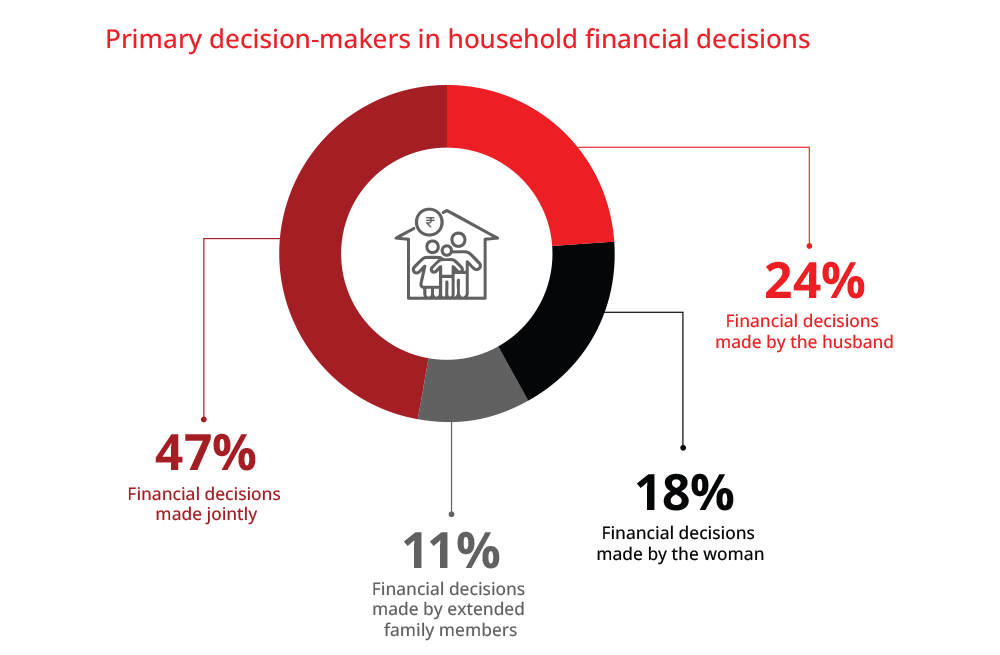

Financial Decision-Making

The survey reveals a shift towards greater financial autonomy among rural women entrepreneurs. 18% of respondents make financial decisions independently, while 47% make financial decisions jointly with their husbands.

24% stated that their husbands make all financial decisions, and the remaining 11% consult their immediate or extended family members.

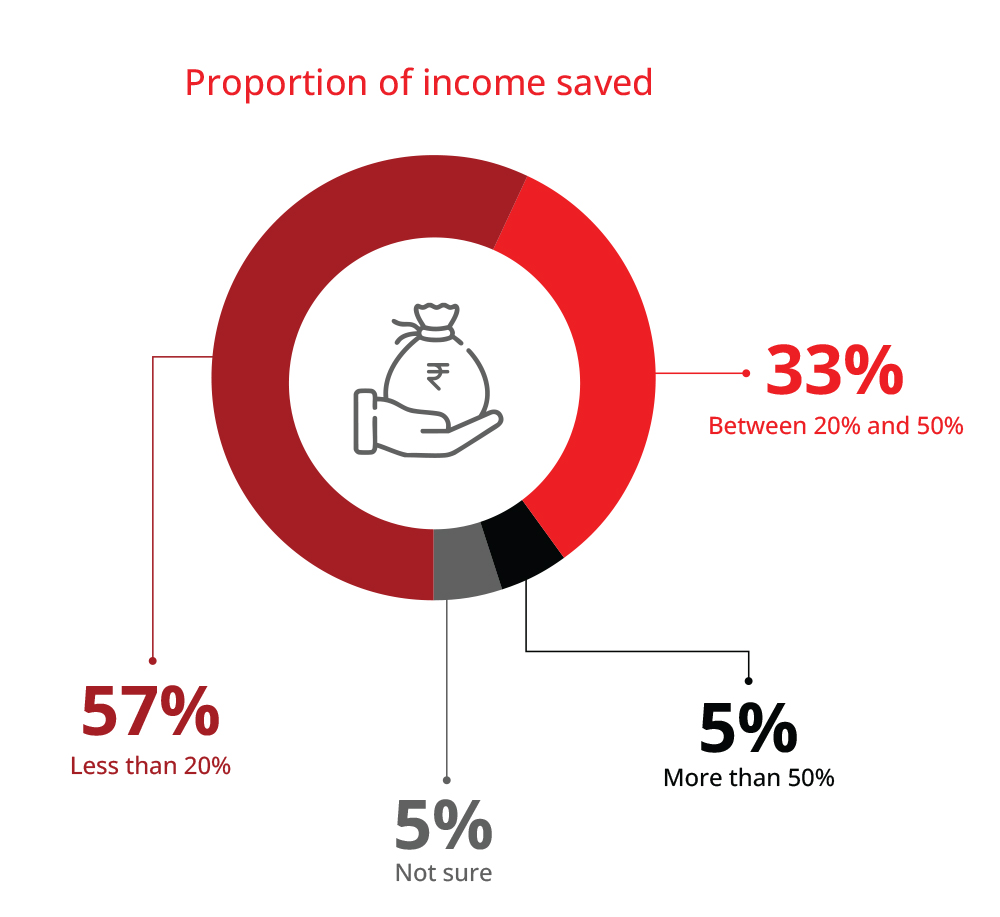

Savings and Investments

A notable 90% of respondents save a portion of their income. Out of these, 57% save less than 20% of their monthly income, while 33% save between 20% and 50%. 5% save more than 50% of their income, while the remaining respondents are unsure about the portion of their income saved, suggesting a need for improved financial literacy and planning.

100% of respondents in Madhya Pradesh, 95% in Maharashtra, and 73% in Rajasthan set aside a portion of their income as savings.

Among savers, 56% opt for bank deposits, 39% participate in SHG savings programmes, and 18% set aside cash without investing it in any instruments. Fixed Deposits (FDs) and Recurring Deposits (RDs), as well as investments in gold, are less common, with only 11% and 5% opting for these methods, respectively.

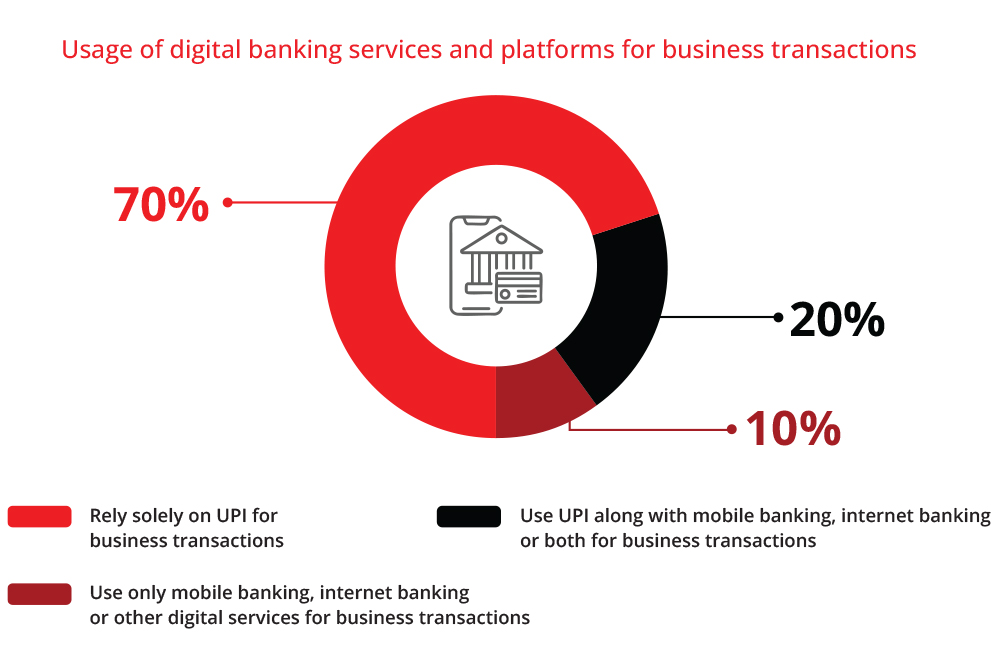

Banking Preferences and Digital Usage

The rural women entrepreneurs surveyed exhibit a strong preference for traditional banking methods. A majority — 89% — favour in-person banking, underscoring their reliance on conventional channels despite the increasing availability of digital services.

Despite 99% of respondents a having bank account, only 38% utilise digital banking services for their businesses. Among these digital users, 70% rely solely on UPI for business transactions, 20% combine UPI with mobile or internet banking, and 10% use only mobile banking, internet banking, or other digital services.

Access to credit

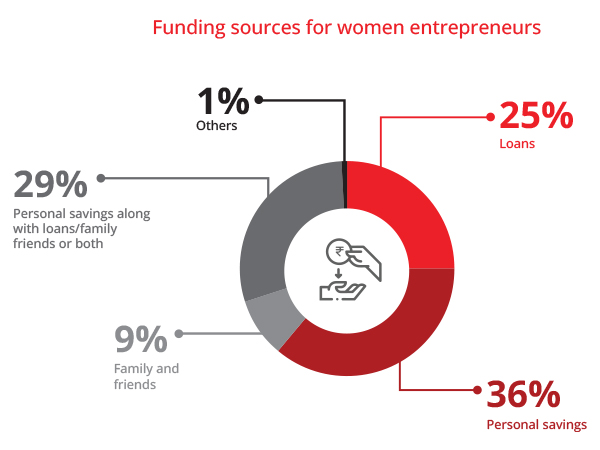

36% of rural women entrepreneurs started their businesses using personal savings, while 25% relied on loans.

Additionally,29% combined their savings with loans or borrowed from family and friends, employing both formal and informal financial sources. Notably, for 9% of these women, family and friends served as the primary funding source, highlighting the role of social networks in supporting small businesses.

Nearly 80% secured funding through a combination of SHGs and/or other lending channels, while 43% relied solely on loans from SHGs. 15% of the respondents stated that they had accessed government credit schemes.

Growth aspirations

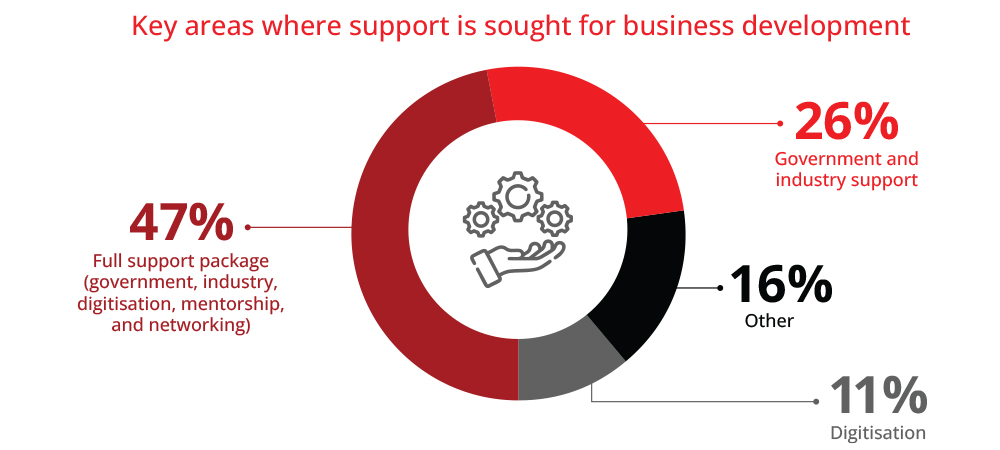

To expand their businesses, rural entrepreneurs seek support from industry and government (72%), assistance with digitisation (39%), business mentorship (35%), and networking opportunities (32%).Focus groups revealed a strong commitment to community development among respondents, who aspired to create jobs for other women in their villages.