- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Sustained and broadening prices pressures continued to underpin the tightening stance

- Spillovers that could potentially unhinge inflation expectations were also considered

- The PHP’s weakness vs the USD, driven by diverging monetary policy, would fan imported inflation

- The surprise and forceful policy rate hike has lowered the bar for aggressive policy tightening

- Forecast implications: A 50bps hike during August’s meeting is in play

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

The Bangko Sentral ng Pilipinas (BSP) surprised on multiple fronts with yesterday’s unexpected announcement. First, the Philippine central bank delivered an increase to its key policy rate (overnight reverse repurchase rate) that was outside of its usual scheduled meeting. The BSP was scheduled to review its monetary policy stance in August, following the 25bps hikes in each meeting in June and May. Second, it opted for a large quantum of 75bps increase to 3.25%. It was bigger than the potential 50bps that might have taken place during the August meeting, which was signalled and considered earlier by Governor Medalla. It was also larger than the 50bps seen in a single meeting during the interest rate hiking cycle in 2018.

Key takeaways from Monetary Board’s release

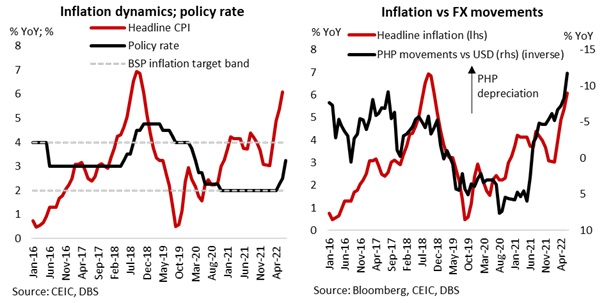

The BSP’s hawkish stance was clearly reflected in the Monetary Board’s press release that justified the surprise tightening. Sustained and broadening price pressures continued to be the key factor underpinning the central bank’s tightening and normalisation stance. Headline inflation remained well above the BSP 2-4% target range at 6.1% YoY in June, marking the fastest increase since late 2018. Beyond rapid commodity price increases, the BSP is also observing signs of second-round price effects that were mentioned previously. Therefore, the BSP saw an urgent need to anchor inflation expectations and temper upside inflation risks.

What was notable in the press release was the mention of policy helping to ‘manage spillovers from other countries that could potentially unanchor inflation expectations.’ We think this might be referring to the Philippine peso’s weakness against the US dollar that would fan further imported inflation, which the BSP wishes to contain.

The PHP is among the worst performing currencies in the region (alongside the South Korea won). The PHP has depreciated by ~9% vs the USD year-to-date, and is also weakening at its fastest YoY pace in many years. The peso’s weakness has been partly driven by diverging monetary policy stance with the US, amid a wide goods trade deficit. Philippines’ positive policy interest rate differential with the US has diminished further following the jumbo 75bps US Fed Fund rate hike in June. The differential would have narrowed even more, if the BSP had not adopted the off-cycle tightening. US tightening expectations for the July meeting have turned more aggressive, following the hot US June inflation print of 9.1% YoY – a 41-year high. On growth, the central bank continues to take comfort from the recovery, which we think is supported by opening dynamics as pandemic woes reverse.

More BSP hikes ahead to dampen inflation

The surprise and forceful policy rate hike on July 14 has lowered the bar for aggressive policy tightening. The BSP remains firmly committed to its price stability mandate over the medium-term, and is likely to stay hawkish to dampen elevated inflation pressures. August’s meeting is set to take place as scheduled, according to Governor Medalla. A 50bps hike in August is in play. There is still room to normalise and tighten policy at a fast pace to return to the pre-pandemic level of 4.0%. The likelihood of the policy rate reaching 4.5% by end-2022 is decent, especially if high inflation remains sticky above the BSP’s 2-4% target range.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024