that customers who are guided by NAV Planner invest more than double of that – at around SGD7,500 a year. The bank created more than 30 million personalised nudges last year for its NAV Planner users.

DBS has also seen a four-fold increase (for the period of Jan-Feb ’20 vs Jan-Feb ’21) in the number of retail investors who are now invested outside Singapore. With a higher and wider exposure to global market volatilities, more must be done to help retail investors invest their money wisely and safely. “Investors should only make investment decisions after fully understanding their risk profiles and risk appetites, and consult professional sources of information,” added Wee. “As more look to self-directed investing, it is important we equip them with the right information and intelligence digitally to construct their portfolios.”

How DBS’ new digital investment advisor works

DBS reaffirms commitment to help one million customers get insured and invested

DBS is committed to help one million customers – roughly a fifth of Singapore’s residents – get insured and invested by 2023 as they take steps towards securing financial and retirement resilience. For younger customers, the bank is focused on helping them grow their savings by investing their money wisely and safely. In addition to the launch of its new digital investment advisor, DBS will next look at tackling the most common and largest-sized liability on a customer’s balance sheet, i.e. a first home mortgage. As the largest home mortgage provider in Singapore, the bank intends to get more deeply involved in helping younger customers with their home planning journey.

For older customers, DBS will look at helping this group – who are typically asset-rich, cash-poor – ‘decumulate’ by way of monetising assets and convert to cash for more liquidity to invest. This helps protect them from outliving their savings during retirement. To achieve this, the bank will look at gamification methods to encourage more Singaporeans – both young and old – to embark on their financial planning journeys with DBS, and plans to announce a nation-wide financial planning challenge shortly.

DBS will also partner more like-minded organisations to advance Singapore’s financial planning agenda. The bank recently partnered the Centre for Continuing & Professional Education (CCPE) of Singapore University of Social Sciences (SUSS) to jointly educate the public on the importance of financial planning, especially at different stages of their personal and professional lives. The financial literacy programme aims to beef up their knowledge in navigating the uncertainties ahead to achieve financial wellness. This is in addition to the online depository of how-to guides and knowledge articles DBS maintains for public use, as well as the various financial literacy programmes and webinars the bank runs for customers as well as for students across ITE colleges in Singapore.

For more information on DBS’ NAV Planner and the new digital investment advisor, or to subscribe to financial tips and content provided by DBS, visit the NAV page at https://www.dbs.com.sg/personal/nav/index.page.

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 12 consecutive years from 2009 to 2020.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

To make the investing journey seamless, DBS has also streamlined several processes such as amalgamating the Customer Knowledge Assessment (CKA) and Customer Account Review (CAR) assessments a customer must take and pass, before being permitted to invest in more sophisticated products. This rigorous approach, dubbed “Make Your Money Work Harder”, is available via NAV Planner on DBS digibank online and mobile banking app. It mirrors the offline consultation a customer would have today with the bank’s Wealth Planning Managers (WPMs), which safeguards the interests of investors as they grow their retirement nest egg.

Said Evy Wee, Head of Financial Planning and Personal Investing, DBS Bank: “Our ongoing efforts to democratise access to wealth management services not only enable more people to participate in the markets, but also help mitigate their risks. We found that only one in 10 customers could successfully complete their investment journey, because they actually prefer a lot more hand holding. So with today’s launch, we are augmenting the advice our customers receive with the expertise of our funds selection team, where we prioritise funds which are positively-rated by the team. The additional expert guidance will help our customers overcome investment inertia, and for some who are already savvy investors, to make more informed investment decisions.”

A need to help our customers get their investment fundamentals right

Even as more people begun investing in the first half of 2020, a majority of DBS customers are still underinvested, and for some, remain uninvested. In fact, only two in 10 retail customers took action to invest over the past 12 months. Data has also revealed that the bank’s customers are prioritising retirement planning, even as Covid-19 related uncertainties force a shorter-term review of financial obligations, as almost half of its retail customers who are currently invested have invested via their retirement schemes (e.g. in CPFIS and/or SRS).

The bank has also observed a positive response to the personalised nudges and recommendations provided by its NAV Planner tool. Retail customers invest on average a sum of SGD3,000 a year, and DBS found that customers who are guided by NAV Planner invest more than double of that – at around SGD7,500 a year. The bank created more than 30 million personalised nudges last year for its NAV Planner users.

DBS has also seen a four-fold increase (for the period of Jan-Feb ’20 vs Jan-Feb ’21) in the number of retail investors who are now invested outside Singapore. With a higher and wider exposure to global market volatilities, more must be done to help retail investors invest their money wisely and safely. “Investors should only make investment decisions after fully understanding their risk profiles and risk appetites, and consult professional sources of information,” added Wee. “As more look to self-directed investing, it is important we equip them with the right information and intelligence digitally to construct their portfolios.”

How DBS’ new digital investment advisor works

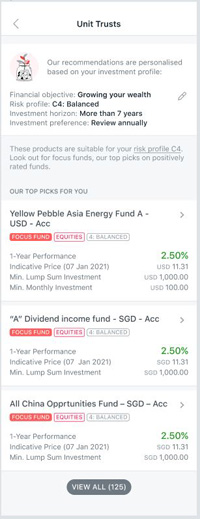

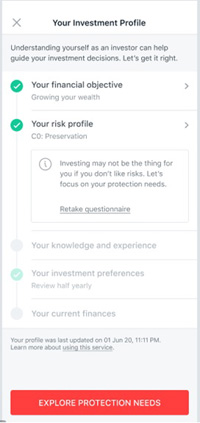

| Customers will be prompted to first complete a five-question assessment in order to establish an accurate investment profile. Questions are focused on determining their financial objective(s), risk profile (which includes investment tenor and risk rating), investment preferences, and financial situation (if changes are expected in the short term). The journey is also designed to help them complete the CKA and CAR knowledge assessments stipulated under regulatory requirements. Altogether, the process is designed to remove investment bias and guesswork for every investor. | .jpg) DBS’ new digital investment advisor takes a multi-dimensional approach to customer investment profiling before providing retail investors with specific recommendations |

| Once that is complete, the “Make Your Money Work Harder” digital advisor will leverage new AI/ML models to short-list and recommend specific investment solutions across six broad product product classes available to retail customers today. For a start, these products will include all Collective Investment Schemes, insurance solutions and the Asia/Global portfolios managed by DBS digiPortfolio. Investors will also be able to filter and check their preferences – they can choose to see products which are available for CPFIS or SRS funding so that they can make their holdings in these retirement schemes work harder. |  Investment recommendations are prioritised for expert guidance; funds which are on the DBS’ Focus Funds list are displayed in higher order than the others. |

| As an additional safeguard, customers who obtain a ‘zero’ risk profile, will not receive investment recommendations. As these customers have stated that they are not willing to lose any capital, they will be advised to review insurance solutions instead. Customers who are found by NAV Planner to have a negative cashflow will also not be able to gain access to the advisor. Instead they will be provided steps to help turn their finances around or be prompted to consolidate their holdings via SGFinDex. Similarly, DBS/POSB customers who are aged 70 and above are advised to consult with a WPM instead (either through bank branches island-wide or virtually via TeleAdvisory) as their needs would be more complex and fluid. |  Customers who obtain a ‘zero’ risk profile being advised to review insurance solutions instead |

DBS reaffirms commitment to help one million customers get insured and invested

DBS is committed to help one million customers – roughly a fifth of Singapore’s residents – get insured and invested by 2023 as they take steps towards securing financial and retirement resilience. For younger customers, the bank is focused on helping them grow their savings by investing their money wisely and safely. In addition to the launch of its new digital investment advisor, DBS will next look at tackling the most common and largest-sized liability on a customer’s balance sheet, i.e. a first home mortgage. As the largest home mortgage provider in Singapore, the bank intends to get more deeply involved in helping younger customers with their home planning journey.

For older customers, DBS will look at helping this group – who are typically asset-rich, cash-poor – ‘decumulate’ by way of monetising assets and convert to cash for more liquidity to invest. This helps protect them from outliving their savings during retirement. To achieve this, the bank will look at gamification methods to encourage more Singaporeans – both young and old – to embark on their financial planning journeys with DBS, and plans to announce a nation-wide financial planning challenge shortly.

DBS will also partner more like-minded organisations to advance Singapore’s financial planning agenda. The bank recently partnered the Centre for Continuing & Professional Education (CCPE) of Singapore University of Social Sciences (SUSS) to jointly educate the public on the importance of financial planning, especially at different stages of their personal and professional lives. The financial literacy programme aims to beef up their knowledge in navigating the uncertainties ahead to achieve financial wellness. This is in addition to the online depository of how-to guides and knowledge articles DBS maintains for public use, as well as the various financial literacy programmes and webinars the bank runs for customers as well as for students across ITE colleges in Singapore.

For more information on DBS’ NAV Planner and the new digital investment advisor, or to subscribe to financial tips and content provided by DBS, visit the NAV page at https://www.dbs.com.sg/personal/nav/index.page.

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 12 consecutive years from 2009 to 2020.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.