Our Strategy

DELIVERING VALUE TO OUR STAKEHOLDERS

Our strategy is to become the Asian bank of choice for a rising Asia. We aim to intermediate trade and investment flows between Asia’s three key axes of growth – Greater China, South Asia and Southeast Asia. In Singapore, our home market, we are a universal bank that serves all customer segments. Outside of Singapore, we focus on affluent individuals, SMEs and corporates.

We developed a roadmap comprising nine strategic priorities in 2010. We aim to build on our strong position in Singapore, reposition our franchise in Hong Kong, and achieve greater geographical balance by building out our presence in Greater China and South and Southeast Asia. We also aim to develop regional business lines: transaction banking to capitalise on increasing regional trade flows and the rise of Asian MNCs and SMEs, as well as wealth management to better serve the rising number of affluent individuals. We are steering our treasury capabilities towards structuring and marketing products for corporate and retail customers to hedge risks and take advantage of market trends. We are also improving our processes to achieve greater customer satisfaction and higher employee engagement as well as building more resilient technology infrastructure.

THE ASIAN BANK OF CHOICE FOR THE NEW ASIA – STRATEGIC PRIORITIES

To differentiate ourselves, we will develop our unique brand of banking, Banking the Asian Way. We nurture Asian-style relationships with customers, staff and the community. We use our knowledge of how to do business in this region to provide unique Asian insights when we create solutions for our customers. We deliver Asian-style service to customers characterised by “the humility to serve and the confidence to lead”. We offer customers seamless connectivity across our network of key Asian markets. Finally, we combine innovation with an understanding of fast-evolving customer trends and behaviours to reach out to customers.

WELL-POSITIONED FOR GROWTH

The Board and management team recently reviewed and validated our strategy; we will continue to execute on the nine strategic priorities that we articulated three years ago. In the coming years, we will also focus on additional areas to capture emerging megatrends.

As Asia continues to develop, funding requirements for infrastructure developments will grow. This demand cannot be met by bank financing alone and needs to be complemented by debt financing. With increasing financial integration, there will be tremendous growth potential for debt markets in Asia. We will leverage our strengths in fixed income to capture this opportunity.

We recognise that the way we interact with our customers will change with technology. As new channels and forms of distribution develop, we will need to innovate to keep up with technological advances and cater to changing customer behaviour. To help us create the bank of the future, we will embrace innovation and technology to deliver banking in a way that is relevant and beneficial to consumers’ changing needs.

Finally, our actions will be guided by a long-term perspective and the interests of multiple stakeholders we serve – investors, customers, employees, regulators and society. We will continue to grow prudently, maintain a strong balance sheet and uphold the spirit of regulatory reforms to ensure that we can preserve investors’ capital, stand by customers, keep our people employed and serve the broader community throughout business cycles. We believe that to be a force for good, we must deliver sustainable banking. We can create value for our stakeholders over the long term only if our agenda facilitates the production of economic goods and services.

In this annual report, we have taken a step forward to further our commitment to delivering value to stakeholders. We have structured our discussions on our achievements for 2012 around our five key stakeholders. We recognise the symbiotic relationship that exists between stakeholders in the long term, and in achieving our strategic priorities, we serve more than one stakeholder. We are thus drawing on concepts around “integrated reporting”. DBS is the first Singaporean member of a pilot programme set up by the International Integrated Reporting Council.

As we embark on this journey, we will be making continuous improvements over time to better communicate the progress we are making on our strategy and performance.

ENGAGING MULTIPLE STAKEHOLDERS

TRACKING OUR PROGRESS

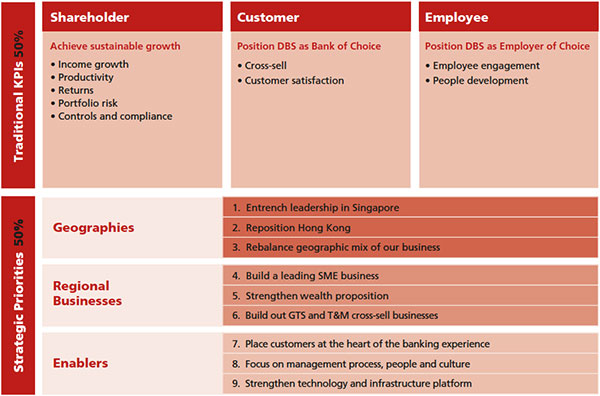

We track the execution of our strategy through a balanced scorecard, which maps our key performance indicators (KPIs) across various stakeholder groups. The scorecard is divided into two parts, each with equal weighting. Specific objectives for each part are updated every year and approved by the Board. The scorecard is cascaded throughout the organisation to ensure the performance goals of all staff are aligned to it.

Specific KPIs are in place to track the progress made against investors, customers and employees. KPIs relating to regulators and society are embedded in our scorecard and cut across all aspects of our operations. As we operate in a regulated industry, upholding regulatory requirements is paramount and underlies all of our decisions and actions. We recognise the importance of serving society at large and being aware of our impact on the environment.

The first part of the scorecard comprises KPIs set for the current year. Shareholder metrics measure the financial results achieved and include income growth, return on equity and expense-related ratios. Control and compliance KPIs are also a focus in this section. We measure risk-related KPIs to ensure that the Group’s income growth is balanced against the level of risk taken. Customer metrics measure the Group’s achievement in increasing customer wallet share and satisfaction. Employee KPIs seek to measure the progress we have made in being an employer of choice, such as employee engagement, training, mobility and turnover.

The second part sets out the initiatives we intend to complete in the current year as part of our longer-term journey towards achieving our strategic objectives. Specific KPIs and targets are set for our nine priorities. Our ability to meet the current-year targets in the first part is dependent on successfully executing the second part in the preceding years.

In the next section, we will highlight the progress and achievements we made in 2012.

DBS GROUP SCORECARD