- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- The BOT remains a major central bank in the region that has yet to signal policy normalisation

- Our ‘Taylor rule’ analysis shows BOT’s growth focus differs from its past reaction to inflation

- Continued growth recovery despite uncertainties; a matter of time before other goals are prioritised

- Risks of an earlier policy rate hike in late-2022 and a faster tightening path

- Receive 1Y THB OIS at above 1.00%. Switch to 1Y-5Y curve flatteners if BOT shifts hawkish

Related Insights

Asia’s monetary policy tightening tide is gathering pace amid a growth recovery from the pandemic, rising inflationary pressures, and a hawkish US Fed. The Bank of Thailand (BOT)’s policy stance, however, differs from others in Malaysia and Philippines, which have begun their rate normalisation cycles. The BOT remains a major central bank in the region that is dovish and primarily focused on supporting growth. The BOT has yet to signal its intent to normalise policy, but we see a rising risk for a hawkish shift. This report evaluates the BOT’s reaction function stacked against its monetary policy framework. We also consider the upside risks to our baseline view for BOT’s policy interest rate to remain unchanged at 0.50% through 2022 and early-2023. From an interest rates perspective, we assess if a hawkish BOT shift in 2H22 has been priced in and discuss strategy implications.

The BOT’s monetary policy framework revolves around three key goals: 1) medium-term price stability, 2) sustainable economic growth, and 3) financial stability. The authorities’ primary focus through the pandemic is supporting growth and limiting scarring. Our analysis below, which deciphers BOT’s monetary policy reaction function through a ‘Taylor rule’ approach, however reflects policymakers’ greater historical sensitivity to its first goal, inflation.

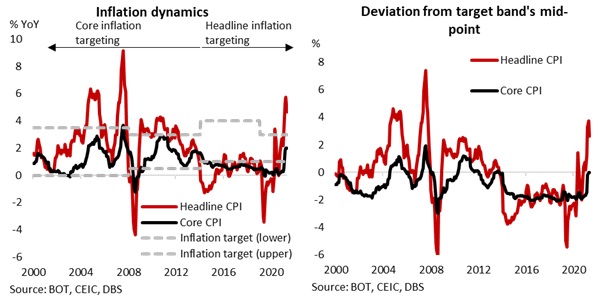

Regarding the BOT’s price stability mandate, the authorities have conducted monetary policy under a flexible inflation targeting approach since May 2000. The BOT historically tweaked its target inflation metric and its inflation target band. From 2015, it targeted an annual average of headline inflation instead of core inflation under the flexible targeting regime first introduced in May 2000. The target inflation band tended to be narrowed, with the headline inflation target band standing at 1-3%. Upside inflationary pressures have emerged in 2022 amid surging commodity prices driven by supply disruptions, with headline inflation exceeding the target band. Core inflation has also turned higher.

BOT’s reaction function estimation

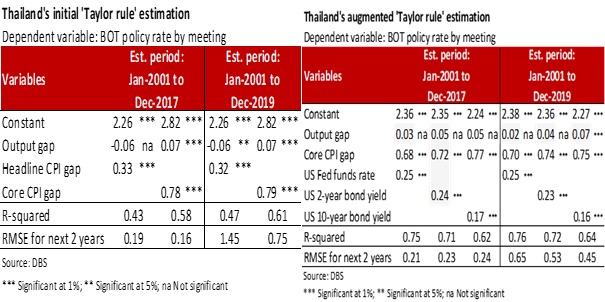

We estimate an implicit monetary policy reaction function by identifying possible ‘Taylor rules’ that the BOT might consider in its interest rate decisions beginning from 2001.

Our models, which cover two time periods (Jan-2001 to Dec-2017 and Jan-2001 to Dec-2019), estimate the output gap’s coefficients as almost zero, with the sensitivities to headline and core inflation high and positive overall, especially the latter. The two inflation variables are broadly statistically significant but unclear for the output gap. Out-of-sample predictions for the policy rate over the next two years (eight policy meetings each year) showed smaller forecast errors when using core inflation instead of headline inflation. Despite the shifting inflation target bands, the results affirm the BOT’s emphasis on core inflation.

We augment our initial model estimations with various US variables (Fed funds rate, 2-year and 10-year government bond yields). The US variables have positive coefficients and are statistically significant in influencing BOT’s decisions. Their coefficients are, however, smaller than that for core inflation deviations (which are little changed and robust from the initial modelling). Including the US variables improve the models’ fit and lower the out-of-sample forecast errors, on average over the two time periods. The coefficients for the output gap remain close to zero, consistent with the initial model but not significant for most estimates.

Hawkish scenario to BOT’s policy rate path

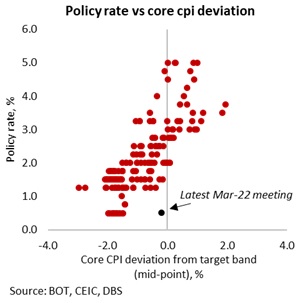

The BOT’s current growth priority when headline and core inflation is rising represents a departure from the empirical evidence shown by our estimated reaction function. We expect Thailand’s economy to continue recovering from the pandemic, helped by opening tailwinds (e.g., ongoing tourism revival). Still, darkening global economic headwinds have dampened recovery expectations relative to the start of 2022. The uncertainty has kept the BOT dovish, which informs our view of BOT staying on hold through 2022 and early-2023.

However, we see upside risk to BOT's dovish policy stance stemming from broadening price pressures as the negative output gap narrows, prompting policymakers to pivot towards policy normalisation and focus on price and financial stability. BOT's policy rate of 0.50% looks mechanically low relative to core inflation deviation. We will be watching for a shift in BOT’s rhetoric to hawkish from the current dovish stance as an important signpost to update our expectations for BOT’s policy normalisation schedule.

THB Rates: Hawkish shift not fully priced

While THB OIS swaps are pricing for several rate hikes ahead, we think a hawkish BOT shift in 2H22 is far from being priced. By "hawkish shift," we mean specifically the scenario where BOT explicitly shifts its focus away from economic support and towards taming inflation or keeping up with global rate hikes (for financial stability reasons) and signals that rate hikes would be imminent in 2H22.

Comparing recent moves in 1Y, 2Y and 5Y OIS swaps, we note that the 1Y has been relatively more stable within a 0.8-1.0% range. In contrast, the March-early May rise in 2Y and 5Y has been much larger and fluctuations seem to mirror Fed hike pricing. The relative stability of the 1Y has undoubtedly been underpinned by BOT's unwavering growth focus which has anchored market expectations that BOT lift-off would be further-out and the pace of hikes would be more gradual.

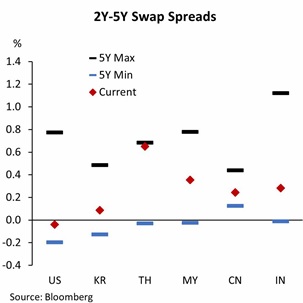

We also look at 1Y-5Y and 2Y-5Y swap curve spreads to assess the priced extent of front-loading of hikes - The tighter the spreads, the more front-loaded the priced hikes. We see that THB curve spreads are relatively wide compared to history. THB curve spreads are also wide compared to other regional markets, especially INR, MYR and PHP swaps, where the respective central banks have recently either pivoted hawkish or lifted rates earlier than expected. Based on the indicators above, we assess that a hawkish BOT shift in 2H22 is not yet fully-priced.

Our baseline policy rate forecast sees the BOT staying on hold in 2022 and lifting off only in 2Q of next year. Therefore, our strategy for 2H22 is to receive 1Y THB OIS at above 1.00% to extract carry and rolldown while the BOT keeps the policy rate at 0.50%. Closer to the end of 2H22, we could look to switch into 2Y-5Y OIS curve flatteners to position for a BOT that could sound less dovish to prepare markets for hikes in 2023. However, if a hawkish BOT pivot became our base case at any point in 2H22, we would immediately switch into 1Y-5Y OIS curve flatteners that should benefit most from the front-loading of hikes.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FocusThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.