breaking-new-ground

Breaking New GroundThe “can-do” bank: How DBS tried new ways to do good by customers

By DBS and The Nutgraf, 2 Aug 2023

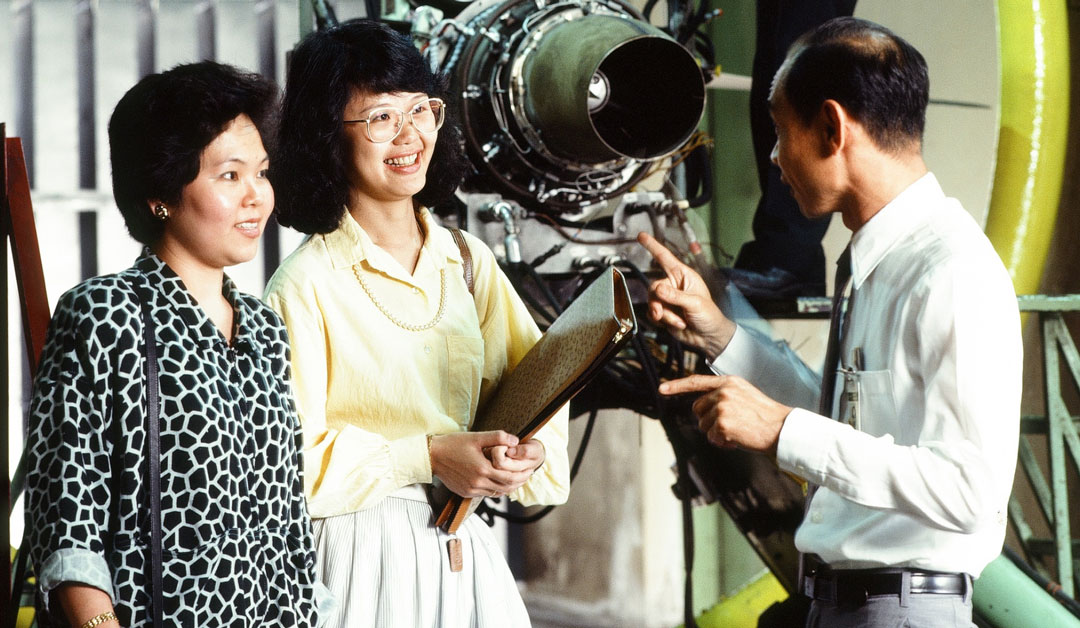

Corporate banking employees during a visit to a customer’s aircraft repair factory in 1986. Photo: DBS

The articles in this series are presented jointly by DBS and content agency The Nutgraf. In the lead up to the bank’s 55th anniversary, The Nutgraf team interviewed 12 alumni to uncover these lesser-known stories about the bank in its early days, and its key contributions to a young and developing Singapore.

Six months before the turn of the new millennium, DBS senior managing director Tan Soo Nan was nervously putting the final touches to the launch of a new product with US investment group Frank Russell.

The new product, named Horizon Investment Fund, had much riding on it. For one thing, the landscape of Singapore banking had changed.

The Government had earlier taken steps to liberalise the banking industry, which meant that there was going to be more competition and opportunities for Singapore banks. DBS wanted to entice the mass affluent investor with a new suite of investment products but it needed a strong brand to accompany it.

“My mandate was to work with an international fund manager to give the retail investors here the brand, the confidence in our new product. So we worked with the house of Frank Russell,” said Mr Tan.

He turned to Frank Russell. While they were keen, they didn’t think Singapore’s market was big enough. Unit trusts raised an average of SGD 50 million to 60 million from their launch, which was just a third of the USD 100 million a typical launch usually raised.

Undaunted, Mr Tan raised the stakes and countered that they could get SGD 300 million in funds.

“It did not deter us. I was convinced that it could be done. So we set a target of about SGD 300 million, compared to the minimum of about USD 100 million in the US,” he said.

It was a risk but, in Mr Tan’s eyes, a calculated one. And it paid off.

The Horizon Investment Funds, which had a minimum investment of SGD 50,000, blew past the SGD 300 million target. It raised SGD 840 million barely a year after its launch.

What was equally striking was the approach DBS took to raise the funds: at a time when pushy marketing tactics were quite common, it prohibited mis-selling and provided training and incentives for its bank officers to educate Singaporeans about how to wisely manage their money through unit trusts.

For DBS, this rewarding outcome reaffirmed the ethos that guided it since its inception as a development bank in 1968: it can be done, no matter the odds.

This thinking has motivated its bankers over the decades to push the envelope and try new things to do good by consumers and Singapore’s financial sector.

From going against banking conventions to launch new products, to conducting data-driven experiments in transforming user experience and raising the bar in upskilling bank staff to serve customers better, DBS has had its fair share of “can-do” moments.

“It goes back to DBS’ mission, to its role in Singapore. We were all conscious that if there is a gap to be filled, if there is a way to strengthen Singapore's financial system and capital markets, then there is a role for DBS,” said Mr Tan.

Autosave comes to town

One early example of how DBS pushed the market in a new direction was introducing a product in January 1980 that made it possible for Singaporeans to earn interest on the balances in their current account for the first time. At that time, members of the Association of Banks (ABS) had an agreement not to pay interest on current accounts.

“DBS invented Autosave – a hybrid of the current account and savings account,” recalled Mr Lock Sai Hung, a DBS pioneer who joined the bank in 1969.

It came up with a “manual sweep” solution to automatically transfer funds from customers’ current account into an Autosave savings account where the balance would earn interest – 6.5% per annum at the time of its launch.

“This was a huge movement. We started with personal banking Autosave. Later, we went to corporate Autosave. We garnered a huge pool of funds. Whether you were a company or a personal depositor, you wanted the best rates. And this was the best,” said Mr Lock.

The product was welcomed by Singaporeans, who had “endured for too long the cold and unimaginative services” offered by dominant banks, a commentary in the Sin Chew Jit Poh noted.

Not surprisingly, the Autosave scheme came under fire from certain ABS members which The Business Times described as a “cosy cartel”, which had set lending and prime rates at a relatively generous mark-up above their costs of funding, while offering no interest on their current account deposits. As a relatively new player in the retail banking market, DBS did not become an ABS member until a day after the launch of Autosave.

Six local banks even “made their objections known to the Ministry of Finance in apparently strong terms but the Ministry gave them the short shrift”, reported The Business Times on 6 November 1980.

DBS stood its ground, driven by the “great conviction that Autosave was good for customers”, recalled Mrs Elsie Foh, who joined as a senior officer in 1974 and would rise to become the Consumer Banking Group’s Managing Director & Chief Operating Officer in 2003.

“We had confidence that we would not have to pull it out,” she said. “Slowly but surely the other banks decided that it made sense, and so they followed.”

By end 1980, the furore in the industry against Autosave had “dwindled to reluctant acceptance”, reported BT, adding that DBS “saw Autosave as a much-needed innovation that improved the service offered to its customers”.

The “how can” mindset

The idea of Autosave, as Mrs Foh recalled, arose from a simple question: how can we do good for more customers?

The answer, in a nutshell, was to ask even more “how can” questions to stimulate further innovation in banking products and user experience.

When millions of people thronged DBS branches to subscribe for shares in Initial Public Offerings (IPO), Mrs Foh’s team asked, “How can we encourage more people to use ATMs to apply for shares?”

DBS employees organising thousands of share applications received in 1986. Photo: DBS

During the early 1990s, people manually applied for shares, leading to huge operational inefficiencies and crowd control issues, not to mention over-worked staff, recalled Mrs Foh.

“So we thought hard and said, ‘Why don't we let people use the ATM to apply for a cashier’s order to buy the SingTel shares?’,” she recounted.

The result was the ESA (Electronic Shares Application) service via ATMs. It proved a big hit, significantly shrinking queues and setting a new industry practice as other local banks adopted ESA for their ATMs.

Automating to serve customers better

Another “can do” moment came when customers complained about their ATM experience.

“Many customers would tell us, ‘I wanted SGD 10 notes but I couldn't get it. How come your ATM has run out of cash so fast?’” said Mrs Foh.

So the DBS retail banking team experimented with data-driven approach to fix these issues. Working with the IT department, it came up with tools to “see how often the machine had to be replenished, which denominations had run out, and which ATMs were more frequently utilised and were out of funds”, recalled Mrs Foh.

“It was not as sophisticated as today, where you have robotics and advanced AI to help you. But in those days, it was good enough for us to know that these particular lots of ATMs need to be replenished sooner than the others,” she said.

The automation of banking processes over the years – through ATMs, Autophone banking, internet and mobile banking – meant that one question frequently popped up: how can we optimise the use of DBS’ physical branches?

“When we developed more innovations, people did not need to go to the bank that often.

We thought: our bank branches could do more marketing and sales and this would bring more product innovations at the same time,” said Mrs Foh.

“So how can we sell more loans, different types of loans? How can we sell various types of investment products?”

Raising the training bar

One solution was to help DBS bank tellers upskill to become customer service officers and relationship managers so they could sell more products.

Having acquired POSB in 1998, amid a wave of consolidation ahead of Singapore’s financial sector liberalisation, DBS now had an even larger customer base and network of branches.

One golden training opportunity took place in 1999, ahead of the launch of Horizon Investment Funds.

Mr Tan set strict guidelines for selling the product: “Retail investors must purchase this unit trust with their eyes wide open about the possible returns and risks.”

“I said, we cannot mis-sell. If you were to simply keep pushing the product, then you run the risk that you could be selling it to the wrong person,’” he recalled. “So we needed to provide training and provide disclosures to make sure everyone was above-board. Most important of all, we need to provide incentives to our customer officers to talk to our branch customers.”

To encourage a can-do mindset, DBS designed a performance-based incentive system that treated all officers equally.

“Why would they want to do this extra work to sell the product? The incentive must be designed in the way that it's got nothing to do with your academic qualification or to your position in the organisation,” explained Mr Tan.

The rest, as they say, is history. The Business Times reported in November 2000 that Horizon was the biggest most successful launch of any fund.

The training and experience DBS gained from the Horizon series also paved the way for the launch of a product truly designed for the man-on-the-street in January 2000: the Eight funds, which had a minimum investment amount of SGD 5,000. By March 2001, the Horizon and Eight multi-manager funds would have SGD 1.47 billion in assets.

“We demonstrated that a retail banking investment product with the right structure and model can actually bring in a lot of money,” said Mr Tan.

Data-driven customisation

To provide its banking officers with a wider range of quality products to sell, DBS had also been digging deep into data and technology to better understand consumers’ needs.

Over the decades, it had already developed a rich customer information system that tracked its customers’ usage of ATM cards, savings accounts, loan payment patterns, spending behaviour and much more.

With this, it started early on to customise retail banking products for different segments – an approach it tested out with the launch of personal loans, which were a relatively new concept in the early 1990s.

DBS packaged different loans for specific needs, from weddings to education, housing, renovation and even for purchasing works of art. “We used the word ‘Assist’ to brand these products: Student Assist, Home Assist and more,” said Mrs Foh.

This design helped consumers put their finger easily on what specific loan product they needed when they walked into a branch, and promptly receive relevant loan details such as interest rates and duration, she added.

DBS employees discussing credit card designs with the bank’s advertising agency in 1987, the year before the cards were launched. Photo: DBS

DBS took customisation to another level in 1988 when it became the first local bank to enter the Singapore credit card market, which was previously dominated by foreign players. Having acquired a team of experienced staff from the credit card unit of a foreign bank, it set up a separate subsidiary to manage the new business and tapped its massive database of customer insights to offer more competitive products.

“After we launched our first credit card, competition in the credit card market became very intense. That was when a lot of credit card innovations came,” said Mrs Foh, recalling the slew of products such as co-branded credit cards with Esso petrol stations and Takashimaya shopping centre that Singaporeans still use today.

The can-do spirit lives on

Three decades on, exponential advances in Big Data and digital finance across Singapore’s banking sector have led to fresh product innovations as well as customisation at scale.

DBS has led the way with a host of innovations from the launch of its digital payments platform DBS PayLah! in 2014 to the introduction of Singapore’s first Video Teller Machines in 2017. This has won the bank a host of awards over the years, including the title of “Most Innovative Financial Institution – Global” (2022) and the “World’s Best Bank” by Global Finance (2022).

From integrating video analytics with robotics for oversight and customer meet-and-greets, to honing its hyper-personalisation capabilities through AI and generating over 30 million monthly insights in Singapore for its consumer banking and wealth management clients using its digital financial planning tool NAV Planner, DBS has opened new possibilities for customers to “Live more, Bank less”.

Even as DBS’ innovation quest exponentially expands the universe of “can-do” opportunities, its mindset of doing good for the customer has not shifted.

As Mr Lock put it, “You have to serve the best interests of your customers, that should be your whole focus.”