Corporate Governance

OUR COMMITMENT TO GOVERNANCE

DBS Group Holdings Ltd (DBSH) is fully committed to effective governance to protect the interests of all our stakeholders and to promote the long-term sustainability of the Group. The Group’s efforts in improving corporate governance were recognised and it was named the winner of the Singapore Corporate Governance Award 2013 in the Big Cap Category.

For the financial year ended 2013 (“FY2013”), DBSH has complied with the Banking (Corporate Governance) Regulations 2005 (“Banking Regulations”), and complied in all material aspects with the principles laid down by the Guidelines on Corporate Governance for Banks, Financial Holding Companies and Direct Insurers issued on 3 April 2013, which comprises the Code of Corporate Governance 2012 (“2012 Code” or “Code”) and supplementary guidelines and policies added by the Monetary Authority of Singapore (MAS) (“Guidelines”) to cater to the diverse and complex risks undertaken by financial institutions.

This report is arranged according to the principles listed in the Code. Principles 1 to 6 deal with Board matters, principles 7 to 9 with remuneration, principles 10 to 13 with accountability and audit and principles 14 to 16 with shareholder rights and responsibilities.

BOARD MATTERS

THE BOARD’S CONDUCT OF AFFAIRS

(PRINCIPLE 1)

Our Directors

The Board comprises nine directors, namely Mr Peter Seah Lim Huat (Chairman), Mr Piyush Gupta (Chief Executive Officer or “CEO”), Dr Bart Joseph Broadman, Ms Euleen Goh Yiu Kiang, Mr Ho Tian Yee, Mr Nihal Vijaya Devadas Kaviratne CBE, Mr Andre Sekulic, Mr Danny Teoh Leong Kay and Mrs Ow Foong Pheng.

Board Balance and Diversity

- 1 Executive Director

- 8 Non-Executive Directors, out of which 7 are Independent Directors (including the Chairman)

- 78% Male, 22% Female

Please refer to pages 188 to 192 of this Annual Report for key information of each director. Biodata of each director can also be found @ www.dbs.com

Board Responsibility

The Board directs the Group in the conduct of its affairs and ensures that corporate responsibility and ethical standards underline the conduct of the Group’s business. It bears ultimate responsibility for the Group’s governance, strategy, risk management and financial performance.

The Board believes that it is important to have a corporate culture imbued with the principles of corporate governance and to this end, seeks to ensure that a robust corporate governance framework is in place to promote transparency, fairness and accountability throughout the organisation.

Key Responsibilities of the Board

- Setting the strategic vision, direction and long-term goals of the Group and ensuring that adequate resources are available to meet these objectives

- Approving and monitoring capital and financial plans, the annual budget, the annual and interim financial statements, capital expenditures and strategic acquisitions and divestments

- Establishing a framework for risks to be assessed and managed

- Reviewing management performance

- Determining the Group’s values and standards (including ethical standards) and ensuring that obligations to its stakeholders are understood and met

- Developing succession plans for the Board and CEO

- Considering sustainability issues (including environmental and social factors) as part of the Group’s strategy

Delegation by the Board

To enable the Board to discharge its stewardship and fiduciary responsibilities effectively, it delegates authority to Board committees to oversee specific responsibilities based on clearly defined terms of reference.

The terms of reference for each Board committee stipulate the responsibilities of the committee, quorum and voting requirements, as well as qualifications for Board committee membership. Each Board committee has direct access to management and the power to hire independent advisers as it deems necessary. Changes to the terms of reference for any Board committee require Board approval.

An integral part of the Group’s corporate governance framework is the Group Approving Authority (GAA) established by the Board. The GAA sets out the delegation of authority at various levels and is consistently applied throughout the Group. Changes to the GAA require Board approval.

Material Transactions Requiring Board Approval

The material transactions that require Board approval under the GAA include:

- Group’s strategic and business plans

- Group’s annual budget

- Capital expenditures and expenses exceeding certain material limits

- Strategic investments and divestments

- Capital-related matters including capital adequacy objectives, capital structure, capital issuance and redemption

- Dividend policy

- Risk strategy and risk appetite

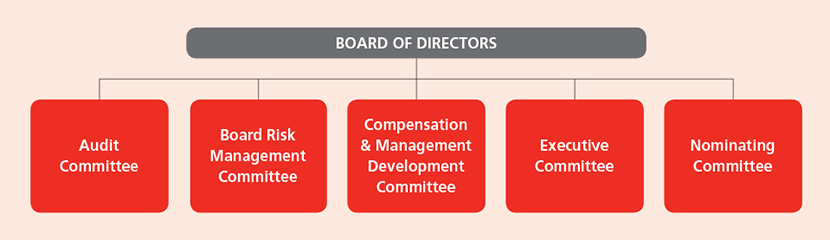

Board Committees

The Board committees have been constituted in compliance with the Banking Regulations. A brief description of the composition and responsibilities delegated to each Board committee is set out in the table below.

| Board Committee | Main Areas Of Oversight | Composition | Further Information |

|---|---|---|---|

| Executive Committee (Exco) |

|

Comprises 3 members, of which 2 members (including the Exco chairman) are independent directors. | See page 54 of this report for further information on the composition, responsibilities and activities of the Exco. |

| Nominating Committee (NC) |

|

Comprises 5 members, of which 4 members (including the NC chairman) are independent directors. All members are non-executive directors. | See page 55 of this report for further information on the composition, responsibilities and activities of the NC. |

| Audit Committee (AC) |

|

Comprises 5 members, of which 4 members (including the AC chairman) are independent directors. All members are non-executive directors. | See pages 70 to 71 of this report for further information on the composition, responsibilities and activities of the AC. |

| Board Risk Management Committee (BRMC) |

|

Comprises 6 members, all of whom are independent and non-executive directors. | See page 68 of this report for further information on the composition, responsibilities and activities of the BRMC. |

| Compensation and Management Development Committee (CMDC) |

|

Comprises 4 members, all of whom are independent and non-executive directors. | See page 58 of this report for further information on the composition, responsibilities and activities of the CMDC. |

Board Meetings and Attendance

The Board meets on a regular basis, and ad-hoc meetings are held where warranted. During the scheduled Board meetings, the Board is updated by management on the Group‘s business activities and performance to enable the Board to have a deeper insight into the Group’s businesses. The Chairman of each Board committee will also update the Board on the matters discussed during the respective Board committee meetings.

When exigencies prevent a director from attending a Board meeting in person, he or she can participate by telephone or video-conference. Board approvals for routine matters in the ordinary course of business can also be obtained through written resolutions approved by circulation as permitted under the Articles of Association of DBSH.

Board Activity in 2013

There were 5 scheduled Board meetings and 2 ad-hoc Board meetings in 2013. Key matters discussed at these meetings include financial performance, annual budget, corporate and risk strategy, business plans, significant operational matters, capital-related matters (including the issuance of perpetual capital securities by DBSH in exchange for the Class N Preference Shares issued by DBS Bank) and potential acquisitions/divestments.

Regular reports received by the Board at scheduled Board meetings include:

- presentations by the CEO on the Group’s business and operations;

- presentations by the CFO on financial performance and significant financial updates; and

- presentations by external professionals on impending changes in market conditions as well as corporate governance, capital, tax, accounting, listing and other regulations, which may have an impact on the Group’s affairs.

The table below sets forth the number of meetings held and attended by Board members during the financial year.

ATTENDANCE AT BOARD AND BOARD COMMITTEE MEETINGS

(1 JANUARY 2013 TO 31 DECEMBER 2013)

| Name of Director | Board Meetings | EXCO Meetings | AC Meetings | BRMC Meetings | NC Meetings | CMDC Meetings | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| No. of Meetings Held @ Attendance |

No. of Meetings Held @ Attendance |

No. of Meetings Held @ Attendance |

No. of Meetings Held @ Attendance |

No. of Meetings Held @ Attendance |

No. of Meetings Held @ Attendance |

|||||||

| Peter Seah Lim Huat | 7 | 7 | 11 | 11 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Piyush Gupta1 | 7 | 7 | 11 | 11 | – | – | – | – | – | – | – | – |

| Bart Joseph Broadman | 7 | 7 | – | – | – | – | 4 | 4 | – | – | 4 | 3 |

| Christopher Cheng Wai Chee2 | 2 | 2 | – | – | 2 | 2 | – | – | – | – | 2 | 2 |

| Euleen Goh Yiu Kiang | 7 | 7 | 11 | 11 | – | – | 4 | 4 | 4 | 4 | 4 | 4 |

| Ho Tian Yee | 7 | 7 | – | – | – | – | 4 | 4 | 4 | 4 | – | – |

| Nihal Vijaya Devadas Kaviratne CBE | 7 | 7 | – | – | 4 | 4 | 4 | 4 | – | – | – | – |

| Andre Sekulic | 7 | 7 | – | – | 4 | 4 | – | – | – | – | 4 | 4 |

| Danny Teoh Leong Kay | 7 | 7 | – | – | 4 | 4 | 4 | 4 | 4 | 4 | – | – |

| Woo Foong Pheng (Mrs Ow) |

7 | 6 | – | – | 4 | 3 | – | – | 4 | 4 | – | – |

| 1 | Mr Piyush Gupta attended all AC, BRMC and CMDC meetings held during the financial year by invitation of the relevant committee |

| 2 | Stepped down on 29 April 2013 as (i) Director of DBSH and DBS Bank, (ii) Member of AC and (iii) Member of CMDC |

Board Induction and Training

A comprehensive and tailored induction is arranged as part of the on-boarding programme for every new director to familiarise him or her with the discharge of his or her duties and to introduce the Group’s business and governance practice and arrangements, amongst others. The Group also encourages and make arrangements for first-time directors to attend the Singapore Institute of Directors’ ‘Listed Companies Directorships’ programme.

Please refer to page 56 of this report for details on the selection criteria and nomination process as well as the induction programme for new directors.

A continuous development programme was introduced in 2010 to enhance Board effectiveness. The objective of this programme is to provide directors with training by external professionals and management to keep them abreast of legal, regulatory, corporate governance and economic developments which are relevant to the business and operations of the Group. To ensure that the topics covered under this programme are relevant and appropriate, the NC regularly reviews the schedule and proposes topics that would meet the objective of the programme. In 2013, the programme covered topics such as key developments in China, US and the region, overview of the Singapore Personal Data Protection Act, update on European banking developments, and update on directors’ duties under recent legislative and corporate governance initiatives.

BOARD COMPOSITION AND GUIDANCE

(PRINCIPLE 2)

Independence of Judgement

There is a strong independent element on the Board, with the independent directors making up more than two-thirds of the Board. The number of independent directors exceeds the requirements set out in the Code, Guidelines and Banking Regulations. This ensures that the Board is able to exercise objective judgment on corporate affairs independently.

Annual Review of Director’s Independence

The NC conducts a review and determines annually whether each director is independent. In making its determination, the NC considers whether a director is: (i) independent of management and business relationships (for example, an independent director should not be a former employee or significant customer or supplier of the Group, a close relative of an executive director, or related to any of the Group’s external auditors, lawyers, consultants or service providers); (ii) independent from substantial shareholders; and (iii) independent based on length of service. Independence is assessed in compliance with the stringent standards required of financial institutions prescribed under the Banking Regulations.

The seven directors considered independent by the NC are Dr Bart Broadman, Ms Euleen Goh, Mr Ho Tian Yee, Mr Nihal Kaviratne, Mr Peter Seah, Mr Andre Sekulic and Mr Danny Teoh. The independent directors provide the Board with objectivity and a balance of perspectives. They also ensure that the performance of management is objectively measured against the key performance indicators established annually to measure and guide management performance.

Ms Euleen Goh, Mr Ho Tian Yee, Mr Nihal Kaviratne, Mr Peter Seah and Mr Danny Teoh are on the boards of companies that have a banking relationship with DBS, and are also directors of companies linked to Temasek Holdings (Private) Limited (“Temasek-linked Companies”), DBSH’s substantial shareholder. However, the NC considers the above-named directors (i) independent of business relationships as the revenues arising from such relationships are not material; and (ii) independent of the substantial shareholder as their appointments on the boards of Temasek-linked Companies are non-executive in nature and they are not involved in the day-to-day conduct of these companies’ businesses.

Mrs Ow Foong Pheng, who is a Permanent Secretary for the Ministry of Trade and Industry, Singapore, is considered not independent of the substantial shareholder as the Singapore government is the ultimate owner of Temasek Holdings (Private) Limited. However, Mrs Ow Foong Pheng is considered independent of management and business relationships with DBSH.

Robust procedures have been instituted to manage potential conflicts of interest between a director and the Group. Such conflicts could arise, for instance, when the Group extends credit facilities or provides products or services to a director’s company. An appropriate account tagging mechanism has been put in place to monitor and control the occurrences of conflicts, which are then escalated for aggregation purposes under the SGX-ST Listing Manual (“SGX Listing Rules”). Exposures of DBS Bank Ltd (“DBS Bank” or the “Bank”) to the individual directors and their respective related concerns are tabled at the quarterly Board meetings.

Board Composition

The Board is of the view that the size of the Board is appropriate, given the current size and geographic footprint of the Group’s operations. The NC reviews the size and composition of the Board at least annually, taking into account the requirements of the business and the resourcing level required at Board committees. The Board members collectively bring range and depth of experience and industry expertise to the table, representing diversity of gender, nationality, skills and knowledge.

Executive Committee

The Exco is chaired by Mr Peter Seah and comprises Ms Euleen Goh and Mr Piyush Gupta. In accordance with the requirements of the Code, Guidelines and Banking Regulations, the majority of Exco members (including the Chairman) are independent directors.

Key responsibilities of the Exco

Review and provide recommendations on matters that would require Board approval, including:

- strategic matters such as country and business strategies

- business plans, annual budget, capital structure and dividend policy

- strategic investments or divestments

- delegation of authority stipulated by the GAA

- weak credit cases

Activities of the Exco in 2013

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

(PRINCIPLE 3)

Separation of the Role of Chairman and the CEO

The Group’s leadership model espouses a clear division of responsibilities between the Chairman and the CEO, which ensures an appropriate balance of power, increased accountability and enhanced independence in decision-making. The Chairman and the CEO are not related.

The Chairman provides clear and distinct leadership to the Board with respect to the Group’s strategic growth. The Chairman maintains open lines of communication with senior management, and acts as a sounding board on strategic and operational matters.

The CEO heads the Group Executive Committee and the Group Management Committee, which are the highest management bodies. He oversees the execution of the Group’s strategy and is responsible for managing its day-to-day operations.

The Board is of the view that it is not necessary to appoint a lead independent director, given that the present Chairman is independent, non-executive and unrelated to the CEO.

Role of the Chairman

The Chairman is responsible for leading the Board to enable the Board to discharge its duties effectively, and for maintaining and enhancing the Group’s standards of corporate governance. He oversees the setting of the agenda of Board meetings in consultation with the CEO to ensure that there is sufficient information and time to address all agenda items, and promotes open and frank debates by all directors at Board meetings. As the Chairman also sits on all the Board committees, he plays an important role in managing the business of the Board and supervising the activities of each Board committee.

The Chairman oversees, guides and advises the CEO and senior management. He also encourages constructive relations within the Board, and between the Board and senior management. Directors and members of the Group Management Committee have the opportunity to interact through regular dinners which are held around the time of each scheduled Board meeting, and at the annual Board strategy offsite.

Finally, the Chairman encourages and facilitates constructive dialogue between shareholders, Board members and management at shareholders meetings.

BOARD MEMBERSHIP

(PRINCIPLE 4)

Nominating Committee

The NC is chaired by Mr Peter Seah and comprises Ms Euleen Goh, Mr Ho Tian Yee, Mrs Ow Foong Pheng and Mr Danny Teoh, all of whom are non-executive directors. In accordance with the requirements of the Code, Guidelines and Banking Regulations, a majority (four out of five members of the NC), including the NC Chairman, are independent directors. Mrs Ow Foong Pheng, who is a non-independent director, is considered independent from business relationships and management.

NC members are subject to an annual assessment of their independence as prescribed by the Code, the Guidelines and the Banking Regulations. This independence assessment takes into account the NC members’ business relationships with the Group, relationships with members of management, relationships with the substantial shareholder of DBSH as well as length of service.

Key responsibilities of the NC

- Reviewing regularly the composition of the Board and Board committees

- Reviewing the Board’s succession plans for directors, in particular, the Chairman and the CEO

- Identifying, reviewing and recommending Board appointments for approval by the Board, taking into account the experience, expertise, knowledge and skills of the candidate and the needs of the Board

- Determining independence of proposed and existing directors, and assessing if each proposed and/or existing director is a fit and proper person and is qualified for the office of director

- Reviewing and recommending to the Board the re-appointment of any non-executive director having regard to their performance, commitment and ability to contribute to the Board as well as his or her skillset

- Conducting on an annual basis an evaluation of the performance of the Board, the Board committees and the directors

- Making an annual assessment of whether each director has sufficient time to discharge his or her responsibilities, taking into consideration multiple board representations and other principal commitments

- Exercising oversight of the training of Board members

- Reviewing key staff appointments (including CEO, CFO and CRO)

Selection Criteria, Nomination Process and Induction Training for New Directors

The NC leads and has put in place a formal and transparent process for the appointment and re-appointment of directors to the Board.

The NC recognizes the importance of an appropriate balance and diversity of industry knowledge, skills, backgrounds, experience, professional qualifications, gender and nationalities in building an effective Board. To achieve this, the NC reviews the Board’s collective skills matrix regularly to ensure that the Board has the appropriate diversity to perform effectively. The matrix takes into account whether a director has the specific knowledge, skills or experience in various areas such as banking/financial services, financial management, economics, specialised audit/ accounting, Financial Stability Board principles, remuneration practices, technical sophistication in risk disciplines, strategic planning, country expertise in other markets and strong business network.

As part of the formal process for the appointment of new directors, the NC reviews the composition of the Board and Board committees and identifies the skillsets which will enhance the effectiveness of the Board and the relevant Board committees. Thereafter, suitable candidates are identified from various sources and, in compliance with the Banking Regulations, the NC conducts an initial assessment to:

| (i) | review a candidate’s qualifications, attributes, capabilities, skills, age, past experience and such other relevant factors as may be determined by the NC to determine whether the candidate is a fit and proper person for the office in accordance with the MAS’ fit and proper guidelines (which require the candidate to be competent, honest, to have integrity and be of sound financial standing); and |

| (ii) | ascertain whether the candidate is independent from any substantial shareholder of the Group and/or from management and business relationships with the Group. |

The NC then proceeds to interview short-listed candidates to determine if he or she possesses the qualifications and skills required and makes its recommendations to the Board accordingly.

Upon appointment, a new director receives his or her letter of appointment, and is issued with a Directors’ Handbook setting out a director’s duties, responsibilities and disclosure obligations as a director of a financial institution. He or she is also briefed on key disclosure duties and statutory obligations. The new director also gains an understanding of the Group’s management, business and governance practices through a series of detailed induction briefings by members of senior management on the Group’s various businesses and support functions.

Terms of Appointment

The Group has a standing policy that a non-executive director may serve up to a maximum of 3 three-year terms. The Group considers this tenure to be appropriate for members to gain an understanding of the Group and to make an effective contribution. None of the incumbent directors have served more than 6 years.

Prior to the end of each three-year term, there is a formal process in place for the NC to consider whether to extend the tenure of the non-executive director. If a non-executive director is a member of the NC, he or she will recuse himself or herself from deliberations on his or her own re-appointment.

Rotation and Re-election of Directors

One-third of directors who are longest-serving are required to retire from office every year at the Annual General Meeting (AGM). Based on such a rotation process, each director is required to submit himself or herself for re-election by shareholders at least once every three years.

Where an existing director is required to retire from office, the NC reviews the composition of the Board and takes into account factors such as that existing director’s attendance, participation, contribution and competing time commitments when deciding whether to recommend that director for re-election.

Dr Bart Broadman, Mr Piyush Gupta and Mr Ho Tian Yee shall be retiring by rotation at the AGM to be held on 28 April 2014 (“2014 AGM”). At the recommendation of the NC, they will be seeking re-election at the 2014 AGM.

In addition, as Mr Nihal Kaviratne will be turning 70 years of age before the 2014 AGM, he is required under Section 153 of the Companies Act to step down at the 2014 AGM. At the recommendation of the NC, Mr Nihal Kaviratne will be seeking shareholders’ approval for re-appointment as a director at the 2014 AGM.

Directors’ Time Commitment

As a director’s ability to commit time to the Group’s affairs is essential for performance, the NC has formulated guidelines to assess each director’s ability to make such a commitment. The guidelines consider the number of other board and committee memberships a director holds, as well as size and complexity of the companies in which he or she is a board member. All directors are aware of his or her time commitment obligations and have met the requirements under the guidelines. In addition, each director completed a self-assessment of his or her time commitment obligations in 2013. The NC conducts a review of the time commitment of each director on an ongoing basis. The Board believes that each director has to personally determine the demands of his or her competing directorships and obligations and assess how much time

is available to serve on the Board effectively. Accordingly, the Board has not made a determination of the maximum number of listed company board representations a director may hold.

BOARD PERFORMANCE

(PRINCIPLE 5)

The NC makes an assessment at least once a year to determine whether the Board and Board committees are performing effectively and identifies steps for improvement. The evaluation covers a range of issues including Board composition as well as the timeliness and quality of information provided to the Board. As part of the Board effectiveness evaluation for 2013, each director completed a Board evaluation questionnaire and returned it to the Chairman. The evaluation results were discussed with the NC and the Board, and key action steps were mapped with the goal of enhancing the effectiveness of the Board and the Board committees.

ACCESS TO INFORMATION

(PRINCIPLE 6)

Prior to each Board and Board committee meeting, directors are provided with complete and relevant information concerning agenda items in a timely manner. All such information is uploaded onto a board portal which can be readily accessed on tablet devices provided to the directors by DBSH.

Directors have direct access to senior management and may request from management such additional information as needed in order to make informed and timely decisions. Directors have the discretion to engage external advisers at the expense of the Group.

Directors have separate and independent access to the Group Secretary at all times. The Group Secretary attends all Board meetings and ensures that applicable rules and regulations are complied with. The Group Secretary facilitates communication between the Board, its committees and management, and the induction of new directors, and generally assists directors in the discharge of their duties. The appointment and removal of the Group Secretary require the approval of the Board.

REMUNERATION MATTERS

PROCEDURES FOR DEVELOPING REMUNERATION POLICIES (PRINCIPLE 7)

LEVEL AND MIX OF REMUNERATION (PRINCIPLE 8)

Remuneration Strategy

The quality and commitment of our human capital is fundamental to our success. The overall objective of the Group’s remuneration policy is to establish a framework for attracting, retaining and motivating employees, and creating incentives for delivering long-term performance within established risk limits. The policy reinforces a culture that rewards for performance. The Group’s remuneration policy aims to be consistent with the principles and standards set out by the Financial Stability Board (FSB) and the relevant local regulators where it operates.

Our reward strategy aims to drive pay for performance culture and is aligned to our risk framework. It also balances the need for us to win the war for talent in the banking industry while protecting the long-term interests of our shareholders. Performance is judged, not only on what is achieved, but also on how it is achieved as well as alignment to the Group’s values.

Governance

The governance of the Group’s remuneration policy (including design, implementation and ongoing review) falls under the remit of the CMDC. The CMDC ensures that the balance between shareholder returns and remuneration is appropriate.

Compensation and Management Development Committee

The CMDC is chaired by Mr Peter Seah and comprises Dr Bart Broadman, Ms Euleen Goh and Mr Andre Sekulic, all of whom are non-executive and independent directors. The number of independent directors exceeds the requirements of the Code, Guidelines and Banking Regulations.

Key responsibilities of the CMDC

- Overseeing the Group’s principles and framework of compensation to ensure their alignment with prudent risk-taking to build a sustainable business in the long terms

- Overseeing the remuneration of senior executives, including reviewing and approving the remuneration of the executive director

- Approving employee incentive schemes and reviewing their effectiveness in employee retention and the creation of long-term value for the Group

- Overseeing management development and succession planning to ensure that management bench strength is robust and able to cope with attrition and the Group’s expansion plans

In fulfilling its responsibilities, the CMDC ensures that the Group complies with the corporate governance practices as stipulated under the Code, Guidelines and the Banking Regulations. Details are outlined under Principles 7, 8 and 9 of this report.

The CMDC reviews and approves the Group’s remuneration policy and the annual variable pay pool which are also endorsed at the Board level. It provides oversight of the remuneration of executive directors, senior executives and control functions in line with FSB guidelines. The CMDC also reviews cases where total remuneration exceeds a pre-defined threshold, or where a deferral mechanism is implemented as a risk control process.

The CMDC has direct access to senior management and works closely with the BRMC and the AC when performing its role. In addition, Dr Bart Broadman, Ms Euleen Goh and Mr Peter Seah are also members of the BRMC while Mr Peter Seah and Mr Andre Sekulic are members of the AC. Their membership in other Board committees enable them to make remuneration decisions in a more informed, holistic and independent manner.

In 2013, an external management consulting firm, Oliver Wyman, was engaged to provide an independent review of the Group’s compensation system and processes to ensure compliance with the FSB Principles for Sound Compensation Practices. Oliver Wyman and its consultants are independent and not related to DBSH or any of its directors.

As part of the Group’s Talent Management process, an annual review of people plans for the Group’s business and support units was undertaken by DBS Bank and endorsed by CMDC. The review focused on (i) succession and the depth of the talent pipeline; (ii) people development initiatives and readiness of the people plans to support business operations and growth plans; and (iii) quality of the Group talent development programs in each business and support units /countries as well as the state of talent development activities within the Group.

Remuneration approach

The 2 main thrusts of the Group’s remuneration approach are designed to:

-

Focus on total compensation

DBS manages remuneration from a total compensation perspective. An employee’s total compensation is determined by the Group, business and individual performances.DBS participates in remuneration surveys to ensure that its total compensation is competitive against banks of similar size and standing which we compete with for talent.

-

Alignment with appropriate risk taking behaviour

The Group aims to differentiate the ratio between variable and fixed pay according to performance, rank and function. The proportion of variable pay increases significantly with increase in responsibility and rank. This is in line with the FSB principle to ensure that employee incentives remain focused on prudent risk taking and effective control, depending on the employee’s role.The payout structure is designed to incentivise employees whose decisions can have a material impact on the Group to adopt appropriate risk behaviour. These employees include senior management, key personnel at business units and senior control staff. The Group defines this group of staff based on their roles as well as the quantum of their variable remuneration and the ratio of their variable to fixed pay, where such employees may have an impact on the risk profile of the Group.

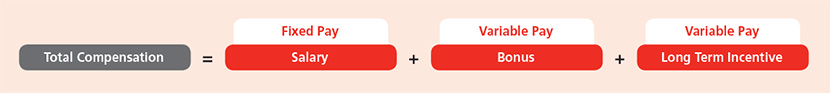

Elements of Total Compensation

An employee’s total compensation is made up of the following elements:

(1) Fixed Pay - Salary

| Purpose & Link to Strategy | Operation | Measures |

|---|---|---|

|

|

|

(2) Variable Pay – Bonus (Cash) and Long Term Incentive (Shares)

| Purpose & Link to Strategy | Operation | Measures |

|---|---|---|

|

|

|

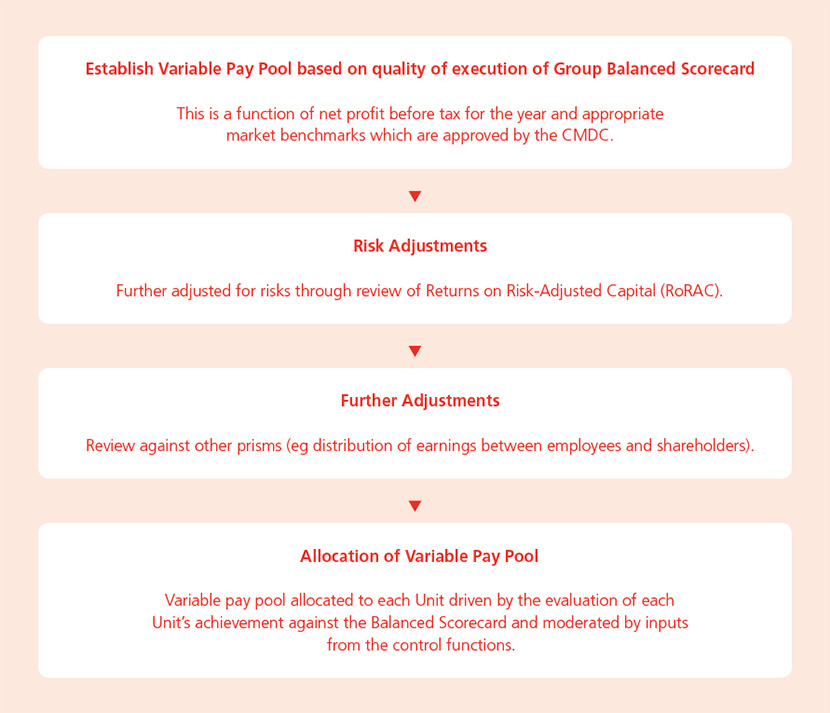

Sizing and allocation of variable pay pool

The final variable pay pool therefore takes into consideration the need to remain competitive in the markets that the Group operates in while being consistent with our risk appetite.

The Group uses a comprehensive performance management methodology based on the Group Balanced Scorecard (the “Group Scorecard”) approach to determine the size and allocation of the variable pay pool. The Group Scorecard can be found on page 23 of this Annual Report.

Inputs to the Group Scorecard need to be agreed with the Board at the beginning of each year. The Group Scorecard comprises financial and non-financial metrics encompassing employees, customers, shareholders, risks and compliance objectives. The Group Scorecard is cascaded throughout the Group to drive synergies across all Units and strengthen the alignment between pay and performance.

A summary of the Performance Management Process is as follows:

| Objective Setting | Interim Review | Performance Review |

|---|---|---|

|

|

|

The variable pay pool is derived from a combination of bottoms-up and top-down approach. This process of establishing the variable pay pool is as follows:

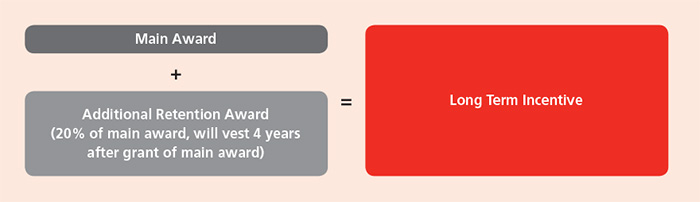

Long-term share incentives

Long-term share incentives are designed to foster a culture that aligns employees’ interests with shareholders and to enable employees to share in the Group’s success. The Group has put in place 2 plans covering all employees as follows:

| Plan | Eligibility |

|---|---|

| DBSH Share Plan (“Share Plan”) | Vice President & above |

| DBSH Employee Share Plan (ESP) | Assistant Vice President & below |

Long-term share incentives under the Share Plan and the ESP are delivered in the form of restricted share awards (“Share Awards”) which comprise two elements:

Share Awards granted under both the Share Plan and the ESP form part of employees’ annual deferred remuneration. The main award vests over 4 years in the manner set out below, while the additional retention award vests 4 years after the grant date:

- 33% of shares in the main award vest 2 years after the grant date;

- another 33% vest 3 years after the grant date; and

- the remaining 34% vest 4 years after the grant date, when retention award also vest

In addition, as part of talent retention, Share Awards which only comprise one element (i.e. the main award) may be granted to employees holding the rank of Vice President and below.

Prior to 2009, a DBSH Share Option Plan (SOP) was also part of the long-term share incentives that had been put in place. The SOP expired on 19 June 2009 and it was not extended or replaced. The termination does not affect the rights of holders of outstanding existing options.

Details of the Share Plan and SOP appear on pages 182 to 183 of the Directors’ Report.

Determining Individual Total Compensation

Individual awards are linked to the achievement of quantitative as well as qualitative objectives set out in the individual’s key performance indicators (KPIs). In addition, in determining the variable pay of senior management and the respective Units’ bonus pools, inputs from control functions such as Audit, Compliance and Risk are sought (as a check for adherence to established operational risks, concentration risk, tenure risk and country risk frameworks). An individual award is not formula driven but considered holistically taking into account both the “what” and “how” the KPIs are achieved to ensure sustainable performance as well as alignment to DBS values.

Sales employees are incentivised to promote development of mutually beneficial long-term relationships with their customers, rather than focus on short term gains. Non-financial metrics such as customer satisfaction and compliance with fair dealing principles are incorporated into their KPIs.

Control functions (Risk, Finance, Legal, Compliance and Audit) are measured independently from the business units they support to prevent any conflicts in interests. The remuneration of the CRO and Group Head of Audit are endorsed by the Board Risk Management Committee and the Audit Committee respectively.

The Group does not allow accelerated payment of deferred remuneration except in cases such as death in service. There are no provisions for:

- special executive retirement plans;

- golden parachutes or special executive severance packages; and/or

- guaranteed bonuses beyond one year

Remuneration of Non-Executive Directors

The remuneration for non-executive directors, including the Chairman, has been benchmarked to reflect trends in global, regional and local banking markets. Non-executive directors will receive 70% of their fees in cash and the remaining 30% in share awards. The share awards are not subject to a vesting period, but are subject to a selling moratorium whereby each non-executive director is required to hold the equivalent of one year’s basic retainer for his or her tenure as a director and for one year after the date he or she steps down. The fair value of share grants to the non-executive directors shall be based on the volume-weighted average price of DBSH ordinary shares over the 10 trading days immediately following the AGM. The actual number of DBSH ordinary shares to be awarded will be rounded down to the nearest share, and any residual balance will be paid in cash. Shareholders are entitled to vote on non-executive directors’ remuneration at the forthcoming 2014 AGM.

Remuneration of Executive Director

Mr Piyush Gupta has led the Group since November 2009. During his tenure, the Group has made significant progress against its objective of being the Bank of Choice in Asia. The Group’s performance against the Group Scorecard was especially strong in the areas of:

- Executing our strategic initiatives resulting in record full-year net profit of SGD 3.50 billion for 2013 in an environment of significant market volatility

- Strengthening our regional capabilities across our key markets of Greater China, Southeast Asia and South Asia

- Leveraging on our solid capital base, strong liquidity and high credit ratings to position the Group for long-term sustainable growth

The CMDC decides on the remuneration for the executive director based on the Group’s achievement against the Group Scorecard and market rates for this role in the marketplace. The CMDC’s recommendation for the executive director’s remuneration is endorsed by the Board.

DISCLOSURE ON REMUNERATION

(PRINCIPLE 9)

Annual fee structure for Board

The proposed annual fee structure for the Board for 2013 is set out below. This fee structure is subject to shareholders’ approval at the forthcoming 2014 AGM.

| Fees for 2012 SGD |

Fees for 2013 SGD |

|

|---|---|---|

| Basic Annual Retainer Fees | ||

| Board | 80,000 | 80,000 |

| Additional Chairman fees for: | ||

| Board | 500,000 | 1,350,000 |

| Audit Committee | 75,000 | 75,000 |

| Board Risk Management Committee | 75,000 | 75,000 |

| Compensation and Management Development Committee | 65,000 | 65,000 |

| Executive Committee | 75,000 | 75,000 |

| Nominating Committee | 35,000 | 35,000 |

| Additional Committee member fees for: | ||

| Audit Committee | 45,000 | 45,000 |

| Board Risk Management Committee | 45,000 | 45,000 |

| Compensation and Management Development Committee | 35,000 | 35,000 |

| Executive Committee | 45,000 | 45,000 |

| Nominating Committee | 20,000 | 20,000 |

As part of the annual review of non-executive directors’ fees, the CMDC and the Board (other than Mr Peter Seah who recused himself from all CMDC and Board discussions relating to the Board Chairman’s annual retainer fee) considered whether the Board Chairman’s annual retainer fee should be revised, taking into account the role and contribution of the Board Chairman and the performance of the Group under his leadership. In view of (i) the amount of time the Board Chairman spends on DBS matters; (ii) the significant and strategic value of his input and guidance to management; and (iii) the strong performance of the Group under his leadership in the last three years, and considering the board chairman’s fee of comparable financial institutions, the CMDC and the Board recommend increasing the Board Chairman’s annual retainer fee to SGD 1,350,000 for 2013.

Apart from the proposed increase in the Board Chairman’s annual retainer fee, no other changes are proposed to be made to the annual fee structure for the Board for 2013.

Breakdown of Directors’ Remuneration

The following table shows the composition of directors’ remuneration for 2013. Directors who were appointed or who resigned or retired during the year are included in the table.

BREAKDOWN OF DBS DIRECTORS’ REMUNERATION FOR PERFORMANCE YEAR 2013

(1 JANUARY 2013 – 31 DECEMBER 2013)

| Name of Director | Salary Remuneration SGD | Cash Bonus1 SGD | Share Plan SGD | Directors’ Fees2 SGD | Share-based Remuneration3 SGD | Others4 SGD | Total SGD |

|---|---|---|---|---|---|---|---|

| Peter Seah Lim Huat | – | – | – | 1,261,050 | 540,450 | 41,168 | 1,842,668 |

| Piyush Gupta | 1,200,000 | 3,425,000 | 4,525,0005 | – | – | 54,974 | 9,204,9746 |

| Bart Joseph Broadman | – | – | – | 150,150 | 64,350 | – | 214,500 |

| Christopher Cheng Wai Chee7 | – | – | – | 73,564 | – | – | 73,564 |

| Euleen Goh Yiu Kiang | – | – | – | 240,800 | 103,200 | – | 344,000 |

| Ho Tian Yee | – | – | – | 140,700 | 60,300 | – | 201,000 |

| Nihal Vijaya Devadas Kaviratne CBE | – | – | – | 177,800 | 76,200 | – | 254,000 |

| Andre Sekulic | – | – | – | 187,250 | 80,250 | – | 267,500 |

| Danny Teoh Leong Kay | – | – | – | 201,250 | 86,250 | – | 287,500 |

| Woo Foong Pheng (Mrs Ow)8 |

– | – | – | 202,500 | – | – | 202,500 |

| 1 | The amount has been accrued in 2013 financial statements |

| 2 | Fees payable in cash, in 2014, for being a director in 2013. This is subject to shareholder approval at the 2014 AGM |

| 3 | This is to be granted in the form of DBSH ordinary shares, for being a director in 2013. The actual number of DBSH ordinary shares to be awarded will be rounded down to the nearest share, and any residual balance will be paid in cash. This is subject to shareholder approval at the 2014 AGM |

| 4 | Represents non-cash component and comprises club, car and driver |

| 5 | For better comparability with other listed companies, these figures exclude the estimated value of retention shares amounting to SGD 905,000 which will only vest in the 4th year if the incumbent is still in the employment of the Group |

| 6 | Refers to 2013 performance remuneration – includes fixed pay in 2013, cash bonus received in 2014 and DBSH ordinary shares granted in 2014 |

| 7 | Dr Cheng, who stepped down on 29 April 2013, will receive all of his director’s remuneration in cash |

| 8 | Director’s remuneration payable to Mrs Ow Foong Pheng will be paid fully in cash to a government agency, the Directorship & Consultancy Appointments Council |

- Directors are also paid attendance fees for Board and Board Committee meetings, as well as for attending the AGM and the annual Board offsite

- Fees have been pro-rated according to the date of appointment or resignation. There were 365 days in calendar year 2013

In 2013, none of the Group’s employees were immediate family members of a director.

Senior Management and Material Risk Takers’ Remuneration

The following tables show the breakdown of remuneration and long-term remuneration awards for senior management and key risk takers. Senior management (SM) is defined as the executive director and members of the Group Management Committee, who have authority and responsibility for planning the activities and the overall direction of the Group.

Material risk takers (MRTs) are defined as individual employees whose duties require them to take on material risk on behalf of the Group in the course of their work. These could be either individual employees or a group of employees who may not pose a risk to the financial soundness of an institution on an individual basis, but may present a material risk on a collective basis.

Table 1: Guaranteed Bonuses, Sign-on Bonuses and Severance Payments

| Category | SM | MRTs |

|---|---|---|

| Number of guaranteed bonuses | 0 | 0 |

| Number of sign-on bonuses | 0 | 7 |

| Number of severance payments | 0 | 0 |

| Total amounts of above payments made during the Financial Year (SGD ’000) | 0 | 2,108 |

Table 2: Breakdown of Remuneration Awarded in Current Financial Year

| Category | SM | MRTs | |||

|---|---|---|---|---|---|

| Unrestricted % |

Deferred % |

Unrestricted % |

Deferred % |

||

| Fixed remuneration | Cash-based | 20 | – | 38 | – |

| Shares and share-linked instruments | – | – | – | – | |

| Other forms of remuneration | – | – | – | – | |

| Variable remuneration | Cash-based | 36 | – | 41 | – |

| Shares and share-linked instruments | – | 44 | – | 21 | |

| Other forms of remuneration | – | – | – | – | |

| Total | 100 | 100 | |||

Table 3: Breakdown of Long-term Remuneration Awards

| Category | SM % |

MRTs % |

|---|---|---|

| Change in deferred remuneration awarded in current financial year1 | 8 (8)4 | 13 (8)4 |

| Change in amount of outstanding deferred remuneration from previous financial year2 | 493 (49)4 | 423 (41)4 |

Outstanding deferred remuneration (breakdown):

|

|

|

Outstanding deferred remuneration (performance adjustments):

|

|

|

Outstanding retained remuneration (performance adjustments):

|

|

|

| Headcount | 20 | 252 |

| 1 | Value of DBSH ordinary shares (including retention shares) granted in respect of performance year 2013 vs. value of DBSH ordinary shares (including retention shares) granted in respect of performance year 2012. Share price taken at date of grant |

| 2 | [No. of unvested DBSH ordinary shares as at 31 Dec 13 x share price as at 31 Dec 13] / [No. of unvested DBSH ordinary shares as at 31 Dec 12 x share price as at 31 Dec 12] |

| 3 | The increase is due to the difference in share price between 31 Dec 2012 and 31 Dec 2013 as well as the larger number of DBSH ordinary shares granted in 2013 |

| 4 | The figure in the parenthesis showed the change in deferred remuneration awarded if the same population of staff that fulfils the definition of SM and MRTs for both performance year 2012 and 2013 is used |

Examples of explicit ex-post adjustments include malus, clawbacks or similar reversal or downward revaluations of awards.

Examples of implicit ex-post adjustments include fluctuations in the value of DBSH ordinary shares or performance units.

Key executives’ remuneration

Although the Code and the Guidelines recommend that at least the top five key executives’ remuneration be disclosed within bands of SGD 250,000 and in aggregate, the Board believes that such disclosure would be disadvantageous to the Group’s business interests, given the highly competitive conditions in the banking industry where poaching of executives is commonplace.

ACCOUNTABILITY AND AUDIT

ACCOUNTABILITY

(PRINCIPLE 10)

The Board is regularly updated on the performance, position and prospects of the Group. Management provides the Board with detailed financial performance reports on a monthly basis. Prior to each quarterly Board meeting, management provides Board members with detailed reports on the Group’s financial performance and related matters and will present such reports at the Board meeting. As members of the Group Executive Committee are present at all Board meetings, Board members have the opportunity to discuss with senior management on the business and operations of the Group during each Board meeting.

The CEO and CFO provide the AC and the external auditors with a letter of representation attesting to the integrity of the financial statements each quarter.

The Board provides shareholders with quarterly and annual financial reports. In presenting these statements, the Board aims to give shareholders a balanced assessment of the Group’s financial performance and position. The Board also ensures timely and full disclosure of material corporate developments to shareholders.

RISK MANAGEMENT AND INTERNAL CONTROLS

(PRINCIPLE 11)

Board Risk Management Committee

The BRMC is chaired by Ms Euleen Goh and comprises Dr Bart Broadman, Mr Ho Tian Yee, Mr Nihal Kaviratne, Mr Peter Seah and Mr Danny Teoh, all of whom are non-executive independent directors. The BRMC members are appropriately qualified to discharge their responsibilities, and five out of six BRMC members have the relevant technical financial sophistication in risk disciplines.

Key responsibilities of the BRMC

- Setting of risk appetite for the various types of risk and cascading this into risk appetite limits and the monitoring of exposures against these risk appetite limits

- Monitoring all other types of large risk exposures against risk limits and risk strategy in accordance with approved guidelines

- Monitoring of large risk events and subsequent remedial action plans

- Monitoring market developments, such as macro-economic, credit, industry, country and commodity risks and stress tests related to these developments

- Approving the Group’s overall and specific risk governance frameworks

- Reviewing (jointly with the AC) the adequacy and effectiveness of the Group’s internal control framework

- Approving Basel compliant risk models and monitoring the performance of previously approved models

- Overseeing an independent Group-wide risk management system and ensuring there are sufficient resources to monitor risks

- Exercising oversight of the Internal Capital Adequacy Assessment Process including approval of stress scenarios and commensurate results for capital, risk-weighted assets, profit and loss and liquidity

- Approving the Group-wide Recovery Plan

Activities of the BRMC in 2013

Internal Controls

The Group has instituted an internal controls framework covering financial, operational, compliance and technology controls, as well as risk management policies and systems. DBS’ risk governance structure includes three lines of defence with clear roles and responsibilities. The business management, in partnership with support functions, is the first line of defence and is primarily responsible for identification, assessment and management of risk within approved risk appetite and policies. They are required to develop and maintain appropriate risk management controls including self-assurance processes. As the second line of defence, corporate oversight functions (such as Risk Management Group and Group Legal & Compliance) are responsible for establishment and maintenance of risk management frameworks as well as monitoring and reporting of key risk issues. Group Audit, as the third line of defence, provides assurance on the reliability, adequacy and effectiveness of the Group’s system of internal controls, risk management procedures, governance framework and processes, and the quality of performance in carrying out assigned responsibilities.

Please refer to the section on ‘Risk Management’ in this Annual Report which sets out the overall risk governance and various risk management frameworks covering credit, market, liquidity and operational risks.

The Group has in place a risk management process that requires all units to perform a half-yearly Control Self Assessment (CSA) to assess the effectiveness of their internal controls. In addition, all units of the Group are required to submit quarterly attestations on their controls relating to the financial reporting process, and annual attestations on their compliance with the overall internal controls framework. Leveraging on the results of the CSA and the quarterly and annual attestations, the CEO and CFO would in turn provide an annual attestation to the AC relating to adequacy and effectiveness of the Group’s risk management and internal control systems. Group Audit performs regular independent reviews to provide assurance on the adequacy and effectiveness of the Group’s risk management, control and governance processes. The AC and BRMC review the overall adequacy and effectiveness of the Group’s internal controls framework.

Board’s commentary on adequacy and effectiveness of internal controls

The Board has received assurance from the CEO and CFO that, as at 31 December 2013:

| (a) | the Group’s financial records have been properly maintained, and the financial statements give a true and fair view of the Group’s operations and finances; and |

| (b) | the Group’s risk management and internal control systems were adequate and effective to address financial, operational, compliance and information technology risks which the Group considers relevant and material to its operations. |

Based on the internal controls established and maintained by the Group, work performed by the internal and external auditors, reviews performed by management and various Board committees and assurances received from the CEO and CFO, the Board, with the concurrence of the AC, is of the opinion that the Group’s internal controls and risk management systems were adequate and effective as at 31 December 2013 to address financial, operational, compliance and information technology risks which the Group considers relevant and material to its operations.

DBS Code of Conduct

The DBS Code of Conduct (“Code of Conduct”) sets out the principles and standards of behaviour that are expected of all employees of the Group (including part-time and temporary employees) when dealing with customers, business associates, regulators and colleagues. The principles covered in the Code of Conduct include professional integrity, confidentiality, conflicts of interests, fair dealings with customers and whistle blowing. All employees are required to read and acknowledge the Code of Conduct on an annual basis. Members of the public may access the Code of Conduct on the Group’s website, as well as write in via the portal available.

Significant Incident Protocol and Code of Conduct

The Group has in place a significant incident protocol that highlights processes and procedures for incidents according to the level of severity. In this way, appropriate levels of management are made aware of these incidents and can take action accordingly. In addition, there are procedures on the escalation, investigation and follow up of any reported wrong-doing by a DBS employee, customer, vendor or third party. The procedure for escalation is in various Group policies but most predominantly in the Code of Conduct.

The Code of Conduct define processes for DBS staff to report incidents and provides protection for those staff for these disclosures. The Code of Conduct also encourages employees to report their concerns to the Group’s dedicated, independent investigation team within Group Legal, Compliance and Secretariat which handles whistle-blowing cases according to a well defined protocol. Alternatively, in case of actual or potential conflict of interest or fear of retribution, employees may write in confidence to Human Resources, Group Audit, or even the CEO or Chairman.

Related Party Transactions

The Group has embedded procedures to comply with all regulations governing related party transactions, including those in the Banking Act, Chapter 19 (“Banking Act”), MAS directives and the SGX Listing Rules. The Banking Act and MAS directives impose limits on credit exposures by the Group to certain related entities and persons, while the SGX Listing Rules cover interested party transactions in general.

All new directors are briefed on all relevant provisions that affect them. If necessary, existing credit facilities to related parties are adjusted prior to a director’s appointment, and all credit facilities to related parties are continually monitored. Checks are conducted before the Group enters into credit or other transactions with related parties to ensure compliance with regulations.

As required under the SGX Listing Rules, the following are details of interested person transactions in 2013:

| Name of Interested Person | Aggregate value of all Interested Person Transactions during 2013 (excluding transactions less than SGD 100,000) |

|---|---|

| CapitaLand Limited Group | 6,865,374 |

| Certis CISCO Security Pte Ltd Group | 14,676,979 |

| Mapletree Investments Pte Ltd Group | 464,400 |

| MediaCorp Pte Ltd Group | 2,963,551 |

| Singapore Airlines Limited Group | 390,000 |

| Singapore Telecommunications Limited Group | 37,745,810 |

| SMRT Corporation Ltd Group | 6,969,864 |

| StarHub Ltd Group | 5,054,284 |

| Temasek Capital (Private) Limited Group | 177,792 |

| Total Interested Person Transactions (SGD) | 75,308,054 |

Material Contracts

Since the end of the previous financial year, no material contracts involving the interest of any director or controlling shareholder of the Group has been entered into by the Group or any of its subsidiary companies, and no such contract subsisted as at 31 December 2013, save as disclosed via SGXNET.

Dealings in securities

In conformance with the “black-out” policies prescribed under SGX Listing Rules, DBSH directors and employees are prohibited from trading in DBSH securities one month before the release of the full-year results and two weeks before the release of the first, second and third quarter results. In addition, business units and subsidiaries engaging in proprietary trading are restricted from trading in DBSH securities during the black-out period. Prior to the commencement of each black-out period, Group Secretariat will send an email to all directors and employees to inform them of the duration of such period.

Directors and officers are prohibited at all times from trading in DBSH securities if they are in possession of material non-public information. The Group has put in place a personal investment policy which prohibits employees with access to price-sensitive information in the course of their duties from trading in securities in which they possess such price-sensitive information. Such employees are also required to seek pre-clearance before making any personal trades in securities, and may only trade through the Group’s stock broking subsidiaries for securities listed in Singapore and Hong Kong. The personal investment policy discourages employees from engaging in short-term speculative trading, and states that investment decisions should be geared towards long-term investment.

AUDIT COMMITTEE

(PRINCIPLE 12)

The AC is chaired by Mr Danny Teoh and comprises Mr Nihal Kaviratne, Mr Peter Seah, Mrs Ow Foong Pheng and Mr Andre Sekulic, all of whom are non-executive directors. Mr Danny Teoh possesses an accounting qualification and was the managing partner of KPMG, Singapore. All members of the AC have recent and relevant accounting or related financial management expertise or experience. In accordance with the requirements of the Code, Guidelines and Banking Regulations, a majority (four out of five members of the AC) including the AC Chairman are independent directors. Mrs Ow Foong Pheng, who is a non-independent director, is considered independent from business relationships and management.

Key responsibilities of the AC

- Monitoring the financial reporting process and ensuring the integrity of the Group’s financial statements

- Reviewing the adequacy and effectiveness of internal controls, such as financial, operational, compliance and information technology controls, as well as accounting policies and systems

- Reviewing all material related party transactions

- Reviewing the policy and arrangements by which staff of the Group may, in confidence, raise concerns about possible improprieties in matters of financial reporting or other matters and to ensure that arrangements are also in place for such concerns to be raised and independently investigated and for appropriate follow-up action to be taken

- Reviewing the internal auditor’s plans, the scope and results of audits, and effectiveness of the internal audit function

- Approving the hiring, removal, resignation, evaluation and compensation of Head of Group Audit

- Reviewing the scope and results of the external audit and the independence and objectivity of the external auditors, and ensuring that the external auditors promptly informs the AC if there are any weaknesses in the Group’s internal controls and ensuring that such weaknesses are promptly rectified

- Making recommendations to the Board on the proposals to shareholders on the appointment, re-appointment and renewal of the external auditors and approving the remuneration and terms of engagement of the external auditors

- Overseeing the implementation of the Group Disclosure Policy by the Group Disclosure Committee and approve proposed changes of a substantive nature

The AC has full discretion to invite any director and executive to attend its meetings. Separate sessions with the external auditors are held without the presence of management at each AC meeting to discuss matters that might have to be raised privately. In addition, there is at least one scheduled private session annually for the head of Group Audit to meet with the AC. The AC Chairman meets the internal auditors regularly to discuss the internal audit plan, current work, key findings and other significant matters. The AC has explicit authority to investigate any matter within its terms of reference, and has full access to and cooperation by management.

The AC has reviewed the Group’s audited financial statements with management and the external auditors and is of the view that the Group’s financial statements for 2013 are fairly presented in conformity with relevant Singapore Financial Reporting Standards in all material aspects.

During the financial year, the AC carried out an annual assessment of the effectiveness of the Group Audit function. The review showed that Group Audit continues to perform to a very high standard; adopts effective communication to stakeholders; places high importance to its people, continuously investing to enhance its bench-strength; stays relevant and competent to changes in the Bank’s risk and regulatory environment.

Activities of the AC in 2013

During the course of 2013, the AC’s activities included:

- Performing quarterly reviews of financial statements (audited and unaudited), and making recommendations to the Board for approval

- Performing quarterly reviews of reports from Group Audit and Group Legal and Compliance

- Reviewing the Group’s progress on the implementation of the Fair Dealing Outcomes across the Group, in line with the principles issued by MAS

- Reviewing the annual audit plan and the legal and compliance plans, approving any changes as necessary

- Reviewing the annual re-appointment of the external auditors and determining their remuneration, and making a recommendation for Board approval

- Reviewing the observations from the independent external assessor appointed to conduct an assessment of Group Audit’s conformance with the Institute of Internal Auditors (IIA) International Standards for the Professional Practice of Internal Auditing

External Auditors

The AC makes recommendations to the Board for the appointment, re-appointment and dismissal of the external auditors including the remuneration and terms of engagement. The Group has complied with Rule 712 and Rule 715 of the SGX Listing Rules in relation to its external auditors.

The total fees paid to our external auditors, PricewaterhouseCoopers LLP (PwC), for the financial year ended 31 December 2013, and the breakdown of the fees paid for audit and non-audit services respectively are set out below:

| Fees paid to PwC for FY 2013 | SGD ’000 |

|---|---|

| For Audit and Audit-Related Services | 6,740 |

| For Non-Audit Services | 1,868 |

| Total Fees paid | 8,608 |

INTERNAL AUDIT

(PRINCIPLE 13)

Group Audit is a function that is independent of the activities it audits. The objective, scope of authority and responsibilities of Group Audit are defined in the Group Audit charter, which is approved by the AC. In DBSH, Group Audit reports functionally to the Chairman of the AC and administratively to the CEO.

Group Audit’s responsibilities include:

| (i) | Evaluating the adequacy and effectiveness of the Group’s risk management and internal control systems, including whether there is prompt and accurate recording of transactions and proper safeguarding of assets; |

| (ii) | Providing an independent assessment of the Group’s credit management processes, portfolio strategies and portfolio quality; |

| (iii) | Reviewing whether the Group complies with laws and regulations and adheres to established policies; and |

| (iv) | Reviewing whether management is taking appropriate steps to address control deficiencies. |

Group Audit adopts a risk-based approach in its auditing activities. An annual audit plan is developed using a structured risk and control assessment framework, where Group Audit assesses the inherent risk and control effectiveness of each auditable entity in the Group. The assessment also covers risks arising from new lines of business or product. Audit projects are planned based on the results of the assessment, with priority given to auditing higher risk areas. Consideration is also given to conducting audit projects required by regulators. Appropriate resources are deployed to complete the plan, which is reviewed and approved by the AC.

Group Audit has unfettered access to the AC, the Board and senior management, as well as the right to seek information and explanation. Group Audit staff is required to adhere to the Code of Conduct as well as the Code of Ethics established by the IIA, from which the principles of objectivity, competence, confidentiality and integrity are based.

Audit reports containing identified issues and corrective action plans are reported to the AC and senior management. The progress of the corrective action plans is monitored through a centralised issue management system. Information on outstanding issues is included in regular reports to the AC, the Chairman, senior management and business and support unit heads.

Group Audit apprises the regulators and external auditors of all relevant audit matters. It works closely with the external auditors to coordinate audit efforts.

In line with leading practices, Group Audit has established a quality assurance and improvement programme that covers all aspects of its audit activity and conforms to the International Standards for the Professional Practice of Internal Auditing. The programme includes periodic internal quality assurance reviews, self-assessments based on standards established by the IIA and internal audit methodologies, stakeholder surveys and industry benchmarking surveys. External quality assessments are also carried out at least once every five years by qualified professionals from an external organisation. The most recent assessment was conducted in 2013 by KPMG.

Based on KPMG’s Strategic Performance Review of Internal Audit (“K’SPRint”) methodology, the following assessment was made, which include areas considered as leading practices:

- Management buy-in and adoption of Group Audit’s annually refreshed Top 10 Key Audit Focus Areas (based on its annual risk and control assessment results, perspectives of senior management and business plans) reflects strong recognition of Group Audit’s contribution in helping to shape the control culture and awareness within the organisation;

- Strong positive feedback from management on stakeholder engagement;

- Organisational structure within Group Audit ensures proper functional and geographical engagement and coverage;

- Having an internal bulletin, complimented by members of the Group Management Committee as a useful communication tool, alerts stakeholders to control weaknesses in respective areas;

- A successful Guest Auditor Programme, which invites internal applicants from other departments to participate in audit reviews alongside experienced auditors, brings value to both Group Audit (leverage on product knowledge) and stakeholders (understanding of audit requirements); and

- Comprehensive Annual Audit Planning Process.

KPMG concluded that Group Audit conforms to the International Standards for the Professional Practice of Internal Auditing.

Group Audit achieved another significant milestone during its participation in the 2013 Securities Investors Association of Singapore (SIAS) Investors’ Choice Awards, jointly organised by the SIAS, IIA Singapore and Singapore Management University. Group Audit emerged as the runner-up for the Internal Audit Excellence Award, and top among banks for the third year running. These wins are significant for the Group as the SIAS Investors’ Choice Awards is one of only few awards in the market that recognises public-listed companies for their exemplary corporate governance and transparency practices.

Group Audit continues to improve on its approach towards the internal audit function. One of its initiatives is the extensive use of computer-assisted audit techniques (CAATs) as well as more complex data analytics, for greater efficiency and effectiveness, as well as to enhance productivity. Technology will continue to play a central role in driving innovation and process automation to improve quality and efficiency in performing audits and managing internal department processes. The future of audit lies in the ability to identify emerging risks. As such, Group Audit is continuously looking into ways to connect the dots by sharing insights on issues, and how one issue is connected to another, with all stakeholders. This boundary-spanning sharing also crosses business segments and geographical locations.

Last but not least, Group Audit continues to invest in its people, ensuring that it is adequately staffed to meet the demands of internal audit. Proper training roadmaps and up-skilling programmes are instituted to constantly enhance the knowledge, skills and competencies of its internal auditors.

SHAREHOLDER RIGHTS AND RESPONSIBILITIES

SHAREHOLDER RIGHTS

(PRINCIPLE 14)

The Group’s robust corporate governance culture and awareness promote fair and equitable treatment of all shareholders. All shareholders enjoy specific rights under the Singapore Companies’ Act and Articles of Association. All shareholders are treated fairly and equitably.

These rights include, amongst others, the right to participate in profit distributions and the right to attend and vote at general meetings. Ordinary shareholders are entitled to attend and vote at the AGM by person or proxy. A shareholder may appoint up to the maximum of two proxies, who need not be shareholders of DBSH. Notwithstanding the two-proxy rule, investors who hold DBSH ordinary shares through CPF or custodian banks, but have not been appointed as proxies, are also allowed to attend the AGM as observers.

The Group respects the equal information rights of all shareholders and is committed to the practice of fair, transparent and timely disclosure. All price-sensitive information is publicly released prior to any sessions with individual investors or analysts.

COMMUNICATION WITH SHAREHOLDERS

(PRINCIPLE 15)

The Group’s investor relations activities promote regular, effective and fair communication with shareholders. Briefing sessions for the media and analysts are conducted when quarterly results are released. All press statements and quarterly financial statements are published on the DBSH and SGX websites. A dedicated investor relations team supports the CEO and the CFO in maintaining a close and active dialogue with institutional investors. The Group’s website provides contact details for investors to submit their feedback and raise any questions.

During the year, management met with more than 370 investors at more than 280 investor meetings. It participated in nine local and foreign investor conferences and non-deal road shows. These meetings provide a forum for management to explain the Group’s strategy and financial performance. Management also uses meetings with investors and analysts to solicit their perceptions of the Group.

At the IR Magazine Awards and Conference South East Asia 2013, the Group was named the Best Investor Relations in the banks and financial services sector. The Group was also conferred the Best Investor Relations (bronze) award in the category for companies with a market capitalisation of SGD 1 billion and above at the Singapore Corporate Awards 2013.

The Group has a formal disclosure policy to ensure that all disclosures of material information are timely, complete and accurate. The policy also spells out how material information should be managed to prevent selective disclosure. In 2012, the Group Disclosure Committee (GDC) was formed to assist the CEO and CFO in implementing the Group’s disclosure policy. The GDC comprises the CFO, members of the Group Executive Committee as well as various department heads. The GDC’s objectives are to periodically review the Group’s disclosure policy and update it as needed; ensure that all material disclosures are appropriate, complete and accurate; and ensure the avoidance of selective or inadvertent disclosure of material information.

The Group’s efforts to improve disclosure were recognised at the 14th Investors’ Choice Awards organised by the SIAS, where it won the Most Transparent Company Award in the finance category.

CONDUCT OF SHAREHOLDER MEETINGS

(PRINCIPLE 16)

The AGM provides shareholders with the opportunity to share their views and to meet the Board of Directors, including the chairpersons of the Board committees and certain members of senior management. The Group’s external auditor is available to answer shareholders’ queries. At the AGM, the Group’s financial performance for the preceding year is presented to shareholders.

At general meetings, the Chairman plays a pivotal role in fostering constructive dialogue between shareholders and the Board members. The Group encourages and values shareholder participation at its general meetings. To enhance shareholder participation, the Group puts all resolutions at general meetings to vote by electronic poll and announces the results by showing the number of votes cast for and against each resolution and the respective percentage.

In accordance with the recommendations contained in the Code and the Guidelines, resolutions requiring shareholder approval are tabled separately for adoption at the DBSH’s general meetings unless they are closely related and are more appropriately tabled together.