All that Glitter is from Gold: Riding the Global Wave

There is a building case for holding gold as a hedge to global turbulence.

Still safe-haven but volatile: Gold prices have been choppy in 2018. In the past decade, flush liquidity and positive risk sentiment boosted most asset classes, with gold prices moving up 30%, lagging equity gains in the same period but performing better than US Treasuries. At the start of 2018, prices rallied towards USD1350 per ounce but then found resistance in the form of a strong US dollar to slide below USD1200 by 3Q18 before confining to a USD1250-1300 range.

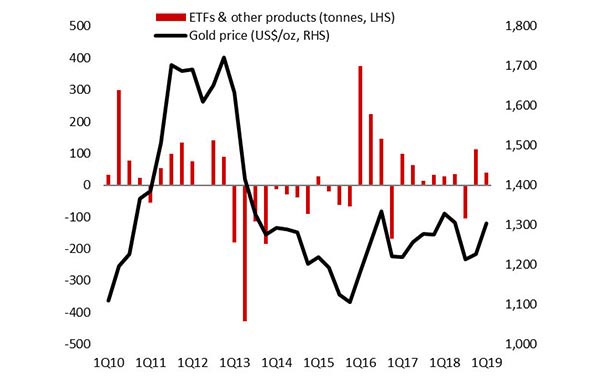

Despite the US Fed’s decision to not raise rates this year, the US dollar continued to strengthen, which encouraged profit-taking on gold. Concerns over global growth and trade tensions between US-China particularly helped in strengthening the US dollar and dampened all asset classes; gold was no exception. There were outflows from gold ETFs and related financial products. In April alone, ETF outflows were equivalent to USD2.2bn, mainly driven by North America and SPDR Gold Shares.

Source: World Gold Council, DBS Group Research

Source: World Gold Council, DBS Group Research

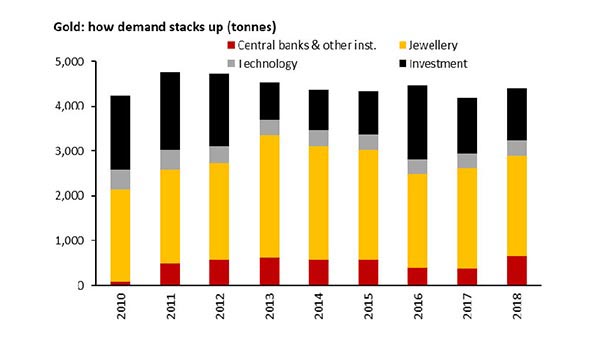

Demand from central banks remained strong, as they continued to add gold to their reserves in 1Q19, after recording a 50-year high in net purchases last year. 1Q purchases this year were the highest for the start of the year in six years. A need to maintain liquidity, ensure safety and diversification of investments in the midst of global uncertainties and a dampened growth outlook have spurred gold purchases.

Russia bought the most in 1Q19, in line with its de-dollarisation policy. This trend should continue as Russia’s head of central bank (which holds the sixth highest gold holdings in the world) highlighted at end-1Q19 that it is necessary to increase gold reserves even more given sanction risks. As of March 2019, the US holds the most volume of gold holdings, followed by Germany, IMF and Italy. China and India are at the seventh and eleventh position, respectively. Central banks’ gold demand is forecasted to grow by 10% in 2019, supporting prices.

Looking ahead: Factoring in persistent US dollar strength despite a rate pause and below-expectations gold demand in 1Q19, DBS strategists are revising down the gold price forecast for 2019 to USD1,306 per ounce. Prices have room to bottom out in the near term, hinging on episodes of US dollar weakness. A successful resolution of US-China trade issues, as well as growth impact from China’s stimulus policy would be particularly helpful to gold prices. Gold prices are forecast to average USD1,310 per ounce in 3Q19, 1.6% higher than DBS’s own 2Q19 estimate of USD1,290 per ounce.

Demand for gold arises from four segments: Half of all gold consumption is for jewellery, a third for investments, 10% for use in technology (industrial raw materials) and 6% to fill reserves of central banks. Last year, demand for gold - volume basis - picked up due to higher central bank purchases but a risk-averse environment amidst heightened global volatility also led to a rush of outflows especially from ETFs.

Source: World Gold Council, DBS Group Research

Source: World Gold Council, DBS Group Research

Diversification avenue: In the current environment, there is a building case for holding gold as a hedge to global turbulence, and to diversify one’s portfolio. But the attractiveness as a hedge to inflation is weak, especially since inflation is low and likely to remain low. Investors can gain exposure to gold by various channels: a) purchasing physical gold (bars and coins); accounts for about 60% of global annual demand; b) gold exchange-traded funds (ETFs), gold-backed bonds and similar funds; c) gold derivatives through forwards, options and futures; d) indirect exposure through gold mining stocks and trading houses; e) others, which include e-investment into gold etc.

India’s love for gold: India is one of the world’s largest gold importers and consumers of gold. Domestic purchases are seasonal: start of a year is usually unfavourable as it marks an inauspicious period. This follows by a strong rest of 1Q and part-2Q owing to a traditional period for wedding purchases and Akshaya Tritiya festival.

For instance, there were more than 20 auspicious wedding days in the Hindu calendar during 1Q19, 3x that of the first quarter in 2018, according to the World Gold Council - the key driver of a spurt in India’s jewellery demand at the start of this year.

Rural sector demand also recovers in this quarter, provided crop prices hold up (and boost incomes) and monsoon trends are positive. Late-3Q is another strong period for demand due to a string of religious festivities. Apart from seasonality, rupee trends and inflation also influence demand.

The bulk of the domestic demand is met through imports, thus posing a strain on external balances. In the past, a surge in imports akin to 2013, led to administrative curbs. These were lifted in 2014 as external stability returned, with authorities mulling over an import tax hike last year to contain the economy’s current account deficit.

Longer-out, there is strong interest to contain gold imports, by monetising idle assets with households through sovereign gold bonds, special gold deposits, amongst others.

Staying connected to home is easy for the Global Indian.

Get In Touch