DBS Hong Kong launches the DBS Omni Credit Card Companion App - with 4 ‘First-In-Market’ innovations | 繁體

“There is something new under the sun”

Revolutionise credit card experience

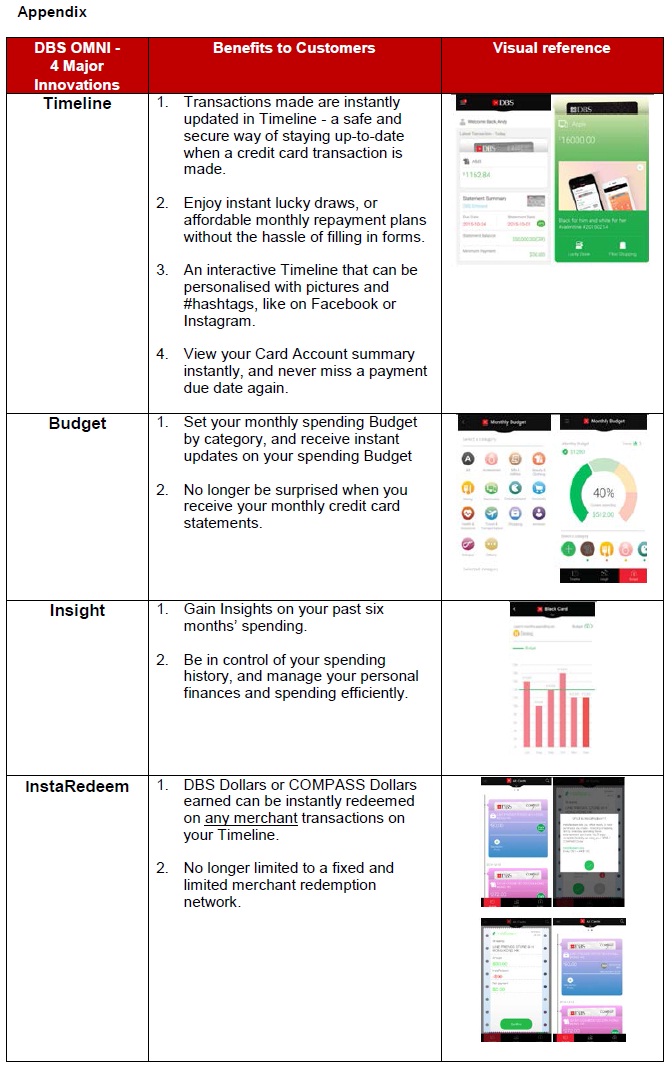

- Be instantly informed of your DBS credit card transactions, via notifications on your Timeline

- Track your personal finances effectively with Budget and Insight

- Instant redemption of cash rebates at any merchants globally, via InstaRedeem

.jpg)

With these innovative features on DBS Omni, customers enjoy greater peace of mind when spending on their DBS credit cards. Transactions are instantly and conveniently updated on their Timeline. InstaRedeem frees customers to enjoy Instant Redemption of their cash rebate at any merchants globally. DBS Omni also serves as a personal finance manager by allowing customers to set monthly spending via Budget and view categorised spending via Insight , all of which enable customers to truly be in control of their spending - all with a simple touch on their smartphones.

DBS Bank has and continues to invest considerable resources to drive innovation and digital banking, with many notable examples of first-in-market and award-winning initiatives in providing a joyful customer experience. Among them is the DBS Loan Centre mobile application, the first-in-town innovation enabling the entire loan application process to be completed within one minute using a smartphone virtually anywhere and at any time for a truly breakthrough banking experience.

Mr Ken Chew, Executive Director, Consumer Finance and eBusiness, DBS Bank (Hong Kong), said, “We are very excited to be sharing something new with our customers today. Our continued investments in innovation and digital banking show DBS’ commitment to staying relevant to the changing needs of our customers, who are spending more time online and on their mobile phones. DBS Omni enables us to introduce an innovative, yet simple and intuitive mobile solution to our customers in Hong Kong, so that our customers can perform DBS credit card transactions on the go, and with the convenience of their mobile devices.”

Download DBS Omni to win a Tesla Model S 70D

DBS credit card customers who successfully download and register DBS Omni today, will enjoy a chance to win a Tesla Model S70D worth over HK$640,000. DBS Omni is available for download on iOS and Android mobile devices from today.

Photo Captions

Photo 1: Ken Chew, Executive Director, Consumer Finance and eBusiness, of DBS Bank (Hong Kong), highlights the first-in-market innovations of the DBS Omni app at a press conference today.

.jpg)

Photo 2: DBS Bank (Hong Kong) CEO Sebastian Paredes (left) and Pearlyn Phau, Deputy Group Head of Consumer Banking Group and Wealth Management, of DBS Bank (right), officially launch the DBS Omni app.

.jpg)

Photo 3: (From left) Ken Chew, Executive Director, Consumer Finance and eBusiness, of DBS Bank (Hong Kong), Sebastian Paredes, CEO of DBS Bank (Hong Kong), and Pearlyn Phau, Deputy Group Head of Consumer Banking Group and Wealth Management, of DBS Bank, officiate at the DBS Omni press conference.

.jpg)

Photo 4: Ken Chew, Executive Director, Consumer Finance and eBusiness, of DBS Bank (Hong Kong), (third left) Sebastian Paredes, CEO of DBS Bank (Hong Kong), (fourth left) and Pearlyn Phau, Deputy Group Head of Consumer Banking Group and Wealth Management, of DBS Bank, (fourth right) joined other guests and partners to celebrate the launch of the DBS Omni app.

[End]

About DBS

DBS - Living, Breathing Asia

DBS is a leading financial services group in Asia, with over 280 branches across 18 markets. Headquartered and listed in Singapore, DBS has a growing presence in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's capital position, as well as "AA-" and "Aa1" credit ratings, is among the highest in Asia-Pacific. DBS has been recognised for its leadership in the region, having been named “Asia’s Best Bank” by The Banker, a member of the Financial Times group, and “Best Bank in Asia-Pacific” by Global Finance. The bank has also been named “Safest Bank in Asia” by Global Finance for seven consecutive years from 2009 to 2015.

DBS provides a full range of services in consumer, SME and corporate banking activities across Asia. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. These market insights and regional connectivity have helped to drive the bank’s growth as it sets out to be the Asian bank of choice. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. The bank acknowledges the passion, commitment and can-do spirit in all of our 21,000 staff, representing over 40 nationalities. For more information, please visit www.dbs.com.