CFO statement

Results demonstrate resilience of our franchise

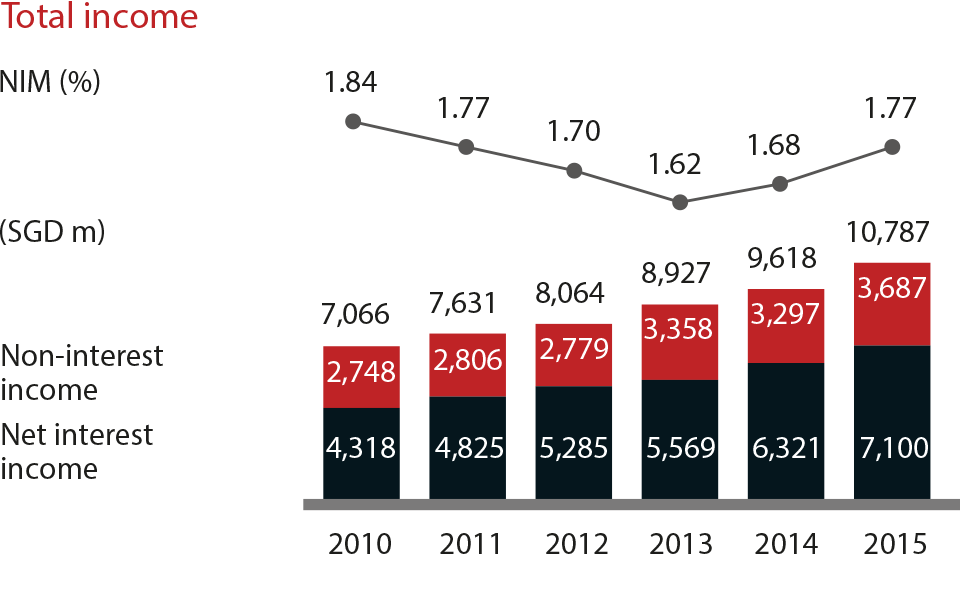

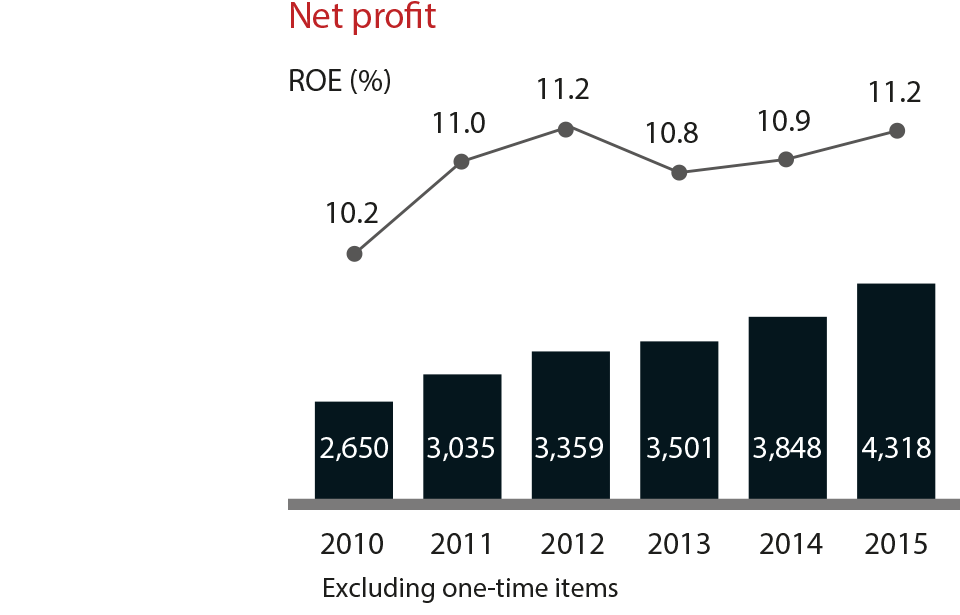

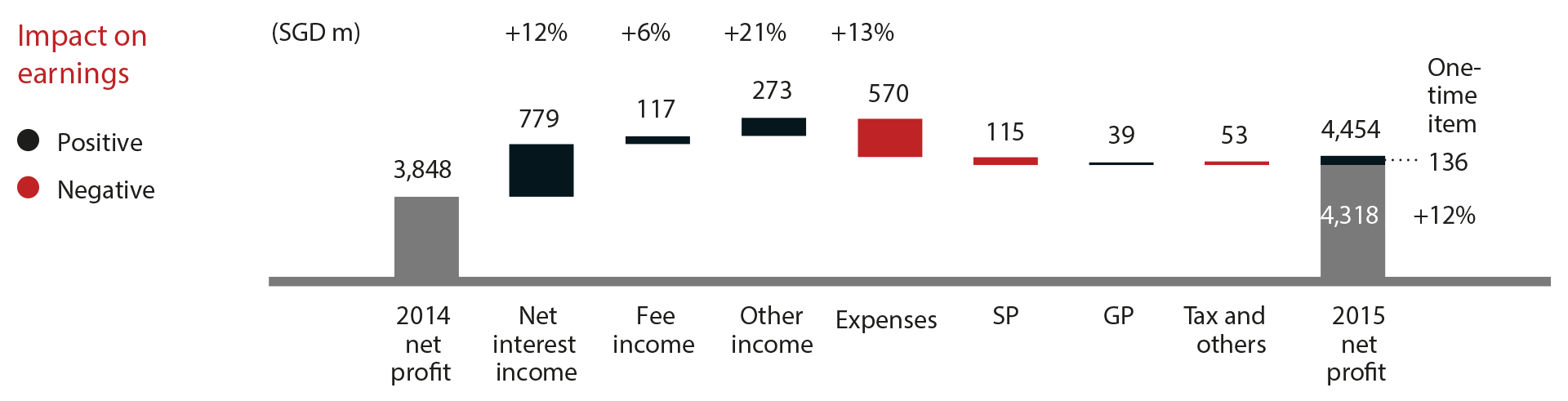

Despite a tough operating environment in 2015, net profit rose to a record SGD 4.45 billion. Excluding one-time items, net profit rose 12% from the previous year to SGD 4.32 billion. Total income crossed the SGD 10 billion mark for the first time, growing 12% to SGD 10.8 billion with both net interest income and non-interest income reaching new highs. Return on equity improved from 10.9% to 11.2%.

The results underscored the breadth and resilience of our franchise as we successfully captured income opportunities and managed risks in a year marked by slower economic growth, weak commodity prices, financial market volatility and heightened asset quality concerns.

Macroeconomic factors had a material influence on our performance

A favourable operating environment - supported by quantitative easing from various central banks - in the first half of the year increasingly gave way to uncertainty emanating from China. The resultant movements in interest rates and currencies had a material influence on our performance. While some of their effects were beneficial, others created challenges that we were able to successfully manage.

At home, benchmark interest rates used for pricing SGD loans rose steadily on expectations of higher US rates and from the adoption of a modest exchange rate policy by the Monetary Authority of Singapore. Interbank rates increased from 0.5% at the beginning of the year to 1.2% while swap offer rates rose by a similar magnitude to 1.7%. At the same time, we took effective steps to contain deposit costs. As a result, net interest margin rose nine basis points to 1.77%, which was the highest since 2012.

A convergence and subsequent reversal of offshore and onshore RMB rates - a consequence of China’s monetary easing and currency depreciation - together with falling commodity prices resulted in an underlying 25% or SGD 13 billion contraction in trade loans. We were able to offset the decline with a 5% or SGD 11 billion increase in non-trade loans. We grew Singapore housing loans by 13% as we gained share in a quiet market by offering customers a more stable pricing mechanism than most competitors could. We also supported institutional banking customers borrowing for corporate restructuring, loan refinancing and infrastructure projects. As a result, we were able to keep overall loans stable in constant-currency terms during the year.

Central banks’ policy actions in the early months of the year, some of which were unexpected, boosted risk appetite and contributed to especially strong performances in wealth management and treasury activities in the first half. This reversed in the second half as overall confidence became fragile after sharp declines in China’s stock markets and an unexpected depreciation in August of the RMB. Lingering uncertainty over the timing and pace of US Fed tightening exacerbated the volatility in financial markets. As a result, the strong first-half growth in non-interest income moderated in the second half.

The 7% depreciation of SGD against USD during the year benefited our performance, contributing 3% points to reported income and earnings growth. It accounted for all of the year’s reported loan growth of 3%.

Balance sheet strength maintained

We took steps to ensure that the high quality of our balance sheet was maintained in a more challenging operating environment.

Asset quality continued to be resilient. Non-performing loan formation was offset by recoveries, upgrades and write-offs of existing NPLs. The non-performing loan ratio was unchanged at 0.9%. We took specific allowance charges of 19 basis points of loans during the year, little changed from the previous year. Our allowance coverage of 148% was higher than many of our peers’, reflecting the prudent level of cumulative general allowances at SGD 3.2 billion. If collateral was considered, the coverage was 303%.

We kept ample liquidity to support growth and meet contingencies. The loan-deposit ratio was comfortable at 88% even as higher-cost deposits were managed out. Deposits were supplemented by wholesale funding across a range of tenors, and included USD 1 billion of inaugural issuances of covered bonds with triple-A ratings from Moody’s and Fitch. The liquidity coverage ratio in the fourth quarter of the year was 122%, well above the final regulatory requirement of 100% effective 2019. We also met the requirement for net stable funding ratio effective 2018.

Despite having one of the highest risk densities in the world at 60%, our fully phased-in Common Equity Tier-1 ratio of 12.4% was well above regulatory requirements. After factoring in recently announced rule changes by the Basel Committee (the “Standardised Approach - Counterparty Credit Risk” to be implemented in 2017 and the “Fundamental Review of the Trading Book – Revised Standardised Approach” to be implemented in 2019), our capital ratios will continue to remain comfortably above requirements. Our leverage ratio was 7.3%, way above the minimum requirement of 3% envisaged by the Basel Committee. We will continue to assess the impact of regulatory reforms currently undergoing consultation.

Like other banks, we will manage our exposures to contain the impact of risk-weighted asset inflation. We intend to maintain our existing dividend policy, which is to pay sustainable dividends while maintaining capital ratios consistent with regulations and the expectations of rating agencies, investors and other stakeholders. Our payouts also take into account the long-term growth prospects of our businesses.

Net book value per diluted share increased 7% to SGD 15.82. The accretion in net book value was not reflected in the share price, which fell 19%, similar to domestic peers, as bank shares led a sell-down on the Singapore Exchange in the latter part of the year. DBS had a market capitalisation of SGD 42 billion at 31 December 2015.

Integrated and sustainability reporting

Our 2015 report is fully in line with the Integrated Reporting framework issued by the International Integrated Reporting Council in December 2014. The enhancements we made this year include improved disclosures for “material matters”, “stakeholders outreach” and our management of resources.

Our Integrated Reporting reflects the integrated thinking behind our strategy and embedded into our business practices. We use a balanced scorecard with key performance indicators to drive alignment of strategy and priorities throughout the organisation.

This report also marks a milestone in our commitment towards sustainability reporting. It has been prepared to the G4 Sustainability Reporting Guidelines issued by the Global Reporting Initiative or GRI. These efforts position us well for meeting the proposed requirements by the Singapore Exchange for sustainability reporting in 2017.

New impairment methodology

In 2018, International Financial Reporting Standard 9 will take effect. This new accounting standard will govern how reporting entities classify and measure financial instruments, take impairment (or allowance) charges and account for hedges.

At present, for impairment assessment, Singapore banks comply with the provisions of MAS Notice 612 where banks maintain, in addition to specific allowances, a prudent level of general allowances of at least 1% of uncollateralised exposures. This is an intended departure from the incurred loss provisioning approach prescribed under FRS 39, and possible changes to the current regulatory specifications will determine how IFRS 9’s expected credit loss (ECL) model is eventually implemented. Any such changes are unlikely to result in additional allowance charges for DBS at the point of adoption. The Group has begun preparations in the meantime, leveraging existing credit rating systems, models, processes and tools.

Starting 2016 from a position of strength

Our performance in 2015 was achieved in the midst of slower economic growth and financial market volatility. It attests to the resilience of our franchise, which is underpinned by multiple business engines, a solid balance sheet and prudent risk management. We will remain vigilant to risks while staying nimble across our businesses and regional network to capture the many opportunities that Asia continues to offer. The region’s economic fundamentals are sound and its long-term growth potential remains undimmed. Our foundations are secure and we enter 2016 from a position of strength.

Financial performance summary