Consumer banking

Key 2015 awards

- Best Retail Bank, Singapore

- Best Mortgage-Lending Bank, Singapore

- Best Mobile Banking Experience, Asia-Pacific

- Best Digital Payment Experience, Asia-Pacific

- Best Digital Wallet Platform, Asia-Pacific

- Best App Content by a Consumer Brand (Gold), Southeast Asia

- Best User Experience (Gold), Southeast Asia

Financial performance

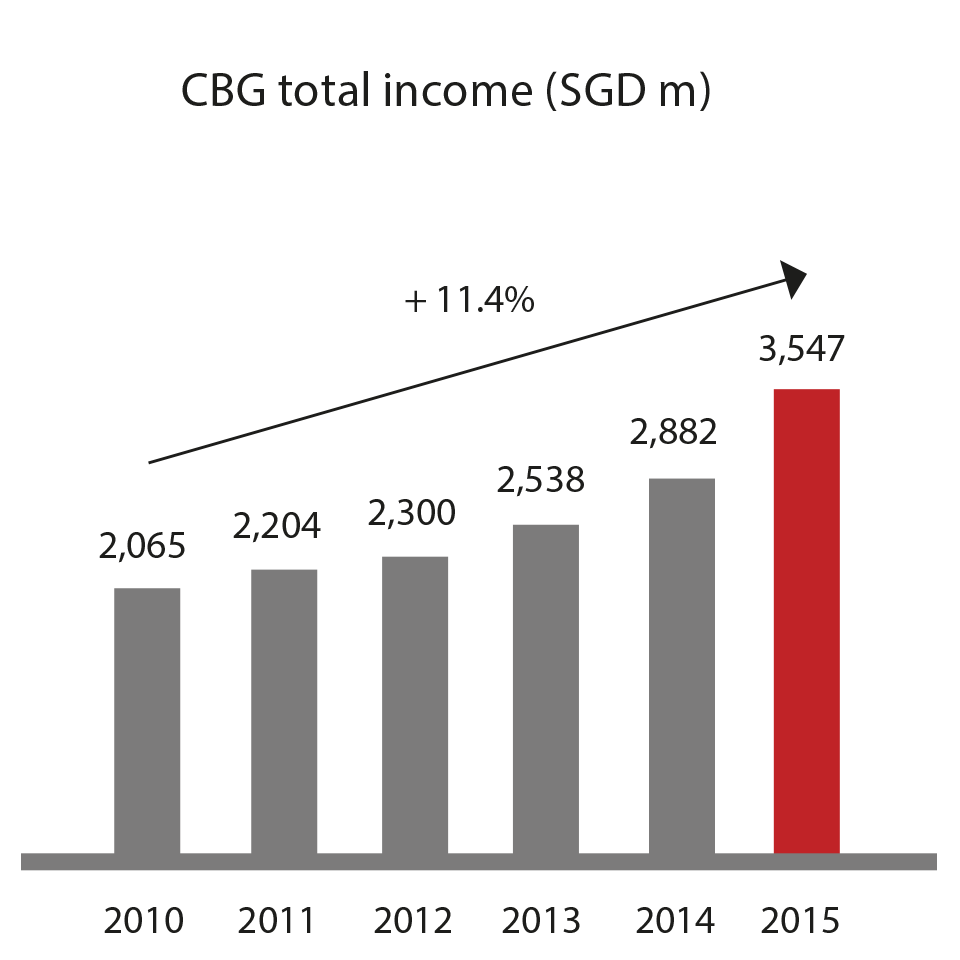

Consumer Banking Group's (CBG) total income rose 23% to SGD 3.5 billion, led by broad-based growth across wealth management, customer deposits, housing loans and other secured lending. Net interest income grew by 28%. Non-interest income from investment and bancassurance product sales grew at a strong 19%. We also continued to improve our cost-income ratio from 67% to 64%. Allowances grew in line with loan growth, and profit before tax was SGD 1.17 billion, 34% higher than a year ago.

In Singapore, we continued to win market share and are the leading player in customer deposits, housing loans and cards. Despite increased competition for deposits, we maintained our 53% market share for retail savings accounts in Singapore. In the bancassurance business, we grew 20%, making us one of the top players in the market.

In Hong Kong, total income increased 27% with strong broad-based growth across wealth management, bancassurance, cards and unsecured loans. We gained good traction in building sticky deposits with current and savings account balances growing at 25%. We also further strengthened our market position in the cards and unsecured loans business. In 2015, card sales increased 10%, ahead of market growth rates. Similarly, our unsecured loan portfolio grew at a healthy 17%.

We also continued to make good progress across growth markets, delivering strong double-digit income growth in Indonesia and Taiwan.

Accelerating digital innovation

As the pace of digital adoption increases, we are sparing no effort to deliver world class digital capabilities to our customers. We are upping the ante on not just the breadth of our digital offerings, but also on the holistic customer experience as they use our platforms. For example, we are one of the first banks in the region to build in-house design and user experience capabilities, which we incorporate as an integral part of our digital offerings.

Onboarding our customers digitally

We continue to see strong growth in our online and mobile banking customers. In Singapore, we have the largest base of online banking customers with over 2.5 million iBanking users and 1.25 million mBanking users. Our mobile activity continued to lead the industry in Singapore and mobile accounted for over 60% of our daily logins of over 400,000. Close to 70% of financial transactions took place through digital channels, across the region.

We launched digital account opening for new customers. This breakthrough initiative means new-to-bank customers can open accounts at their convenience, without having to visit a branch. We accelerated our digital acquisition initiative. In Singapore, almost 38% of credit card customers came through digitally, from 27% in the previous year. We also revamped our equity trading capabilities to deliver a more user-friendly trading experience for customers in Singapore and Hong Kong.

We also enhanced our mobility platform which allowed our relationship managers to access their sales management tools on the go. The deployment of a unique customer onboarding feature in Singapore and Taiwan has made the onboarding journey not only paperless, but also more seamless and efficient.

Transacting with us made easier

We continued to enhance our P2P payment capabilities through our mobile wallet DBS PayLah!, where we have a growing base of over 300,000 users. We were the first bank in Singapore to enable verification using thumbprint technology and brought the app to Apple Watch, making us the first wearable bank.

We revamped international remittances over the past few years. Our digital remittance services not only lead the market for convenience and speed, they also offer the most competitive pricing. Our focus on the end-to-end customer digital experience has led this business to grow from 320,000 annual transactions three years ago, to almost 2.1 million overseas remittance transactions in 2015.

We also continue to push our digital capabilities in our growth markets. We offer customers both mobile and internet banking capabilities in China, India and Taiwan, making it easier for them to transact on our platforms. We are continuing to see good digital traction among our Treasures customers and increased usage of our digital capabilities for forex transactions and unit trust purchases.

Engaging our customers

While we are seeing good traction and feedback on our digital capabilities, we are not standing still. We revamped iBanking and improved mBanking to provide relevant and customised offerings to our customers. Our Online Recommendation Engine allows us to target customer needs more accurately to provide more relevant offers. Complex rules and data points such as customer profiles, preferences and transaction patterns are used to improve relevance and productivity.

In September 2015, we piloted DBS FastTrack, a first-of-its-kind app to be introduced by a bank in Singapore and more crucially, to help food and beverage businesses tackle many of their current challenges. DBS FastTrack provides a seamless ordering and payments solution for businesses while eliminating or drastically shortening customers' wait time. Businesses in turn can use the app to help enhance productivity and reduce manpower costs.

In Hong Kong, we launched the first-of-its-kind credit card app, DBS Omni. This revolutionary app has several market leading innovations, from budgeting, analysis of spends, to real-time reward redemption.

Focus on delivering an exceptional customer experience

While we innovate on our digital offerings, we understand our customers' need to continue to access our physical locations and have provided new and innovative ways for them to do so. We were the first bank in Singapore to roll out an SMS queue management system across our branches. Customers simply request for a queue number via SMS prior to visiting branches and receive notifications when their turn comes up. This gives them better flexibility to use the time they would otherwise have spent waiting in line. We also removed traditional queues and provided seats for our customers, making branch visits more comfortable.

During the year, we partnered popular retail chains in Singapore such as Cold Storage, Market Place, Jasons and Giant stores to increase our cash withdrawal points in addition to previously formed partnerships. Together with our ATM network, this brings our cash withdrawal touchpoints in Singapore to close to 2,000 - the most for any bank.

To meet the higher demand for new notes during the Lunar New Year season, we were the first bank to introduce pop-up ATMs. DBS placed 29 specially-configured pop-up ATMs at 10 community clubs islandwide to dispense new notes. The initiative was well received by our customers, who took the opportunity to withdraw new notes outside branch operating hours.

Fulfilling customers' retirement and insurance needs

We officially announced our 15-year regional bancassurance partnership with Manulife Financial Asia at the beginning of 2016, making Manulife DBS' key provider of bancassurance solutions. Under the agreement, there will be a payment by Manulife to DBS of SGD 1.6 billion that will be accrued over the life of the partnership.

Through this partnership, DBS' customers will gain access to Manulife's best-in-class suite of life and health solutions. DBS and Manulife have also agreed to co-invest up to SGD 100 million over the next 15 years in digital technology and innovation enhancements. This joint fund will enable us to focus on developing innovative solutions to serve Asia's fast-growing consumer base, and help customers fulfil their retirement and insurance needs.

2016 FOCUS AREAS

- Continue to make significant improvement in customer experience across all our markets and customer segments

- Drive customer acquisition and deepen share of wallet, leveraging analytics and needs-based solutions and conversations

- Accelerate pace of digitisation - delivering real progress in acquisition, payments, mobile, analytics, wealth management, customer engagement and operating leverage

- Provide superior advice and planning to our customers in wealth planning, protection, and retirement needs

- Remain vigilant and be nimble to market changes