How We Create Value

What We Do

ASIA’S THREE KEY

AXES OF GROWTH

Greater China

Southeast Asia

South Asia

Our aim is to become “The Asian Bank of Choice for a new Asia”. We are an Asia-centric commercial bank focused on harnessing the region’s long-term potential as the centre of economic gravity shifts eastwards to Asia. To differentiate ourselves, we have developed a unique brand of banking, Banking the Asian Way. We seek to provide a kind of banking that is joyful and trustworthy as we help to transform this region that we live in.

We are distinct from local lenders or global players. As an Asian specialist, we have the reach and sophistication to outcompete local lenders, and deep Asian insights that distinguish us from global competitors.

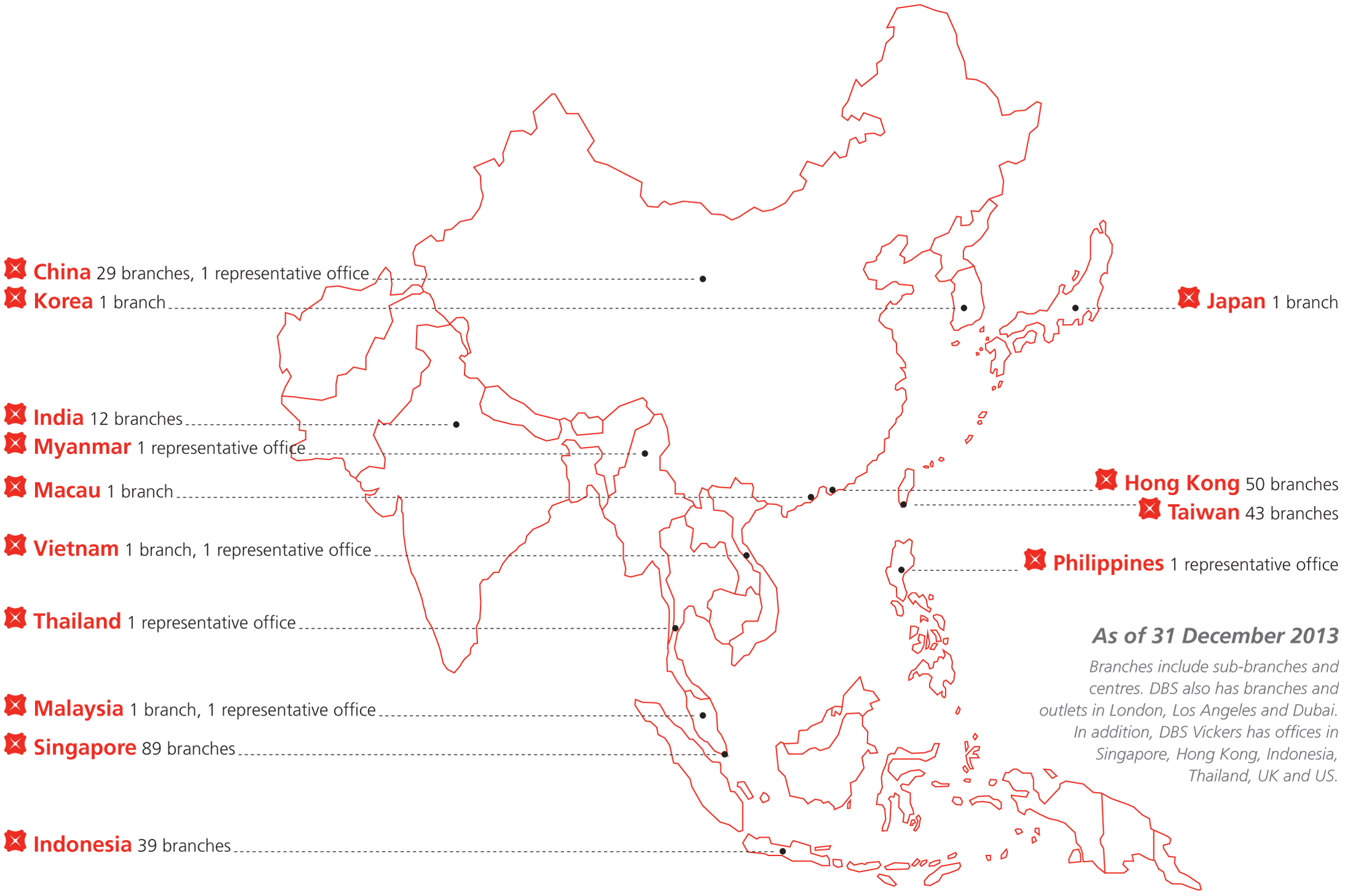

We seek to intermediate trade and investment flows between Asia’s three key axes of growth – Greater China, South Asia and Southeast Asia - as well as participate in Asia’s growing affluence. Our key franchises are in Singapore, Hong Kong, China, Taiwan, India and Indonesia.

In Singapore, our home market, we are a universal bank serving all customer segments, including the mass market through the DBS and POSB “People’s Bank” franchise. In other markets, we focus on three lines of business:

- Corporate/Investment banking (covering large corporations and institutional investors)

- SME banking

- Wealth management

We see an opportunity to leverage digital technology as a means to reach customers across Asia.

Why We Do It

Banking benefits the community when it creates long-term economic value and generates profits in a responsible way. We have the ability to improve lives with our products and services. A housing loan can empower individuals to build homes for their families; a business loan can create job opportunities for thousands. We recognise we have obligations to multiple stakeholders – shareholders, customers, employees, regulators and society – and strive to consistently deliver value to all of them.

Given our roots as the Development Bank of Singapore and unique position as the custodian of Singapore’s oldest and much-loved Post Office Savings Bank (now known as POSB), we believe that banking is more than just being a commercially-centred enterprise. We are committed to the philosophy of doing the right thing for our stakeholders and have embedded it in our business. Apart from creating long-term economic value, we also seek to positively benefit the communities we are present in, and deliver social value. To further our corporate social responsibility efforts, we recently established a SGD 50 million foundation to further our commitment to be a force for good.

Where We Do It

LARGEST BANK IN SINGAPORE

- Extensive network of more than 2,300 DBS/POSB branches and self-service banking machines

- Leading market share across corporate and consumer banking, serving over 4.6 million retail customers

GREATER CHINA

- Hong Kong: Anchor of our Greater China franchise with 50 branches

- China: Locally incorporated in 2007, first Singapore bank to do so; 29 branches in 10 major cities today

- Taiwan: Locally incorporated in 2012, first Singapore bank to do so; 43 branches today

SOUTH AND SOUTHEAST ASIA

- India: 12 branches in 12 major cities, largest network for a Singapore bank

- Indonesia: 39 branches across 11 major cities

OVER 250 BRANCHES ACROSS ASIA

How We Bank

is how we intend to become the bank of choice for customers. It comprises:

Asian Relationships

For us, customer centricity is not just a buzzword. We strive to embody elements of what relationships are about in Asia: a) being there for the long haul, through good times and bad, and b) recognising that relationships have swings and roundabouts, and that every transaction does not have to be profitable in its own right. At DBS, we also value relationships with staff and the community.

Asian Connectivity

We work in a collaborative manner across geographies, supporting our customers as they expand. Our one-bank approach lets us rise above individual country and business line priorities.

Asian Service

We aim for every customer to walk away from any interaction feeling that we have been Respectful, Easy to deal with and Dependable. Our service ethos is characterised by the “humility to serve and the confidence to lead”.

Asian Innovation

We understand that some global solutions do not necessarily apply to Asia. We leverage our insights to constantly innovate new ways of banking as we strive to make banking more intuitive and interactive for our customers.

Asian Insights

We know Asia better and use our knowledge of how to do business in this region to provide unique Asian insights to support our customers’ growth. We leverage our knowledge of local markets to create Asian-specific products to address our customers’ bespoke needs.

EFFECTIVE CORPORATE GOVERNANCE

+

+

What Guides Us Internally

We are committed to the highest standards of integrity, ethics and professionalism. We believe that sound and effective corporate governance is fundamental to the Group’s long-term success and sustainability. It forms the basis for responsible management, ensures rigour in the decision-making process, and guides our commitment to safeguarding stakeholders’ interests and maximising shareholder value. Our governance is in accordance with relevant provisions in the Singapore Code of Corporate Governance and related guidelines, and banking regulations issued by the Monetary Authority of Singapore. We also align ourselves with international corporate governance best practices.

To achieve effective corporate governance, we have put in place a framework that combines competent leadership, effective risk management and a values-led culture. The Group is directed by an independent Board comprising individuals with diverse skill-sets and experience. Two-thirds of the Board are former bankers and the rest are industry experts in domains ranging from consumer goods to accounting. The Board seeks to ensure that the Group is well-positioned for growth and risk, and provides direction for management by setting, reviewing and overseeing the implementation of the Group’s strategy. Effective risk management is central to all parts of our organisation. Our risk management frameworks – approved by the Board (please refer to page 78 for Section 3 of Risk Management) – sets the boundaries in which our business groups can operate and achieve their objectives in accordance with our scorecard (please refer to page 23 of Management Discussion). Our performance against these objectives determines individual benefits including remuneration and helps drive appropriate behaviours.

We also consider the impact our decisions will have on all our stakeholders and strive to strike a balance between long-term priorities and short-term objectives. Our organisational values shape the way we do business and work within the Group. We believe that what we do goes beyond banking. We value relationships and teamwork. We embrace change and innovation to challenge the status quo to provide better banking solutions. We have the courage to take responsibility for decisions and are empowered to make things happen. Finally, we aim to build an organisation where people feel good and energised about being part of an exciting workplace.