| Banking in Asia has become much more challenging as both retail and corporate customers are now more demanding, and have much more sophisticated financial needs. |

| |

| The financial markets were once anchored by plain deposits and loans. Increasingly, both retail and corporate customers are turning to the capital markets for either investments or funding needs. DBS has stayed on top of these trends. On the consumer front, DBS has actively led the industry in originating investment alternatives to plain deposits. For corporate customers, DBS continues to be a leader in the underwriting and placement of funding needs through the capital markets. We also provide highly competitive Treasury risk management and yield enhancement solutions. |

| |

| Traditional retail and corporate banking products, as well as mortgage and corporate loans, have witnessed unprecedented price competition, sharply reducing the profitability of traditional businesses. DBS has positioned itself to be a leader in many of the new and developing businesses that generate potentially much better profitability dynamics. By investing and building capabilities in more sophisticated financial services, DBS differentiates itself from many of its competitors. |

| |

|

|

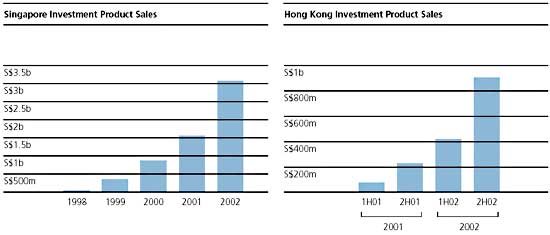

(Left) One of our key drivers has been our ability to cross-sell wealth management products through our distribution network. (Right) Being a customer of DBS?Treasures Priority Banking means having access to its services regardless of geography - whether in Singapore or Hong Kong. |

|

| |

|

| |

| Wealth Management |

| DBS has achieved extraordinary success in Wealth Management by growing the volume of business distributed to our retail customer bases. DBS has moved aggressively to become both a leading and a trusted financial advisor. |

| |

| In Singapore, DBS grew from selling S$1.6 billion of investment products in 2001 to S$3.1 billion in 2002. In Hong Kong the combined DBS Kwong On Bank and Dao Heng Bank entities sold S$1.4 billion of investment products compared to S$450 million in 2001. In fact, the sales of investment products in the second half of 2002 was more than five times that of the first half of 2001, before the DBS acquisition of Dao Heng Bank. |

| |

|

| |

| DBS achieved this success by delivering top product lines through our strong distribution capabilities. DBS actively seeks out top global investment funds for its customers through its alliance with Frank Russell and through other third party funds. We provide bancassurrance products and services exclusively through Aviva, and global online trading through our alliance with TD Waterhouse. In 2002 the largest selling products were the structured products such as "Growth" and "Swing" that offer guaranteed principal and upsides that are linked to regional equity indices. These products were structured in-house by our Treasury and Markets team. |

| |

|

| |

| Investment Banking |

| Notwithstanding the weak equity markets, DBS captured a 35% market share of IPO volumes. DBS?investments in building deeper investment banking capabilities paid off in other areas such as in debt capital markets and merger and acquisition advisory activities. |

| |

| • |

DBS was again ranked No.1 in debt capital market activity by Thomson Financial with a market share of 20%. |

| |

| • |

According to Bloomberg, the M&A advisory team emerged No.1 in Singapore with 23 transactions to its credit. Including the M&A team based in Hong Kong, DBS completed 40 transactions in 2002 that gave us a No.1 ranking by Thomson Financial for Asia ex-Japan. |

|

| |

| Besides the strong market shares in the various investment banking markets, DBS stood apart with the creativity of its landmark deals. Most notably, DBS successfully launched a S$205 million underwritingfor CapitaMall Trust, which was the first Real Estate Investment Trust (REIT) in Singapore. DBS also lead-managed the S$240 million A-REIT transaction for Ascendas Investment and Macquarie Goodman Industrial Management, the first industrial property REIT in Singapore. The investment banking team completed the securitization of Capital Square, which was the largest Singapore Dollar bond issue, and the US$180 million Syndicated Financing for Shanghai Hua Qing, which was awarded the IFR "China Loan of the Year". |

| |

| Awards and Accolades won by DBS Investment Banking Group in 2002 |

| The Asset’s Asian Awards 2002 |

| • |

Best Domestic Investment Bank in Singapore |

| • |

Best Mid-Cap Loan House |

| • |

Best New Equity Structure for Ascendas REIT |

|

| IFR Asia Awards 2002 "Review of the Year" |

| • |

"China Loan of the Year" for Shanghai Hua Qing Real Estate Term Loan solely-arranged by DBS |

| • |

Singapore Loan House of the Year |

| • |

IFR Asia’s top bookrunner of all Singapore dollar bonds |

|

| Thomson Financial’s and Bloomberg’s top M&A advisor of completed deals in Asia (by transaction number) |

|

| Project Finance magazine (published by Euromoney) |

| • |

"Asia Pacific Telecoms Deal of the Year for 2002" for Maxis Mobile/ Maxis Communications US$435 million term loan lead-arranged by DBS |

|

| Euroweek "Asian Review of the Year 2002" |

| • |

"Best sovereign/ public sector Asian Loan 2002" for Bangko Sentral ng Pilipinas US$675m term loan with DBS as a co-ordinating arranger |

| • |

"Best corporate Asian Loan 2002" for Maxis Mobile/Maxis Communications US$435 million term loan lead-arranged by DBS |

|

| Global Investor "Asia Pacific Sub-Custody Survey 2002" |

| • |

Number One Custodian Bank for Singapore |

|

| Global Custodian |

| • |

"Best for Custody Services in Thailand" for DBS Thai Danu Bank |

| • |

Top ratings for custody services in Singapore |

|

| GSCS Benchmarks "Review of Sub-custodian services 2002" |

| • |

Star Ratings for excellence for settlement performance, safekeeping performance and overall performance |

|

| Global Finance |

| • |

Best Trade Finance Bank in Singapore 2002 |

|

| Euromoney Awards for Excellence 2002 |

| • |

Best Bank in Singapore 2002 |

| • |

Best Equity House in Singapore |

| • |

Best Bond House in Singapore |

|

| FinanceAsia 2002 Country Awards |

| • |

Best Local Investment Bank |

|

| Asiamoney’s Best Domestic Bank Awards 2002 |

| • |

Best Bank in Singapore |

| • |

Best Domestic Equity House |

| • |

Best Domestic Bond House |

|

|

| |

|

Top bookrunners of Singapore dollar bonds 1/1/02 - 31/12/02 |

|

|

|

|

Name |

Issues |

Amount S$ (m) |

% |

|

|

|

|

|

DBS |

12 |

1,532.5 |

19.7 |

|

|

|

|

|

Citigroup/SSB |

22 |

1,346.8 |

17.3 |

|

|

|

|

|

Standard Chartered |

28 |

987.6 |

12.7 |

|

|

|

|

|

HSBC |

18 |

892.5 |

11.5 |

|

|

|

|

|

OCBC |

13 |

659.6 |

8.5 |

|

|

|

|

|

UBS Warburg |

7 |

413.8 |

5.3 |

|

|

|

|

|

Banc of America |

4 |

364.2 |

4.7 |

|

|

|

|

|

Barclays Capital |

4 |

349.8 |

4.5 |

|

|

|

|

|

UOB |

2 |

282.7 |

3.6 |

|

|

|

|

|

Deutsche |

3 |

267.5 |

3.4 |

|

|

|

|

|

Total* |

117 |

7,774.3 |

|

|

|

|

|

|

*Market Volume |

Proportional credit |

|

|

|

Source: Thomson Financial |

SDC Code AS12 |

|

|

DBS was again ranked Number One in debt capital market activity by Thomson Financial with a market share of 20%.

|

|

|

|

| In 2002, DBS was the Manager of Star Cruises?HK$1.2 billion rights issue and had earlier raised US$80million for Star Cruises?second major equity transaction. |

|

|

| |

| DBS' Investor & Trusts Services continued to prevail over declining indices and decreasing trade volumes with a steadfast focus on delivering quality services to its international and domestic clients. In the process, it won several awards from premier global financial magazines including the "Best Custodian Bank" in Singapore by Global Investor, the "Top Rated Custody award for Singapore" by Global Custodian, and a 4-star rating by GSCS Benchmarks. Additionally, DBS Thai Danu Bank was placed among the best for custody services in Thailand by Global Custodian and achieved the highest overall score in the survey of emerging markets world-wide. |

| |

|

| |

| Treasury and Markets |

| As our corporate and retail customers increasingly turn to the markets as their source of funding or investments, DBS?Treasury and Markets team has played a key role in maintaining DBS?status as a key financial intermediary in the region. Treasury and Markets leverages off the strong liquidity of DBS?balance sheet to maintain its role as a leading market maker in the regional currency and interest rate markets. |

| |

|

| Increasingly the Treasury and Markets business emphasizes customer related businesses, is more focused on structuring derivatives and is more geographically diversified. Shown above, the Treasury & Markets trading floor in Hong Kong. |

| |

| Our Central Treasury function manages the excess funds of the Group. Surplus deposits, if channelled to the interbank market, earn very low yields given the current interest rate environment. We systematically looked for higher investment alternatives. At end 2002, S$8.4 million of our surplus funds were invested in medium-term, investment-grade debt securities. This initiative helped us improve our overall net interest margin from 1.87% in 2001 to 1.99% in 2002 despite the low interest rate environment, and the pricing pressures on existing and new mortgage loans. |

| |

| Increasingly, the Treasury and Markets business emphasizes customer related businesses, is more focused on structuring derivatives, and is more geographically diversified. |

| |

| • |

Of the Treasury income reported in the "Other Income- Gains/Losses on Foreign Exchange, Derivatives and Securities" line item, about 50% of these earnings are driven by customer-related transactions. |

| |

| • |

In the past, the Group relied on basic interest rate and foreign currency products. Today, it is moving up the value-add curve by structuring more complex interest rate, foreign currency and equity derivatives that are tailored to meet DBS?customer needs for yield enhancement or for hedging. |

| |

| • |

In 2001, 87% of Treasury earnings came from Singapore, and 8% came from Hong Kong. In 2002, 70% of Treasury earnings came from Singapore and 28% from Hong Kong. |

|

| |

| Despite the expansion of treasury product range and earnings, DBS?market risk as measured by its Daily Earnings at Risk (DEaR) continues to be conservative. The DEaR limit is carefully monitored. Throughout 2002, it was held in a fairly tight range of an average of S$14.9 million, or a level equal to 0.1% of DBS Group’s shareholder funds, which is in line with that for leading international banks. |

| |

|

| The Group uses a Daily Earnings at Risk (DEaR) measure as one mechanism for controlling trading risk. The DEaR chart (left) shows the daily distribution of DEaR in the trading portfolio. The table (right) shows the year-end average, high and low DEaR for each trading risk classification for the DBS Group. |

| |

|

| |

|

|

|

|