| DBS has a dominant consumer banking franchise in Singapore, and a strong consumer position in Hong Kong, Asia’s two most developed and bestregulated markets. In Singapore, through the acquisition of POSBank, DBS has about 60% market share in savings deposits and more than four million customers, over 90% of Singapore’s population. |

| |

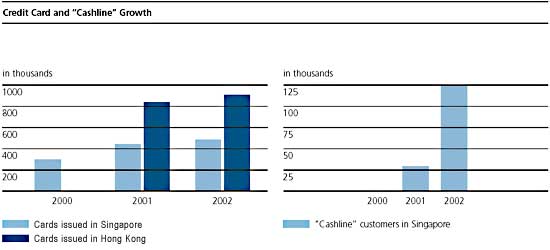

| In Singapore, the starting point of a majority of DBS?customer relationships has been through its savings accounts. Since the merger of DBS and POSB, the Bank has successfully combined the more comprehensive and diverse financial service offerings of DBS with the basic banking services offered by POSB. Last year, DBS grew its credit card receivables by over 20% and sold over S$3 billion of investment products to its customers in Singapore. DBS?new personal unsecured product called "Cashline" garnered more than 125,000 accounts, and commands a number two market position in less than 15 months since its launch. "Cashline" received the "Asian Banker 2002 Retail Products Excellence" award. |

| |

|

| |

| In Hong Kong, DBS has a smaller distribution network but uses it effectively to reach out to its one million customers. In 2002, almost S$1.4 billion of wealth management products were sold in Hong Kong, more than tripling the amount sold in 2001. The resounding success enjoyed by DBS in wealth management sales in both Singapore and Hong Kong reflects our unique ability to combine DBS?originating, structuring and sourcing products strengths with our broad distribution capability. |

| |

| DBS has made strong progress in building our enterprise banking business. In Hong Kong, DBS is one of the leading banks supporting small-and-medium-sized companies (SME’s) with a deep range of financial services. The Group estimates that it now has more than 10% market share of the trade finance and the SME business segment largely through its Dao Heng Bank franchise. DBS will actively support these SME customers as they migrate into China. |

| |

| In Singapore, 80% of the "Enterprise 50" companies are DBS?customers, and seven out of the 10 finalists of the "Rotary-ASME Entrepreneur of the Year Award 2002" are our clients. DBS?regional operations have helped us win the "Best Trade Finance Bank" in Singapore award from Global Finance Magazine based on "transaction volume, scope of global coverage, customer service, competitive pricing and innovative technologies". DBS provides these customers with increasingly convenient cash management services, trade financing, hire purchase financing and working capital loans for their near-term business needs, as well as sophisticated investment banking advice to enhance their long-term business growth prospects. |

| |

|

| |

| The DBS Network |

| DBS?extensive distribution network straddles across all customer contact points, including branches, ATMs, call centers, cash acceptance machines, and internet banking. DBS has 87 branches in Singapore, 75 branches in Hong Kong, and 62 branches in Thailand. In Singapore, DBS has a proprietary selfservice banking network that has 1,000 electronic terminals around the country. DBS also has almost 420,000 online customers. |

| |

| Strategically, DBS?goal is to use its branches for product promotions and wealth management services, to direct routine service traffic to the call centers and electronic banking facilities. In this increasingly competitive banking landscape it is critical for DBS to maintain personal contact with customers at the branches for value-added services. However, routine banking and financial transactions will continue to be migrated to electronic facilities to improve the cost dynamics per transaction. |

| |

|

|

| (Left & Center) Strategically, DBS uses its branches for product promotions and wealth management services.(Right) Close to 400 cabs promoting "Cashline" ply our streets each day, helping to garner more than 125,000 accounts since its launch. |

| |

| Did you know? |

| • |

DBS has 3.5 million ATM card holders among Singapore’s population of 4.2 million |

| • |

DBS processes 17 million self-service electronic banking transactions per month estimated at 70% of Singapore’s volume |

| • |

DBS has a total of 1,000 electronic banking terminals in Singapore |

| • |

DBS?ATM clusters have on average 99.8% uptime rate |

| • |

The number of customers who rated DBS an "excellent" for overall services increased by more than 50% to 112,000 in 2002. |

| • |

Transaction volume at cash deposit machines has increased 150% from 6.25 million in 2001 to 15.57 million in 2002 |

| • |

In 2002, DBS received applications for over one billion units of the DBS leadmanaged S$204.5 million CapitaMall Trust. DBS?ability to harness the power of its retail distribution through electronic channels contributed to the five times oversubscription of this first Real Estate Investment Trust offering in Singapore. |

|

| |

|

|

| (Left) The strategic locations of our e-banking facilities add to our customers?convenience in carrying out banking transactions 24 hours a day, 7 days a week. (Center) The POSB Mastercard proved to be a big hit with customers. More than 150,000 cards were issued within one year of the launch. (Right) Leveraging on the vast network, DBS?ATMs have proven to be a highly effective distribution channel for promoting products to customers as well as raising awareness of its offerings. |

| |

|

| |

| Customer Service |

| When a bank processes as much as 70% of the estimated retail transactions in a country, as DBS does, the burden to maintain best-in-class service levels is challenging. Competitors that process a small fraction of DBS?volumes have an advantage in only providing selected services. Nevertheless, DBS is committed to delivering superior customer services and has made significant investments in people, technology and systems to address this challenge. |

| |

| In Singapore, we define customer access through the widest and most comprehensive range of branches, electronic banking services, and call centers. These customer touch points increasingly provide unique services. DBS is the first bank to use its ATMs to offer electronic facilities such as unit trust applications, automobile "Certificate of Entitlement" bidding, instant application for internet banking and IPO bidding. DBS is also the only bank whose ATMs support three languages: English, Chinese and Malay. |

| |

| The second pillar of building strong customer service is the Bank’s commitment to high standards in "straight through" processing with very low default rates. DBS now has eight processing operations that are ISO certified, implying that error rates have been reduced through disciplined process management. ATM clusters have improved their uptimes to 99.8% on average in 2002. We introduced in our Hong Kong and Singapore operations the Six Sigma standard. Currently, DBS estimates that it is operating at about 4.5 Sigma and has been noted by international trade magazines for its high processing standards. |

| |

|

| DBS?extensive suite of products and services is designed to suit the customer’s wealth journey, personal achievements and lifestyle preferences. |

| |

|

| |

|

|

|

|

|

|

|