Institutional banking

Key 2015 awards

- Best Transaction Bank for Trade Finance Services, Global

- Most Innovative Investment Bank, Asia-Pacific

- Best Invoice Discount Management Deal, Global

- Best Debt Bank, Asia Pacific

- Best Corporate Digital Bank, Singapore

- Best Asia Commercial Bank

- Best Asia Investment Bank

- Best Regional Specialist Awards, Supply Chain Solutions, Asia-Pacific

- Best REIT House, Asia

- Regional House of the Year

- Singapore Loan House

- Best Transaction Services House, Asia

We place the customer at the centre of all we do, and are committed to help institutional clients and investors with their financial needs. We aim to build a sustainable annuity business to supplement our core lending business and have continued to drive initiatives to add value to our customers.

Financial performance

IBG's total income rose 7% to SGD 5.3 billion as net interest income grew 9% from improved net interest margin. Income from loans grew 14% to SGD 2.5 billion, largely from Singapore and Hong Kong customers for investments and corporate restructurings. Income from trade finance declined 14% due to the slowdown in China and depressed commodities pricing. Our focus on building quality deposits, coupled with cash mandates won in the year, resulted in strong cash management performance.

Non-interest income grew 3% to SGD 1.8 billion. Growth in fees from cash management and loan-related activities was offset by declines in trade and investment banking income. Treasury customer income rose 4%. IBG's non-loan to total income ratio declined to 47%.

Allowances rose SGD 18 million to SGD 558 million as higher specific allowances were partially offset by lower general allowances.

IBG continued to deepen our wallet share with customers. Our relationship teams, organised by industry segments, are able to understand our customers' business and risks better. Our insights into the region have also helped us foster deeper conversations and relationships with clients. In a survey of more than 500 companies by Greenwich, a market intelligence provider, the number of large corporates in Asia using DBS as a core bank rose from 20% in 2014 to 25%.

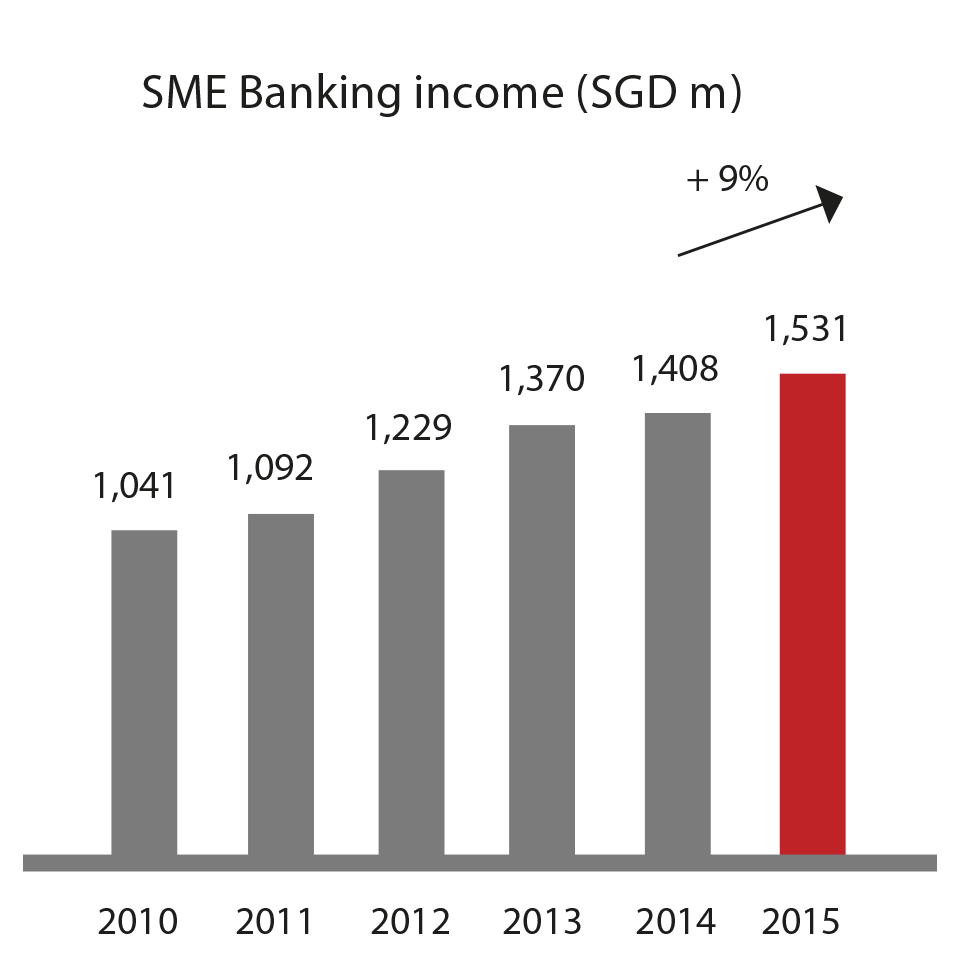

Building a leading SME banking franchise by leveraging digital innovation to drive client acquisition and deepen existing relationships continued to be a focus area in 2015. Income from SME banking grew 9% to a record SGD 1.53 billion as growth in transaction deposits and fees offset the impact of lower treasury customer flows. We also acquired 17% more SME customers across the region.

Providing access to capital

We had another fruitful year working with our regional clients to raise new capital for investments and refinancing. We remained among the top three arrangers for syndicated loans across Asia (ex-Japan), with our involvement in 123 deals amounting to USD 74.8 billion. DBS also topped the league tables for arrangers in Southeast Asia and Singapore, collectively accounting for 36% of Asia (ex-Japan) volumes.

In debt capital markets, we employed our extensive capabilities to assist clients to issue bonds in the most efficient market to minimise their funding costs. We successfully worked with several first-time issuers, such as Huawei, a global networking and telecommunications solutions provider, which successfully completed a 10-year USD 1 billion issue. We also led benchmark-sized deals for leading regional companies such as Lenovo, Bank of China and Stats ChipPAC in the USD, SGD and offshore RMB bond markets. In Asia ex-Japan bonds, we made an impressive leap and were ranked fourth compared to 10th in 2014. Despite intense competition, we widened our lead in the SGD bond market as our share grew from 35% to 41%.

We continued to be the leading equity and REIT house in Singapore, retaining our pole position in the league tables. We played a key role in milestone transactions such as Keppel Infrastructure Trust's maiden equity fund raising, which was for its merger with Cityspring Infrastructure Trust. We also successfully listed BHG Retail REIT, the only initial public offering on the mainboard of the Singapore Exchange in 2015. It is the first Chinese enterprise-sponsored retail REIT to be listed offshore.

Our expertise and knowledge of the market allowed us to secure roles as the sole financial advisor and/or underwriter in multiple transactions, where we supported Singapore-listed entities' equity fund raising for cross-border acquisitions and other expansion plans. Despite volatile market conditions, we strengthened our position and more than doubled our participation in Singapore transactions from 33% to 72%.

At the other end of the spectrum, we launched DBS mLoan, an innovative short term working capital loan for small businesses, which are often unable to access financing because a lack of audited accounts or personal income statements prevents banks from carrying out credit assessments. We use their electronically verifiable cash flows, such as card payments, and measure them against a payment and collection model to assess creditworthiness.

We are one of the first banks to offer a venture debt solution for tech start-ups at the growth stage of their life cycle. They can use it for working capital, fixed asset acquisitions and project financing, minimising dilution to their equity base.

Enabling cash flow optimisation

In 2015, global transaction banking income was little changed at SGD 1.6 billion. Our cash management, securities and fidicuary services and open account trade businesses all delivered strong double digit growth, offsetting a decline in documentary trade. Within trade, the shift towards open account trade resulted in higher margins and helped to mitigate the market driven decline seen in trade finance volumes.

Corporate treasurers seeking to improve the liquidity of their balance sheets tapped into our supply chain financing and account receivable purchasing solutions, which grew 24% in 2015. Our IDEAL digital platform made it easy for clients, their suppliers and buyers to integrate and take advantage of these facilities.

Our working capital management programme integrates our expertise in cash management and trade finance, providing advisory services to help clients improve working capital management and minimise funding costs. Our working capital advisory services provide clients with industry benchmarks, supply chain diagnostics and solutions to achieve best-in-class working capital management practices. We worked on close to 40 mandates in 2015.

Helping customers manage financial risks

Treasury customer sales income from IBG customers increased 4% to SGD 829 million, despite the drop in RMB-related activities in the second half.

We helped clients structure treasury products to hedge their risks. In the offshore RMB market particularly, DBS has the infrastructure and capability to offer a wide range of products, enabling clients to minimise foreign exchange risk, manage investments denominated in RMB and gain access to a broad range of financing solutions.

Making banking easier

Our digital initiatives were well received by customers as more of them transacted online or on the go. We added 16,000 new accounts to our corporate banking mobile app IDEAL.

The number of corporate subscribers to DealOnline increased almost 30% from the previous year. DealOnline is our full-fledged electronic foreign exchange online platform, which offers auto pricing and dealing in foreign exchange, swaps, forwards and non-deliverable forward contracts.

SME customers in Singapore and Hong Kong can now apply for a business account online in just 15 minutes, while in India, they can open an account within the day. We are also the only bank in Singapore to offer virtual account opening for customers to complete the account opening process via a simple voice or video call without having to step into a branch.

SME customers in Hong Kong are able to apply for loans via a mobile app and receive in-principle approval within an hour. In Singapore, SMEs can apply for up to 11 types of loan products online. They can track the application in real time and obtain instant notifications on the progress of their loan application.

Facilitating regional connectivity

Our extensive network in Asia, as well as our presence in Japan, Korea, United Arab Emirates, United Kingdom and United States, enables us to connect corporates with opportunities in Asia. In 2015, we opened an office in Sydney to facilitate Australia-Asia business and investment flows.

We have completed several landmark cross-border transactions such as Bank of China's multi-currency, multi-market, first of its kind USD3.55 billion bond, in conjunction with China's One Belt One Road initiative.

Others included Formosa Group's USD 510 million bridge loan and USD 1.5 billion syndicated term loan to fund investments in Vietnam. We also provided a comprehensive financing solution to support the USD 1.8 billion acquisition of Singapore-based STATS ChipPac by Jiangsu Changjiang Electronics Technology.

Unlocking shareholder value

As companies seek to grow in new markets or diversify their revenue sources, they look for domestic or cross-border M&A opportunities. In addition to helping them structure comprehensive financing solutions to support their acquisitions, DBS also served as financial advisor in several M&A transactions that have unlocked shareholder value. These include the acquisition of Keppel Land by Keppel Corporation, the acquisition of Biosensors International Group by CITIC Private Equity, the merger of Ascendas and Jurong International with SingBridge and Surbana, and the merger of Cityspring Infrastructure Trust with Keppel Infrastructure Trust, which created the largest infrastructure trust in Singapore.

Placing customers at the heart of the banking experience

We redesigned more than 30 customer experiences based on human-centred design principles. For example, we redesigned our transaction banking organisational structure with inputs from customers.

Through the DBS BusinessClass programme, an online social network for SMEs, we have facilitated more than 400 conversations and 20 networking events among the member base of 15,000 SMEs. The network also linked SMEs with tech start-ups to facilitate the adoption of new technologies to enhance productivity.

2016 FOCUS AREAS

- Invest in enhancing our product and people capabilities. This includes deepening our industry coverage and scaling up our business with institutional investors, who value banks like DBS with strong balance sheets, credit ratings, Asian insights and the ability to tailor products to capitalise on regional market conditions

- Continue to use technology to acquire new customers, simplify the way customers transact and enhance the customer experience. Experiments underway include the use of data analytics to detect fraud in trade finance, the commercial adoption of distributed ledger technology to transmit electronic documents, more options for SME owners to bank on the go, and a digital platform for the real-time distribution of structured investment products

- Accelerate our cash management business, which includes expanding the range of global cash management solutions such as domestic and international liquidity management and next-generation commercial cards

- Focus on growth markets such as forging strategic alliances in India and Indonesia; capturing China connectivity opportunities including financial liberalisation, "One Belt One Road" and overseas expansion by Chinese companies