Fintech and the future of banking

4 Jul 2023

Technologies shaping the future of fintech and the top fintech trends of 2023

Fintech, or financial technology, is a rapidly growing industry that combines traditional finance with modern technology to provide innovative financial services to individuals and businesses. Put simply, fintech uses technology to offer new financial services to people and businesses, transforming the way we think about money, payments, lending, and investing.

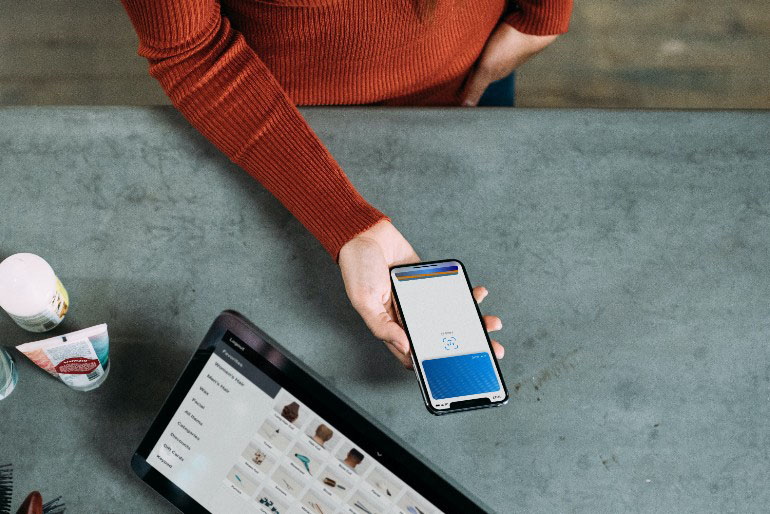

Some recent fintech innovations you may already be familiar with include digital currency or cryptocurrency, digital exchanges powered by blockchain (like the DBS Digital Exchange, or DDEx), automated transactions facilitated by smart contracts, and not to mention, digital payments and digital wallets (such as DBS PayLah!). At DBS, we pride ourselves on our digital leadership and transformation, which began as early as 2014.

One key focus of the industry is the integration of artificial intelligence (AI) and machine learning (ML) into fintech platforms. In this article, we will explore what fintech is, how it is transforming the future of finance, how AI is related to fintech, and the top fintech trends of 2023.

What is a fintech ecosystem?

You may have heard the term “fintech ecosystem”. This refers to an interconnected network of financial technology (fintech) companies, investors, regulators, and other stakeholders that work together to create, distribute, and consume fintech products and services. This ecosystem encompasses what is commonly known as the “five elements of the fintech ecosystem”: fintech companies and/ or startups, technology developers, financial customers, the government, as well as traditional financial institutions that are embracing new technologies.

According to Startup Genome’s Global Startup Ecosystem Report 2022 Fintech Edition, the top five fintech ecosystems in Asia are Singapore, Hong Kong, Beijing, Shanghai and Mumbai. DBS is present in and serves consumers in four of these markets.

Is fintech (finance technology) the future of finance?

The traditional financial services industry is already facing disruption, as more players leverage emerging technologies to offer modern solutions to age old challenges.

In general, services such as mobile banking, digital payments, peer-to-peer lending, robo-advisors, and blockchain-based solutions (like cryptocurrency and distributed ledger technology) are making financial services more accessible, affordable, and convenient than ever before; changing the way we manage money in our daily lives.

This transformation is in its early stages, and there is still much potential for innovation and growth. As technology continues to evolve, the potential for further disruption is enormous. Hence, many are optimistic that fintech will continue to play a significant role in the future of finance.

The future of fintech in the era of AI

Over recent years, artificial intelligence (AI) and machine learning (ML) have emerged as key drivers of growth in the fintech and banking industry. By analysing large volumes of data, identifying patterns, and from thereon, predicting expected trends, AI and ML algorithms have been used to improve fraud detection and prevention, assess credit risks, and even provide hyper-personalised recommendations for investors and other banking clients. They are also commonly used to power chatbots, which play a big role in enhancing the customer service experience in this digital era.

But that’s not all – there are still many other potential areas where AI can continue to make significant impact on the future of fintech, such as predictive analytics and natural language processing.

Since AI can be used to analyse large amounts of data to identify patterns and make predictions about future trends, it can be particularly useful in areas such as credit risk assessment and investment management, where accurate predictions can have a significant impact on financial outcomes.

Additionally, AI can be used to process unstructured data, such as social media posts and news articles. Through this, it can identify more qualitative trends and sentiments.

More technologies shaping the future of finance

1. Blockchain

Blockchain is a decentralised digital ledger technology that enables secure and transparent transactions without the need for intermediaries. Blockchain has the potential to transform many areas of banking, from payments and remittances to asset management and supply chain finance. Blockchain is also the technology behind cryptocurrency.

DBS has two blockchain-backed businesses – DDEx and Partior – and in an interview with The Straits Times, DBS CEO Piyush Gupta has said that he is confident the technology will power the world’s back office in the coming decade.

2. Internet of Things (IoT)

The IoT refers to the growing network of interconnected devices that are capable of collecting and sharing data. In the context of finance, IoT can be used to facilitate payments and enable real-time monitoring of financial transactions and assets.

3. Big data analytics

Big data analytics refers to the use of advanced algorithms and tools to analyse large datasets. In the context of finance, big data analytics can be used to identify patterns and trends in financial data, and to develop predictive models for investment and risk management.

4. Quantum computing

Quantum computing is a new type of computing technology that uses quantum mechanics to perform calculations at a much faster rate than traditional computers. In the context of finance, quantum computing has the potential to revolutionise areas such as portfolio optimisation and risk management.

What are some of the top fintech trends of 2023?

1. “Buy now, pay later” (BNPL) payments

Instalment payment plans have been around for a long time, but they used to be reserved for purchases like electronics and household furniture and appliances. Customers would finance large purchases by spreading it over multiple smaller payments, sometimes paying interest to do so. These days, however, this form of short-term financing is often referred to as “buy now, pay later” (BNPL) and is available for almost all types of consumer products, typically through an intermediate payment platform and without interest costs.

According to Reportlinker.com’s Buy Now Pay Later Global Market Report 2023, the BNPL market grew from USD 105.15 billion in 2022 to USD 155.79 billion in 2023, and is expected to continue growing to USD 744.06 billion by 2027. Although BNPL can be done through both on- and offline payment methods, the forecasted growth is generally driven by the staggering increase in the adoption of digital payments, which was accelerated by the Covid-19 pandemic.

2. Cybersecurity

Today, most of our lives are “stored” online – be it our work or personal information. Unfortunately, this means that there is a wealth of vulnerable data in the digital world, making cyber hygiene and cybersecurity more important than ever before. And with cyber criminals adapting almost as fast as the technologies they seek to hack, organisations must continue to invest in keeping their data secure.

Although the use of AI and other technologies is already widespread in cybersecurity and fraud prevention, it is likely to continue disrupting the field. According to the International Data Corporation, AI in the cybersecurity market is growing at a compound annual growth rate (CAGR) of 23.6% and will reach a market value of USD 46.3 billion in 2027.

AI-powered security systems are expected to grow increasingly sophisticated in terms of contextual reasoning and synthesising data, enabling predictive analytics and real-time responses to threats.

3. Open banking and APIs

Open banking is a growing trend in 2023, and is the technology that allows consumers to access their financial data through more platforms, by leveraging third-party providers and application programming interfaces (APIs). Many of the use cases for this technology are in the personal finance management space, whereby users can choose to integrate their financial information from multiple different sources and access them on a single platform.

For instance, the NAV Planner on the DBS digibank app is free for all consumers to use, and if you consent, you can import and integrate your financial information from other institutions (like other banks, insurers, and government bodies) for a holistic view of your finances on the app.

The benefit of enhanced convenience and accessibility is clear for consumers. For organisations, this opens up opportunities to innovate better products and solutions, and offer more tailored recommendations to consumers.

4. DeFi and blockchain technology

Decentralised finance (DeFi) and blockchain technology have been around for the past decade, but it seems that this is just the beginning. The cryptocurrency markets have been wildly volatile, with as many digital exchanges and currencies rising as collapsing. Despite these challenges, there have been massive developments in the related technologies that power these digital innovations – namely blockchain, or decentralised ledger technology.

As adoption of the emerging technology increases, more regulation could follow suit as governments and regulatory authorities look to establish some sort of middle ground that manages to leverage the technology while keeping consumers secure.

In Singapore, DBS is working with the Monetary Authority of Singapore (MAS) on Project Guardian, an industry pilot for digital asset and DeFi. The pilot conducted foreign exchange and government bond transactions against liquidity pools comprising of tokenised Singapore Government Securities Bonds, Japanese Government Bonds, Japanese Yen (JPY) and Singapore Dollar (SGD).