Investors

DELIVERING BETTER RETURNS

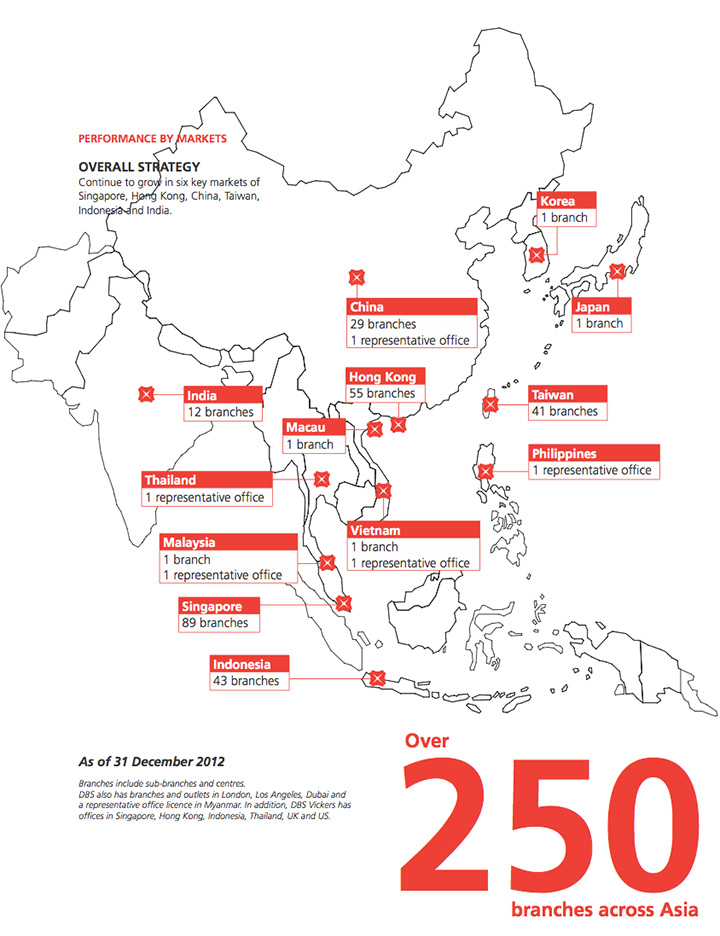

Our investors comprise shareholders and debtholders who expect superior and sustainable returns commensurate with their risk appetite, with profits earned in a responsible manner. We have consistently delivered strong financial performance over the past three years. 2012 was another year of record income and net profit. We pushed multiple levers to improve returns in an environment of continued interest rate softness.

We improved the efficiency of our balance sheet by driving the SGD loandeposit ratio higher from 64% to 69%.

We gained market share in domestic loans while retaining our dominant share of savings deposits. Our revamped branch operating model, introduced two years ago, contributed to higher cross-selling, which in turn improved the cost efficiency of our branch network.

Hong Kong’s earnings reached a record. We continued to build out franchises in other countries to achieve a more balanced geographic mix. Strong growth in Indonesia enabled it to turn around its performance in 2012.

Our regional businesses – transaction banking, wealth management and SME, which all yield higher returns – also made good progress as their income grew 31%, 27% and 13% respectively. Income from treasury customer activities accounted for 44% of total treasury income, substantially above the proportion two years ago when we decided to steer the business towards more sustainable activities.

Our asset quality continued to be strong as a result of prudent risk management. Liquidity remained healthy as we built up funding from diversified sources. We are also strongly capitalised and well positioned to comply with Basel III capital and liquidity requirements.

GROUP PROFIT AND LOSS SUMMARY

| 2012 | 2011 | % chg | ||

| Selected income statement items ($m) | ||||

| Net interest income | 5,285 | 4,825 | 10 | |

| Net fee and commission income | 1,579 | 1,542 | 2 | |

| Net trading income | 689 | 680 | 1 | |

| Other income | 511 | 584 | (13) | |

| Total income | 8,064 | 7,631 | 6 | |

| Expenses | 3,614 | 3,303 | 9 | |

| Profit before allowances | 4,450 | 4,328 | 3 | |

| Allowances for credit and other losses | 417 | 722 | (42) | |

| Profit before tax | 4,157 | 3,733 | 11 | |

| Net profit | 3,359 | 3,035 | 11 | |

| One-time items | 450 | – | NM | |

| Net profit including one-time items | 3,809 | 3,035 | 26 | |

| Selected balance sheet items ($m) | ||||

| Customer loans1 | 210,519 | 194,720 | 8 | |

| Interbank assets1 | 29,407 | 27,183 | 8 | |

| Total assets | 353,033 | 340,847 | 4 | |

| Customer deposits2 | 242,907 | 225,346 | 8 | |

| Interbank liabilities2 | 25,908 | 28,087 | (8) | |

| Total liabilities | 317,035 | 307,778 | 3 | |

| Shareholders’ funds | 31,737 | 28,794 | 10 | |

| Key financial ratios (%) (excluding one-time items) | ||||

| Net interest margin | 1.70 | 1.77 | – | |

| Non-interest/total income | 34.5 | 36.8 | – | |

| Cost/income ratio | 44.8 | 43.3 | – | |

| Return on assets | 0.97 | 0.97 | – | |

| Return on equity | 11.2 | 11.0 | – | |

| Loan/deposit ratio | 86.7 | 86.4 | – | |

| NPL ratio | 1.2 | 1.3 | – | |

| Specific allowances (loans)/average loans (bp) | 10 | 11 | – | |

| Tier 1 capital adequacy ratio | 14.0 | 12.9 | – | |

| Total capital adequacy ratio | 17.1 | 15.8 | – | |

| Per share data ($) | ||||

| Per basic share | ||||

| – earnings excluding one-time items | 1.39 | 1.30 | – | |

| – earnings | 1.57 | 1.30 | – | |

| – net book value | 12.96 | 11.99 | – | |

| Per diluted share | ||||

| – earnings excluding one-time items | 1.37 | 1.26 | – | |

| – earnings | 1.56 | 1.26 | – | |

| – net book value | 12.86 | 11.75 | – | |

1

Includes financial assets at fair value through profit or loss on the balance sheet

2

Includes financial liabilities at fair value through profit or loss on the balance sheet

NM

Not Meaningful

DBS' return on equity before divestment gains rose to 11.2%, the best in five years.

OVERALL FINANCIAL PERFORMANCE

NET PROFIT AT A RECORD

Our net profit reached a record SGD 3.81 billion, which included divestment gains of SGD 450 million. Excluding the gains, net profit rose 11% from the previous year to SGD 3.36 billion.

Total income crossed SGD 8 billion for the first time as net interest income reached a new high and customer-driven non-interest income continued to grow, reflecting our deepening franchise across the region. Return on equity before the divestment gains rose to 11.2%, the best in five years.

Net interest income grew 10% to SGD 5.29 billion. Loans expanded 12% in constant currency terms to SGD 211 billion from regional corporate borrowing and Singapore consumer loan growth. Net interest margin fell seven basis points to 1.70% as a result of market liberalisation in China and asset re-pricing in a soft interest rate environment, partially offset by an improved average loan-deposit ratio.

Non-interest income was little changed at SGD 2.78 billion as improved crossselling was offset by lower equity capital market activities. Fee income from trade and remittances, wealth management product sales and cards recorded doubledigit percentage increases, in line with efforts to grow these businesses. Income from customer flows for treasury products increased 6% to SGD 868 million and accounted for 44% of total treasury income. While weak equity markets affected stockbroking and investment banking income, DBS benefited from strong bond and real estate investment trust activity during the year as we led in both domestic and cross-border issuances.

Expenses rose 9% to SGD 3.61 billion from the full-period impact of investments and staff increases made in the previous year to support business growth. The cost-income ratio was at 45%, with staff costs making up 23% of income.

Credit conditions remained benign and specific allowances were stable at SGD 198 million or 10 basis points of loans. General allowances of SGD 211 million were taken in tandem with SGD 16 billion of loan growth during the year.

A gain of SGD 450 million was recorded for the partial divestment of a stake in the Bank of Philippine Islands.

FINANCIAL POSITION REMAINS STRONG

Asset quality continued to be strong. Non-performing assets fell 6% from a year ago to SGD 2.7 billion, of which 46% were current in interest and principal. The non-performing loan rate declined slightly to 1.2%. The allowance coverage of non-performing assets rose to 142%, the highest on record.

Liquidity remained healthy as we built up funding from diversified sources.

Strong liquidity buffers were maintained across currencies to protect against contingencies as well as support business growth. The loan-deposit ratio was at 87% as deposits rose 10% in constant currency terms from a year ago to SGD 243 billion. In Singapore, we continued to capture more than half of the system savings deposits. Our non-SGD funding was supplemented by wholesale sources, including commercial papers and medium term notes. Our ability to attract funding has been supported by credit ratings of AA- (by S&P and Fitch) and Aa1 (by Moody’s), which are among the highest in the world. We have been named Safest Bank in Asia by Global Finance magazine since 2009.

Unrealised marked-to-market gains for the available-for-sale investment portfolio amounted to SGD 634 million, compared to SGD 411 million at end-2011. Gains of SGD 419 million were realised from the sale of investment securities during the year, compared to SGD 454 million in 2011.

We are also well capitalised. The Group’s Tier-1 ratio of 14.0% and total capital adequacy ratio of 17.1% are well above regulatory requirements. We are well positioned to comply with Basel III capital requirements, which came into effect in Singapore on 1 January 2013.

Based on transitional arrangements prevailing on 1 January 2013, the Group’s pro-forma Basel III core Tier-1 ratio as at 31 December 2012 was 13.5%. If all adjustments that are required by 1 January 2018 are made, the Group’s pro-forma core Tier-1 ratio was 11.8%. Both ratios are above the minimum requirement, which progressively rises from 4.5% on 1 January 2013 to 9.0% on 1 January 2019 (including the capital conservation buffer).

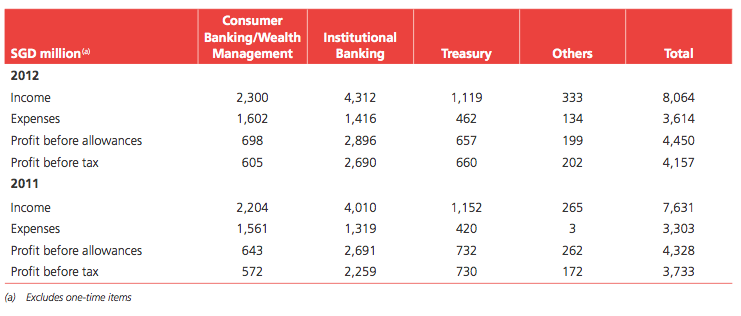

PERFORMANCE BY BUSINESS LINES

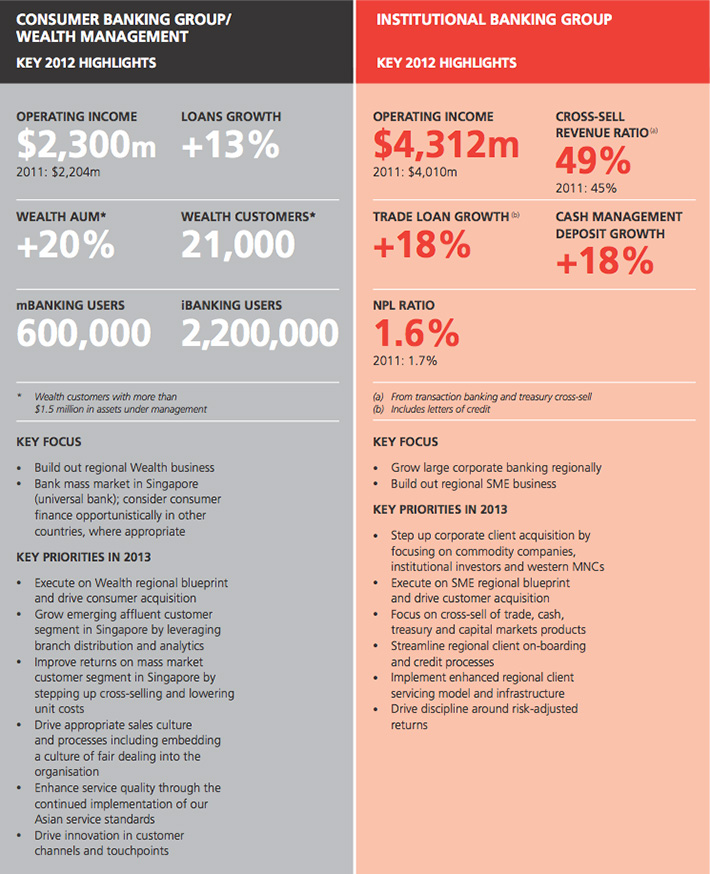

CONSUMER BANKING/WEALTH MANAGEMENT

Consumer Banking/Wealth Management (CBG) provides individual customers with a diverse range of banking and related financial services. The products and services available to customers include current and savings accounts, fixed deposits, loans and home finance, cards, payments, investment and insurance products.

Total income grew 4% to SGD 2.30 billion led by higher non-interest income from the Wealth Management segment and higher fee income from credit cards and unsecured loans. Net interest income was little changed as higher customer loan and deposit volumes were offset by lower net interest margin, similar to the industry. Profit before tax rose 6% to SGD 605 million.

We continued to execute on our Wealth Management blueprint, which is centred on offering the full suite of our products and services seamlessly to clients across the region. Wealth Management income grew 27% to SGD 787 million as we benefited from the full impact of our integrated wealth management platform, which was launched in second-half 2011. This has enabled us to gain scale across the full spectrum of affluent and private banking customer segments by using the same research capabilities, product expertise in capital markets and treasury, as well as an integrated back office and infrastructure to support the front line. We are therefore able to acquire new customers and serve existing ones with lower unit costs.

The new platform has allowed us to up-tier qualifying POSB and DBS customers, offering them access to the full range of wealth products. We continued to develop wealth relationships with existing Institutional Banking customers. Our private banking customer base extended to Europe and the Middle East as an increasing number of individuals and families outside Asia sought the safety and Asian opportunities that DBS provides. Total assets under management for high net worth individuals rose 20% to SGD 56 billion.

Our product range also expanded during the year. We strengthened our precious metals offerings and launched safekeeping facilities for physical gold, investment accounts for gold and silver, as well as call options on both metals. Leveraging on our research and insights into Asia, our customers benefited from a range of treasury products to take advantage of opportunities in currency, equity and credit markets. They also had access to fixed income issuances that we managed. For high net worth clients, we launched a discretionary portfolio management service. Attesting to our efforts in growing our franchise, we were named the “Outstanding Private Bank in Southeast Asia” by Private Banker International.

In Singapore, our DBS/POSB network of 89 branches and 1,100 ATMs served more than 4.5 million customers in the mass market and affluent segments. We maintained our 53% market share of Singapore-dollar savings deposits and kept our leading positions in housing loans, car loans, debit and credit cards. CBG’s Singapore housing loan portfolio rose 19% to SGD 36 billion. We leveraged on our branch network and used customer analytics to improve customer sales. This contributed to new loan bookings during the year which, including amounts not yet disbursed, rose 35% to SGD 14 billion. In addition, income from sales of investments and insurance products from branches rose 24%. The higher fee income offset pressure on net interest margins on loans and deposits caused by the continued softness in interest rates.

As part of our efforts to expand customer touchpoints, we entered into a partnership with Singapore Post. The number of customers using Singapore Post branches to make cash deposits and withdrawals has grown steadily since this channel was made available in November 2011. In addition, the number of POSB centres rose to 19 from six two years ago. In Hong Kong, we continued with efforts to reposition the consumer banking business towards the affluent and private banking segments. We relocated branches to more suitable locations and upgraded them to serve these segments more effectively. These efforts are ongoing but yielded early results by improving the profitability of our consumer banking operations in Hong Kong.

INSTITUTIONAL BANKING

Institutional Banking (IBG) provides financial services and products to institutional clients including bank and non-bank financial institutions, government-linked companies, large corporates and SMEs. Products and services comprise the full range of credit facilities from short-term working capital financing to specialised lending. IBG also provides global transaction services such as cash management, trade finance and securities and fiduciary services; treasury and markets products; corporate finance and advisory banking as well as capital markets solutions.

Income grew 8% to SGD 4.31 billion across all client segments, led by transaction banking and cross-selling of treasury products which offset tighter margins in lending. Overall income growth was affected by slower equity capital markets, which resulted in lower investment banking fees and stockbroking commissions.

As a result of our efforts to drive cross-sell, IBG’s income mix continued to shift from balance sheet lending towards transaction banking and treasury cross-selling. The proportion of income from both activities rose four percentage points from 2011 to 49%, which was beneficial to the Group’s return on equity.

Overall expenses grew 7% to SGD 1.42 billion as headcount was added and investments were made to improve processes and systems to expand regional capabilities. The growth was in line with income growth and the cost-income ratio was unchanged from 2011 at 33%. Credit conditions remained benign and allowances were low. Profit before tax rose 19% to SGD 2.69 billion.

For our large corporate clients, we continued to leverage our balance sheet strength and deepen client relationships across our Asian network. Together with our ability to offer innovative financing solutions and advisory services, we delivered a 15% increase in income for the large corporate customer segment.

In the SME client segment, income rose 13% to SGD 1.23 billion. Our efforts to build a leading franchise premised on offering convenient, simple and fast service made headway after two years of investments. We rolled out a regional SME framework in key markets to standardise and streamline processes, shortening the response time to customers. While SME loans rose 11%, the percentage of income from non-loan products rose three percentage points to 60%, an all-time high, as deepening customer relationships further improved cross-selling.

Transaction banking had another record year with 18% growth in trade assets including letters of credit, record deposit growth of 18% and an increase in income of 31% to SGD 1.41 billion. This capped a third consecutive year of income growth, bringing the compounded annualised growth rate over the period to 26%. Trade finance income rose 37% to cross SGD 1 billion for the first time from strong asset growth, which offset the impact of lower margins in the second half of the year from interest rate liberalisation in China. Income from cash management and securities and fiduciary services increased 18%. During the year, we acquired 11,300 new transaction banking customers, which included more than 500 multinational and large companies. This brought the total number of customers we serve to more than 150,000. We won 88 large cash mandates and trade deals that generated annual income exceeding SGD 1 million each, demonstrating that our expanded profile and capabilities in Asia are on a par with global competitors. This was reinforced by the tripling of the industry awards we won in 2012 to 50, which included an impressive win of 15 awards at The Asset magazine’s Transaction Banking Awards 2012.

As part of the efforts to expand our transaction banking capabilities, we launched an award-winning regional Internet banking platform called DBS IDEAL3.0™ in our six key markets. The platform enables customers to carry out a complete suite of cash management and trade finance transactions at any time and from any place in the world. Our range of transaction banking services was expanded with new product offerings involving supply chain financing, accounts receivables solutions and structured financing for commodity clients.

Across the region, we further deepened our customer reach in Singapore, Hong Kong and emerging markets. Singapore continued to be an important contributor. Overall assets and deposits grew 12% and 16% respectively as IBG cemented relationships with large corporates and expanded its presence in the SME market.

We added 12,000 new SME customers during the year, bringing our client coverage to more than 40% of the local SME market. A new social enterprise programme was launched to provide such SMEs with marketing support and management advice in addition to traditional banking products.

In Hong Kong, IBG continued to strengthen the connectivity with China and drove cross-border customer business and referrals in account management. This led to more than a doubling of Hong Kong-related cross-border income.

Income from China, Taiwan, India and Indonesia each rose by double-digit percentages, contributing 27% of total IBG income and further diversifying the geographical mix.

TREASURY

Treasury provides treasury services to companies, institutional and private investors, financial institutions and other market participants. It is involved in sales, structuring, market-making and trading across a broad range of financial products including foreign exchange, interest rate, credit, debt, equity and other structured derivatives. Treasury is also responsible for managing the Group’s surplus deposits based on approved benchmarks.

In the presentation of the business units’ financial performance, customer related income from the cross-sell of treasury products to individual and institutional customers is reflected under CBG and IBG and not in Treasury. Income from these activities rose 6% to SGD 868 million in line with efforts to enhance cross-selling. For a holistic view of our Treasury business, the commentary in this section encompasses customer cross-selling activities.

Income reflected in Treasury relates only to trading, market-making, risk warehousing and investment activities. Treasury’s full-year performance was challenging as market sentiment was dampened by the Eurozone crisis and general economic uncertainty. Profit before tax declined 10% to SGD 660 million as total income fell 3% to SGD 1.12 billion and total expenses rose 10% to SGD 462 million. The lower income resulted from lower trading gains on interest rate and foreign exchange, partially offset by improved performance in credit as debt securities prices improved with declining yields during the year.

In Singapore, we maintained clear leadership in a broad range of activities, including SGD/USD foreign exchange, SGD bonds, SGD money markets and SGD derivatives across different asset classes. We continued to be the leading market maker for SGD FX and cross-currency options with an estimated 50% of market share. With the biggest foreign exchange derivatives team in Singapore among local banks, we were able to offer superior pricing capabilities to customers.

In Hong Kong, we continued to be a leading player in offshore RMB activities. We have an estimated 10% share of the interbank offshore RMB spot market.

We were also an active market-maker in USD/RMB non-deliverable forwards, USD/RMB non-deliverable swaps and RMB non-deliverable interest rate swaps in the interbank market. Our extensive capabilities and nimbleness enabled us to be one of the first banks to offer customers a range of offshore RMB products.

We were also a leading player in the onshore/offshore RMB (or CNY/CNH) options market globally. We provided risk management solutions to clients with CNY/CNH exposures from their cross-border businesses. Our structuring and warehousing capabilities allowed us to structure RMB investment products for private banking and retail customers to enhance investment yields.

Attesting to our regional leadership, we were named “Derivatives House of the Year in Asia ex-Japan” by Asia Risk.

Our fixed income team capitalised on the strong appetite from individual and institutional investors for bond issuances during the year. We maintained our long-standing leadership in the SGD bond market and leveraged on this strength to extend our reach to overseas issuances. We are now ranked fourth in underwriting league tables for Asian local currency bonds and Asia ex-Japan equity-linked bonds, ahead of many global banks.

In Hong Kong, we were a joint-lead manager for China Oilfield Service’s 10-year USD 1 billion issue, which was one of the largest and highest-rated Chinese-issuer bonds in 2012. In Indonesia, we were among the top 10 underwriters of rupiah bonds. In India, we underwrote 13 issues and executed a USD convertible bond for Amtek India as sole global co-ordinator and bookrunner. We successfully brought Indian Oil Corporation to the SGD bond market. As it was the maiden SGD bond issuance from an Indian non-bank issuer, the SGD 400 million 10-year bond was named the India Capital Markets Deal of the Year by IFR Asia.

DBS, headquartered at Marina Bay Financial Centre, was named the “Best Bank in Singapore” by Global Finance, Euromoney, Asiamoney, FinanceAsia and Alpha Southeast Asia.

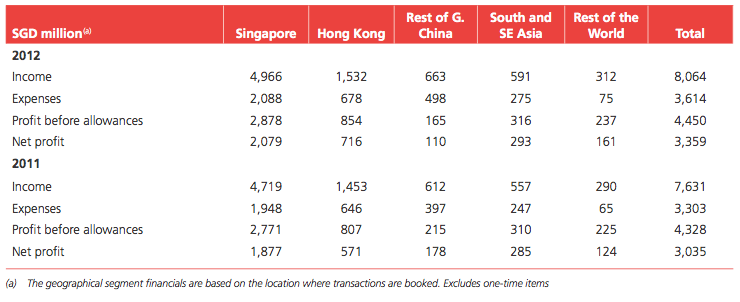

SINGAPORE

With Singapore as our home market, we further entrenched our leadership here. Despite the continued low interest rate environment, income rose 5% to SGD 4.97 billion as higher net interest income from loan and deposit growth and higher customer-driven non-interest income were offset by lower marketrelated contributions. Net profit rose 11% to SGD 2.08 billion.

We continued to make progress in gaining market share in SGD loans and deposits. Our market share in domestic loans rose for another year, from 23% in 2011 to 24%, as SGD loans grew SGD 12 billion or 15%. We continued to be a leading player in mortgages, auto loans, unsecured credit, debit and credit cards. We retained our top position in deposits with a 53% market share in SGD savings deposits and 25% in total deposits. Our SGD loan-deposit ratio improved from 64% to 69%.

We further enhanced the effectiveness of our branch network to serve our customers in a more systematic and targeted manner. A revamped branch operating model assigns branch managers with the responsibility to serve customers more effectively with better use of customer data analytics and targeted marketing activities. The number of housing loans closed by sales staff improved 138%, while a mortgagerelated insurance product was sold for every two housing loans booked compared to one in three housing loans booked in 2011.

We made further headway with SMEs. We were named “Best SME Bank in Singapore” by Alpha Southeast Asia magazine. We leveraged on our strong balance sheet and expertise across the range of trade, cash, treasury and capital markets products to drive cross-sell and grow our franchise.

We reinforced our leadership position in high-return product segments. We remain the top market player in trade finance and cash management. We are also market leader in SGD currencies, SGD money markets and SGD derivatives across different asset classes. We are the leading market maker for SGD FX and crosscurrency options, with an estimated 50% share of the market. We maintained our leading positions in equity, bond and REITs issuances.

As part of efforts to strengthen our technology and infrastructure, we started rolling out a new core banking platform for Singapore in 2012, having already completed the process in the emerging markets earlier.

In 2012, DBS was named the “Best Bank in Singapore” by Global Finance, Euromoney, Asiamoney, FinanceAsia and Alpha Southeast Asia. We were also named “Singapore Retail Bank of the Year” by Asian Banking and Finance and the “Best Private Bank in Singapore” by The Banker. We were also named “House of the Year, Singapore” by Asia Risk.

HONG KONG

In Hong Kong, our shift in strategy is bearing fruit. As the anchor of our Greater China franchise, our Hong Kong operations have been repositioned to better capture the benefits of the city’s connectivity with China. In addition, we have repositioned our consumer segment towards affluent individuals. The shift in focus has led to stronger financial performance. Net profit rose 25% to SGD 716 million, a record high. Income rose 5% to SGD 1.53 billion led by higher net interest income from improved margins and higher average loan volumes. Improved balance sheet management – by skewing our loan mix towards corporate loans and lessening the proportion of housing loans, and by improving the quality of our funding – resulted in a nine basis point margin improvement to 1.48%.

The rise in interest margins occurred despite a lowering of the loan-deposit ratio from 123% to 97%. Non-interest income was supported by higher wealth management fees with our shift towards affluent banking, but was affected by lower stockbroking, investment banking and trading income.

We grew our customer base of China state-owned and private-owned enterprises by 35% in 2012. Income from Chinese large corporates in Hong Kong increased by more than 70%.

We continue to be a leading player in offshore RMB activities. We were named “House of the Year, Hong Kong” by Asia Risk, attesting to our ability to respond nimbly to market opportunities in the offshore RMB treasury segment.

We further expanded our SME franchise, among the largest in the market, by focusing on cross-selling and customer acquisition. We won the Hong Kong General Chamber of Small and Medium Business’ “Best SME’s Partner” for the fourth consecutive year.

REST OF GREATER CHINA

Overall income growth in Rest of Greater China slowed to 8% from a year ago. While underlying franchise development was healthy, the performance was set back by a significant compression in interest margins in China. The lower margins, as well as higher expenses from the expansion of our China branch network, resulted in a 38% decline in net profit to SGD 110 million.

CHINA

There was a slowdown in economic activity for much of the second half of the year, which was caused by a combination of domestic and external factors. There was also considerable pressure on net interest margins from interest rate liberalisation. In addition, a concentration of maturing trade loans in the third quarter affected our China-related loan volumes. As a result of these market and DBS-specific factors, China’s income was flat from a year ago. While income from the onshore franchise was soft, we leveraged on our China connectivity and doubled cross-border income from China clients.

We continued to grow our customer franchise centred on major China state-owned enterprises and private owned enterprises. However, given the macroeconomic uncertainties, we moderated the roll-out of our SME strategy.

We opened a branch in Chongqing and four sub-branches in Shanghai, Beijing and Hangzhou, which contributed to the higher expenses.

We made inroads among large corporate customers, particularly in our trade and cash businesses and in treasury crossselling. We were named “Rising Star Treasury and Working Capital Bank for MNCs / Large Corporates in China" by The Asset. Our cash and treasury capabilities were also recognised by Asiamoney. We were ranked third best foreign cash management bank in China for large and small corporates, and fourth for medium-sized corporates. We were also named the “Best Treasury and Cash Management Bank, Foreign” by Global Finance.

TAIWAN

Our operations in Taiwan were converted to a locally-incorporated subsidiary in January 2012. We are now the fourthlargest foreign bank in the country by capital. DBS Bank (Taiwan) has also been named by S&P and Fitch as the most highly-rated bank in Taiwan. Income grew 22% as loans and deposits rose 17% and 16% respectively.

Two SME banking centres were opened in Taipei to support the expansion of our institutional banking franchise. We were the largest SME lender among all foreign banks in Taiwan. For large corporates, we leveraged on our debt capital market capabilities to launch and underwrite European convertible bonds for three technology clients with a total value of USD 768 million, accounting for 71% of the Taiwan market. Our cash capabilities were also recognised by the market. A poll by Asiamoney ranked us third best foreign cash management bank in Taiwan for small and medium-sized corporates, and fourth for large corporates.

SOUTH AND SOUTHEAST ASIA

Income for this region grew 6% to SGD 591 million and net profit rose 3% to SGD 293 million. We continued to register good growth in India and Indonesia.

INDIA

We are now the fourth-largest foreign bank in India. Income grew 12%. As a result of continued stress in the Indian economy which led to a depreciation of the rupee, reported loans remained flat but showed a slight growth in constantcurrency terms. We continued to grow the local currency book and improved our funding. As a result, deposits grew 33%. Underlying franchise growth remained healthy.

We made headway among large corporates and SMEs in cash and trade. Asiamoney ranked us third-best foreign cash management bank in India for small and medium-sized corporates, and fifth for large corporates. We extended our product suite by leveraging on our strong bond product capabilities. We arranged 15 deals in the domestic and international markets, and facilitated the first ever SGD bond issuances by an Indian bank and an Indian corporate.

In the wealth management customer segment, deposits grew 120%, albeit from a small base, as we deepened non-resident Indian customer relationships.

INDONESIA

Strong economic growth in Indonesia combined with consistent execution of strategy resulted in a further turnaround of our Indonesian franchise. Income and net profit rose 18% and 30% to record highs as loans rose 11%, deposits grew 18% and net interest margin improved. Returns also improved significantly, compared to a low in 2010. We were named “Best Foreign Bank in Indonesia” by Bisnis Indonesia.

The institutional banking franchise focused on customer acquisition and driving cross-sell in trade, cash and foreign exchange. We were named the “Best Arranger of Loans for Indonesian Borrowers” by Euroweek, while Asiamoney ranked us the best foreign cash management bank in Indonesia for small corporates, fourth for mediumsized corporates and third for large corporates. We were also named the “Best Treasury and Working Capital Bank for MNCs / Large Corporates” by The Asset magazine.

REST OF THE WORLD

Our presence in Korea and Japan serves Asian MNCs as they expand in the region. Our offices in Dubai, London and Los Angeles are used to intermediate capital and investment flows into Asia from corporates as well as high net worth individuals. Income from these countries collectively grew 8% to SGD 312 million while net profit rose 30% to SGD 161 million.