Responsible and Ethical AI in Banking and Finance

DBS' Gen AI-powered CSO Assistant helps its customer service officers to handle customer queries more efficiently, thereby spending more time to deepen customer relationships

6 October 2025

Ethical AI in Banking is central to DBS’ vision of reimagining banking services for customers across Asia. As one of the region’s leading banks, DBS began its transformation journey in 2014 to strengthen its AI capabilities, embracing responsible and ethical AI in banking and finance as guiding principles.

Today, the bank has embedded the use of AI across the organisation, with hundreds of use cases deployed to date. These use cases have brought about significant productivity and process improvements. These include delivering more than SGD 750 million in economic value in 2024.

By pairing innovation with robust governance, DBS ensures its adoption of responsible AI in finance delivers measurable value, enhances customer trust, and sets new standards for the industry.

Some of the bank’s AI use cases include:

- Generative AI (Gen AI) - Powered CSO Assistant: Helps its 1,000 customer service officers (CSOs) by transcribing, summarising and recommending answers in real time, supporting over 250,000 monthly queries.

- DBS-GPT: An internal Gen‑AI assistant supporting content generation, information retrieval and workflow automation.

- Fraud/Compliance Monitoring Systems: An AI/ML solution that helps determine and flag out high-risk transactions in less than 10 milliseconds, resulting in 15% savings of customers’ hard-earned money from scams.

- Environmental, Social, and Governance (ESG) risk management: Introduction of Gen AI tool in ESG Risk Questionnaire to enable quicker processing of questionnaires, screening of negative news and improve relationship manager productivity.

To build a scalable technology infrastructure that keeps up with the rapid development of AI, DBS has implemented stringent frameworks to ensure its use of data and AI is lawful, ethical and fair. This helps sustain confidence and trust in its AI model outputs.

DBS' Responsible Data Use Framework

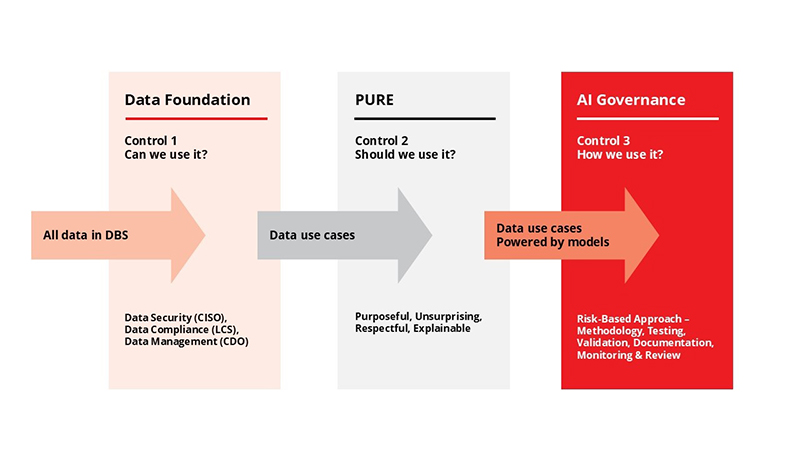

DBS' use of AI is underpinned by its Responsible Data Useframework, a cornerstone of its commitment to Responsible AI in Banking. The framework ensures that the use of data and adoption of AI is lawful, ethical, and fair. The framework ensures risks associated with AI use are properly addressed, enabling the bank to industrialise AI use safely and ethically. Broadly, the framework seeks to address three core questions:

- Data foundation – Can we use it?

This addresses foundational data management aspects such as data security, privacy, access and quality. This assures that all AI applications in finance comply with data privacy regulations, supporting AI governance in banking. - DBS PURE framework – Should we use it?

This guides the application of data within specific business contexts, emphasising the principles of Purposeful, Unsurprising, Explainable, and Respectful (PURE) data use. The framework has been in use since 2019 and is regularly updated to enable the bank to tap the potential of data and AI amid evolving regulations, changing customer expectations and societal norms. - Model governance – How do we use it?

DBS takes a risk-based approach towards AI model governance encompassing key features such as materiality assessment, mandatory governance requirements, an AI protocol (registry), clear roles and responsibilities, and senior management accountability. This governance structure ensures AI accountability in banking, reinforcing DBS’ leadership in responsible AI in finance.

Ensuring the PURE delivery of AI use cases across the bank

At the heart of DBS’ commitment to AI regulation and compliance in finance lies its PURE framework, serving as an ethical compass for the responsible delivery of AI use cases across the bank:

- Purposeful: Data use must have a clear and justifiable purpose.

- Unsurprising: Data use should align with individuals' and corporations' reasonable expectations.

- Respectful: Data use should adhere to social norms and demonstrate respect for individuals' privacy and dignity.

- Explainable: Data use must be transparent and justifiable, allowing for clear understanding of the process and its rationale.

Overcoming AI challenges

In its journey to industrialise the adoption of responsible AI in banking, DBS has had to overcome several key challenges:

- a Culture of Responsible AI through Employee Education – To successfully scale ethical AI in banking, DBS had to ensure that all employees are data and AI literate. It developed seven novice and nine practitioner modules on its internal e-learning platform to equip employees with data management knowledge and capabilities. The bank continues to update its training modules to keep up with the latest technology developments.

DBS also furthered its commitment to training and awareness by introducing several initiatives:- Digital ‘Fairness’ practitioner module: A comprehensive online course titled "Responsible Data Use - AI/ML Governance on Fairness (For Practitioners)" provides detailed training on ethical AI development and deployment.

- PURE learning for new joiners: It also incorporated a PURE learning component to the bank’s new joiner curriculum to underline the importance of responsible data use to all employees, irrespective of their role.

- Gen AI Unplugged Webinar Series: DBS hosts regular webinars featuring external experts on AI practices and addressing emerging challenges, including ethical AI.

- Integration into Legacy Systems and Workflows - Incorporating AI into existing banking operations can be complex and resource-intensive. DBS leverages a centralised enterprise data and AI platform that supports modular integration. Reusable model components, templates, and automation have reduced AI project timelines from 15 months to under 3 months.

- Addressing Incremental Risks with Adoption of New AI Technology – As the bank continues to push the boundaries with the latest AI technologies, it has also evolved its AI governance framework to address incremental risks. DBS adopts a systematic and risk-based approach when adopting new AI technology.

- For example, its initial scope of Gen AI adoption was intentionally designed for internal use with high levels of human oversight and incremental progression. DBS also established a cross functional Responsible AI Taskforce to ensure appropriate expertise is leveraged to thoroughly evaluate use case pilots and guide risk mitigation. Clearance channels were also elevated for Gen AI use cases to ensure sufficient senior management oversight.

Active industry participation to set standards for AI deployment

In early 2023, DBS was invited to participate in Project MindForge, a Monetary Authority of Singapore (MAS) initiative dedicated to advancing responsible AI in banking and promoting ethical AI in finance across the industry. Recognising the transformative potential and inherent risks of GenAI, Project MindForge aims to establish a robust framework for ethical and secure implementation. DBS, as a leading member of the MAS-established consortium, collaborated with financial institutions and technology providers to spearhead this critical initiative.

Conclusion

A large part of DBS’ success in its AI journey can be attributed to its partners and peers in the responsible and ethical AI ecosystem. Cooperation is key to succeed in fostering Responsible and Ethical AI in the Banking and Financial sector in this rapidly evolving business environment. DBS will continue to work closely with regulators and industry bodies to advance Responsible AI knowledge in the community as a leader in responsible and ethical AI.