- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Latest jobs data underscore the Fed’s quandary

- Vacancy rates are falling, but unemployment and wages are still indicating a robust labour market

- Housing is bound to soften against sharply rising mortgage rates

- But home price and rents are yet to reach a level that would make the Fed comfortable

- Softer housing and jobs data are coming, but Fed would need a lot of that before relenting

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024

Commentary: US labour and housing markets

US headline inflation has eased from a peak of 9% in June to 8.2% in August and is likely to fall to or below 8% in September. Similarly, core PCE inflation peaked in June. And yet, markets have not been able to take solace, with the Federal Reserve continuing with its policy tightening path. The reason behind this has been made clear by Fed officials through the course of this year—unless the labour and housing markets soften, underlying inflation pressures would likely remain uncomfortably high. Hence, while inflation numbers are important to track, at this juncture, those two markets are key to gauging the final phase of this monetary tightening cycle.

Friday’s jobs data release underscores the Fed’s quandary. Job growth slowed, but was still robust, with employers adding 263,000 jobs in September, pushing down the unemployment rate to 3.5%, a half-century low. There are plenty of anecdotes of companies freezing hiring in light of softening demand, but so far that has not yet translated into an economy-wide deterioration in employment conditions.

In addition to hiring, the number of vacancies is a critical indicator of labour market strength. In that area, the developments are indicative of some weakening, with job openings in August posting their largest decline since the early months of the Covid-19 pandemic. Wage growth is running at about 5%, which, like jobs growth, is on the softer side, but well above the Fed’s comfort zone, which is formed around its 2% inflation target.

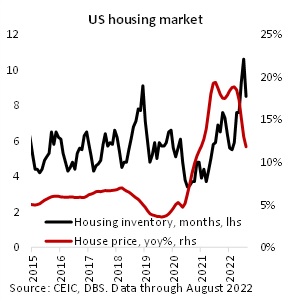

What about housing? US mortgage rates have risen sharply this year; the average interest rate for a 30-year fixed-rate mortgage has risen to about 6.7%, compared to about 3% in January. Home prices, which were up nearly 20%yoy earlier this year, have begun to soften, although they are still up by double digits. Home inventories shrunk sharply during the Covid years, but now transactions are easing, and the number of houses on the market is rising. This should pave the way for weaker rents at some point, but unfortunately for the markets, not in the very near term.

Taimur Baig

To read the full report, click here to Download the PDF.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024