Shareholders

REVIEW BY BUSINESS UNITS

CONSUMER BANKING / WEALTH MANAGEMENT

- Build out regional wealth business

- Bank mass market in Singapore; consider consumer finance opportunistically in other countries

- Increase focus on digitisation to enhance efficiency

- Make the customer experience more interactive and intuitive

- Leverage analytics and the use of big data

INTRODUCTION

Consumer Banking / Wealth Management (CBG) provides individual customers with a diverse range of banking and related financial services. Our customers can take comfort that we have been consistently named “Safest Bank in Asia” by Global Finance magazine since 2009. We have deep roots in Singapore, where we serve all parts of the community through our extensive network of more than 2,300 DBS and POSB branches, ATMs and self-service banking machines.

Our Wealth Management franchise offers a full suite of products and services. Affluent individuals are served in the DBS Treasures customer segment while high net worth individuals with assets of more than SGD 1.5 million are served in the DBS Treasures Private Client and DBS Private Bank segments. In addition to offering customers the safety that comes from being well-capitalised and having one of the highest credit ratings, we are differentiated by our insights on Asia and access to investments that tap into Asia’s growth.

FINANCIAL PERFORMANCE

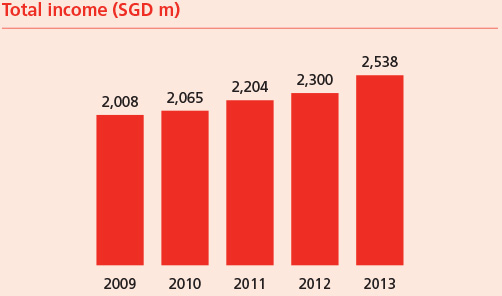

CBG’s total income rose 10% to SGD 2.54 billion. Net profit increased at a faster rate of 17% to SGD 603 million, as a result of productivity gains and stable credit costs. The pace of growth in both income and earnings was higher than the previous year.

The stronger performance was led by a 19% increase in non-interest income to SGD 1.04 billion as contributions from investment and bancassurance product sales grew 27%, demonstrating the strength of our wealth management franchise.

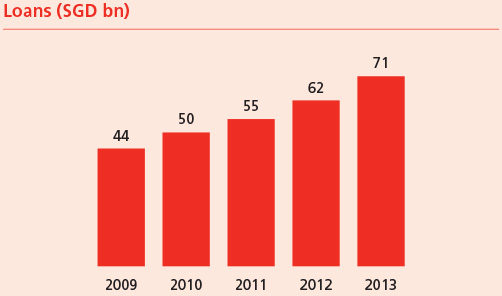

Net interest income rose 5% to SGD 1.50 billion driven by loan and deposit volume growth, partially offset by lower interest margin.

In Singapore, loans grew 10% from housing and other secured consumer loans. Drawdowns of housing loans approved in previous years contributed to 32% of the growth in our Singapore housing loan portfolio. However, applications for new Singapore housing loans declined 20% compared to 2012 following a series of government measures to cool the market. On the other hand, housing loan yields have been firming. The proportion of applications for fixed-rate loans increased as more borrowers became amenable to paying a premium to lock in rates for mostly up to three years while interest rates are low. The proportion of applications for public housing loans also increased from 2012 as we introduced a product to attract buyers who would otherwise have borrowed directly from the public housing authority.

Deposits grew 6% mainly from SGD current and savings accounts, in which we maintained our leading market share. SGD deposits costs were stable during the year.

We continued to manage operating costs tightly while investing in technology to enhance our digital capabilities. Expenses rose 9% to SGD 1.74 billion. Allowances continued to be low as asset quality remained stable in a benign credit environment. Around 90% of our Singapore housing loans, which account for the majority of our housing loan exposure, are to borrowers with only one housing loan. The average outstanding Singapore housing loan in our portfolio is only 56% of the property’s market value. We also adopted debt servicing standards long before they became regulatory requirements to ensure that borrowers did not overstretch themselves.

STRATEGIC INITIATIVES

We achieved the franchise development goals we set for ourselves in 2013. They were to improve our online platforms, cement our leading position in wealth management and make further strides in customer service.

Digital initiatives

With consumer transactions rapidly shifting online, we continue to enhance our Internet and mobile platforms to make them seamless extensions of our physical branch footprint. The revamp incorporates an improved engine to pull together customer and product information, a refreshed and consistent look and feel for all our online and mobile channels, and the introduction of innovative applications. Once the full revamp is completed, our Internet and mobile platforms will be simpler and more intuitive to use, offer a higher degree of customisation to individual needs, and enable customers to interact in real time with relationship managers or branch staff. Customers will be able to make everyday transactions such as payments, receive assistance for making investment decisions, call up information on lifestyle activities such as dining and shopping, and check on their bank accounts – all at their convenience, 24 x 7.

Among the specific enhancements we introduced during the year was a mobile app, DBS Home Connect, enabling Singapore home buyers to find out the valuation of a residential property as well as recent transaction prices in the vicinity by pointing their mobile device at the property. In addition, applicants for credit cards and unsecured loans can download our Optical Character Reader to reduce the time for completing their online applications. Customers can also use our online platform to remit funds; transfers to India and Indonesia can be completed in a matter of minutes.

We also partnered Alibaba’s e-commerce payments site Alipay to allow our Singapore, Hong Kong and China customers to purchase items on Taobao, a popular online market. We tapped social media to enhance brand awareness and launch products, including a crowd-sourcing deposit-gathering programme called uGoiGo™ that was launched in Hong Kong with great success and subsequently replicated in other markets.

We have been meticulous in our efforts to build a secure foundation around our electronic platforms. During the year, we completed the roll-out of additional security features, including a new-generation log-in token for customers and a system to alert customers when transaction sizes cross a threshold or when they are not routine. These changes have contributed to a safer and easier experience. As a result, channel usage increased over 40%, driven primarily by mobile. We now have more than 2.4 million online and 800,000 mobile users across the region. On an average day there are more than 300,000 logins, with mobile accounting for close to 40% of the total. To reduce paper usage and go green, we have enabled our customers to receive statements in electronic form. In Singapore, over 50% of our customers now do so.

Wealth management

In Wealth management, we continued to make changes to improve the effectiveness of our client interaction. We increased the number of relationship managers across the region by 13% and equipped them with customised tools that make them more effective in helping clients to make investment decisions. We up-tiered qualifying clients in order to serve them better. In Hong Kong, we completed the integration of our middle and back offices to improve the quality of support for front-line staff.

Our wealth management online platforms were re-designed based on clients’ feedback. They asked for products and services that were relevant to their investment needs and risk appetite, information and execution that are delivered at speed, and simple processes. The revamped platform empowers clients with quick and intuitive access to services, product information and research. Insights and analysis can be customised according to clients’ preferences. Equities and funds trading have been incorporated into the platform, enhancing the range of asset classes that are available online.

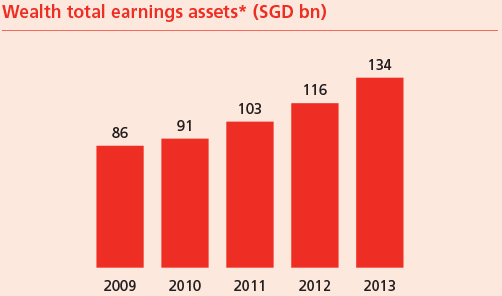

These efforts, coming on top of those in recent years, enabled us to continue achieving strong growth in our wealth management business. Total earning assets rose 15% during the year to SGD 134 billion, bringing growth since 2010 to 47%. Wealth management income grew 18% during the year to SGD 924 million; since 2010, it has grown 83%. The number of wealth management clients grew 5% during the year.

Customer experience

Making continuous improvements to deliver a superior experience for all our customers remained a key strategic objective. In previous years, we successfully cut queue times at our branches, improved the speed at which calls to our customer hotline were answered, and increased the availability of our ATMs. In 2013, our distribution channels were expanded by a partnership with 7-Eleven, a convenience store chain, to enable our customers to withdraw cash from its 500 outlets across Singapore. This built on the

partnership with SingPost that was launched in 2012, which enabled our customers to carry out basic banking transactions at 56 post offices in Singapore.

We used data analytics to strengthen our ability to respond to and pre-empt customers’ needs. A voice analytics programme has improved the efficiency of our call centre operations. The technology has enabled us, for example, to identify calls requiring longer handling times as well as the underlying causes for repeat calls from a customer. Propensity models were developed using advanced statistical techniques to improve customer targeting. This has reduced frictional costs for the customer and improved our operating efficiency. We also launched real-time marketing and service offers using our new complex event processing technology. For example, when a customer makes an airline purchase online, he will receive personalised complementary hotel and travel insurance offers within seconds. This new capability has improved both customer satisfaction and conversion rates.

We also continued to improve customer experience. For example, the new onboarding process for upgraded DBS Treasures customers in Singapore now takes one day instead of seven days previously. We are now working on similar initiatives across other markets to similarly differentiate the customer journey. Our efforts are being noticed and appreciated by our customers and the industry. We received the following accolades: “Best Local Private Bank in Singapore” by Euromoney magazine, “Best Wealth Manager in Indonesia” by The Asset magazine, “Best Consumer Bank (Foreign) in China” by Global Finance and “Best Wealth Management in Hong Kong” by Global Banking & Finance. We were also given numerous awards in Singapore, including “Best Use of Social Media/Mobile” for the DBS Traveller Shield campaign by Marketing Magazine. Customer engagement results for Singapore’s DBS Private Bank and DBS Treasures Private Client registered significant progress with both segments achieving 75th percentile scores in an industry survey carried out by Gallup, a management consultant. DBS Treasures customer engagement satisfaction scores increased in all our markets, with Hong Kong and Indonesia achieving significant improvements. DBS and POSB customer engagement satisfaction scores also increased significantly.

OUTLOOK

We remain optimistic about our operating environment, barring any unforeseen shock. While recent regulations are likely to affect the short-term growth of housing and car loans in some markets, we are fortunate to be operating in a region with promising demographics and a rapidly growing middle class that will provide continued opportunities for growth. We will grow sensibly while managing asset quality.

We will continue to fundamentally reshape the customer experience and our value proposition by leveraging technology and our wealth management capabilities. We will focus on reinforcing our leadership position in wealth management with differentiated offerings, driving digital innovation with specific emphasis on mobility, payments and e-wealth, using big data analytics to provide customers with timely offers, and enhancing the customer experience across all segments and touchpoints.

INSTITUTIONAL BANKING GROUP

- Grow large corporate banking business regionally

- Build out regional SME business

- Scale up the western MNC and institutional investor businesses

- Grow SME franchise by customer acquisition and offering customised solutions

- Scale up cash business by leveraging online platform and drive trade business by offering/working capital solutions

- Maintain leadership in fixed income, capital markets and syndications

- Leverage e-channels and innovation to extend reach and differentiate client experience

INTRODUCTION

Institutional Banking (IBG) provides financial services and products to over 200,000 institutional clients, including bank and non-bank financial institutions, government-linked companies, large corporates and small and medium-sized enterprises (SMEs). We offer the complete range of credit facilities from short-term working capital financing to specialised lending. We also provide transaction banking services such as cash management and trade finance, treasury and market products, corporate finance, advisory banking and capital market solutions. Building leading transaction banking and SME businesses are two of the Group’s strategic objectives.

FINANCIAL PERFORMANCE

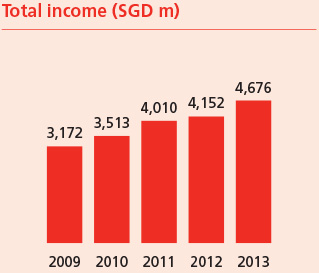

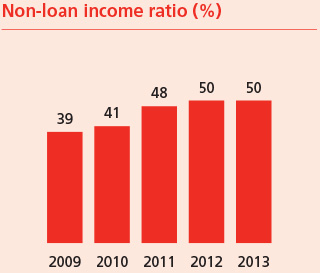

IBG posted another strong year. Total income grew 13% to SGD 4.68 billion from strong asset growth and non-loan activities across most markets, underpinned by robust demand in Asia. Improved non-loan activities contributed to an 18% increase in non-interest income to SGD 1.65 billion as we continued to deliver holistic solutions to customers. Non-loan activities accounted for 50% of IBG’s total income. Net interest income rose 10% to SGD 3.02 billion. Customer loans grew 20% to SGD 179 billion from strong broad-based demand across the region, but the impact was partially offset by a lower net interest margin. We also grew deposits from both existing clients as well as our growing customer base of western multinational corporations and institutional investors.

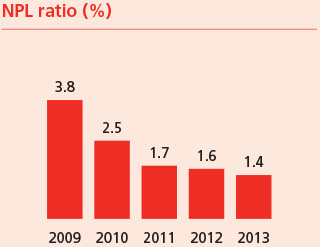

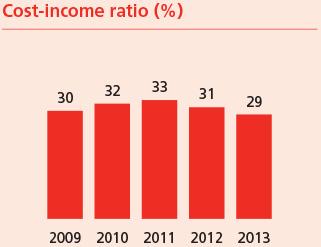

While investing for the future, we remained disciplined on costs and improved the cost-income ratio to 29% from 31% in 2012. Profit before allowances grew 14% to SGD 3.30 billion. Total allowances amounted to SGD 544 million as general allowances increased in line with loan growth and specific allowances rose from exceptionally low levels. The non-performing loan ratio remained low at 1.4% despite uncertainties in some growth markets, such as India. We continued to be vigilant and actively managed risks during the year.

Net profit grew 5% to SGD 2.32 billion.

STRATEGIC INITIATIVES

Global Transaction Services (GTS)

GTS achieved another strong year as fee activities propelled total income to a record SGD 1.48 billion, up 5%. While earnings were affected by industry-wide margin pressure on trade finance loans, our investment in higher-value working capital solutions enabled us to continue making gains in several product segments. Since 2010, GTS has added over SGD 700 million of annuity income streams with high return on capital, contributing to improving the Group’s profitability and earnings quality.

Over the past three years, we launched high value-added products ranging from sophisticated liquidity management solutions and supply chain structures, to new payment technologies that provide ease of use and the ability to handle massive volumes. We also expanded our capabilities to serve established multinationals as well as SMEs building out their Asia franchise. We have become a key relationship bank for large Asian companies establishing regional treasury centres in Singapore and Hong Kong.

The sophistication of the products we offer is as good as any in the world. Combined with our strong balance sheet, it has resulted in new mandates from the world’s leading companies. We offer solutions to assist clients to generate free cash flow, a critical and highly valued activity. In the past 24 months, we have won 190 deals in excess of SGD 1 million of income.

The technology we invested in has allowed us to acquire clients, provide state-of-the-art customer service, and deepen wallet share without a corresponding increase in staff cost.

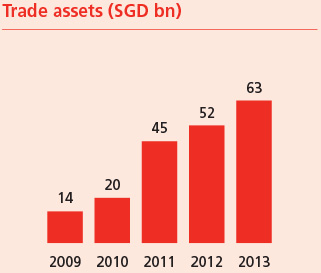

The combination of new products, expanded client servicing capabilities and more efficient technology has led to record levels of GTS assets and deposits. In 2013, deposits grew SGD 24 billion to SGD 119 billion while trade assets grew SGD 11 billion to SGD 63 billion. Growth in deposits outpaced growth in assets for the third straight year, strengthening DBS’ liquidity further.

With interest rates at historical lows, margins for both trade and cash products have been compressed. As such, we believe there is significant intrinsic value embedded in our recent deposit and asset growth.

As the driver of the global economy in the next decade, Asia will continue to lead the world in the rate of growth of both manufacturing and domestic consumption. As companies invest in Asia to capitalise on these opportunities, we are well-positioned with our extensive range of products and services to support them.

SME Banking

With the building of the SME regional platform architecture completed in 2012, our efforts in 2013 were focused on acquiring new clients and on increasing wallet share across the markets we operate in. Total income rose 11% to SGD 1.37 billion, exceeding the target we set for the year, from broad-based growth. Loans grew 14% to SGD 40 billion while deposits increased 11% to SGD 35 billion. Non-loan income accounted for 63% of total income from 60% in 2012, helped by strong treasury product sales, particularly in Hong Kong, and debt and equity issuances.

The performance was the result of upgrades we made to our operations. We enhanced our credit process by building local programmes in each country to approve mid-sized exposures with a clear set of rules and parameters. The programmes have reduced the time taken to assess and approve credit applications across all our markets. We incorporated technology into our efforts to improve customer experience. Our online account opening was extensively automated with a new engine that pulls together customer data from public sources. This has reduced the time taken for clients to open an account to 15 minutes, compared to the industry average of one to two hours. We also revamped our website to give a simplified and consistent look and feel for easy navigation. Our relationship managers now use iPads to receive updated client and product information, enabling them to evaluate customer requirements and propose solutions on the go.

While Singapore and Hong Kong currently account for a significant proportion of our SME business, we are able to provide high-value services in treasury, cash management, trade facilities and advisory services to SMEs in China, Taiwan, India and Indonesia to support their regional expansion.

Treasury and capital market products in particular led our non-loan activities with SMEs during the year. While large corporates dominated debt raising in 2012, it was SMEs that were active in embracing the debt capital market in 2013 as an alternative source of funding for expansion. In Singapore, we were the market leader in advising SMEs on bond issuance and had a market share of 45% in 2013. In a securitisation deal that won two awards from International Financing Review magazine, we helped TG Master, a property developer, raise SGD 200 million of unencumbered capital secured against future payments from committed bookings of a property project it had launched. The transaction improved its cash flow by enabling it to finance other ongoing projects. We also supported Soilbuild Business Space REIT in its initial public offering and provided advisory services to Frencken Group for its acquisition of Juken Technology.

Our success has been reflected in the awards we won during the year. The Asset magazine named us “Best Bank for Emerging Corporates in Asia”, we were recognised as “Best SME bank in Hong Kong” by Global Banking & Finance Review, and we were named “Best Small Business Lending Bank” at Global Finance’s Stars of China Awards.

Customer experience

During the year, we continued to strengthen our operating systems and streamline our processes, which are instrumental to our ability to introduce innovative customer solutions. We launched a one-stop customer service call centre called DBS Business Care to provide a prompt response to customer needs. For a start, we rolled out Business Care in Singapore and Hong Kong.

We improved the customer on-boarding experience with a simplified documentation process. Our account opening documents were awarded the Crystal Mark for being written in plain English. We launched an online appointment system so that waiting time can be reduced when customers visit a branch to complete their account opening.

We improved client engagement by using a disciplined approach to account planning. Clients have cited their appreciation for the regular strategic dialogues we conducted with them and noticed the increasingly advisory approach we have been taking to address their business needs. We also organised Asian Insights industry forums for industry participants to exchange insights, outlook and trends, and the forums have been well received. The improvement in customer satisfaction is evident from the increased number of clients across all countries who cited DBS as their core bank in the latest annual customer surveys.

OUTLOOK

The investments we made in recent years to improve regional connectivity, product expertise and customer engagement are reaping strong results. We are winning new mandates across multiple customer segments and business lines.

Our strategy remains unchanged. We will work with clients across the region, leveraging on our regional network, product capabilities and technological innovation. We will develop our western multinational and institutional investor client base, grow our SME franchise regionally by driving customer acquisition and offering innovative holistic solutions, use our cash and trade product capabilities to help customers manage their working capital needs, and maintain leadership in capital markets and syndication.

Treasury

The Treasury segment reflects only income related to market-making, risk warehousing and investment activities. Income from treasury customer activities is reflected in IBG and CBG since such income derives from our relationship with the customers in those business segments. Total Treasury income encompasses Treasury segment income and customer income

- Grow treasury customer income

- Strengthen product and electronic distribution capabilities across all asset classes

- Grow customer income further

- Deliver offshore RMB and cross-border solutions for customers

- Continue efforts to build a leading Asian fixed income house

- Build a customer-centric commodity business

- Build up institutional investor business with a focus on treasury products

- Keep pace with evolving regulatory over-the-counter derivatives reforms globally

We are an Asian leader in treasury and offer a broad range of products and services to individuals, companies and financial institutions. We offer cash and derivative products in foreign exchange, interest rates, equities, commodities and fixed income securities. We carry out activities related to market-making, risk warehousing and investment activities. We also help customers raise funds through debt issuances. Our nimbleness in structuring products for customers in response to changing market conditions sets us apart from competitors. Our sales and structuring teams work with relationship managers and other product specialists across the Group to offer total risk management solutions to customers.

We are the acknowledged leader in Singapore, with dominance in SGD across various asset classes. We are the leading market-maker for SGD foreign exchange and cross-currency options. With one of the biggest foreign exchange and derivatives teams in Singapore, we have been able to offer superior pricing capabilities to customers. In Hong Kong, we are a major market-maker with an estimated market share of about 10% for the RMB spot and forward markets. We offer a full suite of RMB and HKD derivative products to customers. We are committed to extending our leadership in market-making, structuring and distribution capabilities, and strengthening our fixed income origination capabilities in Asian currencies.

We are the leader in SGD rates. As a dominant participant in the interbank swap market, we are a significant provider of liquidity in the interbank SGD swap market. We are a primary dealer of Singapore Government Securities and are one of the largest and most active participants in the market.

Our expertise enables us to offer structured products to individual customers seeking yield or manage sizeable transactions for corporates and institutions. We provide innovative solutions on long-dated or large-sized interest rate swaps and cross currency derivative transactions, benefiting both foreign and domestic customers seeking to match liabilities. We can also develop alternative funding solutions for corporate customers to optimise their capital structure and balance sheet.

FINANCIAL PERFORMANCE

Treasury segment income fell 8% to SGD 1.03 billion. The decline was due mainly to lower gains from interest rate and credit activities. Income from customer activities rose 19% to SGD 1.04 billion from higher sales to institutional and individual customers. This brought total Treasury income to SGD 2.07 billion, a 4% increase over 2012.

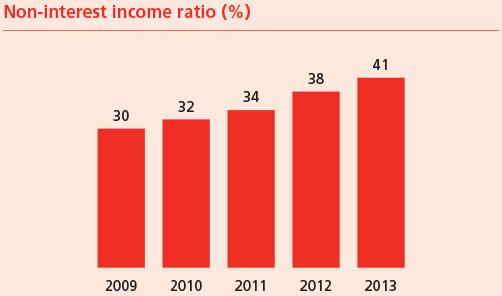

Over the past four years, income from customer activities has grown while treasury segment income has generally remained flat. As a result, the proportion of total Treasury income from customer activities has doubled from 27% in 2009 to 50% in 2013. The shift reflects our ability to respond to market opportunities arising from our extensive product expertise and understanding of customer needs. We also invested in regional expansion, particularly in Greater China where we built an extensive RMB business spanning foreign exchange, bonds, structured products and hedging solutions. Taiwan, China and Hong Kong posted the highest compounded annual income growth during the period.

STRATEGIC INITIATIVES

Commodities

During the year, we expanded our product range with option pricing capabilities for over-the-counter energy products. Since 2011, when we started with copper, we have expanded our product range to aluminium, copper, lead, nickel, iron ore, crude oil and refined oil products, cotton, soybean and bean oil. Customer income from commodity products has grown five-fold since 2011.

Fixed income

Our fixed income capability has been expanded beyond SGD, our traditional stronghold, to regional and G3 currencies.

While SGD debt issuances slowed during the year, we maintained our long-standing leadership with 55 transactions worth SGD 6.1 billion.

We also powered ahead with foreign-currency bond transactions. We completed 23 USD bond transactions as a book-runner, a new benchmark for us, compared to 16 in 2012. Some of the biggest USD deals we were involved in were inaugural issues. They included San Miguel Corp’s landmark USD 800 million issue, which was the largest corporate bond out of the Philippines; Dutch-based Trafigura Beheer BV’s debut USD 500 million perpetual bond, for which we were the only Asian book-runner; and a debut USD 450 million seven-year transaction for Mersin International Port, a joint venture between PSA, Singapore’s port operator, and Akfen, a Turkish infrastructure company. The deal was the first Turkish bond arranged by a Singapore bank. We were also book-runner for the first corporate USD high-yield bond from India, a USD 200 million five-year bond for Rolta LLC. We will continue to grow our USD franchise to serve the global funding needs of our clients.

During the year, we were ranked fifth in underwriting league tables for CNH bonds (excluding financial institutions issues), a marked improvement from 2012. We executed our first CNH bond transaction for a Taiwanese issuer and successfully priced our inaugural CNH bond of RMB 500 million settled in Singapore.

Digital initiatives

We enhanced our online infrastructure as part of efforts to make continuous improvements to customer experience and reach.

DealOnline, our full-fledged online treasury platform, offers auto price streaming and auto-dealing in spot foreign exchange, swap, forward and non-deliverable forward contracts. The platform offers corporate and financial institution customers flexibility to conduct a range of banking activities and services with a secure login. In Singapore, 2,000 SMEs have also signed up.

Corporate customers are able to enquire, book their foreign exchange and manage their cash and trade transactions over a highly customisable dashboard, receive real-time updates via email and SMS on all banking activities and always stay informed. With the same platform, corporate customers can utilise their foreign currencies for either remittance or trade financing purposes. DealOnline also offers individual customers in Hong Kong a 24-hour foreign exchange pricing engine.

OUTLOOK

Regulatory developments could have an impact on our business. They include reforms for the over-the-counter derivatives market, which would involve regulations on central counterparty clearing, trade repository reporting, the US Dodd-Frank Wall Street Reform and Consumer Protection Act, and the European Market Infrastructure Market Regulation.

We will stay the course with our strategy. Our initiatives for 2014 include maintaining the momentum for customer activity with institutional, corporate and individual clients, and strengthening our electronic platform.

REVIEW BY GEOGRAPHIES

SINGAPORE

| Financial performance (SGD m) | 2013 | 2012 |

|---|---|---|

| Income | 5,415 | 4,966 |

| Expenses | 2,288 | 2,088 |

| Profit before allowances | 3,127 | 2,878 |

| Net profit | 2,260 | 2,079 |

As Singapore is our home market, our efforts are directed at entrenching our industry leadership. We seek to deepen relationships with institutions and corporates by providing comprehensive transactional and advisory solutions and growing the SME business. With individuals, our aim is to use our vast distribution network and product expertise as differentiating factors in serving the mass market. We also have a leading position in the affluent and high net worth customer segments.

Despite the continued low interest rate environment, our Singapore franchise significantly outperformed peers, reflecting the success of our strategy. Total income rose 9% to SGD 5.42 billion from higher loan volumes and broad-based non-interest income growth. Full-year net profit rose 9% to SGD 2.26 billion. Excluding regional trading income booked in Singapore, our core Singapore franchise recorded double-digit growth in its top and bottom lines.

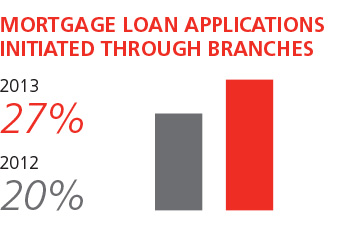

We maintained our domestic loan and deposit market shares. Our market share in domestic loans held steady from 2012 as SGD loans grew 12%. Our top position in savings deposits was also maintained in a competitive market. We continued to implement the new branch operating model which began two years ago. By differentiating branch formats, we can leverage low-cost channels (such as self-service machines) and partnerships (with SingPost, 7-Eleven and Buzz Pod) for transactional activities and utilise branches for customer sales. In 2013, we re-modelled a further eight branches. The effort has yielded encouraging results. During the year, 27% of housing loan applications were initiated at branches compared to 20% in 2012, while sales of insurance and investment income increased 17%. Our partnership with 7-Eleven has resulted in 190,000 customer transactions since its launch while the number of transactions from our partnership with SingPost rose 11%. We also employed customer data analytics in various customer segments, enabling us to be more targeted in our marketing.

With institutions and corporates, we continued to lead in transaction banking, capital markets (including equity, bonds and REITs), syndications and treasury market activities. We also established new SME relationships and deepened wallet share. We assisted SME clients with seven bond issues, further strengthening our dominance in mid-cap bond issuances.

Our use of technology and social media to drive innovation has been recognised. Our marketing campaigns for travel insurance and online banking were recognised by Marketing Magazine for “Best Use of Social/Mobile” and “Best Use of Experiential/Live Marketing”. Our focus on innovation in cross-border payments and e-remittances bore fruit with strong volume growth and market share gains. Since 2010, volumes have grown four-fold and over 80% of transactions are now conducted online.

HONG KONG

| Financial performance (SGD m) | 2013 | 2012 |

|---|---|---|

| Income | 1,863 | 1,532 |

| Expenses | 717 | 678 |

| Profit before allowances | 1,146 | 854 |

| Net profit | 851 | 716 |

As the anchor of our Greater China franchise, Hong Kong plays an instrumental role in our efforts to deepen relationships with leading China enterprises, as well as bring customers from elsewhere into China. It is the base for employing our expertise in transaction banking, treasury and wealth management to connect China with the rest of our network. Our established domestic franchise also serves the full range of corporate and SME clients and affluent individuals in Hong Kong.

Hong Kong achieved another record year as total income, profit before allowances and net profit all reached new highs. Total income rose 22% to SGD 1.86 billion from loan growth, improved net interest margin and broad-based non-interest income growth. Profit before allowances surpassed SGD 1 billion for the first time to SGD 1.15 billion, a 34% increase. Net profit rose 19% to SGD 851 million, contributing to 24% of the Group’s total. Our top and bottom line growth outperformed competitors in the market.

Hong Kong's record performance was the result of strong growth across all customer segments.

Our regional network, product expertise and reputation for consistent customer support through business cycles contributed to a deepening of our relationship with Chinese enterprises with overseas operations during the year. Our relationship has progressively extended beyond credit facilities to strategic advisory as well as capital market and treasury activities. During the year, we were the lead arranger for several transactions related to acquisition financing and debt and equity issuances of Chinese enterprises, and we completed our inaugural Qianhai cross-border bilateral RMB loan agreement. As such, we grew income from Chinese large corporates by 34%.

We maintained our status as a leading bank in offshore RMB transactions. Offshore RMB activity accounted for more than 20% of total Hong Kong income as a result of strong treasury, cash and trade activities. The growth in treasury customer income during the year was led by Hong Kong SMEs, which took advantage of the favourable environment to hedge their RMB requirements.

We devised a composite index called DRIVE (for “DBS RMB Index for VVinning Enterprises”), which uses company surveys to measure the level of adoption of the RMB in Hong Kong for local and global transactions. The index is intended to assist policy makers, businesses and investors to track the usage and acceptance of RMB among Hong Kong companies.

We further expanded our SME franchise by focusing on customer acquisition and offering holistic solutions. We increased the size of our sales team and added two dedicated customer centres to serve this segment. The improved capabilities enabled us to improve the breadth of our relationship with products other than loans.

We continue to be among the largest SME banks in Hong Kong. We were named the “SME Bank of the Year” by Asian Banking and Finance and the “Best SME’s Partner” by the Hong Kong General Chamber of Small and Medium Businesses for the fifth year in a row.

Our efforts to reposition consumer banking continue to pay off as income from investment and insurance products rose 18%. We opened our first DBS Treasures Private Client centre in the city to serve the high net worth segment.

We actively used social media and product differentiation to build brand presence and deepen customer engagement. We launched an online crowd-sourcing campaign called uGoiGo™, which was entirely devised in-house, to acquire DBS Treasures customers. The campaign used a group-buying concept to offer a progressively higher tier of interest rate for time deposits once a specific group size was achieved. With an online marketing and social media strategy, the target size was achieved within two days of launch. Overall, the uGoiGo™ campaign garnered more than 64,000 page views. It also increased the number of DBS Treasures customers acquired by online channels five-fold from 2012. The campaign was awarded the “Best Idea in Viral Marketing” at Marketing Magazine’s MARKies Award 2013, with DBS being the only financial institution to win the award.

GROWTH MARKETS

Our operations in growth markets are integral to our strategy of intermediating trade and investment flows in the region. In these markets, our customers are principally large and medium-sized corporates and affluent individuals.

REST OF GREATER CHINA

| Financial performance (SGD m) | 2013 | 2012 |

|---|---|---|

| Income | 743 | 663 |

| Expenses | 548 | 498 |

| Profit before allowances | 195 | 165 |

| Net profit | 92 | 110 |

Total income in the Rest of Greater China rose 12% to SGD 743 million as a decline in net interest income from lower net interest margin was more than offset by increased fee income and treasury income from customer activities. Net profit fell 16% to SGD 92 million as expenses rose and allowances doubled to SGD 76 million mainly due to higher specific allowances.

China

China’s economic growth was maintained at 7.7%. With further interest rate liberalisation during the year, net interest margin came under pressure, especially in the first half of the year. Against this backdrop, we took steps to improve the loan-deposit ratio and our deposit mix. These efforts helped the financial performance of our China operations in the second half.

Our wealth proposition was enhanced with an expanded product range and improved servicing capabilities. We introduced the Morning Star asset allocation tool to help in clients’ asset allocation. We were the first foreign bank to offer financial needs analysis and enable customers to make purchases of structured investment products online. These improvements resulted in a 44% increase in consumer banking income.

We grew treasury customer income by focusing on the foreign exchange and commodity hedging needs of corporate clients and the investment needs of affluent customers. We were the first to introduce equity-linked notes tailored to an individual customer’s requirements. Moreover, we are able to structure and deliver the customised product within a day of receiving the request.

We fully leveraged our regional connectivity strength to win loan syndication deals. We were the sole arranger for the largest USD syndicated loan in Chongqing for the Chongqing Grain Group, a leading China agricultural corporate.

Clients have positive feedback on our enhanced products and services, as well as our stepped-up engagement with them. We are heartened by the results of externally-conducted customer surveys. In SME banking, we realigned our sales team structure to enable relationship managers to better focus on client servicing. This effort helped us to be named “Best Foreign Bank for Small Business Lending in China” by Global Finance and “Best Foreign Bank” by China Association for Small and Medium Enterprises (CASME) in 2013.

New licences granted to us during the year provide us with new areas of growth. We were appointed by the State Administration of Foreign Exchange as an official market-maker in USD/CNY and SGD/RMB foreign exchange spot and forward contracts. In June, we were among the first batch of foreign banks to win approval to sell domestic unit trusts, which enhanced our wealth proposition. In the fourth quarter, we were one of the first two foreign banks to receive approval to open a sub-branch in the Shanghai Free Trade Zone. We believe that this zone provides a test ground for interest rate liberalisation, RMB internationalisation and the opening up of capital markets. We intend to take full advantage of these opportunities in the coming years.

Taiwan

Taiwan’s economic growth slowed to 2.1% from sluggish external demand and domestic factors. Despite reduced corporate loan demand and increased credit quality concerns, we managed to grow our Taiwan franchise while renewing our focus on credit quality.

In consumer banking, we enhanced our foreign exchange product range. With the launch of an RMB business, our Treasures customer base increased by one-quarter as 5,000 customers signed up, with deposits in excess of RMB 1 billion.

We cemented our position as a leading banking partner to SMEs. We became the second-largest SME lender among foreign banks with a 37% share of loans by foreign banks. Our strong treasury and cash management capabilities, together with our extensive electronic and mobile channels for customers, helped us achieve 25% income growth in the SME segment. We were named “Best Overall Domestic / Cross-border Cash Management Services Provider in Taiwan” for small corporates by Asiamoney magazine.

Treasury sales had a strong performance as more financial institutions as well as corporate and individual clients came to us for structured and currency hedging products. With the Group’s success in offshore RMB products, we were able to capitalise on the deregulation of the offshore RMB market in Taiwan, which enabled customers to make RMB deposits and investments. Income from RMB derivatives grew more than three times as derivative volumes increased five-fold. Our RMB one-year structured investment product garnered RMB 80 million within a few months of its launch.

Our success is predicated on the ability to offer customers connectivity to other Asian markets. We serve more than 200 Taiwanese companies with operations in China, Hong Kong, Singapore, India and Indonesia. In addition to credit facilities, we provide cross-border financial services such as capital market issuance, foreign exchange hedging and trade transactions to these clients.

SOUTH AND SOUTHEAST ASIA

| Financial performance (SGD m) | 2013 | 2012 |

|---|---|---|

| Income | 600 | 591 |

| Expenses | 283 | 275 |

| Profit before allowances | 317 | 316 |

| Net profit | 198 | 293 |

Total income grew 2% to SGD 600 million as the underlying franchise remained resilient despite a challenging macroeconomic environment. Net profit fell 32% as allowances rose from SGD 38 million to SGD 126 million mainly due to higher specific allowances.

India

India’s economy and currency were affected by volatile financial markets during the year, which dented business confidence and consumer demand. The challenging environment resulted in muted balance sheet growth and an increase in non-performing loans in parts of our mid-sized corporate portfolio. We are the fourth-largest foreign bank by assets and strongly believe in India’s long-term growth potential. While slowing down during the year, we took steps to strengthen our franchise to prepare ourselves for the time when growth opportunities return.

We strengthened our credit processes, from the origination of new loans to the monitoring of existing ones. We also took steps to increase overall returns and improve wallet share by conducting in-depth account planning for key corporate clients. We set up an India desk in Singapore to drive offshore business opportunities arising from Indian corporates’ growing regional operations.

Non-interest income was boosted by a range of treasury, cash management and trade activities. We concluded seven debt capital market transactions, including a successful USD 200 million five-year high-yield issue for Rolta, a leading information technology corporation, as well as a SGD 250 million bond, followed by a retap of 150 million, for Tata Communication.

We launched a mobile banking platform for corporate clients to perform transaction banking services on the go. We enhanced our proposition for non-resident Indians with the launch of a remittance service for Singapore-based clients to transfer funds to any bank in India. Since the launch, almost SGD 200 million has been remitted through the online platform, with an average daily transaction count of 900 in December. We launched two foreign currency non-resident (FCNR) products, garnering USD 500 million of FCNR deposits that were subsequently swapped with the Indian central bank during a limited window, enabling clients to capitalise on a short-term opportunity.

We continued to grow our customer franchises as we added close to 1,000 corporate and 5,000 individual customers.

Indonesia

Indonesia’s economic growth slowed to 5.8% from accelerating inflation, falling export prices and slower foreign investment. In the middle of the year, Indonesian financial markets were also affected as capital outflows led to IDR depreciation and volatility in financial asset prices.

Despite the challenging environment, we recorded strong growth in corporate banking and wealth management. To drive higher returns, we managed net interest margin by ensuring price discipline and focusing on target customer segments. In the large corporate segment, we utilised our knowledge in sectors such as commodities and our regional connectivity to support clients’ cross-border financing needs. Among SMEs, our cash management, trade and treasury capabilities helped us to be recognised as “Best Foreign Cash Management Bank for Small Corporate” by Asiamoney magazine.

Our reputation as Asia’s safest bank as well as our extensive product capabilities helped us gain customers among affluent individuals. Widely recognised as one of the top three wealth management banks in Indonesia with competitive investment product suites, we also leveraged our treasury capabilities to structure products with higher returns for customers.