- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

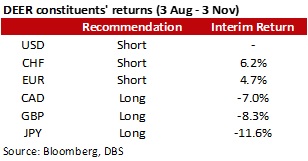

- The DEER Strategy recommends longs in JPY, GBP, CAD, and shorts in USD, CHF, EUR.

- Amid shocks from the UK and a hawkish Fed, the strategy saw a loss of 5.3% since August.

- Still, GBP's and JPY's significant under-valuations now provide compelling opportunities.

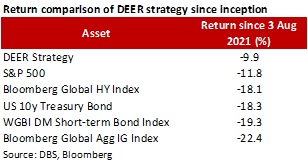

- The DEER Strategy still maintains its outperformance against other asset classes since inception.

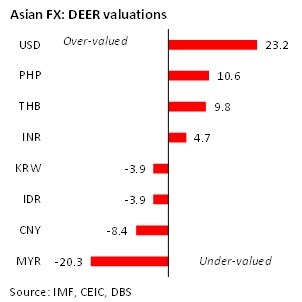

- In Asia ex-Japan, MYR, CNY, IDR, and KRW are under-valued, while PHP, THB, and INR are over-valued.

Related Insights

- USD strength meets resistance22 Apr 2024

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- US PCE deflator and intervention risks next week 19 Apr 2024

Latest G10 DEER valuations

Within major G10 currencies, the JPY, GBP, and CAD are the most undervalued based on our latest DEER valuations. JPY’s undervaluation has undershot to its lowest level on record. It has prompted rate unilateral FX intervention by Japanese authorities since Sep, buying JPY for the first time since 1998. For GBP, its under-valuation and volatility have been exacerbated by a botched mini budget that cast doubts on fiscal sustainability. CAD has replaced the EUR as the third most under-valued.

The USD, NZD, and CHF remain the three most over-valued currencies based on the DEER. The USD has climbed against all major currencies over the last three months, amid upside risks to the Fed’s terminal rate amid strong labour markets. NZD swapped place with CHF as the second most over-valued, though the magnitudes of their valuations are close.

DEER Strategy Recommendations

Our DEER strategy remains long in JPY, GBP, and CAD. Misalignments from our DEER fair values have been widening since August, instead of narrowing. It has also resulted in highly attractive valuations across FX, particularly for JPY and GBP, which had fallen to their lowest against the USD since 1990 and 1985, respectively. Given similar quality of institutions and economic development, further large depreciation seems unlikely. The degree of undershoot looks too large, even after accounting for wider short-term rate differentials this year.

The Japanese government views the current JPY’s move as extreme, and is buying JPY in size. Japan holds ample FX reserves of over USD1trn, built when it was leaning against excessive JPY strength. With JPY purchases estimated at around USD60bn thus far, there is no risk of exhaustion of reserves if intervention stays at its current pace.

For the UK, fiscal plans to be unveiled by new PM Sunak could help to rebuild credibility and support the GBP. However, there has been economic damage from the fiscal debacle under Truss, which resulted in a sharp rise in Gilt yields and the pricing in of a substantial policy risk premium. GBP volatility could remain high, given the considerable fiscal uncertainty.

In Canada, BoC has signalled that policy tightening is close to an end, and it has also downsized to a 50bps rate hike in October. The BoC may aim to be in lockstep with the Fed, which is also preparing to slow its pace of rate hikes. Despite a recent moderation in growth, Canada’s unemployment rate is still lower today than in Q1 2022. Further BoC policy tightening may still be needed to lower inflation, supporting the CAD.

Our strategy also maintains shorts against USD, CHF, and the EUR. Fed Chair Powell had signalled in this week’s FOMC meeting that rate hikes could be downsized as soon as the next Dec meeting, given the cumulative effect of tightening that has been enacted. An eventual pivot towards a rate pause next year could undermine support for the USD, which is now highly stretched on valuations.

EUR had remained resilient, supported by two consecutive 75bps rate hikes from the ECB thus far. However, such a rapid pace of rate hikes could be difficult to sustain, as recession risks rise on elevated energy prices and disrupted Russian gas supply, while periphery economies may also face fiscal sustainability concerns given their high debt levels.

In Switzerland, inflation had eased back to 3.0%, while the strong CHF had finally taken its toll on growth. Switzerland’s manufacturing PMI had fallen to 54.9 in Oct, which is the softest read since Nov 2020. Given that EUR/CHF now trades below parity and inflation pressures are also clearly diminishing, the SNB may be more careful in moderating excessive CHF strength.

Recent DEER return breakdown and analysis

We review the returns of our previous DEER recommendations made on 3 Aug 2022 (see FX: DEER recommendations (August 2022), 3 Aug 2022). The 3M returns are calculated based on closing prices on 3 Nov vs 3M forward prices on 3 Aug 2022.

The USD remains a key driver of returns, with all our shorts against the USD recording gains, and all our longs against the USD seeing losses. The strong USD trend has been due to resilient US economic activity, and persistently elevated inflation that have kept the Fed moving with jumbo 75bps rate hikes. But the Fed is now signalling that smaller-sized rate hikes might be more appropriate, which could temper against USD strength.

Diving into individual crosses, our CHF short posted the largest gain of 6.2%, reversing from last quarter’s 2.7% loss. SNB disappointed expectations of a large hawkish move with just a 75bps hike in Sep, bringing its key rate to 0.50%. Slowing growth and inflation now look to give further pause to hawkish SNB expectations. Our EUR short posted a 4.7% gain, as the Euro Area continues to confront stagflation risks, as well as risks of Russian escalation in the war with Ukraine.

Our CAD long posted a 7.0% loss. Moderating growth in Canada and signs that inflation is peaking have dampened expectations of BoC rate hikes. Meanwhile, Canadian crude prices have also fallen significantly relative to WTI benchmarks, hit hard by refinery shutdowns in the US Midwest, a major export market. An expected restart in the disrupted refinery could lift Canadian crude exports as soon as late November.

GBP saw a significant 8.3% loss. Fiscal risks moved to the fore after markets reacted negatively to Truss’s mini budget, with both GBP and Gilts tumbling in its aftermath. While GBP has since rebounded from its nadir after a change in PM and Chancellor, there is still a significant policy risk premium. Stronger assurances from new PM Sunak on the fiscal front could diminish this risk premium, and allow GBP’s undervaluation to narrow.

Our JPY long posted a large 11.6% loss, as US rates climbed amid Fed rate hikes, while the BoJ had not budged from maintaining its yield curve control policy. Japan clearly sees JPY trading as excessive and one-sided, and have begun interventions to support the JPY. Japan’s current account should also improve as it opens fully to international tourists.

On an aggregated basis, our DEER strategy posted a loss of 5.3% from 3 August to 3 November. Market developments and high volatility have resulted in wider misalignments from fair values, instead of convergence. Moves had been quite extreme, and there could be a strong mean reversion as risks fade.

Since inception, our DEER Strategy has performed better than the S&P500 Index, US 10y Treasury Bond, short-term DM bond index, as well as global IG and HY credit indices.

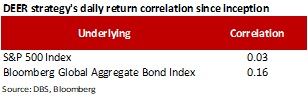

The DEER Strategy’s daily returns have also continued to show limited correlation against returns of both the S&P 500 and the Bloomberg Global Aggregate Bond Index. As such, it still offers a valuable diversification benefit to traditional portfolios consisting of just equities and bonds.

Latest Asian ex-Japan DEER valuations

For Asian ex-Japan currencies, our DEER currency rankings have seen little change. We note that the MYR now sits at a record low valuation, being over 20% cheaper than its DEER fair value. An under-valued currency has unsurprisingly bolstered Malaysia’s monthly trade surplus has hovered above USD60bn since end 2021, and is significantly larger than previous norms. That said, political uncertainty is the bigger concern, with the country scheduled to hold general elections on 19 Nov 2022.

CNY has replaced IDR as the second most under-valued in Asia ex-Japan. Growth concerns stemming from China’s zero-Covid policy and consequent risks of disruption still loom large over sentiment. Meanwhile, the real estate sector remains under pressure, with policy support not being particularly forthcoming. Credit pressures have worsened even for the best-rated Chinese developers. Home buyer sentiment could remain soft, providing no impetus for growth. IDR and KRW can be considered to be joint third, with both being undervalued to a similar extent.

PHP, THB, and INR remained the most over-valued compared to Asian peers, though they are cheap compared to the USD. PHP has been pressured by trade deficits amid strong import demand, while remittance growth is still subdued. While BSP has been supporting PHP in FX markets, Governor Medalla also said that he would not draw a line in the sand for PHP.

THB’s remains over-valued, especially in context of a widening trade deficit, which is now the largest since 2014. BoT’s FX reserves have dropped from a peak of USD 258bn in 2020 to USD 200bn as of Oct, suggesting that policymakers are actively cushioning the THB’s decline and smoothing volatility.

INR is marginally over-valued, even as USD/INR had risen close to 83. India’s trade deficit remains pressured by high oil prices, while expected bond inflows from hopes of inclusion into global bond indices now have to wait till 2023.

Chang Wei Liang

To read the full report, click here to Download the PDF.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- USD strength meets resistance22 Apr 2024

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- US PCE deflator and intervention risks next week 19 Apr 2024

Related Insights

- USD strength meets resistance22 Apr 2024

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- US PCE deflator and intervention risks next week 19 Apr 2024