- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Bank Indonesia exhibits little urgency to tighten policy

- Monetary policy is moving in sync with a supportive fiscal push this year

- Fiscal consolidation is on the cards in 2023

- Strength in commodity prices is a key underlying assumption

- Implications for forecasts: We maintain our rate hike call for 3Q but delay the start to August

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024

Decision: Bank Indonesia acknowledged the risk of inflation breaching the 2-4% target in second half the year and pressure on the currency from global cues but did not exhibit any urgency to normalise policy. Policymakers held the policy rate unchanged at 3.5%, steady since February 2021. Withdrawal of excess liquidity remains the preferred route as the gradual increase in the reserve requirement rate announced in May runs its course. Year-to-date, RRR hikes have reportedly absorbed IDR 119trn worth liquidity without causing material disruption to banks’ financing/ credit activity.

Economic assessment: The central bank’s take on the global and domestic projections were little changed from the last rate review. The view on US Fed rate matched market expectations, with end-2022 rate at 3.5% and end-2023 at 4.0%. Global growth faced downside risks, with average oil price seen at $103bbl, higher end of the government’s budgeted range. Domestic growth forecast remained at 4.5-5.3%, with inflation expected to test past the 2-4% target in second half of the year, before returning to the band in 2023. A manageable core inflation path and limited second round effects were seen as positives. Credit growth is expected to top the official forecast of 7-9% underscoring easy financial conditions. Rupiah movements are likely to be monitored and strengthened through the rupiah exchange rate stabilisation policy through triple intervention framework.

Policy dashboard: Even as Bank Indonesia flagged the uncertain global backdrop and an aggressive US Fed, signs of an impending shift in policy direction were largely absent. In our view, the central bank’s decision to sit out the hawkish camp is premised on:

- BI pre-empted the June inflation report, where headline inflation is expected to breach the upper band of the 4% target range (DBSf: 4.1% yoy). This rise is, however, seen as being supply-driven, with second round effects still muted with core readings below the 3% mark

- Higher subsidy budget has helped contain inflation pressures, thereby providing more headroom to BI to remain in sync with a growth-supportive fiscal policy

- Terms-of-trade benefits will counter risks of any deterioration in the external balance (we see the likelihood of a small current account surplus this year)

- US-Indonesia rate differentials have narrowed but the share of rate sensitive flows in the bond market has fallen vs the last tightening cycle (17% vs 38% before the pandemic)

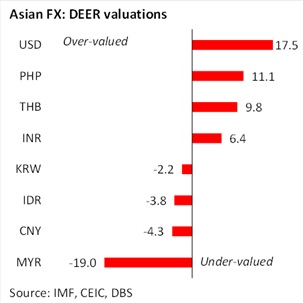

- Despite rupiah’s recent depreciation, on year-to-date basis the currency is amongst the regional outperformers owing to the commodity windfall. Add to this, our DBS Equilibrium Exchange Rate (DEER model) projects the rupiah to be slightly overvalued in our latest update, questioning the need for tightening rates

Factoring in the above arguments and absence of any material change in the central bank’s guidance, we delay our rate hike call to August (from July currently), whilst maintaining the total quantum of hikes for the year at 75bp.

Risks to policymakers’ dovish bias stem from any correction in commodity prices on global recessionary fears in 2H as well a sharp rally in the US$ due to broader risk aversion, which could add depreciation pressure on the rupiah. We continue to monitor BI’s commentary in the run-up to the July policy review.

Oil prices and its fiscal impact still under watch

As we discussed in High subsidy budget leaves Bank Indonesia with more headroom, extension of subsidies helped to keep a lid on price pressures, thereby allowing the authorities more headroom to keep rates on hold.

Two developments, however, suggest fiscal burden could rise if prices of commonly used fuel variants are to be kept unchanged. Firstly, Brent price has averaged $104/bbl year-to-date in 2022, at the upper end of the government’s revised budgeted oil price adjusted to $95-$105/bbl. Supply concerns have, however, lifted prices in June, where month-to-date average is $118/bbl, 13% above official assumption. If such levels prevail in 2H, the subsidy bill could rise further. Secondly, significant widening in oil market crack spreads points to a potential increase in fiscal costs, as prices of more expensive retail fuel prices i.e., refined products need to be kept unchanged whilst revenue gains from natural resources (O&G) moderates. This is likely to carry implications for the economy’s trade (current account) and fiscal math.

Fiscal consolidation needed in 2023

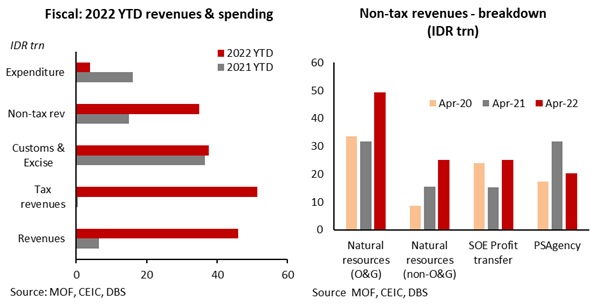

Between Jan-Apr22, total revenues rose by a sharp 46% yoy, boosted by across-the-board pickup in tax (see chart), customs & excise and non-tax receipts, benefiting from price boost in commodity prices, strong trade, and reopening lift. Expenditure rose at a slower clip of 4%, driven in part by higher subsidies, interest payments and social assistance.

We peg our 2022 fiscal deficit forecast at -4.5% of GDP. Banking on terms-of-trade benefits from higher commodity prices, and post pandemic boost, the 2023 fiscal deficit path is geared to return to sub-3% of GDP path. The mandate of Law No. 2/2020 on state fiscal policy and system stability was to provide the government the temporary provision of exceeding the budget deficit cap of -3.0% of GDP for a maximum of three years, due to the pandemic. In line with this provision, 2023 deficit has been pegged at -2.81-2.95% of GDP vs -4.85% in 2022. The underlying math assumes:

- 2023 deficit at IDR 562.6trn (-30% yoy)

- State revenues IDR 2255trn to 2383trn (11.3% to 11.8% of GDP)

- State spending IDR 2818trn to 2979trn

- Around IDR 27trn to 30trn is likely to be allocated towards the new capital

Notably, there will be few savings as pandemic-led stimulus measures are wound down next year and new taxes are considered. Key amongst this will be a) exemptions on income taxes, for instance for companies from sale of imported goods, lower tax rates for priority business sectors etc.; b) VAT exemptions to health sector players i.e., hospitals, agencies contribute to medicines, vaccines, as well as real estate purchases etc.; c) luxury VAT on cars exemptions will end and rates on purchases from 3Q will start and be gradually restored by 4Q. Concurrently, just as the VAT rate increase by 1% went into effect from April 2022, the government started i) taxing crypto transactions and assets; b) coal royalty rate was raised on new contracts on 14-28% if prices reach $100/ton from the current 13.5%. Notably, producers who fulfil DMOs (effectively cap prices at $70-$90, will be subject to 14%).

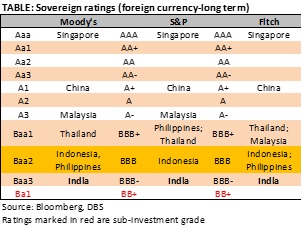

Encouraged by favourable momentum in the fiscal math, trade as well as on-course recovery led the S&P Global Ratings to dial up Indonesia’s rating outlook to ‘stable’ from ‘negative’ earlier in the year.

Besides the math outlined, the prospect of a higher subsidy bill (if oil stays above the assumed range), higher transfers to state owned oil companies, correction in non-O&G commodities and slow growth/ recession prospects in major economies are risks on the horizon, which might jeopardise revenue assumptions, in turn necessitating a sharper pull back in spending plans to keep within targets next year.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024

Related Insights

- Credit: Asia looks overly sanguine amid developing risks 19 Apr 2024

- Crypto Digest: Here comes Bitcoin “halving”18 Apr 2024

- ASEAN-6: Are the tourists back?17 Apr 2024