- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Stagflation is not a concern for China comparing to the West

- Optimism stems from: (1) potential reduction of tariffs on Chinese imports to the US

- (2) gradual relaxation of zero covid policy across China

- (3) fiscal stimulus should begin filtering through the real economy in 2H22

- Annual GDP is projected to conclude at 4.2%

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

Commentary: China/HK equity market should deserve a re-rating in 2H22 due to absence of stagflation

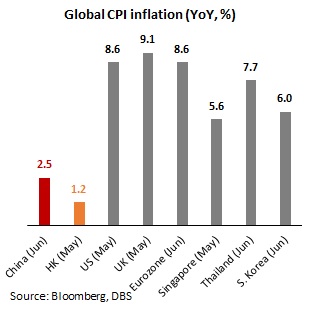

The world may have preoccupied too much with forthcoming recession in the US despite persistent tightness of labor market and elevated inflationary pressure. China’s inflation pressure, on the contrary, are very subdued as evidenced by the mild increment of CPI by 2.5%, alongside the moderation of the PPI thanks to recovering domestic supply-chain and discounted oil imports from Russia. The breakdown of CPI saw mild upward pressure on food prices driven by pork prices, but it is highly unlikely it will spike up to the threshold resembling the inflation situation of US and UK.

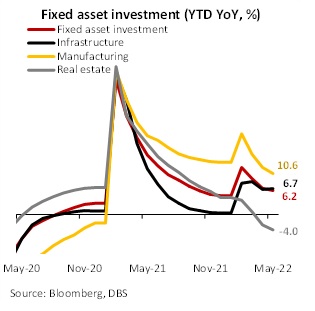

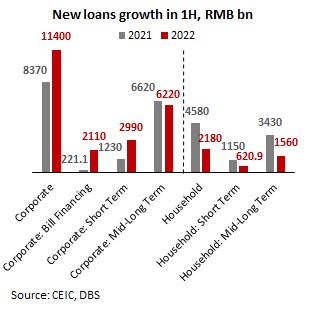

The pressing issue of China is growth deceleration. In fact, 2Q GDP probably only advanced by a meagre 0.9% thereby concluding GDP growth at 2.7% in 1H22, far below the official target of 5.5%. The market however should not focus on China missing official target. Forthcoming positive development include: (1) the potential reduction of tariffs on Chinese imports to the US by the Biden Administration; (2) gradual relaxation of zero covid policy across China (quarantine time has recently been halved for inbound travellers to one week ) alongside the rebound of industrial production (up 0.7% YoY in May) and exports (up 16.9% YoY) , which is consistent with rebound of Services PMI and Manufacturing PMI; (3) positive impact of fiscal stimulus on the real economy shall surface apparently in 2H22 as evidenced by uptick seen from corporate borrowing and infrastructure spending. In particular, new corporate medium and long-term loans soared to RMB1.5tn last month, the highest since January. Infrastructure investment accelerated to 6.7% in the first five months from 6.5% in January-April. Annual GDP is projected to conclude at 4.2% assuming the economy to advance 0.9%, 5.3% and 5.5% respectively in 2Q, 3Q and 4Q.

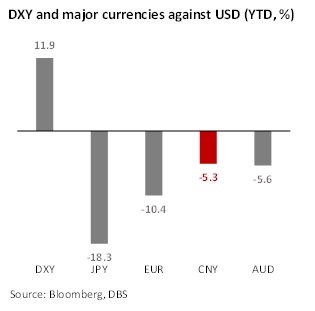

The PBOC could have proactively cut interest rates and reserve requirement ratio in the past 6 months. The authority had chosen instead to protect the resilience of RMB, which substantially outperformed the JPY and EUR despite narrowing rate spread with the USD, dwindling economic growth alongside foreign reserves declining USD179 billion in 1H22 to USD3.07 trillion. This is an intelligent policy choice because currency stability is a prerequisite for asset prices re-rating ahead.

The absence of stagflation in China warrants higher policy flexibility relative to western counterparts. This factor alone should deserve a re-rating considering valuation (PE ratio) of Shanghai Stock Exchange Composite Index and Hang Seng Index are trading at a three-year low of 13.5 and 7.8 respectively. Both indices had already rebounded by 14.8% and 14.7% from the respective year-low. Should China economic growth surprise on the upside ahead, the re-rating of Chinese assets could be explosive. In another scenario, if US recession were to arrive sooner justifying rate cuts by the Fed, the PBoC will likely loose domestic monetary policy in tandem this round at ease. Both scenarios are positive for China/HK equities.

To read the full report, click here to Download the PDF.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Research Library19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024