Post Integration

Now access your bank account via digibank by DBS!

Thank you for banking with us. We highly value your continued trust and relationship. As Lakshmi Vilas Bank is now a part of DBS Bank India Limited, your bank account will only be accessible via digibank by DBS.

Please note, your account can no longer be accessed via the Lakshmi Vilas Bank mobile and internet banking platforms.

Upgrade to an Instant, Intelligent and Intuitive banking experience now, so you can Live More, Bank Less.

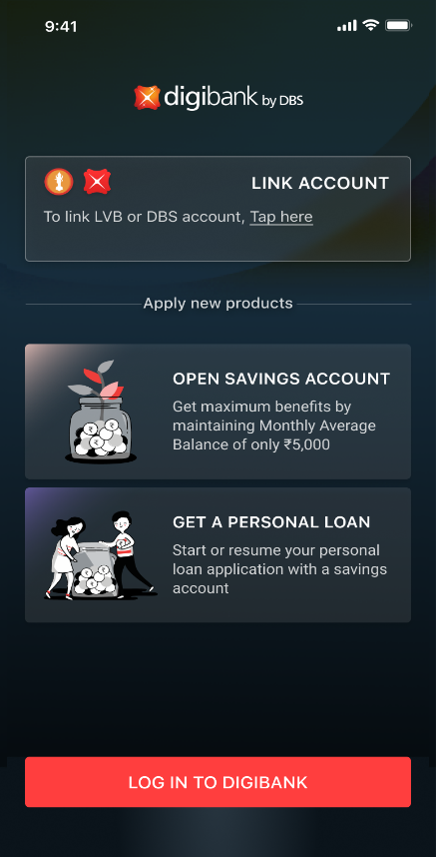

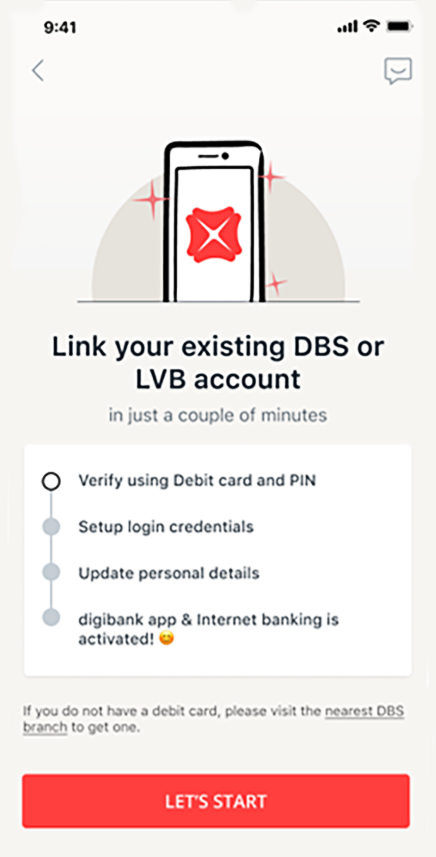

Follow these 3 simple steps to access your account via digibank by DBS:

Download the digibank by DBS app or visit our Internet Banking platform

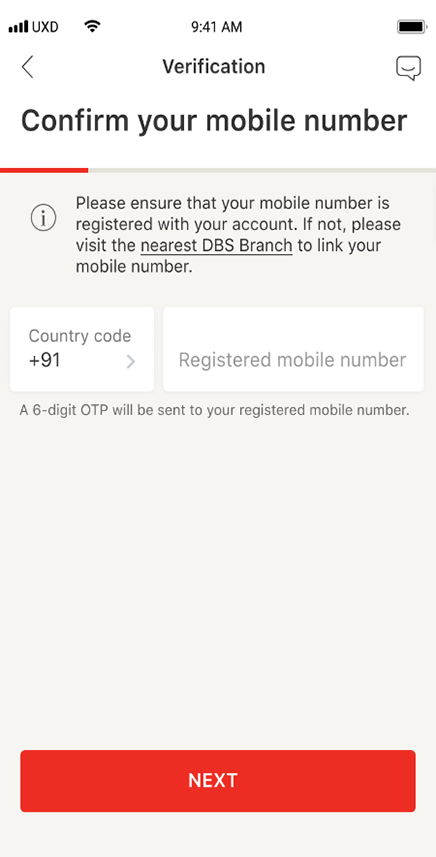

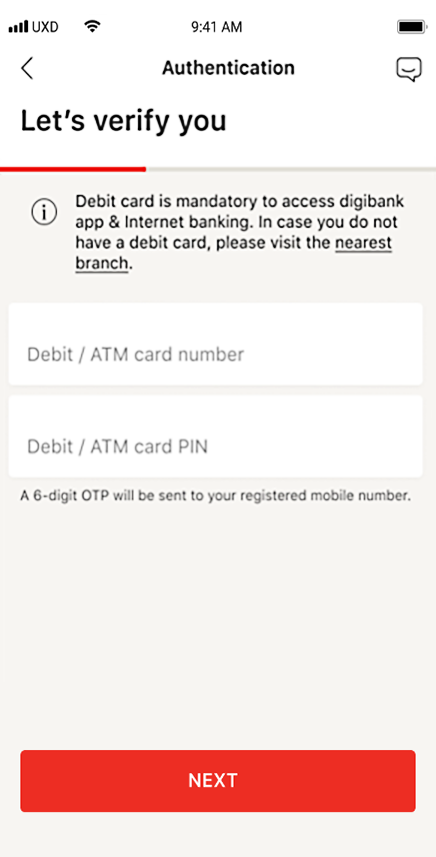

Enter your registered mobile number, your Debit Card number and PIN

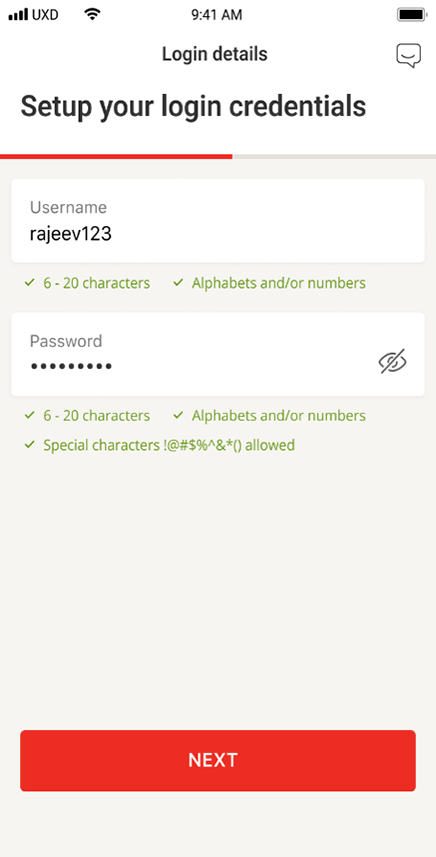

Set up your new login credentials

In case your mobile number is not registered with us and you do not hold an active Debit Card with a valid PIN, please walk into your nearest DBS Bank branch for assistance.

Link your account seamlessly. Watch this video to know how.

Registration Journey

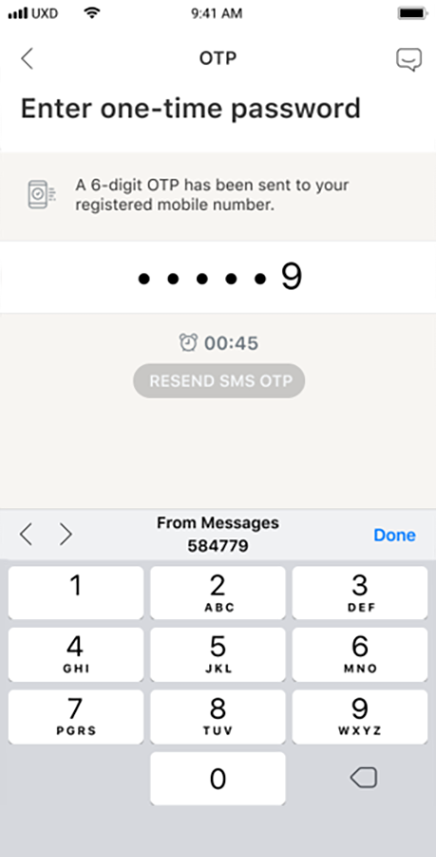

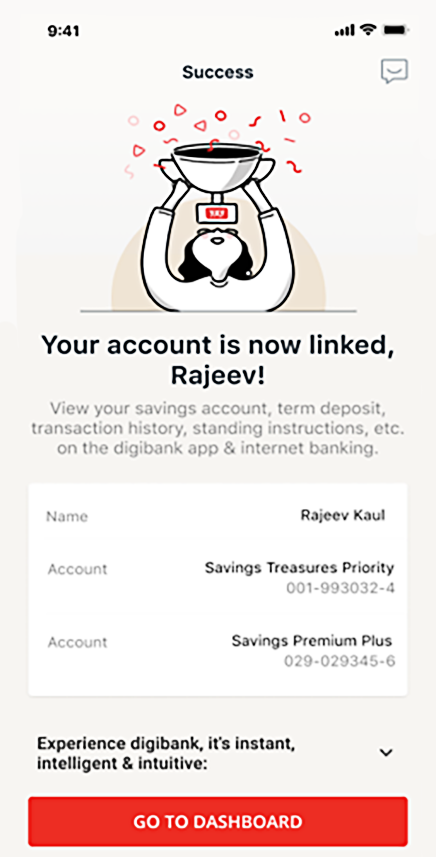

You can also refer to the step-by-step illustration of the journey to link your LVB account to digibank by DBS below:

1

2

3

4

5

6

7

8

9

Frequently Asked Questions

How do I access my LVB bank account online?

Please note your Lakshmi Vilas Bank mobile & internet banking platforms have been discontinued. Access to your bank account is now via digibank by DBS - your digital banking partner.

To register on the digibank by DBS app, you must have an active savings / individual current account, a debit card with a valid PIN and your mobile number must be registered with the bank.

After the migration is complete, please

- Download the digibank by DBS India app from either Google Play Store or Apple App Store and follow the 3 simple steps to access your LVB bank account online; or

- If you already have a digibank account, simply login to the digibank app, and you will have access to both your LVB and digibank account, under the same profile

Will my mobile banking & internet banking login credentials change?

Yes, at the time of registration on the digibank mobile app or internet banking, you will have to set up your user ID and password which can be used for both mobile app and internet banking.

Will my registered payees & billers be available after mobile banking & internet banking migration?

Yes, all your existing "LVB Mobile" & internet banking payees will be available on digibank mobile and internet banking after migration.

Registration

While registering on the digibank app / internet banking, I am getting an error message of mobile number not registered. What can I do?

If your attempt to link your LVB account on the digibank app or internet banking using your mobile number was unsuccessful, then it may be possible that the number is not registered with us. Please visit your nearest DBS Bank branch to check or update your mobile number.

While registering on the digibank app / internet banking, I am getting an error message of Mobile number linked to multiple customer IDs. What can I do?

Please be advised that to register and access your LVB account online, each customer ID should be linked to a unique mobile number. If your attempt to link your LVB account on the digibank app or internet banking using your mobile number and your attempt was unsuccessful due to it being linked to multiple customer IDs, then we request you to kindly visit your nearest DBS Bank branch to check and update different mobile numbers for each of the relevant customer ID.

I have forgotten the Debit Card/ATM PIN. How can I reset the same?

I am unable to register my account as I do not have a Debit Card. It has expired/ been blocked for use. How do I get a debit card?

Simply walk into your nearest DBS Bank branch. Our branch representatives would help you apply for a Debit Card.

While registering on the digibank app / internet banking, I am getting a message that my email address is not updated. What can I do?

Your email address is an important detail that will be required to retrieve or reset your digibank password. If you have received a message that you need to update your PAN / email address with us, then it means that your email address is not updated in our records. Please visit your nearest DBS Bank branch and meet our staff, who will assist you with this process.

While registering on the digibank app / internet banking, I am getting a message that my PAN details are not updated. What can I do?

Your PAN number is an important detail that will be required to retrieve or reset your digibank password. If you have received a message that you need to update your PAN / email address with us, then it means that your PAN number is not updated in our records. Please visit your nearest DBS Bank branch with your original PAN Card & meet our branch staff who will assist you with this process.

I am not getting an OTP to complete my registration process. What do I do?

If multiple attempts to get an OTP have failed and you are unable to complete your registration journey on either the digibank app or internet banking, then we request you to please write to us at customercareindia@dbs.com so that we can investigate the issue.

After Registration

I am unable to view my account (s) or book / close a fixed deposit

If you are unable to view your account details in the app after completing your registration, we request you to please visit your nearest DBS Bank branch or write to us at customercareindia@dbs.com or call us on 1860 267 4567

I am unable to view my payee list

If you are unable to view your payees in digibank by DBS please visit your nearest DBS Bank branch or write to us at customercareindia@dbs.com or call us on 1860 267 4567

I am unable to add a new payee or do any transactions

If you are unable to add a new payee in digibank by DBS, we request you to please visit your nearest DBS Bank branch or write to us at customercareindia@dbs.com or call us on 1860 267 4567

I am unable to block my Debit Card. What do I do?

If you were unable to block your Debit Card in the digibank by DBS app or internet banking, please call our Customer Care at 1860 267 4567, to report a Fraud or to block your card immediately.

Other FAQs

What will be mobile banking & internet banking transactions limit post migration on the digibank platform?

After the migration to digibank by DBS, you will be able to view and change your daily fund-transfer limit. You will be able to transfer funds within the defined limit of up to INR 5 Lakhs for Mobile Banking, and up to INR 20 Lakhs (depending on savings account defined limits) for Internet Banking. The above-mentioned limit is applicable for:

- Transferring funds to other DBS Bank accounts

- Transferring funds to other bank accounts (IMPS, NEFT, RTGS & UPI)

- Overseas remittances

- Payment via the merchant's website

- Utility Bill payments e.g., DTH, Mobile prepaid, Electricity, etc.

Do I need to register for UPI again when doing transfers within the DBS mobile banking app? Will my LVB UPI ID work post-migration to the digibank app?

UPI facility is available on the digibank app. You will need to create a new UPI ID (@dbs handle) after the successful registration on the digibank app.

Which bank should I select while using internet banking, to make online payments on merchant websites (e.g., e-commerce, ticket bookings, etc.)?

After the migration, please select DBS Bank from the list of Banks, for all your merchant transactions on their websites.

How do I register/ manage my linked account on other UPI payment applications (like Google Pay, Paytm, PhonePe etc.) to avail of UPI facilities?

If you have linked your erstwhile LVB account to other UPI payment applications (like Google Pay, Paytm, PhonePe etc.,), then you do not need to do anything.

But, if you have not linked your LVB account with any of the UPI applications before, then you can easily link your account by simply selecting the bank as DBS Bank.

What will happen if I do a transaction through IMPS / NEFT with the old LVB IFSC Code?

All transactions through IMPS / NEFT with the LVB IFSC Code will continue to be honoured until further notice from us. However, we have already sent a communication advising you to start using the new IFSC codes as the old IFSC codes have been surrendered in February 2022.

Transactions initiated with the old IFSC codes may get declined. Please refer to the webpage in case you would like to confirm the IFSC / MICR code for yourself.

Can I register on digibank mobile or internet banking, if I do not have any Savings account but have a fixed deposit account(s) and/or loan account(s) with LVB?

Customers with no savings or individual current accounts can only access/operate their fixed deposit account(s) and/or loan account(s) through our branches. To register on digibank mobile app /internet banking, customers must have an active savings / individual current account, a debit card & PIN, and their mobile number should be registered with the bank.

Will I be able to generate Demat statements in the digibank app or internet banking?

You can only view your Demat transactions in the digibank app or internet banking. The statement download facility is not available online in the app for Demat.

Will my debit card be migrated to DBS with my account, and will I be able to block and replace the debit card through the digibank app?

Yes, your debit card will be migrated to the DBS systems, and you can manage your debit card, including blocking it and requesting for a new one, only once you have completed your registration on the digibank app.

Can I close my fixed deposit through the digibank mobile app? Is there any penalty for pre-mature withdrawal of the deposit?

Yes, you can close your fixed deposit on the digibank app if it is held singly. In case of a fixed deposit held jointly, the closure request must be submitted at the branch. In case of premature closure, a penalty of 1% will be levied. However, a Tax Saver Fixed Deposit cannot be prematurely closed before its maturity date.

Can I change the nominee of my deposit account through the mobile app?

Yes, you can change your nominee for your deposit account in the digibank app.